hapabapa

The Lucid stock (NASDAQ:LCID) plunged more than 12% in late trading Wednesday (August 3rd) after the premium electric vehicle (“EV”) maker reported Q2 results that fell short of consensus estimates and slashed its full year 2022 production guidance again, citing ongoing industry-wide supply and logistics constraints.

Key items that stood out during the call include 1) re-strategized logistics and production ramp-up plan at its Casa Grande AMP-1 facility, 2) robust order growth, supported by continued international expansion, and 3) being well-funded in advanced of the recent surge in borrowing costs to support long-term growth initiatives despite near-term macro uncertainties. The supply-driven nature of the automotive industry today remains the most prominent downside risk to Lucid’s long-term performance.

Looking ahead, Lucid’s 2H performance will be a main determinant for its strength in both supply chain management, as well as production ramp-up, which continue to be key focus areas on EV startups going forward. There is a lot of credibility for Lucid to restore – especially surrounding its supply chain management efforts – after it slashed its production guidance by a material volume twice already this year. But considering Lucid’s pricing gains demonstrated through its growing backlog despite recent hikes to vehicle MSRPs, it remains uniquely positioned to benefit from a bullish EV demand environment, which continues to support long-term upside potential at current levels.

Progress on Production Ramp-Up

Lucid delivered 679 vehicles in Q2, up 89% from 360 vehicles in Q1. This accordingly resulted in auto revenues of about $96.1 million. Paired with nominal revenues generated from Formula E battery pack sales, Lucid’s total revenues came in at $97.3 million in Q2, representing growth of 69% from Q1. The figure falls short of consensus estimates of $145.5 million.

Lucid reported productions of 1,405 vehicles in the first half of the year. Considering more than 300 vehicles were delivered in April alone, and 360 vehicles were delivered in Q1, the EV maker is estimated to have produced 700 vehicles in the first three months of the year. This accordingly suggests that sequential growth in production volumes was likely muted in the second quarter due to heightened logistics challenges. Based on the revised production target of 6,000 to 7,000 vehicles by the end of the year, Lucid is still at least 4,595 vehicles away from reaching its goal, representing a weekly production run-rate of 177 vehicles in 2H. This compares to a spread-out weekly production run-rate of about 54 vehicles in 1H, underscoring the significant improvements required by Lucid going forward in order to achieve its near-term objectives.

However, the combination of easing supply chain constraints observed in the broader automotive industry, as well as ongoing efforts to internalize logistics at AMP-1 during Q2 are two key supporting factors that should improve Lucid’s ability in scaling productions and achieving its downward-revised production guidance by year-end. AMP-1 currently boasts an annual production capacity of 34,000 vehicles at full ramp-up, which significantly exceeds Lucid’s production target for the year and highlights how its ability to scale productions remains a function of supply and labour availability. Considering Lucid’s recent hiring spree for manufacturing technicians and operational executives, as well as improvements made to its internalized logistics capacities, the efforts suggest that the company is preparing for accelerated ramp-up in both productions and deliveries in 2H.

Expectations for accelerated 2H ramp-up is also consistent with the significant volume of “close-to-completion” vehicles produced in the second quarter that were held back from delivery during the period to further address quality details. Based on information disclosed in the latest earnings call, customer delivery volumes will likely be significantly higher in 2H as related quality matters are sorted:

But in Q2, we also made a significant number of vehicles that we did not factory gate instead electing to hold them back in order to ensure that these cars met the highest standard of quality. Remember, quality must take a priority over volume as a luxury brand, and I’ll touch on quality a little bit later…And although — and many of those cars were meeting some of standards of my quality team, I took the decision that I really want to up the game here and get things right. Now we’re actually releasing a lot of those cars, we’re directing them to our service centers right now and then they’re finding themselves their way to customers having had that attendance, love and attention and care. And I think they’ll be delighted with our best efforts to make them as perfect as they can be.

Source: Lucid 2Q22 Earnings Call

Looking ahead, the anticipated improvements to Lucid’s production ramp-up is also expected to pave the way for rapid margin expansion beginning 2023. Based on the company’s profitability projections in its latest Investor Presentation, the company had initially expected positive gross margins of approximately 21% on deliveries of about 49,000 vehicles by 2023. Although this timeline has been delayed due to factors beyond Lucid’s control, such as protracted industry-wide supply chain constraints and inflationary headwinds, the progress made in ramping up productions are corroborating positive gross profit margins by 2024 when output volumes are forecast to exceed 65,000 vehicles. This is further supported by the 2.85 million square feet of added production footprint and logistics capacity coming online upon completion of AMP-1 phase 2 expansion in late 2023, which would increase total annual production capacity at full ramp-up to 90,000 vehicles.

Robust Order Growth

Lucid’s order book continued to demonstrate robust growth in the second quarter. Total reservations reached more than 37,000 vehicles as of August 3rd, up from more than 30,000 as of May 5th, excluding consideration of an additional 100,000 vehicle reservations received from the Government of Saudi Arabia. The current order book of 37,000 vehicles accordingly represents potential sales of more than $3.5 billion, underscoring resilient demand for Lucid’s premium EVs despite slowing consumer spending.

Lucid’s announcement of a major deal in April to sell as many as 100,000 vehicles to Saudi Arabia’s Ministry of Finance, which could generate at least $4 billion to $8 billion in sales for the EV maker over the next ten years, is a milestone, adding greater visibility to its long-term growth trajectory. Continued progress with its ongoing overseas expansion efforts, including its inaugural presence in Europe with the opening of the Lucid Studio at Odeonsplatz in Munich in May, as well as further expansion into other parts of Germany, the Netherlands and Norway later this year, is also expected to drive greater order book growth for Lucid. And over the longer-term, completion of its AMP-2 manufacturing facility in Saudi Arabia by mid-decade is also expected broaden Lucid’s foray into fast-expanding global opportunities.

This pairs favourably with its premium pricing as well to support continued margin expansion. Despite the recent decision to increase the MSRP on the Air Grand Touring, Air Touring, and Air Pure by $10,000 to $15,000 for all new reservations after June 1st, the growth observed in Lucid’s backlog as of Q2 indicates robust pricing gains. Lucid’s stellar take rates are consistent with the strong demand environment observed by the broader automotive industry, which has yet to sound alarms on any signs of demand destruction despite looming recession risks. The recent increase in oil prices, as well as favourable policy support has also assisted the ongoing momentum in the transition to electric.

This is also consistent with the jump in Lucid Air reservations observed through May, likely encouraged by the surge in oil prices over the period, as well as pulled-forward purchase decisions prior to the price hikes that went into effect June 1st. Yet, reservation volumes still came in stronger-than-expected for the month of June and July despite the price hikes, underscoring Lucid’s pricing power and robust demand environment. In other words, demand remains resilient despite the premium pricing on its vehicles amid a faltering economy, suggesting that Lucid’s continued delivery on best-in-class performance and quality as promised remains a competitive advantage within the increasingly crowded EV landscape.

This continues to corroborate our view that Lucid is performing well on par with even experienced automotive peers, considering it has only started productions less than a year ago. Similar to the broader peer group, which includes both EV start-ups and experienced legacy automakers that are in early stages of the transition to electric, Lucid’s ongoing performance remains a function of supply availability and production ramp-up. In fact, its best-in-class technological performance and resilient take rate at premium pricing implies a robust demand environment that continues to support a sustained long-term growth trajectory. The addition of new models across different vehicle and pricing segments over coming years is expected to further reinforce Lucid’s market share gains over the longer-term by expanding its addressable market.

Well-Funded to Support Long-Term Growth

With $4.6 billion of cash on hand as of Q2 period end, and access to more than $1 billion of undrawn capital in its revolving credit facility, Lucid demonstrates that it remains well-funded to support its ongoing growth initiatives. This represents another pillar of confidence for investors amid rising concerns over slowed growth for tech start-ups given the ongoing increase in borrowing costs.

As discussed in an earlier coverage on the stock, we view Lucid’s issuance of convertible senior notes last December as a practical and even prescient move, taking advantage of private interest from institutional buyers, and securing sufficient liquidity to fund its pipeline of growth opportunities. Although many investors were taken back by the convertible note issuance at the time, the capital was likely raised outside of a “need” basis, indicating Lucid’s prescient move to strengthen its liquidity for funding long-term growth and hedging against rising borrowing costs in advance.

Following the completion of its SPAC merger with CCIV in July 2021, Lucid raised cash proceeds of more than $4.4 billion, in which the company had reiterated would be sufficient to fund its operations and growth plan until the end of 2022. The additional capital raised from the convertible note issuance would only further strengthen Lucid’s liquidity to invest into expansion and growth in which it is ready for. The private interest received on the convertible senior notes issuance, which has a conversion price set at $54.78, also corroborates institutional confidence in Lucid’s future and provides further validation on the company’s prospect for promising upsides ahead.

Paired with Lucid’s recent $1 billion revolving credit facility extended by a consortium of financial institutions, the EV start-up is now funded “well into 2023”, providing it with “further flexibility to scale [its] business”. This is another positive sign for sustained long-term market share gains and growth for Lucid as global EV adoption gains momentum. It also differentiates the viability of Lucid’s business from the growing volume of EV SPAC peers that have recently found themselves reeling from financial trouble amid tightening financial conditions.

Fundamental and Valuation Analysis Update

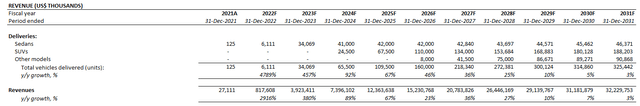

Adjusting our previous forecast for Lucid’s actual second quarter performance, its revised production guidance, and recent developments to its growth strategy as discussed in the foregoing analysis, our base case forecast estimates total revenues of $817.6 million for the current year on the delivery of about 6,111 vehicles. And over the longer-term, Lucid’s revenues are expected to advance at a CAGR of 44% towards $32.2 billion by 2031 on the delivery of more than 325,000 vehicles.

Lucid Revenue Forecast (Author)

The top-line forecast takes into consideration nominal battery pack sales to Formula E as part of Lucid’s legacy “Atieva” battery business. The long-term growth assumption applied is also largely consistent with those discussed in our previous analysis considering there have not been any material changes to Lucid’s operating environment and long-term growth initiatives, including overseas expansion and the roll-out of additional models to increase new market penetration.

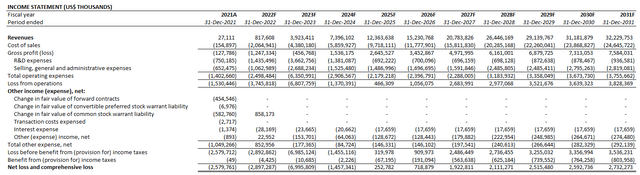

We remain optimistic about Lucid’s trajectory towards GAAP-based profitability by mid-decade. While margins are expected to remain negative in the near-term to support ongoing R&D and marketing efforts in building out its domestic and overseas sales and manufacturing capabilities, the company’s growing order backlog and positive progress in ramping up productions observed to date continue to corroborate gradual margin expansion towards 24% over the longer-term, which is consistent with those in more mature industry peers.

Lucid Financial Forecast (Author)

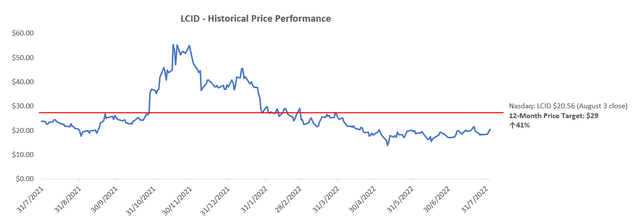

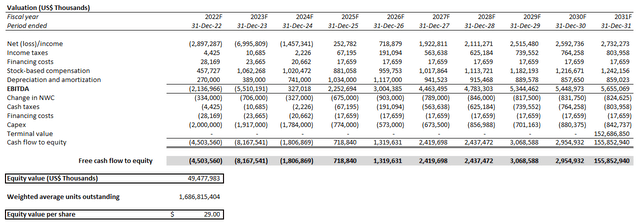

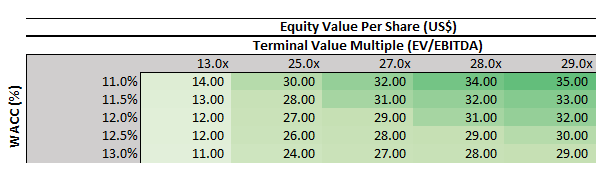

On the valuation front, we are revising the near-term price target from $31 to $29 for the stock as a result of anticipated volume loss in the current year due to ongoing production challenges. The revised PT would represent upside potential of more than 60% based on the last traded share price of about $18 in post-earnings late trading August 3rd.

Lucid Valuation Analysis (Author)

The key valuation assumptions applied in the analysis remains largely consistent with those discussed in our previous coverage, which reflects Lucid’s favourable long-term growth prospects, supported by its differentiated strategy in capitalizing on opportunities within the premium EV market through best-in-class performance and quality. Lucid’s massive – and still growing – order book continues to corroborate favourable market share gains within the higher-priced and higher-margin luxury EV market over the longer-term, which warrants a slight valuation premium over its peer group (ex-Tesla to remove skew).

Lucid Valuation Analysis (Author) Lucid Valuation Sensitivity Analysis (Author)

Final Thoughts

Supply constraints and rising input costs continue to overshadow the automotive industry’s robust demand environment. But as a relatively new player within the capital-intensive business, Lucid’s progress in improving its production and delivery volumes, and growing its order book despite recent price hikes demonstrates its strength in managing and navigating through the unprecedented industry headwinds.

Market expectations have already been lowered for the broader automotive industry, as observed in the Lucid stock’s recent recovery towards early IPO levels despite its downward adjusted guidance from earlier in the year. Looking ahead, Lucid’s performance in the second half of the year will be a critical determinant for restoring investors’ confidence in the stock and catalyzing renewed upside potential beyond the turmoil it has experienced in the first half of the year. The stock remains a favourable long-term investment at current levels, considering there is still a massive growth trajectory to be realized, underpinned by international aspirations and a growing product portfolio to support notable EV market share gains for Lucid over the longer-term.

Be the first to comment