AsiaVision

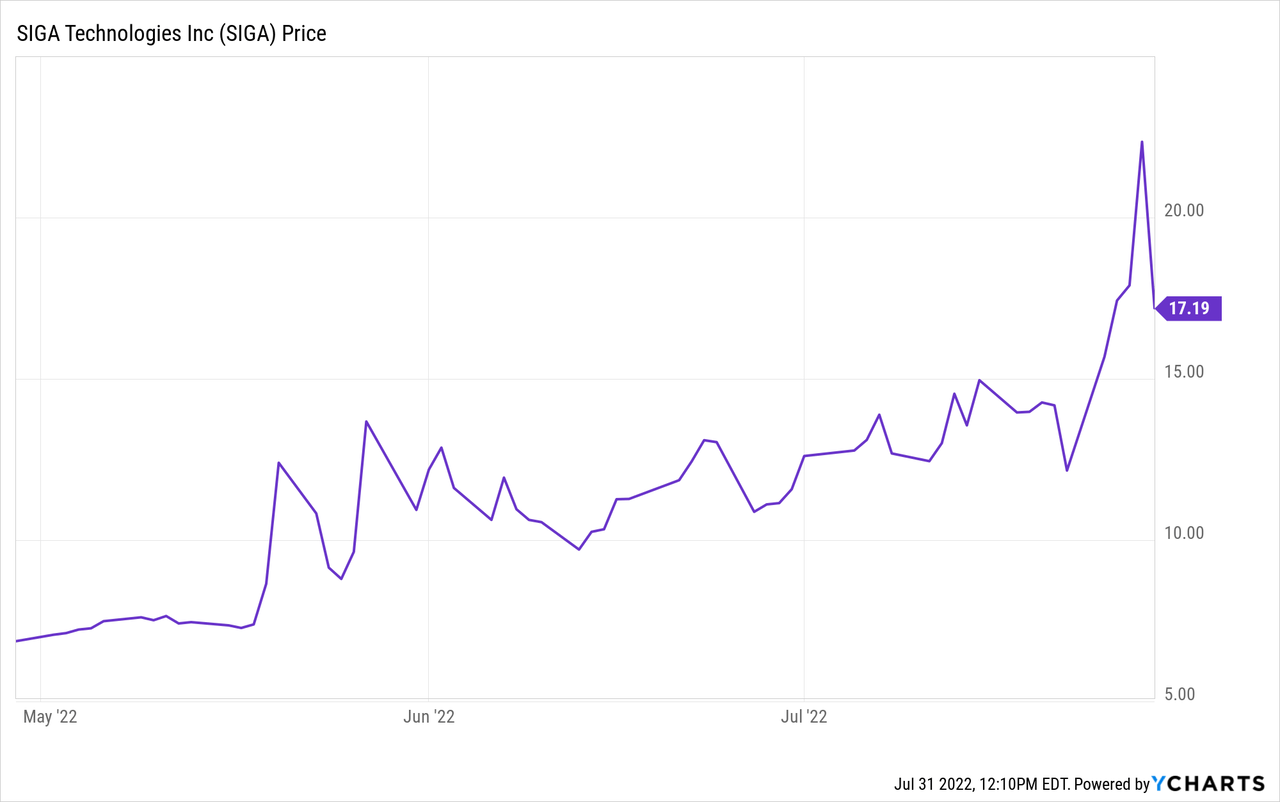

SIGA Technologies’ (NASDAQ:SIGA) sell-off that happened on July 29th was unwarranted, and it represents an excellent buying opportunity for investors:

Right after the FDA update on July 29th, the stock sold off 30%+ at one point without any fundamental reason. We speculate it is likely due to: 1) a high degree of short-sellers going stop-loss hunting; and 2) some investors may have misunderstood some of the FDA’s statements around human data.

Safety and efficacy of TPOXX to treat monkeypox in humans has not been established. Conducting randomized, controlled trials to assess TPOXX’s safety and efficacy in humans with monkeypox infections is essential. We don’t currently know if TPOXX will be beneficial, harmful, or have no effect in treating patients with monkeypox, since drugs that are effective in animal studies are not always effective in humans. Source: FDA (Click)

The key point to remember is that even if the drug does not have human efficacy data, TPOXX is approved for smallpox by: 1) the FDA in 2018 (Click); 2) Canada in 2021 December (Click) for smallpox; and 3) recently received approval in the UK (Click) for monkeypox on July 8, 2022. We highlight that the human trial is not required, as the approval pathway follows animal rule regulation because smallpox is eradicated, and considering the nature of the disease, it is “not ethical nor feasible to test” the drug in humans. TPOXX clearly showed efficacy in animals (rabbits and non-human primates) that were infected with monkeypox. We continue to build a high degree of conviction on TPOXX’s usage for treating monkeypox.

FDA approved TPOXX in 2018 for treatment of smallpox based on efficacy data obtained from animal studies, specifically non-human primates infected with monkeypox virus and rabbits infected with rabbitpox virus. Such studies were relevant since the viruses that cause smallpox, monkeypox, and rabbitpox are in the same family of viruses called “orthopoxviruses.” Safety data was obtained in healthy human volunteers without a smallpox or monkeypox infection. Source: FDA (Click)

FDA’s update de-risks the potential concerns around patient accessibility:

… TPOXX (tecovirimat), an antiviral medication, is being made available through the CDC under an FDA authority called Expanded Access or “compassionate use.” The FDA continues to work with the CDC to streamline their Expanded Access Program for monkeypox to facilitate access.

There are currently no human data demonstrating the efficacy of TPOXX for the treatment of monkeypox, or the safety and pharmacokinetic profile (which helps us understand what the human body does to a drug). Although expanded access program is available, conducting randomized, controlled trials to assess TPOXX’s safety and efficacy in humans with monkeypox infections is essential.

The FDA has more information on TPOXX’s approval for smallpox under the “Animal Rule” regulations on its monkeypox webpage. – July 29 FDA (Click)

The key limitation to our initial thesis was that, regardless of the stockpiling, actual patient access to TPOXX could be challenging due to complexities in regards to the process of patients actually getting TPOXX. For example, patients may need to find physicians who are principal investigators and file an IND that needs to be approved by the IRB, which can take a long time, and patients need to actually enroll in a clinical trial in order to receive the treatment.

The CDC holds an Expanded Access Investigational New Drug protocol (EA-IND) that allows for the use of TPOXX for treatment of orthopoxvirus infections other than variola (which is the virus that causes smallpox), including monkeypox, in adults and children of all ages. The EA-IND provides an umbrella regulatory coverage, so clinicians and facilities do not need to request and obtain their own INDs. The FDA worked closely with the CDC to streamline the protocol to reduce data collection and reporting requirements. The revised protocol is now available for use. Source: FDA (Click)

However, the recent FDA statement clearly shows that FDA will allow the drug to be used under the Expanded Access Investigational New Drug protocol (EA-IND) where physicians “do not need to request and obtain their own INDs.”

Sec. 312.315 Intermediate-size patient populations. Under this section, FDA may permit an investigational drug to be used for the treatment of a patient population smaller than that typical of a treatment IND or treatment protocol. FDA may ask a sponsor to consolidate expanded access under this section when the agency has received a significant number of requests for individual patient expanded access to an investigational drug for the same use. – Source: Access FDA (Click)

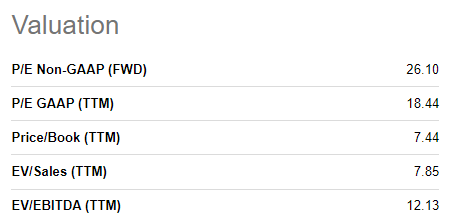

Valuation

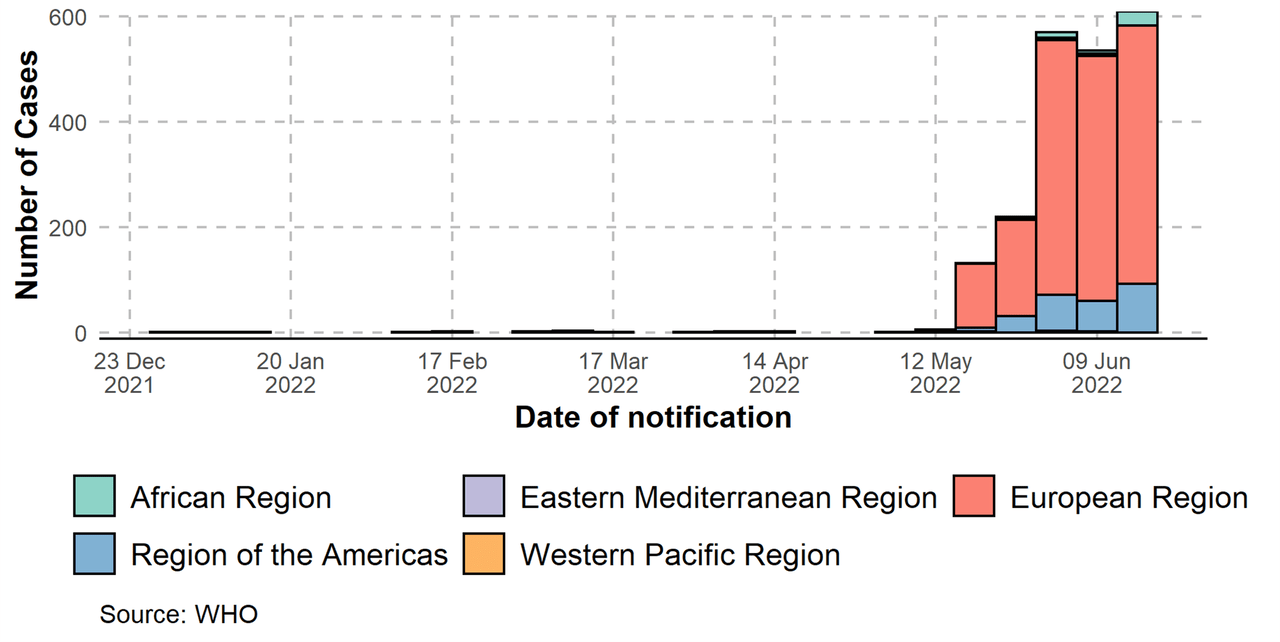

As mentioned in our previous article, it is very hard to predict the valuation of an infectious disease treatment or vaccine company as the revenue will depend greatly on: 1) the government stockpiling or compassionate use program; and 2) the spread of the virus. However, looking at the speed of the disease across the world, WHO’s recent statement calling Monkeypox a global emergency, and New York City and San Francisco calling it a public health emergency, we expect the demand for the treatment to expand exponentially moving forward.

The company announced recently that they have already had a total of USD56M in new orders of treatment courses this year, and we expect more governments around the world will order more with the exponential spread of the virus.

WHO – Monkeypox spread (WHO – Monkeypox spread)

Using a conservative estimate that the company will receive a total of 100M of orders in 2022 (same rate as 1H even though monkeypox spread really started to accelerate as of June-July and we expect a significantly higher number of orders during 2H 22), the company’s P/E ratio would be <20, which is an extremely modest valuation for a commercial biotech company with a differentiated asset.

SA Database (SA Database)

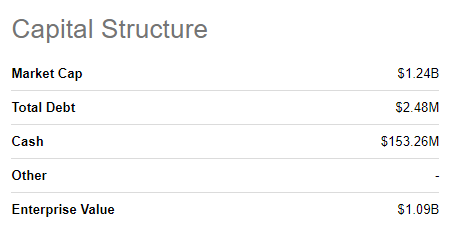

Furthermore, we highlight the company’s robust balance sheet where they hold USD150M in cash, which we believe puts the company in a good financial position. As such, we believe it is unlike that the company needs to raise additional capital. Even if they need to expand their commercial capacity, they will be able to do it using government subsidies like previous pandemics/epidemics (i.e., COVID19 operational warp speed (Click)).

SA Database (SA Database)

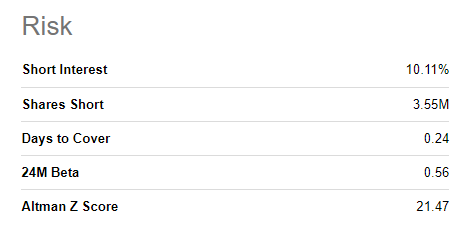

A potential short-squeeze is imminent

Like many high-flying biotechs, the company is heavily shorted. We believe any stock with 10%+ short interest has a high chance of leading to a short-squeeze rally. Especially considering that news around large government orders and approval of the treatment in other jurisdictions is imminent, we believe any positive catalyst can drive the stock another 30-100% triggering a massive short squeeze.

SA Database (SA Database)

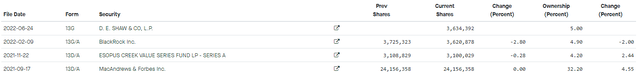

New tier 1 biotech investor on board

Fintel SIGA 13F filing (Fintel)

As shown in a recent 13F filing (Click), D.E. Shaw, a legendary hedge fund, has accumulated 5% of the stock’s float during 1H 22, which is a sizeable position in our view. We believe in having several top-tier holders such as BlackRock and DE.SHAW bodes well for the stock moving forward.

Conclusion: we are buying the dip, SIGA could be a 10-bagger stock

We continue to believe SIGA is a potential 10-bagger stock that is relatively de-risked due to: 1) reasonably valued (PER <20) with cashflow generating lead asset; and 2) strong balance sheet (cash of >USD150M). SIGA should not be seen as a speculative, cash-burning, pre-commercial biotech with a short cash runway even though the stock has appreciated more than 130% this year. The recent unwarranted sell-off should be seen as an excellent buying opportunity for a long-term investor, and our conviction around the stock has only increased with DE Shaw on board (13F filing), the recent FDA announcement around TPOXX’s inclusion into the FDA/CDC’s Expanded Access Investigational New Drug protocol (EA-IND), WHO’s a recent statement calling monkeypox a “global health emergency,” and New York City and San Francisco calling it a public health emergency.

Be the first to comment