sihuo0860371/E+ via Getty Images

The human mind is remarkably good at story telling. We get bits of information and our brain automatically fills in the gaps.

In 2020, we watched people infer success from rising prices.

- Crypto was viewed as generating wealth

- ARK Innovation (ARKK) stocks were going to disrupt and take over industries

Why? Because only that level of fundamental success could justify the level of price movement. The stock is up 100%, so something must be happening.

Well, that’s letting the tail wag the dog isn’t it? Fundamentals should drive price not the other way around, and when the fundamentals finally took over, people learned the hard way that their brains had played tricks on them.

However, human psychology is persistent and the same thing is happening again in 2022 except, since 2022 is mostly a bear market so far, it is people inferring fundamental trouble from price drops.

It is happening across the market, and in some cases, the drops do in fact come with poor fundamentals, but in others, it is just another instance of the brain extrapolating too much from incomplete data.

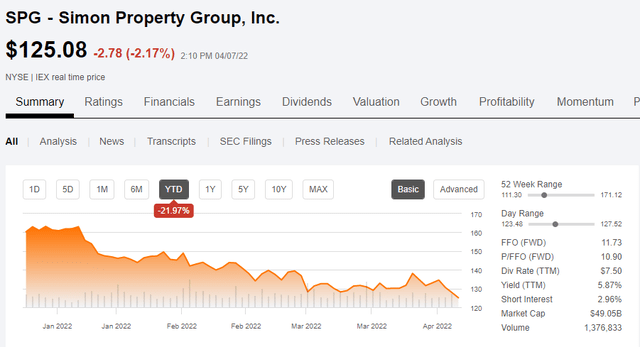

One of the greatest opportunities borne from such extrapolation is Simon Property (NYSE:SPG) which is down 22% year to date.

It was like watching a game of telephone:

Weak consumer sentiment data comes out – a respected and capable reporter on CNBC comments that he thinks it is going to hurt retail stocks – the report does in fact lead retail stocks to drop – those watching interpret the combination of the data and price action as retail being in fundamental trouble.

With each step of communication, a little bit of extra inference was made, and eventually, the message morphs into one that doesn’t logically follow from the actual data.

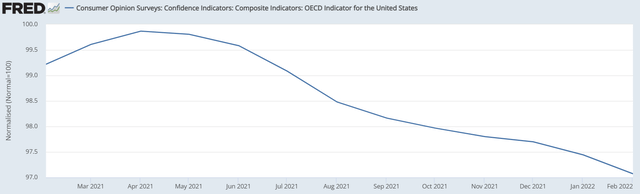

Here is the actual data

There is a legitimate pathway here to which this would impact malls. A less confident consumer spends less which makes the tenants less profitable which in turn makes the tenants less willing to sign leases with the mall REIT.

In normal economic scenarios, these links are likely to hold true because low consumer sentiment is usually caused by a weak jobs/wages which is why this is usually a good forward indicator.

Today, however, there are a couple of skewing factors that I think will cause this to be a false indicator.

Specifically, I think the low consumer sentiment today is largely a result of 2 factors:

- The war in Ukraine

- Inflation

Wars are terrible and even though it is nowhere near U.S. soil, it still makes us feel crappy to be reading reports about the suffering and loss of life. The fact that this reduces consumer sentiment is normal and healthy. It just means that we still have empathy.

Notably, however, it does not actually impact disposable household income.

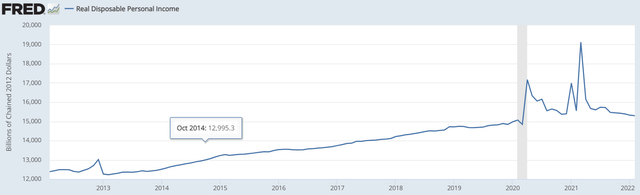

If we go to the source data of actual disposable income, it is clearly rising.

In fact, it is the highest it has ever been with the exception to the temporary blips from stimulus checks.

But what about inflation?

Inflation does have an impact on real disposable income (inflation-adjusted). It causes the otherwise uptrend to tick down a bit in 2022.

From the perspective of the consumer, real disposable income is what matters – how much they can buy with what they have.

Therefore, inflation is wreaking havoc on consumer sentiment.

However, from the perspective of malls, real disposable income is not what matters but rather how much consumers actually spend in nominal dollars.

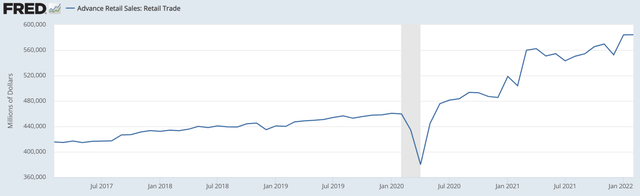

Advance retail sales data shows retail sales are at an all-time high.

Let’s dig in a bit as to why it is the nominal dollars that matter to the mall rather than inflation-adjusted dollars. There are intricacies on both the revenue side and expense side here so we will take them one at a time.

Revenue side

SPG’s revenues come primarily from 3 sources:

- Contractual rent

- Percentage rents

- Direct sales from their owned retailers

Contractual rents are usually based on a percentage of expected sales at the time the lease is signed – somewhere around 8%-14% depending on the nature of the store. The higher absolute nominal sales are, the higher rents will be.

Percentage rents kick in after sales cross a certain threshold. This threshold is set in nominal dollars, so again, the higher absolute nominal sales, the higher REIT revenues will be.

Revenues from owned retailers will be 1 to 1 with nominal sales dollars.

Expense side

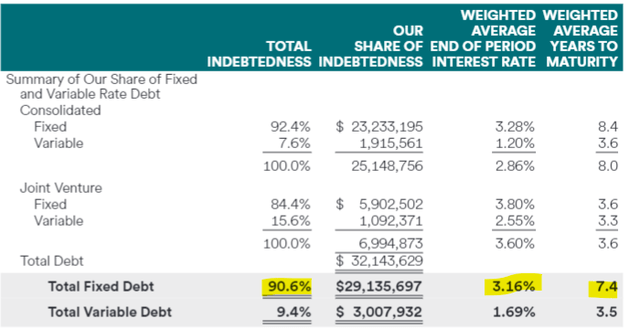

SPG has 90.6% fixed rate debt and they have locked it in for a long time horizon with a weighted average time to maturity of 7.4 years.

The 3.16% weighted average cost is remarkably cheap considering the 10-year Treasury just passed 2.6%.

Given this balance sheet, SPG’s expenses don’t really move all that much with inflation or with interest rates.

Thus, the net effect of inflation is higher sales which leads to higher revenues and there is minimal offset from expenses. So while inflation is hurting the consumer, it is helping the REIT.

So, I think this debunks the idea that a bad consumer sentiment read is causally linked to poor mall performance fundamentally. It might be a good indicator 9 times out of 10, but this is a unique circumstance, and this is that 10th time.

There are a few more economic data points that I want to share which portend fundamental success.

Excellent employment and improving wages

From the Bureau of Labor Statistics

“THE EMPLOYMENT SITUATION — MARCH 2022 – Total nonfarm payroll employment rose by 431,000 in March, and the unemployment rate declined to 3.6 percent”

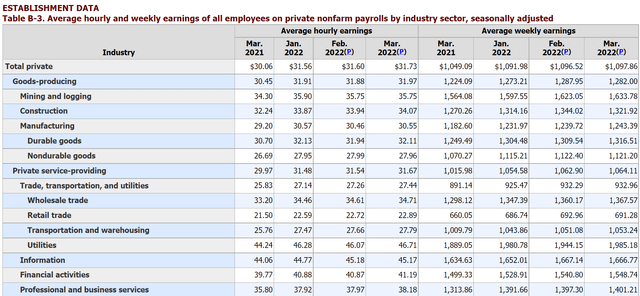

More people are working, and they are earning better wages. Note in the table below that March 2022 is substantially higher than March 2021.

Whether or not these wages keep up with inflation is very relevant to the consumer but not so relevant to the mall REIT. With higher nominal earnings, nominal consumer spending is likely to continue to rise going forward.

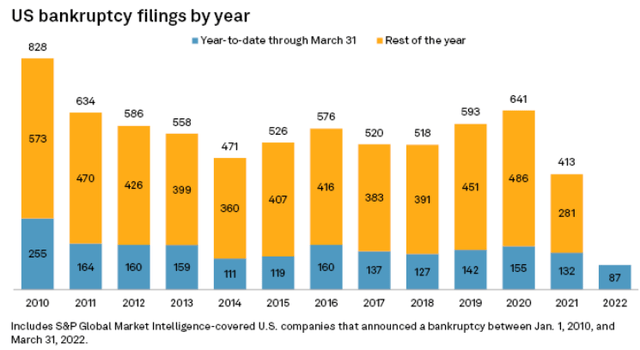

The tenant situation also looks much improved. In prior years, brick-and-mortar retail struggled from tenant bankruptcies reducing the pool of entities demanding real estate space. 2021 was a great year for bankruptcies (low) and 2022 looks even better as it is on pace for the lowest level of bankruptcies in over a decade.

S&P Global Market Intelligence

Fewer bankruptcies are a result of a generally strong economy.

The macro outlook for SPG looks good, but it behooves us to also check the company-specific fundamental indicators.

Company-specific news

Company-specific news flow has been quiet but generally positive.

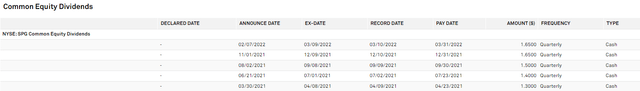

SPG has been gently raising its dividend.

S&P Global Market Intelligence

It reported a substantial beat in 4Q21.

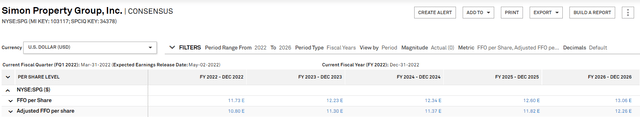

Perhaps the weakest data point is the somewhat below consensus guidance, but given David Simon’s history of sandbagging guidance, I think 2022 will come out ahead of consensus.

I don’t think either of these items could have turned the stock so abruptly negative, so I do think this 20%+ drop is based on the broadly misinterpreted consumer sentiment data. I see the dip as an opportunity to buy SPG.

Valuation

At the now lower price level, SPG is quite a bargain for a company of its pedigree.

- P/NAV of 83.5%

- P/FFO of 10.9X

Such a valuation is appropriate if there is indeed fundamental headwind on the horizon, so I think the downside is largely priced in even if I am totally wrong about my economic read.

Wall Street analyst estimates show SPG growing modestly for the next 5 years.

S&P Global Market Intelligence

This sort of growth pattern is consistent with my views on their fundamental outlook. If consensus estimates are anywhere near correct, it is undervalued.

Modest growth of this pace would typically garner an FFO multiple in the mid-teens. For a mega-cap company with an A-rated balance sheet, I think 18X could be justified.

Moral of the story

If there is one takeaway from this article, it should be this: A company’s stock price dropping does not mean the company is in trouble nor does a company’s price rising mean they are succeeding.

Look to the fundamentals as your guide and use market noise as a source of opportunity.

Be the first to comment