FURKAN TELLIOGLU

Article Thesis

Simon Property Group (NYSE:SPG) has seen its shares drop considerably in recent months. That has made the REIT’s dividend yield explode to 7%, while the valuation has dropped to a pretty low level on top of that. Underlying business momentum remains healthy, which is why the current pretty low share price presents an attractive buying opportunity.

Recap

We covered SPG in the past, such as here, a little more than a year ago, when SPG started to increase its dividend again. We want to take another look now, as the valuation has declined to a pretty low level, and since the market’s recent price action does seem disconnected from SPG’s strong underlying performance.

Shares Are Under Pressure, But Underlying Business Performance Is Solid

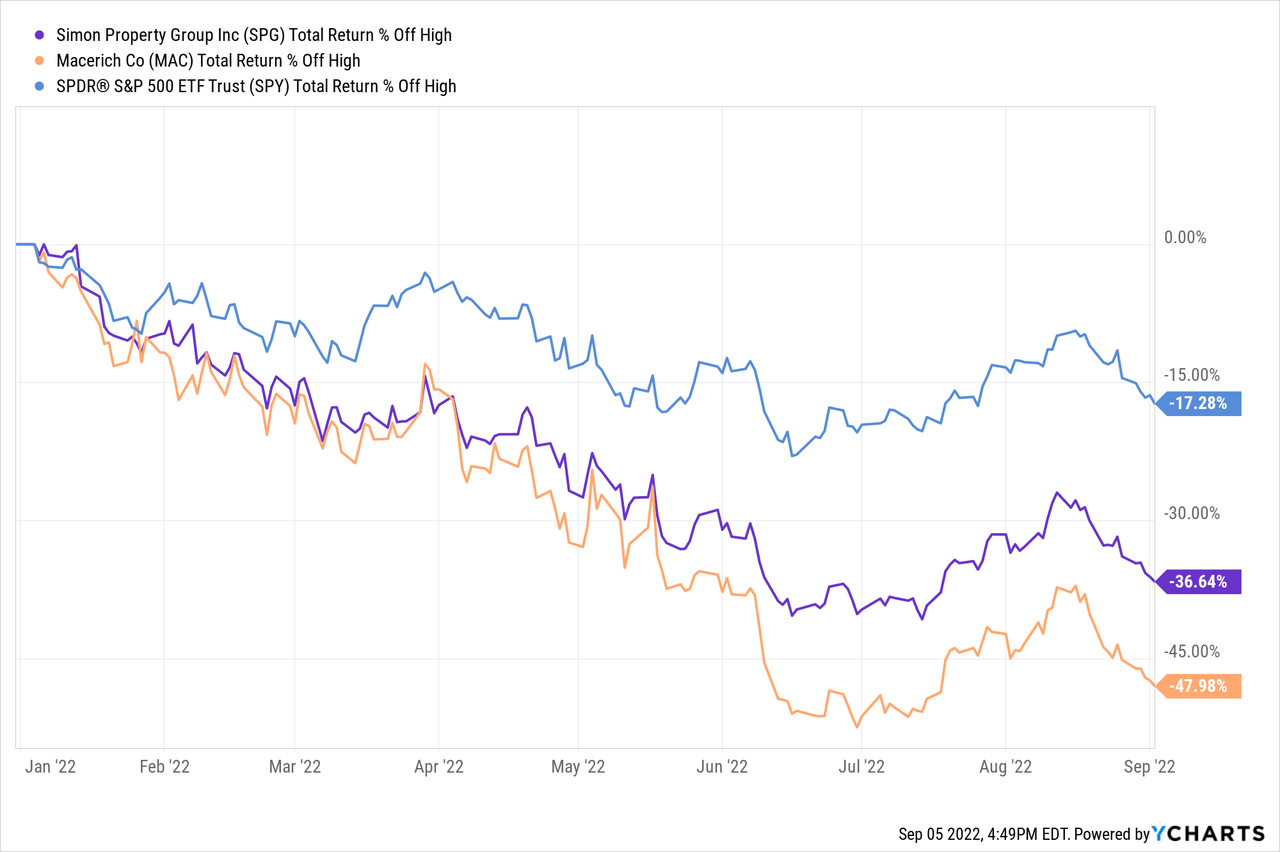

Simon Property Group has, like other mall stocks including Macerich (MAC), seen its shares drop in recent months. Recession worries and an expected fallout from higher inflation have made investors wary of mall stocks, even higher-quality ones such as Simon Property and the aforementioned Macerich:

While the broad market has dropped 17% from the highs seen earlier this year, Simon Property and Macerich have dropped 37% and 48%, respectively. That’s on a total return basis, where considerable dividend payments from these two mall REITs are already included — on a pure stock price basis, their performance was even worse.

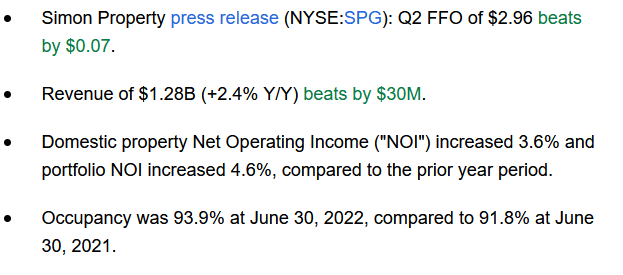

That’s somewhat surprising when we consider that Simon Property has delivered pretty solid results for the most recent quarter, and actually outperformed expectations for that period. The following screenshot shows some of the highlights from SPG’s second quarter:

Seeking Alpha

The company beat estimates on both lines, grew its net operating income considerably, and last but not least, was able to grow its occupancy rate by more than 200 base points. In short, one could say that malls aren’t dead. Or, to be more precise, high-quality malls aren’t dead, and are actually faring quite well. Lower-quality malls in less densely populated areas where average disposable incomes are lower are not doing as well, which isn’t too surprising. They have had more issues even before the pandemic and the current Russia-Ukraine war, and they are more heavily impacted by the current macro issues. Consumers with lower disposable income spend a larger portion of their incomes on food, energy, gasoline, etc. and are thus more heavily impacted by high inflation rates. Their spending power takes a larger hit, which results in them spending fewer dollars at (lower-quality) malls. But consumers with high incomes and high spending power aren’t impacted as heavily by inflation, and they continue to spend their dollars at SPG’s malls. This is precisely why retailers are still happy to set up their stores in SPG’s malls, and this is also why they are willing to pay higher rents to do so. Simon Property Group was able to grow its average rent per square foot once again. Simon Property’s exposure to fast-growing markets such as Florida (18%) and Texas (10%), the first and third-biggest markets for SPG, also provides some insulation in the current environment as a rising population means that more consumers could shop at SPG’s malls in those states.

Results were, in fact, so good that Simon Property’s generally relatively conservative management decided to increase the guidance for the current year. The company now expects funds from operations per share of $11.70 to $11.77, which would represent a pretty conservative earnings multiple of around 8.5 at current prices of marginally above $100 per share. That’s a pretty low valuation, I believe, but I’ll get into that later.

Interest rates have been rising so far this year, and some investors seem to worry about what that will do to Simon Property Group and other REITs. REITs generally employ considerable debt due to the nature of their business, thus rising rates could indeed have an impact on their profitability. But Simon Property seems well-positioned to weather that headwind. First, the company still is able to access debt markets at very favorable terms. During the first half of the current year, Simon Property issued $1.6 billion in new mortgage debt, at an average rate of 3.75%. Considering the current macro environment, that’s very attractive, I believe. In fact, the yield on those mortgages is just slightly higher compared to what the government is paying on treasuries. Due to Simon Property’s healthy balance sheet and its A- credit rating, it’s not too surprising to see that lenders are still willing to provide capital at attractive terms. Those mortgages all were non-recourse, which reduces risks for SPG’s owners and which makes the low rate even more impressive.

Simon Property has massive liquidity, thanks to more than $1 billion in cash on its balance sheet and since it can access more than $7 billion in addition to that via its untapped credit line. In case the company needs additional liquidity, which I do not expect as free cash generation is strong, the company thus has ample reserves to draw from. With a weighted average interest rate of 3.18% and a weighted average time to maturity of 6.9 years, Simon Property looks like a well-financed company that shouldn’t run into considerable problems in a rising rates environment. The company won’t have to refinance overly large portions of its debt in the near term, and thanks to the fact that its free cash flow is considerably stronger than what is required for its dividend, SPG could always opt for debt paydown in absolute terms, thereby reducing interest expenses. Most of SPG’s debt is fixed (94% of consolidated debt), and the floating-rate debt is mostly hedged or swapped to fixed, which reduces the near-term impact of rising rates further.

Despite macro headwinds such as high inflation, recession worries, and rising interest rates, Simon Property is thus doing reasonably well and has actually been outperforming both the expectations from Wall Street as well as management’s previous guidance. The selloff thus seems overdone, but that can be a good thing for investors that have a nice buying opportunity here.

SPG Is A Bargain With A Hefty Yield

I do believe that class A malls such as the ones SPG owns will continue to have a positive future. Demand by high-end retailers including companies such as Apple (AAPL) is there, and mixed-use development (apartments, hotels, office space, and so on) provides additional potential for these premium assets in great locations.

And yet, SPG trades at an earnings multiple of just 8.5, which translates into an earnings (FFO) yield of around 11.8%. Even without any earnings growth whatsoever, Simon Property’s investors could thus reasonably expect to end up with double-digit returns as the company can offer hefty payouts via both dividends and buybacks. On top of that, Simon Property also has the option to use its cash flows for debt reduction, which shifts value from debt holders to equity holders over time.

Simon Property has just raised its dividend again, bringing the annual payout to $7.00. That makes for a hefty 7.0% dividend yield at current prices, and the dividend is still well-covered as the payout ratio is ~60%, which isn’t high for a REIT. On top of its dividend, Simon Property has been returning cash to its owners via buybacks. The company bought back 1.4 million shares in Q2 for a little more than $140 million. That translates into an average share price of a little more than $100, which is pretty good considering the trading range of SPG during the period. Since SPG is now trading at $100 again, I believe that there is a high likelihood of further repurchases. At the pace from Q2, SPG could buy back around 1.5% of its shares per year. I assume that that rate will increase if SPG continues to trade at the current level, and especially if shares dip further.

The fact that insiders seem to think that SPG is undervalued is not only underscored by SPG’s buybacks, but also by recent insider purchases. Several directors have purchased shares of SPG in late June as shown by these Form-4 filings from early July. And it makes sense, after all — SPG is trading at $100 while generating a little less than $12 per share in profit. Prior to the pandemic, profits were at a relatively comparable level, but SPG traded at as much as $180.

Eventually, the current recession worries and inflationary pressures should pass, and SPG could rise back to the high $100s — or even higher, due to rent increases, the development of new assets such as Fukaya-Hanazono Premium Outlets in Japan or McArthurglen in Paris, and thanks to the impact of buybacks. This could take several years of course, but since investors are getting paid handsomely to wait for this to play out, there isn’t any time pressure.

Takeaway

Simon Property has sold off quite a lot in recent months. And yet, the company’s underlying performance is very solid, and rising interest rates aren’t a huge issue for SPG.

The company has just raised its dividend, offers a hefty yield, buys back its shares, insiders are buying, and the valuation is pretty low. That makes for a compelling combination, I believe, which is why I think that SPG is an attractive multi-year investment at current prices.

Be the first to comment