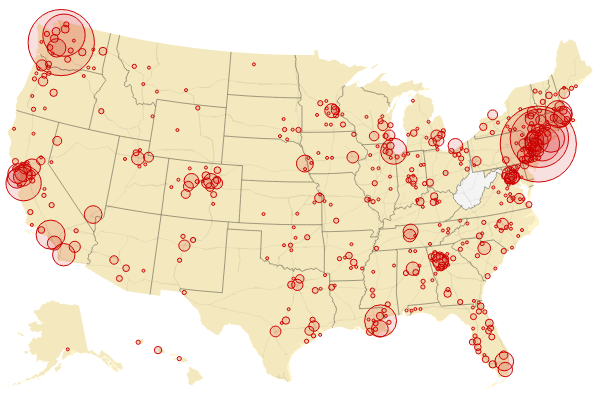

Simon Property Group (NYSE: SPG) is an impressive company with a market capitalization of more than $15 billion. The company was once the largest publicly traded REIT, with a market capitalization of $70 billion. Since then, investor concerns have pummeled the stock. In a nation with unprecedented quarantines, concern over the future of shopping malls is significant. However, as we’ll see throughout this article, the company will be able to weather the storm and emerge stronger.

Simon Property Group – Simon Property Group

COVID-19

In the midst of one of the most unprecedented disasters of the century, foot traffic in major areas of the country has ground to a virtual halt. California, the economic center of the United States, has seen movement grind to a virtual halt. Shortages are reported of goods and people are increasingly shifting to purchasing online.

U.S. COVID-19 cases have passed 7500, making it the country with the 8th largest number of cases. That number is expected to continue growing rapidly, as federal government mistakes have caused the U.S. to lag nearly every other country worldwide in testing. However, the country seems to be catching up, and most experts have been proven correct about unknown community spreading.

The number of cases is expected to grow dramatically over the coming weeks; Ohio alone has stated that it believes it has more than 100 thousand cases. If that’s true, that could spell more than 3 million cases across the United States. An administration that originally said the outbreak would be over in weeks has now said it could last 6+ months.

The effects of this on retail sales and Simon Property Group are expected to be significant. China saw retail sales drop by more than 20%. Simon Property Group focuses on higher tier malls, however, with malls having a tougher time recently, the company’s balance sheet and its financial ability will be stressed. Its ability to handle this fiscally remains to be seen.

There’s several things to pay attention to here. The first is that there are rumors that business-related evictions will be blocked during the downturn. This could harm landlords, especially if they don’t have the financial position to handle a lack of rent from customers they can’t evict. We’ll discuss this further in the financial strength section.

Simon Property Group Overview

Simon Property Group is an impressive company with an impressive portfolio of assets.

Simon Property Group Overview – Simon Property Group

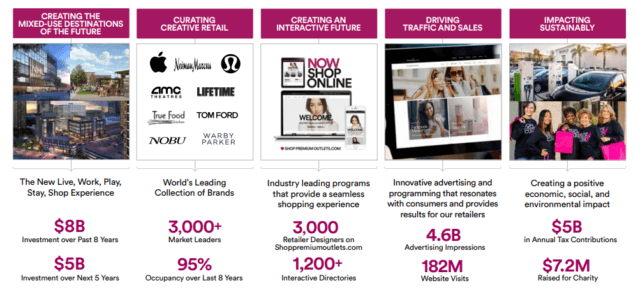

Simon Property Group has invested significantly in the business, with $8 billion in investment over the past 8 years. The company is a premier retailer with a number of high profile customers, driving 95% occupancy over the last 8 years. The company has seen its retail sales growing worldwide, due to having brands such as Tom Ford, Nobu, AMC (NYSE: AMC), and Apple (NASDAQ: AAPL) .

That’s not surprising; people can’t experience Nobu, buying a new Apple product, or watching a movie at AMC from home or Amazon (NASDAQ: AMZN). However, the company is preparing for an online future. The company is working on an online interactive future, driving traffic and sales. The company’s online websites get 15 million visitors per month, which would put it in a growing segment of online retailers, with ~20% of the website visitors of Apple.

Other metrics help to highlight Simon Property Group’s incredibly impressive asset base. The company has an A/A2 credit rating, with premium malls and brands earning >$900 / sq. foot and 96% of the company’s properties in the top 10 largest economies. That’s significant because premium brands have the financial strength to weather a downturn, Nobu for example won’t be moving out of retail stores anytime soon.

Simon Property Group Growth

At the same time, even in a difficult environment, the company has significant potential for growth.

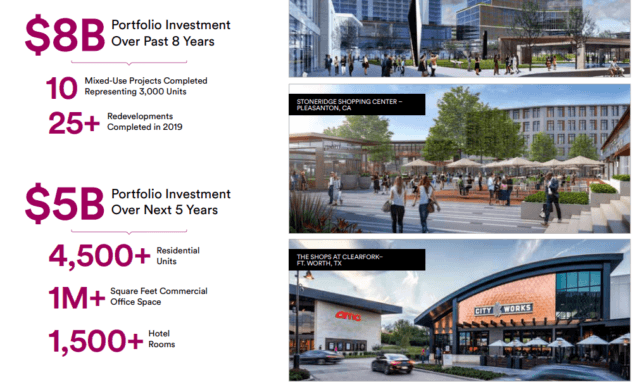

Simon Property Group Investment – Simon Property Group Investor Presentation

The company sees $5 billion in portfolio investment opportunities over the next 5 years, or roughly $1 billion annually. It’s worth noting that the company is expanding its business at roughly the same click it has previously but it’s looking increasingly into high potential mixed risk businesses. For example, the company is looking at 4500+ new residential units and 1500+ new hotel rooms.

These businesses are significant because not only do they continue to generate income throughout downturns, but retail businesses have been shown to do much better as a park of mixed use developments, where shopping at Macy’s (NYSE: M) simply involves walking downstairs.

Simon Property Group Developments – Simon Property Group Investor Presentation

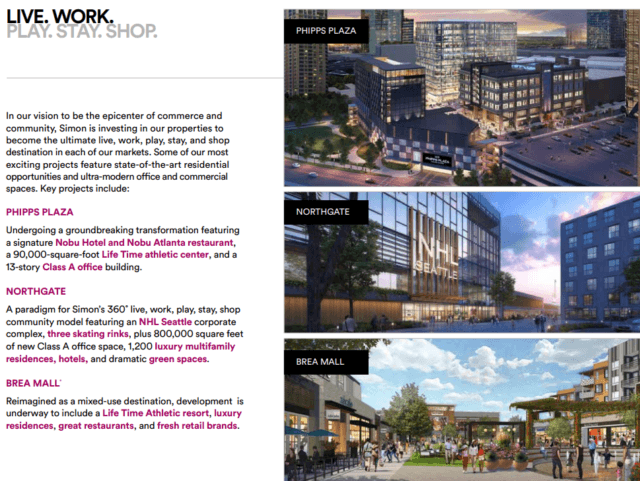

Some of the company’s upcoming developments are discussed above, such as Phipps Plaza, Northgate, and Brea Mall. The company is going through significant projects across its major assets, such as Phipps Plaza, consisting of an athletic center, a 13 story Class A office building, and Nobu Hotel and restaurant, one of the premier hotel and restaurant brands.

This mixed use development will generate reliable office and residential revenue, along with revenue from restaurants and athletic centers even during market downturns. During COVID-19 type scenarios, workers will be able to shop at grocery stores that are a part of their development. These re-imagined developments are the future in a country where malls struggle, as some businesses like clothing retail continue to do better in-person.

Simon Property Group Fiscal Strength

Putting this all together, we get Simon Property Group’s fiscal strength and its ability to handle a downturn.

Simon Property Group Financials – Simon Property Group Investor Presentation

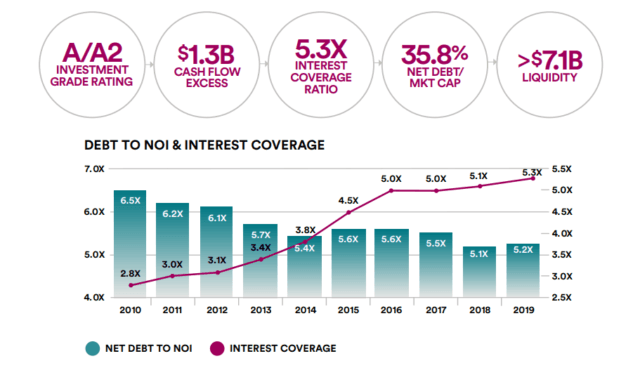

Simon Property Group has a strong investment grade credit rating (A/A2) and $1.3 billion in cash flow in excess of its dividend each year. The company also has >$7.1 billion in liquidity and a fairly managed 35.8% net debt / market capitalization with a massive 5.3x interest coverage ratio. For a company that has $5.8 billion in annual revenue it has more than sufficient liquidity room to handle a 6 month drop in revenue.

And the important thing to pay attention to is how long can this crash last. As we race towards a vaccine for COVID-19, the worst case scenario is ~1 year for a vaccine. Let’s assume the company chooses to also be the best landlord ever and forgive 100% of rent for all customers for that 1 year. That’s no revenue instead of its $5.8 billion in annual revenue. We’ll also assume it suspends dividends for that 1 year.

Suspending dividends will save the company ~$2.5 billion. It’s liquidity and interest coverage ratio will more than cover the other $2.3 billion. Even if we assume it chooses to continue paying that dividend, its $7.1 billion in liquidity can cover $5.8 billion with no revenue. And that’s a lot of worst case scenarios put together – and yet the company can handle.

Simon Property Group Shareholder Rewards

At the same time, once this crisis passes, Simon Property Group will be able to continue its history of shareholder rewards.

Simon Property Group Returns – Simon Property Group Investor Presentation

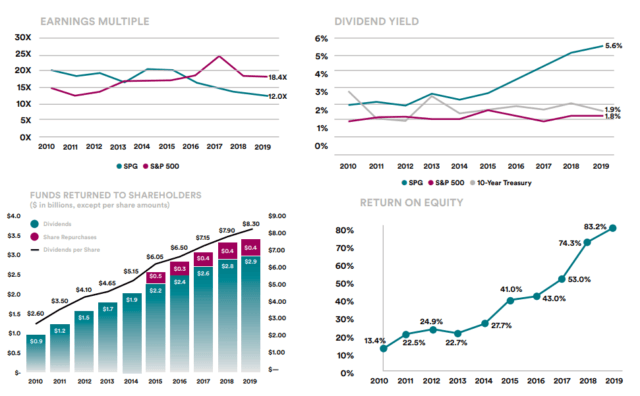

Due to COVID-19, the company has dropped to an even lower earnings multiple of <9 pushing its dividend yield to almost 20%, an unprecedented high dividend yield in this low interest environment. Personally, I’d like to see the company use liquidity and borrowing freedom to expand share repurchases – it has nearly $3 billion in liquidity to get back to the ratios it was in 2010 and over $7.1 in total liquidity, enough to repurchase almost 40% of outstanding shares.

More so, when the crisis recovers, that’d save the company massively on its dividend payments. However, even if the company skips dividends for a year and doesn’t repurchase shares, the potential rewards, for those who invest today, is enormous.

Simon Property Group Risk

Simon Property Group’s risk is one that we already discussed – where the company could have rapid non-payment or inability to pay among customers. That could increase vacancy rates in malls, which are already a difficult business, something that could force a dividend cut. With an almost 20% dividend yield, investors are already pricing in a dividend cut.

However, despite that risk, the company’s properties and their potential will not change when you look out 1-3 years from now. Short-term investment panic means a strong buying opportunity. The only risk the company faces past this is that COVID-19 causes a larger recession which drives customers out of business. That could cause the company’s difficulties to potentially last years.

With all of that said, the risk-reward is well in the favor of significant returns, and I recommend investors pay attention to the company’s potential here.

Conclusion

Simon Property Group is seeing its dividend yield approach an unprecedented 20% as investors worry about how to handle a mall owner that has shut down its malls due to COVID-19. Unprecedented quarantines and concerns about the virus along with general industry difficulties have put the company in an incredibly difficult position. However, despite this, the company has a strong asset portfolio and it is focused on opportunistically growing and improving the portfolio while maintaining income.

Simon Property Group’s dividend is almost 20%. Even without cutting its dividend, if the company closed its malls for 1 year and forgave all customer rent for that time period, it could cover that completely with its liquidity. By that time, most estimates are that a vaccine for COVID-19 would exist. At that point those who invest today would have a near-20% YoC. There’s some chance that COVID-19 will cause a recession, but the company has the fiscal strength.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment