Black_Kira

To profit from the general trend of automobile electrification, investing in lithium miners is one approach to pursue. However, in a roaring bull market, the challenge is to identify lithium projects that are of high-quality, run by technically able and shareholder-friendly management, and still undervalued, as I discussed in a recent interview.

Below, I intend to show Sigma Lithium Corp. (NASDAQ:SGML) (SGML.TSX-V) meets the stringent investment criteria followed at The Natural Resources Hub.

Sigma Lithium Resources

Sigma Lithium is developing the world’s next hard-rock lithium mine – Grota do Cirilo – in the Brazilian state of Minas Gerais, a well-known mining-friendly jurisdiction.

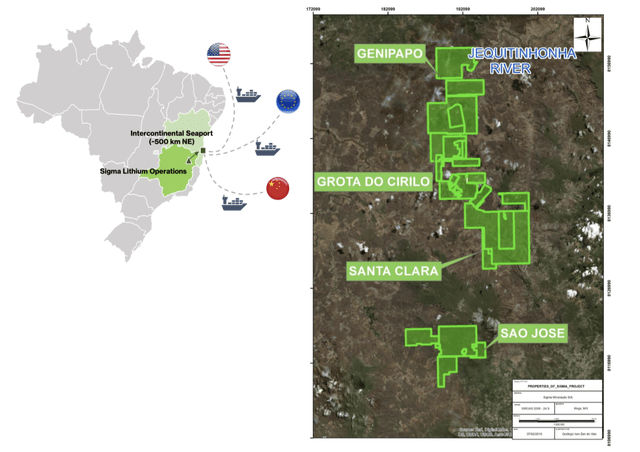

Sigma holds 27 mineral rights in four properties covering 191km2. The wholly-owned project area includes nine past-producing artisanal lithium mines and 11 top-ranked exploration targets (Fig. 1).

Fig. 1. The Grota do Cirilo lithium project in Brazil (Sigma Lithium)

Project History and Growth Strategy

Thanks to its control of a district-scale land package and with an intent to get to cash flowing as quickly as possible in a bullish or bearish capital market, Sigma crafted a pragmatic, phased strategy to construct Phase 1, advance Phase 2 to pre-construction, and define Phase 3 and beyond, all at the same time. Such a multi-prong strategy seems to have been well executed so far, judging from the project progressing on schedule and on budget.

- Sigma reached an internal mineral resource estimate for Xuxa, Barreiro, Murial and Lavra do Meio, although only that for Xuxa was publicly released in 2017. In January 2019, Sigma updated mineral resource estimate for Xuxa and published that for Barreiro, Lavra do Meio and Murial. On June 22, 2022, Sigma released Phase 3 mineral resource estimate, especially for the Nezinho do Chicao pegmatite.

- A DFS for Phase 1 (Xuxa) was issued on October 18, 2019, with accompanying mineral reserve statement, which was updated in December 2021. With pre-stripping underway as of August 2022, Phase 1 is poised for commissioning by year-end 2022 and first production by late 1Q to early 2Q2023.

- A PFS for Phase 2 (Barreiro) was completed in the 2Q2022, following a PEA in December 2022; a DFS for Phase 2 is expected in the 2H2022, likely to be followed in short order by construction earthworks by end-2022 and commercial production by late 2023.

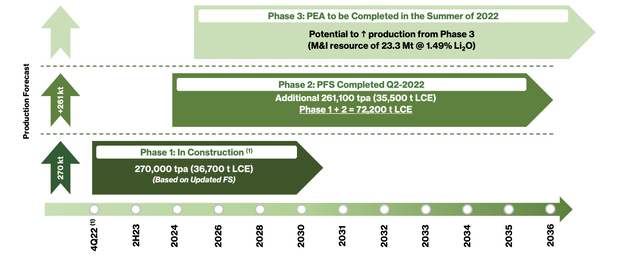

- A PEA for Phase 3 (Murial, Lavra, and Nezinho do Chicao) is pending (Fig. 2).

Fig. 2. Three phases of project development of Sigma Lithium (Sigma Lithium)

Mineral Resource and Reserves: The Largest in Americas

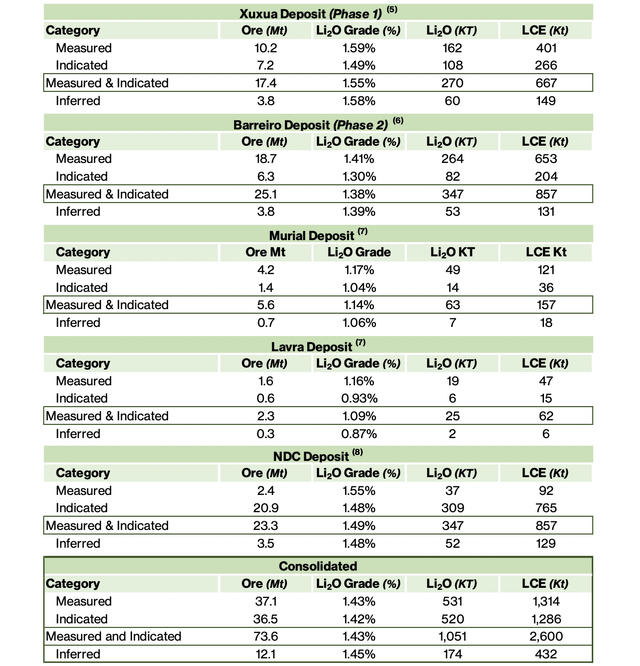

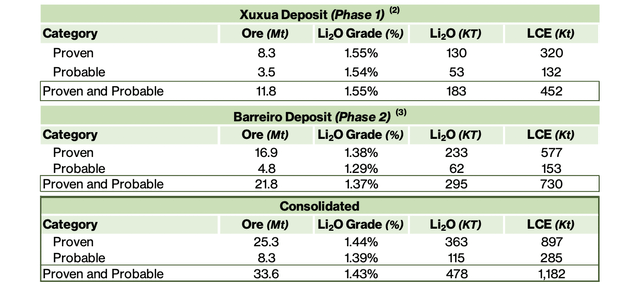

As of August 2022, Sigma has defined 85.7 Mt of lithium ore at 1.43-1.45% Li2O, containing 3,032 Kt of lithium carbonate equivalent (or LCE). The lithium resource includes 1,182 Kt of LCE reserves (Table 1; Table 2).

Table 1. Mineral resource estimates released by Sigma Lithium (Sigma Lithium)

Table 2. Mineral reserves released by Sigma Lithium (Sigma Lithium)

Grota do Cirilo is not only the largest hard-rock lithium project in the Americas, but also known for its open-pittability, high grades (1.43% Li2O), low iron oxide content (0.5%), low mica content (3.1%), and coarse-grained spodumene, let alone existing infrastructure, which collectively leads to extremely low operating costs and superior project economics in technical studies.

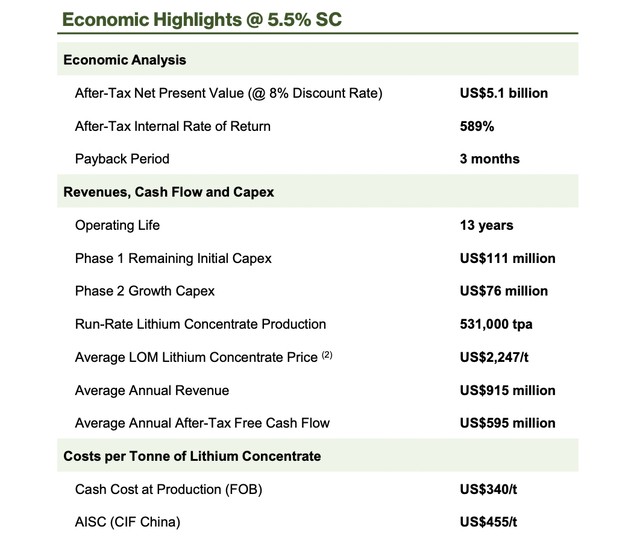

Project Economics

To contain capital expenditures, limit operational complexity and expedite commercial production in a tight market, Sigma chose not to construct a hydroxide conversion plant.

- Phase 1 will produce – for 8 years – 270,000 tpa of spodumene concentrate, containing 36,700 tpa of LCE, with US$111 million in remaining initial CapEx. The project boasts some of the lowest capital intensity among lithium projects in the world.

- Phase 2 PFS indicates, for US$76 million of CapEx, the life of the mine will be extended to 13 years, and an additional 261,100 tpa of concentrate will be produced, for a Phase 1 + 2 total production of 72,200 t LCE, which will be the fourth largest globally. At the conservatively assumed concentrate price of US$2,247/t, the project is estimated to generate an average annual revenue of US$915 million.

As discussed above, the life-of-mine FOB total cash costs will be as low as US$340/t of concentrate for Phase 1 + 2, while the CIF China AISC will be just US$455/t of concentrate. Among hard-rock mines, only the giant Greenbushes mine beats Grota do Cirilo in operating costs.

Thanks to such low operating costs and under the assumed concentrate price, Grota do Cirilo will achieve an EBITDA margin of 82% and net margin of 67%; it will generate US$595 million of FCF per year beginning in 2024. The project is estimated to have an after-tax NPV-8 of US$5.1 billion, an IRR of 589%, and a 3-month payback (Table 3).

Table 3. Phase 1 and Phase 2 project economics, Groto do Cirilo, Sigma Lithium (Sigma Lithium)

Upside and Risk

Sigma Lithium had a market cap of US$2,255 million and an enterprise value of US$2,159 million as of September 2, 2022. It is currently valued at an EV/MRE metric of US$215/t of LCE resource under development, while peer developer Lithium Americas Corp. (LAC) is valued at US$288/t of LCE when only the permitted and under-construction Cauchari-Olaroz project is considered (i.e., the Pastos Grandes and Thacker Pass projects are excluded). In terms of P/NAV multiple, Sigma is valued at 0.43X, while Lithium Americas at 0.90X (or 2.44X when only Cauchari-Olaroz is taken into account). Sigma is clearly undervalued relative to Lithium Americas.

- Should Sigma captures the same P/NAV multiple as Lithium Americas, a revaluation of 2X will result. Phase 3 PEA, soon to be released, will most probably make Sigma yet more undervalued and more upside-potent. The assumed lithium concentrate price (US$2,427/t) is substantially lower than the current price (~US$4,000/t), giving the stock torque on a sustained high lithium price.

- The enterprise value of Sigma comes to 2.96X of projected annual EBITDA, which is substantially lower than the forward EV/EBITDA of established lithium producers that average 9.3X. It thus follows that Sigma will likely experience a 3X revaluation upon Phase 1+2 commercial production by 2024.

- Sigma has so far only delineated lithium resources at five of the nine known artisanal deposits. Future exploration success may support additional phases of development and production growth.

Near-term catalysts that are expected to drive share price appreciation for Sigma are as follows:

- Phase 2 DFS expected in 3Q2022;

- News flow from Phase 3 drill results in the 2H2022;

- Phase 3 PEA scheduled for 3Q2022;

- Phase 1 production commissioning scheduled for end-2022, and first production by March-April 2023;

- Phase 2 production of concentrate expected in late 2023.

The undervaluation of Sigma Lithium may be attributed to the fact that the stock was uplisted to NASDAQ as recently as September 13, 2021, and is viewed as a new issue.

In addition to its being still under the radar, the market may perceive a number of risk factors in Sigma. Some investors may perceive Brazil as having high political risk, even though the state of Minas Gerais has historically been known as a mining-friendly jurisdiction. The Grota do Cirilo project is still in the orphan stage on the Lassonde curve, which is usually associated with possible failures to build and ramp-up the mine on time and on budget.

However, the Sigma management team does not lack experienced mine builders. For example, COO Brian Talbot led the production commissioning and growth programs at Mt. Cattlin, a hard-rock lithium project of Galaxy Resources, now Allkem (OTCPK:OROCF). Indeed, the team is shepherding Grota do Cirilo forward on schedule and on budget. It helps that the mine construction at Grota do Cirilo started well before the currently surging inflation.

Lithium concentrate offtaking has been largely taken care of. LG Energy Solution Ltd signed an off-take agreement for 100,000 + 50,000 tpa of concentrate production while Mitsui has pre-paid for 55,000 tpa, has right to buy 25,000 tpa and more from future production expansion. That these offtake agreements do not cover the entire Phase 1 + 2 production is a non-issue in today’s under-supplied market.

Lastly, I like the fact that Sigma has maintained a tight share structure, clean balance sheet and plenty of liquidity (C$123 million cash, US$60 million credit facility, and no near-term financing plans). A10 Investimentos, a Brazilian PE firm that has controlling shareholder in Sigma, has done a brilliant job in shepherding the project forward. Insiders hold ~1.3% of the shares or 48% if A10 is counted as an insider, which gives them substantial skin in the game.

Investor Takeaways

After 10 years of tireless work, Sigma Lithium is finally on the eve of producing first lithium concentrate by March or April 2023. Once ramped up, the high-quality Grota do Cirilo mine is expected to throw off a lot of cash (forward FCF yield 26%), thanks to its superior project economics.

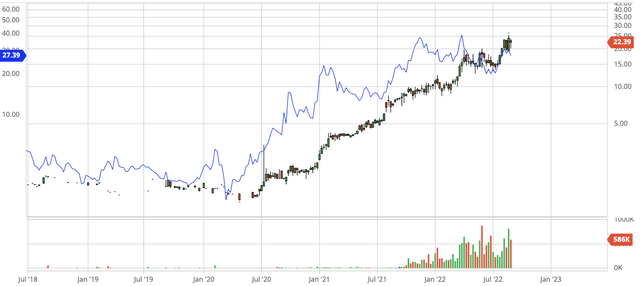

Sigma Lithium has appreciated a lot since the Covid-19 bottom in early 2020 as the project continues to be derisked (Fig. 8). However, as shown above, the stock is still undervalued relative both to development-stage peers and producers and to its net asset value. Therefore, investors who would like to benefit from potential revaluation upon first production may consider establishing a position in Sigma on a dip.

Fig. 3. Stock chart of Sigma Lithium, as compared with Lithium Americas in blue on the LHS (Sigma Lithium)

Be the first to comment