LPETTET

The iShares Short Treasury Bond ETF (NASDAQ:SHV) may have short-term appeal for investors fearing a market crash, as it holds ultra-safe treasury bills and notes with maturity of less than 1 year. It pays a distribution that corresponds to treasury bill yields, with a time lag. However, for long-term minded investors, I would recommend avoiding this fund, as it is almost guaranteed to lose purchasing power, even if inflation returns to 2%.

Fund Overview

the iShares Short Treasury Bond ETF gives investors exposure to treasury bonds with maturities less than 1 year. It has $23 billion in assets.

Strategy

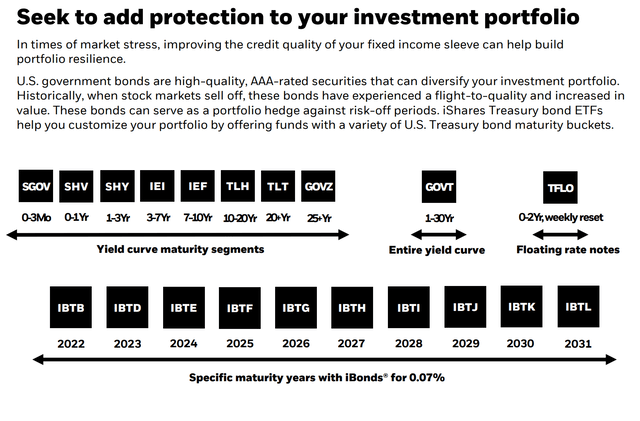

The SHV ETF’s strategy is very simple, it owns treasury bonds with maturities less than 1 year. The effective duration of the fund is 0.30 years, and it allows investors to manage the maturity profile of their bond portfolio (Figure 1).

Figure 1 – SHV allows investors to manage maturity profile of their portfolio (ishares.com)

Portfolio Holdings

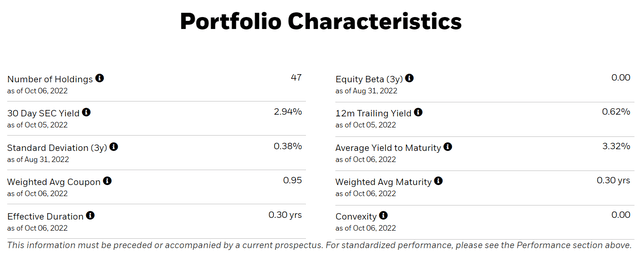

The SHV portfolio has 47 holdings, with an effective duration of 0.30 years and average yield to maturity of 3.32%.

Figure 2 – SHV Portfolio Characteristics (ishares.com)

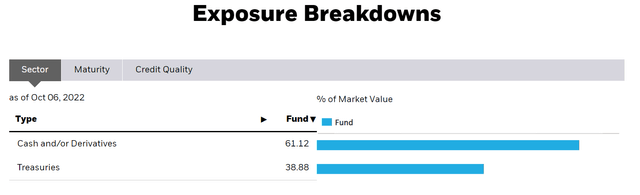

The Fund’s holdings are either treasury bills (considered cash) or close to maturity treasury notes (Figure 3).

Figure 3 – SHV Portfolio Holdings (ishares.com)

Returns

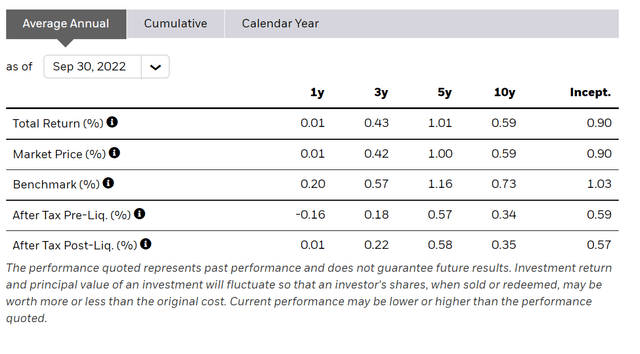

Figure 4 shows the total returns of holding the SHV ETF. Essentially, over any reasonable holding period, the total return of the SHV ETF is between 0.5% to 1%.

Figure 4 – SHV Total Returns (ishares.com)

Distribution & Yield

As seen from Figure 2 above, SHV has a 30-Day SEC yield of 2.94%. SHV pays a monthly distribution, but the amount is variable and depends on the income from its portfolio holdings. The latest distribution of $0.201 / share was paid on October 7, 2022 and annualizes to 2.2% yield.

Note, due to ultra low interest rates in 2021, the fund did not pay any distributions. Distributions restarted in March of 2022.

Fees

The SHV ETF charges a 0.15% expense ratio. The expense ratio is high, relative to the total returns of the fund.

Short-Term Safe Haven Appeal

The SHV may have short-term appeal for investors looking for an ultra-safe haven asset that also pays a little distribution yield. SHV holds treasury bills and close to maturity notes, which essentially has no interest rate or credit risk.

As the Federal Reserve has been increasing the Fed Funds rate in 2022, interest rates along the whole curve have been increasing. 3-Month Treasury Bills are now yielding 3.3%, which should correspond to the SHV’s distribution rate, with a slight time lag, as maturing bills are rolled off.

Figure 5 – 3M Treaury Bill Yields (ycharts)

But It May Lose Purchasing Power In The Long Run

However, for long term investors, I would not recommend holding the SHV. Essentially, you are paying iShares 0.15% expenses per year for the privilege of earning sub-1% total returns, which means you are probably guaranteed to lose purchasing power, even if inflation returns to the Federal Reserve’s 2% target.

Conclusion

In conclusion, the SHV ETF may have short-term appeal for investors fearing a market crash, as it holds ultra-safe treasury bills and notes with maturity of less than 1 year. It pays a distribution that corresponds to treasury bill yields, with a time lag. However, for long-term minded investors, I would recommend avoiding this fund, as it is almost guaranteed to lose purchasing power, even if inflation returns to 2%.

Be the first to comment