PARETO/E+ via Getty Images

Almost two weeks ago, on August 2nd, Siemens Gamesa Renewable Energy, S.A. (OTCPK:GCTAF, OTCPK:GCTAY) released its Q3-2022 earnings. Results were a bit below expectations, with Siemens Gamesa unable to generate profit but with a robust balance sheet that should enable the company to go through this economic cycle.

In this article, I will provide an overview of the Q3-2022 results and I will explain my Hold recommendation.

If you are new to this stock, you can have a look at my previous article where I analyzed the Q2-2022 results, otherwise, if you prefer oil & gas companies, you can read my recent BUY rating for Range Resources.

Stock performance

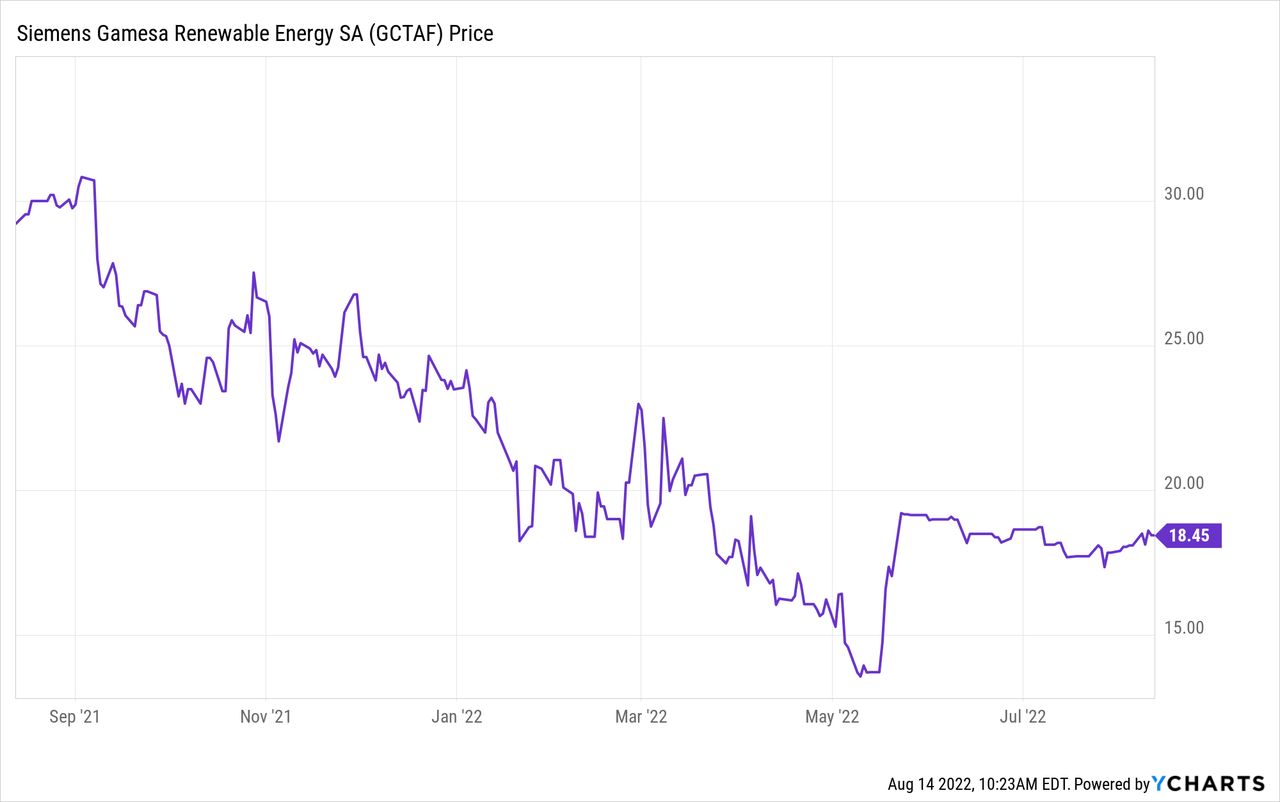

Siemens Gamesa is currently trading at €17.9/share, equivalent to a market cap of €12.2bn and it is up 28% since my previous article when I issued a Buy recommendation (May 6th, 2022, the stock was trading at €14.0). However, since the beginning of the year, Siemens Gamesa has lost 15% of its value and it is down 27% year-on-year. The 52-week minimum is €12.8/share (May 10th, 2022) while the 52-week maximum is €25.8/share, recorded on September 2nd, 2021. The stock is characterized by strong volatility, with the standard deviation being €2.9/share, or 16% of the current trading price.

Operational results

After the bad performance of the second quarter of 2022, Siemens Gamesa is back to consistently receiving new orders: in Q3-2022, the total order intake was €3.5bn, up 132% year-on-year. The main driver of growth was the offshore business which had an astonishing performance, going from €146m in Q3-2021 to €2.1bn, a record high value. Onshore new orders were €1.1bn, or 30% of the total, while orders for the service business saw a 32% decline, from €0.5bn in Q3-2021 to €0.4bn. In terms of capacity, new orders amounted to a total of 2.9 GW, of which 1.2 GW were from the onshore business and 1.7 GW from offshore.

Backlog was quite in line with the previous year, up only 4% to €33.9bn: half of the backlog is represented by the service business (€17.3bn) while onshore and offshore weights 18% and 31% respectively. Geographically speaking, 2/3 of the backlog is due to orders in EMEA while APAC and Americas represent 17% each.

Financial results

Revenues declined 10% year-on-year, from €2.7bn to €2.4bn, mostly due to some challenges with the Siemens Gamesa 5X program ramp-up and project execution. However, the decline was not homogeneous across all sectors: the onshore lost 17% (from €1.3bn to €1.1bn), the offshore sales declined by 5% (from €0.85bn to €0.80bn) while the service revenues increased by 1% (from €525M to €532M) thanks to the increase of the wind turbines under maintenance. The decrease in revenues was not followed by a decline in costs that remained in line with the previous year (€2.9bn) due to inflation, supply chain disruption, project delays and unforeseen failures in legacy offshore platforms. As a result, EBIT is negative at -€459M, 93% lower than in Q3-2021. EBIT margins are extremely negative with the total EBIT margin equal to -14% (-18.2% for the wind turbine generation business and 1% for the service). Net income is negative as well, standing at -€446M.

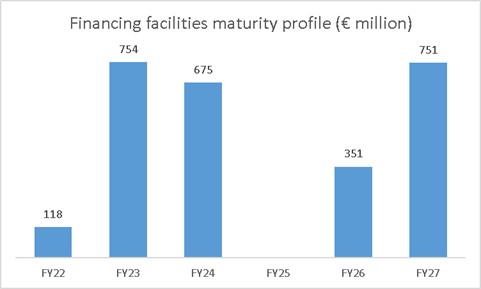

Looking at the balance sheet, one can see that – in Q3-2022 – the net-debt has increased by €0.6bn, from €1.7bn to €2.3bn (€1.2bn cash and €3.5bn debt): operating performance, working capital and capital expenditures were the main reasons behind this increase. Despite the increasing net debt, Siemens Gamesa is not expected to have liquidity problems since, in addition to the €1.2bn cash on the balance sheet, the company also has €1.8bn of undrawn committed credit facility and only €118M of debt will have to be repaid in 2022. Before the end of the year, the company should be able to complete the divestment of some development assets in Southern Europe for a cash consideration of ca €580M which will help to reduce the net-debt.

Author’s analysis

Overall, looking at the financials, my conclusion is that the balance sheet looks robust (despite the high debt) and the main problem is the protracted lack of profitability.

Mistral: organizational restructuring ahead

Together with Q3-2022 results, Siemens Gamesa announced the Mistral initiative, a program for organizational restructuring that will lead to a new operating model from January 2023. The top management has understood that the current operating model is no longer suitable for an increasingly competitive business environment and, therefore, some changes are underway. The company will be organized with a leaner structure with one standardized regional setup across businesses: the onshore, offshore and service areas will have a unique technology and manufacturing team directly led by the COO. In addition, the company will turn to mid to long-term procurement of direct materials and the different businesses will be fully responsible for each P&L. The final aim of the Mistral program is to reduce the project delays that have characterized last quarters as well as improve margins and profitability.

DCF valuation

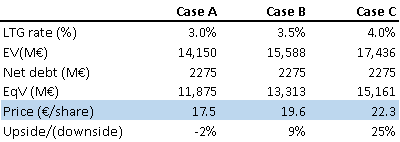

After the Q3-2022 earnings conference call, I updated some assumptions on the basis of my discounted cash flow (“DCF”) valuation, and the result is a target price slightly lower than the current trading price.

The DCF valuation starts from FY2022 revenues based on the guidance provided by Siemens Gamesa: indeed, during the call with analysts, top management announced that FY2022 revenues will be ca 9% lower than FY2021 (at the lower bottom of the -9% and -2% range provided in Q2-2022 results). Free-cash-flows are derived using an FCF-to-sales ratio that, for FY2022, is based on recent actual data while, from 2023 to 2026, includes an adjustment to consider a gradual margin improvement. To discount FCFs I used a 7.5% WACC and for the long-term growth, I assumed a 3% annual growth.

Author’s analysis

As shown in the table, the base case (i.e., 3% LTG) has an implied price of €17.5/share, slightly lower than the current trading price. With more aggressive assumptions on the long-term growth rate, the return starts to get interesting: however, I believe that an LTG rate higher than 3.5% might not be realistic.

Conclusion

Q3-2022 saw Siemens Gamesa report losses once again, but, on the other side, new orders are coming in and the balance sheet is strong. The Mistral program shows that the management is aware of the structural problems affecting the company and – if well executed – could really help to bring the company back to profitability.

Overall, I believe that at the current trading price existing shareholders should not increase their position while new investors should wait for a price drop to make the investment more attractive.

Be the first to comment