jetcityimage/iStock Editorial via Getty Images

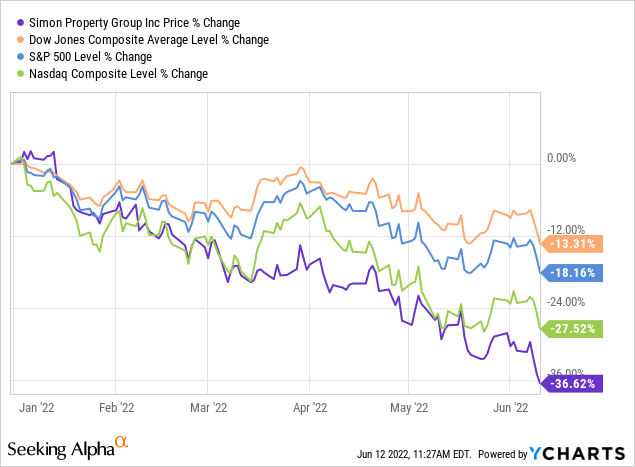

Simon Property Group (NYSE:SPG) has a very bright future ahead. At current levels, investors stand to benefit handsomely both in terms of very attractive income as well as significant capital appreciation. That said, one needs to be mindful of the short-term headwinds. Right now, the market is in manic-depression mode, and for good reasons. High inflation, interest rate hikes (to combat inflation), the war in Ukraine (which has led to record-high energy prices), supply chain disruptions (many of which originated due to the coronavirus) are amongst the biggest factors. The outcome is that major stock market indices are down a lot YTD, and SPG has suffered even more. Specifically, the S&P 500, Nasdaq and Dow are down by 18.16%, 27.52% and 13.31%, respectively, and Simon is down a whopping 36.62%.

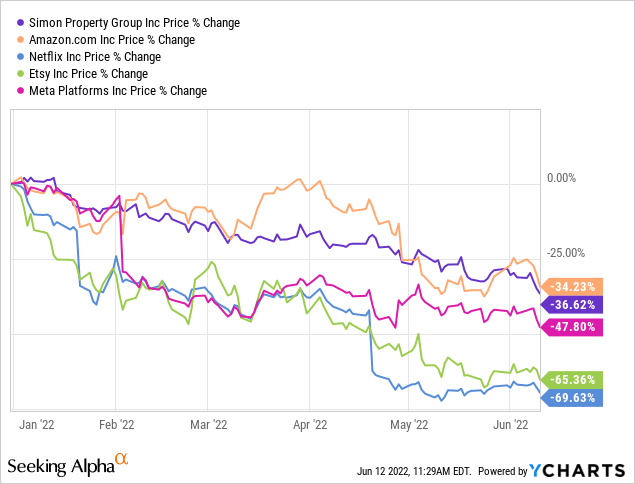

Perhaps some investors can find comfort that Simon is down, more or less, as much as Amazon (AMZN), which has contributed to the so-called ‘retail apocalypse’ and fear around the collapse of brick-and-mortar retail. Also, some investors can find comfort that Simon has outperformed, by a wide margin, tech heavyweights such as Netflix (NFLX) and Meta (FB), and some e-commerce darlings like Etsy (ETSY), many of which have lost 2/3 of their value in just 6 months.

Even though I am still concerned about the valuation of many tech companies going forward (I am not that confident they can sustain the impressive growth rates of the past), Simon’s value proposition is very clear, at least in my mind. First off, the coronavirus virus is no longer in the headlines. Covid was Simon’s biggest nightmare as it led to forced lockdowns and unprecedented cashflow disruptions. Fortunately, Simon, due to its strong balance sheet, charismatic CEO, high quality properties, and diversified product mix, managed to navigate the pandemic very well. In short, Simon made it to the other side in one piece, virtually unscathed, unlike its competitors, the majority of which fell into bankruptcy, namely PREIT (PEI), CBL Properties (CBL) and Washington Prime Group (no longer listed). Macerich (MAC) was forced to raise capital at rock bottom prices, resulting in hefty dilution, in order to handle loan covenants. Only Tanger Factory Outlet (SKT) managed to handle the situation in a fashion similar to Simon.

Today, Simon’s prospects are brighter than ever. Annual FFO exceeds $4 billion and is heading towards the $5 billion mark, underpinned by strong leasing activity and NOI increases. This compares very favourably against a market cap of just under $40 billion, equating to a price-to-FFO ratio below 10. This alone demonstrates how cheap Simon is right now. What’s more, the occupancy rate is approaching pre-pandemic levels (was 93.3% in Q1 2022, compared to 90.8% in Q1 2021), demonstrating the strong demand for Simon’s dynamic high-quality centers, which include, among other things, open-air outlets, the Mills (essentially enclosed outlet centers), traditional malls (with an ever-increasing entertainment component), lifestyle centers and mixed-use hubs, many of which include hotels and multifamily apartments. In other words, Simon is not your typical mall company.

Due to strong performance, Simon increased its guidance, with comparable FFO now expected to be within a range of $11.60 to $11.75 per diluted share for the year ending December 31, 2022, an increase from the $11.50 to $11.70 range guidance provided on 7 February 2022 (an increase of $0.08 per diluted share at the mid-point). It is important to note that Simon has increased its guidance multiple times over the past couple of years. This is a really nice position to be in, especially during these thought times. With the revised mid-point FFO guidance at $11.675, the forward price-to-FFO is below 9. This is a very depressed multiple.

All of the positive information mentioned above, namely strong FFO growth (with more to come) and a falling share price, produces the following result, which is the underlying thesis underpinning my investment in Simon; a very attractive dividend yield (almost 7%) that is safe (due to a very high dividend coverage ratio that is improving further with share repurchases) with a rising yield on cost (as the dividend is on the rise). Let’s break this down further.

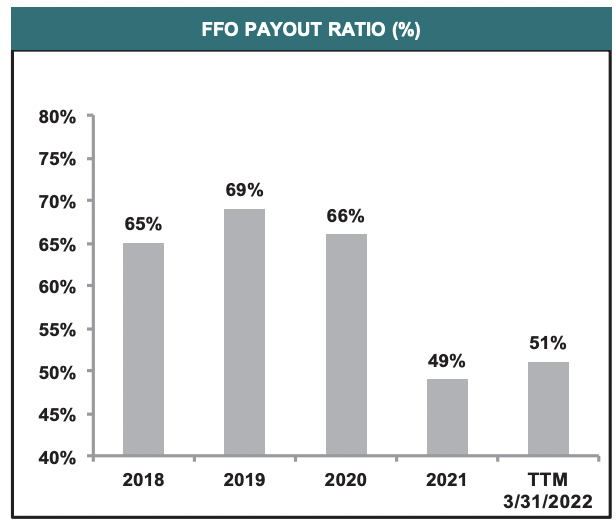

Simon’s dividend yield is high not because the market is expecting a dividend cut, which would have meant a lower share price to reflect a lower per share dividend. The dividend yield is high because the share price has collapsed by almost 40% in a very short period of time due to macro related issues (unrelated to Simon), which have caused general market turmoil. At the beginning of the year, the dividend yield was around 3.5%. Now it is almost 7%. In other words, someone who invests $100,000 in Simon today can expect income of almost $7,000 per year, whereas at the beginning of the year a $100,000 investment in Simon would have produced just ~$3,500 in annual income. That’s quite a difference in a very short period of time. And, as mentioned previously, Simon’s operating metrics are improving; the occupancy rate is up, footfall is strong and tenant sales are at all-time highs. The market is clearly in manic-depressive mode and a great bargain has been presented. Simon is a bargain not just because the dividend yield is high. The dividend is also very well covered, which means it is sustainable, especially when taking into account the strong balance sheet. Specifically, the FFO coverage ratio is just 51%, well below pre-pandemic levels.

Simon Property Group

During the period 2018-2020, the payout ratio constantly exceeded the 65% mark. This means that Simon has significant room to grow its dividend, all else constant. And this is exactly what the company is doing.

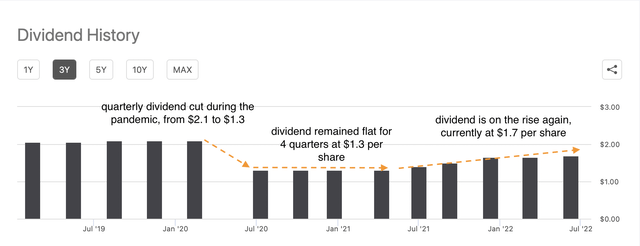

As depicted in the graph above, right after the pandemic hit us, Simon cut the quarterly dividend from $2.1 to $1.3. It remained flat for 4 quarters in a row, at $1.3, and since Q2 2021 it has been on the rise, now reaching $1.7. That said, we are still 20% below pre-pandemic levels. The good news is that Simon has the capacity to reach pre-pandemic levels in a heartbeat. In fact, given the very low FFO payout ratio, Simon can increase its quarterly dividend to pre-pandemic levels of $2.1 and still have a conservative payout ratio. The even better news is that Simon is allocating capital in the best possible way. Specifically, Simon decided use its surplus capital to authorize a new common stock repurchase program, to purchase up to $2 billion of its common stock over the next 24 months. This is great news. It makes sense to first buy back stock at depressed levels, in an aggressive manner, and then hike the dividend at a fast pace. Eventually, Simon’s dividend will surpass pre-pandemic levels. And when this happens, the yield on cost (based on today’s purchases) will be in excess of 8%. Most probably, when this happens, market sentiment will be better and we will experience notable yield compression; in other words significant capital appreciation. In fact, if Simon were to trade in comparison to high quality shopping center REITs, like Federal Realty (FRT), Simon’s share price can exceed $200 per share. My price target continues to be in excess of $200 given Simon’s high quality diverse centers, international diversification, strong e-commerce sales, solid balance sheet and outstanding CEO. Simon is continuing to invest in its business and pursue multiple new developments across the USA as well as internationally. Simon doesn’t only own malls. Its Premium Outlets business is growing at a healthy pace (internationally as well) and e-commerce sales are strong, surpassing $3 billion annually, across all of Simon’s platforms, including the acquisition of distressed retailers out of bankruptcy such as Brooks Brothers and Forever 21. Simon is not your typical mall company. Exciting times lie ahead of us but be prepared for short term headwinds due to the general macro environment, moreso than Simon-specific issues. The current market sell-off has presented a great investment opportunity in Simon and investors stand to benefit from one of the highest and safest dividend yields out there. Eventually, based on FFO surpassing $5 billion annual, the per share dividend can surpass $10 per share. At a 4% dividend yield this equates to a share price of $250. In my view, this is a very realistic scenario and those who invest in Simon today stand to outperform the market by a very wide margin.

Be the first to comment