Olemedia/E+ via Getty Images

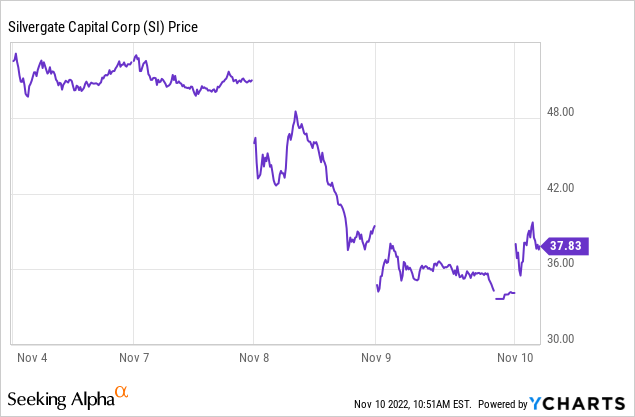

It has been a bloodbath in the crypto world. Meanwhile, CPI came in lower than expected, rocketing markets higher. This seemed to help stabilize the crypto markets.

I’ve been trawling the bargain bin and looked into Silvergate Capital Corporation (NYSE:SI) this morning. I like what they’re doing at Silvergate. It doesn’t look that complicated. They’re holding deposits by customers (institutions looking to trade crypto) and investing this capital base in higher-yielding securities. In other words, it’s a bank. In addition, it has a trading hub linking up liquidity between exchanges. This is called the Silvergate Exchange Network.

There are a lot of rumors (look on Twitter, searching for $SI) that Silvergate Capital could be hurt through exposure to FTX. In addition, it is to be expected institutional involvement with crypto will take a step back, and that hurts the company’s prospects in the short term. I’m not even arguing with the latter. The stock price has come down quite a bit, which reflects that effect.

What could be the exposure to FTX here?

Silvergate just issued an 8-K to alleviate market pressure. Helped by CPI, this has been successful for today (emphasis by me):

“As a prudentially regulated bank, we manage our balance sheet to provide liquidity for our clients while maintaining a strong capital position in excess of the well-capitalized status required by federal banking regulations,” said Alan Lane, Chief Executive Officer of Silvergate. “We are a key infrastructure provider with an established track record, which gives our customers the confidence they need during times like these.”

Mr. Lane added, “In addition to our securities available-for-sale portfolio, which amounted to $8.3 billion at September 30, 2022, as a federally regulated banking institution, we have the ability to borrow from the Federal Home Loan Bank and the Federal Reserve Bank, further strengthening our liquidity position.”

Silvergate’s flagship product, the Silvergate Exchange Network (“SEN”), continues to provide clients with the ability to move U.S. dollars 24 hours a day, 7 days a week. “When our customers want to take advantage of trading opportunities at over 100 different exchanges that bank with Silvergate, the SEN facilitates these fund flows in near real-time, 24/7,” said Ben Reynolds, President of Silvergate.

Silvergate also provides select, underwritten clients with access to bitcoin collateralized loans known as SEN Leverage. To date, these loans have continued to perform as expected with zero losses and zero forced liquidations.

In my opinion, FTX could very well be one of its select underwritten clients. It doesn’t entirely reassure me they have experienced zero losses or forced liquidations YET.

Importantly, these SEN leverage loans are collateralized AND the amount outstanding is limited according to the latest 10-Q:

The outstanding balance of gross SEN Leverage loans was $302.2 million and $335.9 million at September 30, 2022 and December 31, 2021, respectively. Unfunded commitments on SEN Leverage loans were $1.2 billion and $234.6 million at September 30, 2022

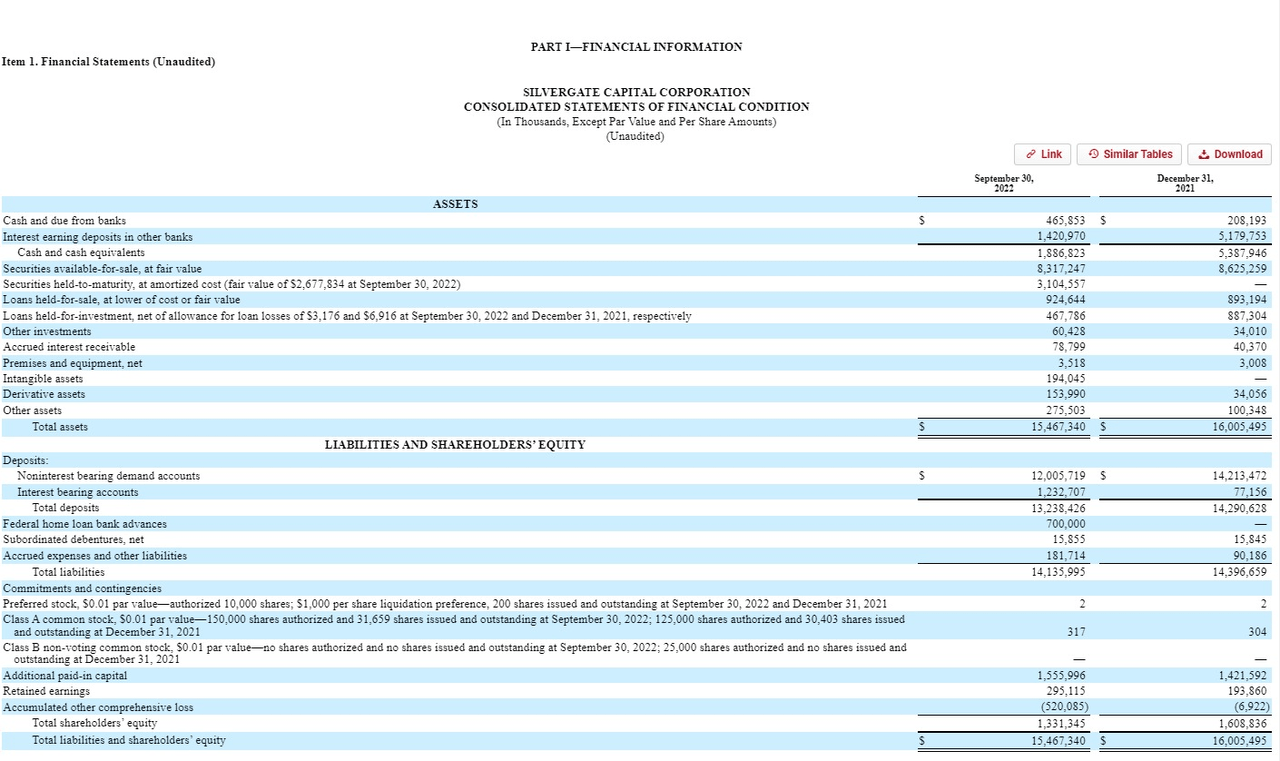

When I’m looking at Silvergate Capital’s balance sheet, it looks reasonable. This is a company with a market cap of roughly $1.25 billion. The liabilities mostly consist of customer deposits (these can get pulled). There are around $13 billion in deposits with Silvergate. Meanwhile, its total assets equal $15.5 billion per September 30. Most are listed as for sale. My impression here is that the book is relatively liquid. Unless a monstrous percentage of deposits get called, they should be able to meet the demand easily enough.

Silvergate Capital 10-Q (Silvergate Capital 10-Q)

Reviewing the balance sheet for potential potholes, I expect the cash is money good. The securities are mostly looking good to me. These are mostly mortgages. Then there are the loans held for sale and held for investments. This is the category where I’m not as sure everything will hold up amidst this liquidity crisis. I think the SEN leverage is included here. Here’s how SI describes its SEN leverage (emphasis added):

Borrowers accessing SEN Leverage provide bitcoin or U.S. dollars as collateral in an amount greater than the line of credit eligible to be advanced. The Bank works with regulated digital asset exchanges and other indirect lenders, as the case may be, to both act as its collateral custodian for such loans, and to liquidate the collateral in the event of a decline in collateral coverage below levels required in the borrower’s loan agreement. At no time does the Bank directly hold the pledged bitcoin. The Bank sets collateral coverage ratios at levels intended to yield collateral liquidation proceeds in excess of the borrower’s loan amount, but the borrower remains obligated for the payment of any deficiency notwithstanding any change in the condition of the exchange, financial or otherwise. The outstanding balance of gross SEN Leverage loans was $302.2 million and $335.9 million at September 30, 2022 and December 31, 2021, respectively. Unfunded commitments on SEN Leverage loans were $1.2 billion and $234.6 million at September 30, 2022.

The risk I see here is that the unfunded commitments may have become funded after September 30. Some of this could be due to FTX, which is mentioned in its most recent presentation:

Silvergate Capital investor presentation (Silvergate Capital investor presentation)

A worst-case scenario would be where there’s significant exposure to FTX, and it turns out FTX can’t make good on its obligations. If FTX has made very big mistakes and Silvergate can’t get its collateral or get it fast enough to meet its obligations, that’s not a good situation.

A secondary concern I have is with this disclosure:

Commercial real estate lending activity has historically been primarily focused on investor properties that are owned by customers with a current banking relationship.

The company has several billion dollars’ worth of commercial mortgages. The great majority are government agency-backed securities. It only owns roughly ~$500 million worth of private-label mortgages.

It makes sense to provide mortgage services to your customers, but in situations like this, it can be a little bit awkward. I saw pictures of a cool FTX headquarter under construction in the Bahamas, for example. If dominos start falling in the crypto universe, it could also mean defaults start rising on that part of the mortgage book.

I looked into Silvergate Capital with the intent to perhaps step in and buy some. It is a highly profitable business that probably benefits from this crisis if it comes through without problems. The balance sheet looks sound enough to me.

However, there are quite a few unknowns like the extent of exposure in SEN loans to FTX, other loans to FTX, collateral that resides with FTX, and the extent to which their mortgage book is exposed to crypto. SI traded up sharply today, and for now, the exposure I liked most is to a few short-term (1 week and one month) $20 puts. The latter currently goes for $0.90, which is less than I paid on average. I expect to lose money on these puts, but there are situations where they will pay off handsomely.

If Silvergate has too much exposure, I’d expect this to come out in one way or another within a relatively short time. It should result in large equity movements because the equity is highly sensitive to the asset/liability relationship.

I have a hard time believing its problems would be insurmountable from what I can see of the current asset/liability mix. However, if they’ve been unlucky or there is further contagion (other borrowers going down, etc.) I can imagine an emergency equity raise becomes a wise move and a lot of fear and uncertainty around this name. Either way, such as scenario would likely result in shares trading down substantially.

The Silvergate Capital Corporation 8-K today was less than completely reassuring. If it looks like the bank will come through well, Silvergate Capital looks highly attractive at these levels. A position that could also be interesting is shorter-dated out-of-the-money puts coupled with long equity.

Be the first to comment