Gennaro Leonardi/iStock Editorial via Getty Images

Pair / three-way trade

Seeking Alpha’s Top Pair Trade Thesis competition is due by midnight on the Fourth of July, so in honor of Independence Day, I picked the following thesis based on truth, justice, and the American way. I love free enterprise and the rule of law. Here’s my bet that they will long endure. While America has thrived due to individual liberty and limited government, one of very few things that we need government for is backstopping private contracts. We’re actually freer when we have a court system that forces people to do what they contractually bound themselves to do. Without that role, we would decline into anarchy.

For background on this situation, please check out Arb’s Golden Age: Elon Musk And Twitter (NYSE:TWTR). Today, it offers a 58% IRR if the deal closes by the second quarter of 2023. That leaves plenty of time to do this the easy (just close on terms) way or the hard (litigate or settle on the courthouse steps) way. Twitter is making good progress rolling through the deal conditions and they’re ready for a legal fight if necessary.

Truth, justice, and the American way? Absolutely. This deal was signed just two months ago. Both the buyer and the seller knew what they were signing. The entire reason to sign a detailed contract is to commit parties to an agreement despite changes in the future that were certain to change the attractiveness of the agreement. Otherwise, they would just shake hands.

Today, the merits of the definitive merger agreement for Elon Musk to buy Twitter for $54.20 per share is being litigated in the court of crazy tweets where there’s no particular standard for truth or justice. Soon, the merits could be litigated in the Delaware Court of Chancery where they care about such things. Followers, likes, and retweets will stop mattering. Contractual minutiae surrounding reasonable best efforts, material adverse change carve outs, and the parties’ representations will start mattering.

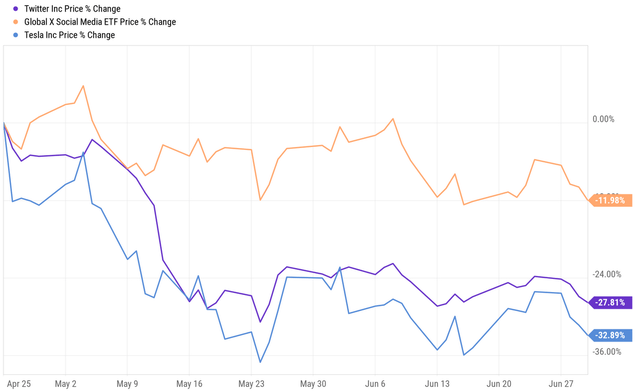

In a legal showdown, Twitter will win and Musk will lose. But only if it gets that far. Musk’s lawyers might try to dissuade him from fighting all the way to a legal decision that would probably force specific performance of the contract. He could be exposed to alleged charges that he has repeatedly violated a non-disclosure and non-disparagement agreement with Twitter, that he possibly failed to timely notify his Twitter investment, and that he allegedly mischaracterized the nature of his investment once he belatedly made the (incorrect) filing. Delaware litigation involves a highly detailed, almost proctological, discovery process. I’ve been a witness in Delaware and my lawyers’ constant admonition is “always tell the truth and never volunteer anything.” Musk appears incapable of following either instruction and his lawyers know it. Once Twitter gets access to his internal communications, there’s a high likelihood verging on a certainty that there’s a record of bad faith and buyer’s remorse. He just doesn’t want to pay full price because the market has sold off and the deal is more expensive than he first expected. Comparable companies as represented by the Global X Social Media ETF (SOCL) are down. Perhaps more importantly, Tesla (NASDAQ:TSLA), Musk’s source for much of the deal funding, is down, too. So he’s willing to say anything to lower the deal price or get out of the deal. But his explanation isn’t true. And backing out of a definitive contract with specific performance isn’t just. It isn’t the American way and it isn’t the Delaware way.

If you agree to a deal that you don’t like, then make a better deal next time.

Tesla

Despite certain misgivings surrounding the principals in my two short ideas – Tesla’s Elon Musk and my bonus short in Truth Social’s Donald Trump – one can learn something from everyone. From Musk, I learn the importance of subsidy harvesting. Throughout its history, Tesla has primarily been a subsidy harvesting company with the actual car business more of a side gig. From Trump, I learn the importance of earned media. He never actually paid for that much advertising, because he was able to generate so much buzz for free.

Tesla’s subsidies are particularly remarkable because they’re so regressive. Average Tesla buyers earn far more than the per capita GDP. They’re disproportionately coastal elites. While rich people should be able to buy whatever toys that they wish to, they should have to pay for them with their own money. As the government is increasingly broke, that may become the consensus among taxpayers and even politicians. If the spigot gets turned off, Tesla’s future could become far bleaker than its past. Much of their business has been in selling environmental credits to competitors such as Ford (F) and GM (GM). Tesla also was a big beneficiary of $7,500 tax credits that artificially lowered the price for customers to buy their cars.

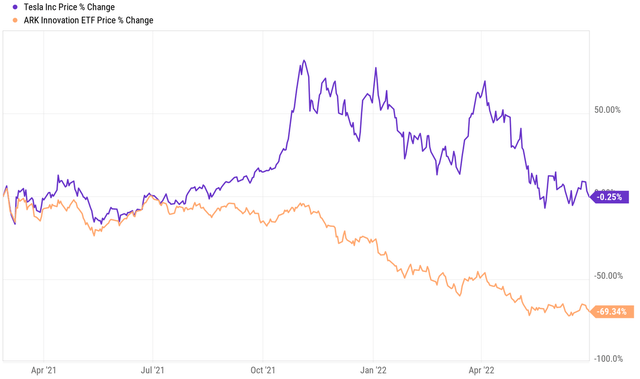

Musk will have to sell more of his Tesla shares in order to pay for Twitter. This may prove to be an inopportune time to do so. In StW’s Best Shorts, I suggested shorting ARK Invest (ARKK).

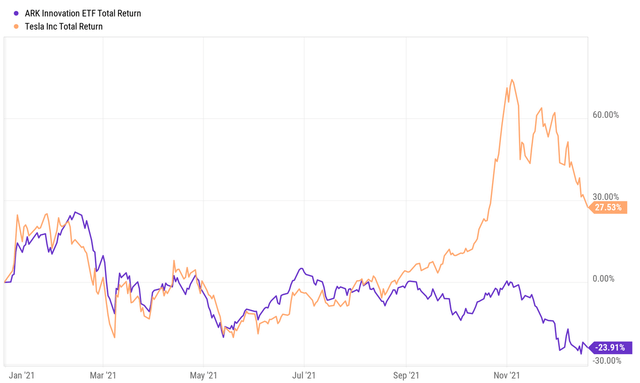

As the mania for overpriced tech has begun its collapse, ARKK shares have declined by more than 69% despite its major position in Tesla trading flat. But if Tesla goes the way of the rest of the ARK portfolio, then the bubble era fund could be in real trouble. The fund family essentially has two parts – unprofitable tech promotions and Tesla. As described in ARK Innovation ETF Is A Cinch:

The first component is unprofitable tech. That was a perfect sector for early COVID, when the world was shut down, interest rates were close to zero, and investors were willing to humor companies without products or customers but with 2030 EBITDA projections. As speculators piled into ARK ETFs, ARK piled into a small number of overlapping illiquid unprofitable tech stocks. Today, ARK’s growth in net assets has stagnated. If it starts to experience outflows, everything will shift into reverse. There will be a run on the bank as speculators realize that the last ones to leave will be left with the least liquid names. Compounding this problem, they have total portfolio and trading transparency, allowing other market participants to front run their efforts to sell.

The second component is Tesla. It really highlights how badly the first component has already done this year that ARKK is down over 20% with its biggest holding beating the market.

Y Charts

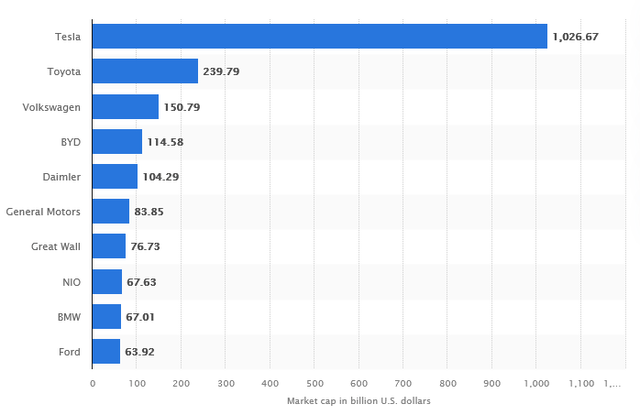

Will TSLA save ARKK by compounding at over 40% over the next five years? If so, its market cap would surpass a trillion dollars next year, two trillion within three, then three trillion, then top out at $4.8 trillion. As speculators place their bets on the future, Tesla has already soared past everyone else in the automotive industry. According to Statista, Tesla’s market cap is an outlier among carmakers:

Statista

But over the next five years, the short-term voting machine will be replaced by the long-term weighing machine. Tesla will have to live up to a long list of promises in order to justify being worth four Toyotas (TM). But it would have to invent time travel to justify being worth 20 Toyotas.

The weighing machine is starting to weigh. Tesla has declined by about a third since that was written in December but that could just be the beginning.

Trump SPAC

If one wants another Twitter hedge, I’d strongly consider the Trump SPAC, Digital World (NASDAQ:DWAC). Their stock is worth less. Their warrants (DWACW) are virtually worthless. For background, check out Trump SPAC: Strong Sell For Digital World. This SPAC is in a deal to promote a right of center alternative to Twitter. Whatever its political merits, it’s technologically and structurally unsound. One problem with going up against big tech is trying to cobble together a platform without big tech. Instead of relying on Amazon (AMZN), they rely on Rumble (CFVI) (CFVIU) (CFVIW)… and it shows.

Caveat

Elon Musk is unpredictable and could do, say, or tweet absolutely anything (although he’s been oddly absent from Twitter for the past week). Donald Trump is pretty volatile too. Prediction markets indicate a one in four chance he gets indicted and a similar chance that he reclaims the White House. So with these two, anything can happen. Size accordingly.

Conclusion

Based on the contract, my long idea is to buy TWTR. Based on the deal’s financing requirements, my short idea is to short TSLA. Based on TWTR’s network effect, my bonus short idea is to short DWAC. Based on prior comment sections, my final idea is to stop writing anything about Donald Trump or Elon Musk – it brings out the trolls.

TL; DR

Buy TWTR, short TSLA, sell DWAC.

Be the first to comment