ablokhin/iStock Editorial via Getty Images

In celebration of my latest batch of short puts on Landstar System, Inc. (NASDAQ:LSTR) expiring worthless, I thought I’d write about the business again to see if it’s worth buying some shares, writing some more puts, or avoiding the name altogether. In my most recent missive on this name, I suggested that the valuation was stretched, and the shares are down about 13% since against a loss of about 6.8% for the S&P 500. If you missed the not so subtle brag in that observation, please go back and reread that sentence. Anyway, I’ll make the “buy, sell, hold” decision by looking at the recent financial history here, and by looking at the stock as a thing quite distinct from the underlying business. Finally, as I frequently point out, “I gotta be me”, and so I’m going to spend some time writing about put options.

Welcome to the “thesis statement” paragraph of the article, dear readers. It’s here where I present the crux of my argument, so you won’t be obliged to read any further than is absolutely necessary. I do this as a public service for people who are both busy and impatient with my singular writing style. You’re welcome. So, I think Landstar had a reasonably good year in 2021 compared to both 2020 and 2021. Also, the company engaged in a very successful buyback in my view. The problem is the share price. Although it’s much closer to what I would consider to be reasonable, it’s not there yet. It’s close, though, which means we’re able to earn some decent premia on short puts with good strike prices. If you’re comfortable with selling puts, I recommend the October $115s at the moment. If you’re not, I would hold off a bit longer before buying this name.

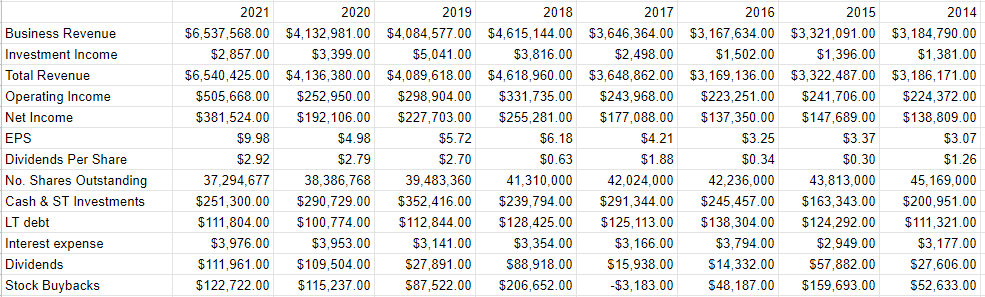

Financial Snapshot

I think the financial performance in 2021 was mostly good. Relative to 2020, revenue was up about 58%, and net income was up a whopping 98% from 2020. Management rewarded shareholders with another uptick in dividends, which climbed by 4.6% or $.13. Also, in case you’re concerned that 2021 looks particularly good because 2020 was uniquely bad, fret no further. The fact is that 2021 was also quite good relative to the pre-pandemic period. Specifically, revenue and net income in 2021 were 60%, and 67.5% greater than they were in 2019 respectively.

Turning to the capital structure, the level of indebtedness hasn’t really moved, but I’m not that concerned about it, given the strength of the balance sheet. Specifically, the company has approximately 2.25 times more cash on the books than long term debt outstanding. Given the huge cash and short term securities hoard of ~$251 million, I’m not concerned about the sustainability of the $112 million dividend outflow.

The Buyback

I feel like writing about the buyback activity in the final quarter, so I’m going to write about the buyback activity in the final quarter. I’ll start by going over the relevant facts provided by the financial statements for both Q3 and the full year.

-

For the period ended September 25, 2021, there were 38,108,586 shares outstanding.

-

For the fiscal year ending December 25, 2021, there were 37,294,677 shares outstanding.

-

Thus, the company retired 813,909 shares in the final quarter of the year.

-

As of September 25, 2021, the company had spent $50,230,000 on stock buybacks, and took in $134,000 in proceeds from stock options. This nets out to $50,096,000 spent on retiring stock during the first 39 weeks of the year.

-

As of December 25, 2021, the company had spent $122,722,000 on stock buybacks, and received $160,000 in proceeds from the exercise of stock options, for a net buyback figure of $122,562,000 spent on retiring stock during the whole year.

-

From the above, we can conclude that during the final quarter of the year, the company spent $72,466,000 to retire 813,909 shares during the final quarter of the year.

-

Applying the math skills so lovingly and compassionately imparted to me by the nuns at Holy Spirit School many decades ago, I conclude that the company managed to retire these shares at an average price of $89.03.

I find that fascinating in light of the fact that the low price for the period at issue was about $150 per share. If anyone from management would be kind enough to reach out and walk me through how they managed this feat, I’d appreciate it, because the idea of buying this far below market is very attractive to me.

Anyway, my sarcasm aside, I’d remind readers that I judge the quality of the buyback by the valuation at which they happen, rather than whether the buyback price is above or below the current market price. If the company paid a huge PE ratio, for instance, I’ll be critical of the buy. If it retired shares at a discount, I’ll be favourably disposed toward it.

Given all of the above, I’d be happy to buy at the right price.

Landstar Financials (Landstar investor relations)

The Stock

Some of you masochists who follow me regularly know that it’s at this point in the article where I turn into a real “downer” because it’s here that I remind everyone that a great company can be a terrible investment at the wrong price. There is a difference between a company, and its stock. This is because the company sells goods or services, hopefully for a profit. The stock, on the other hand, is an often poor proxy for the company, as its price changes reflect more the mood of the crowd than anything related to the company. In particular, the stock is buffeted by the crowd’s changing attitudes about the very long term future of a given company. It’s for this reason that I treat stocks and companies as distinct entities.

I’ll belabour this point by using Landstar itself as an example. The company released annual results on February 18th. If you bought this stock that day, you’re down about 5.5% since. If you waited until April Fool’s Day to buy, you’re up about 3.6%. Obviously, not much changed at “the company” over these six weeks to justify a 9% variance in returns from “the stock.” The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

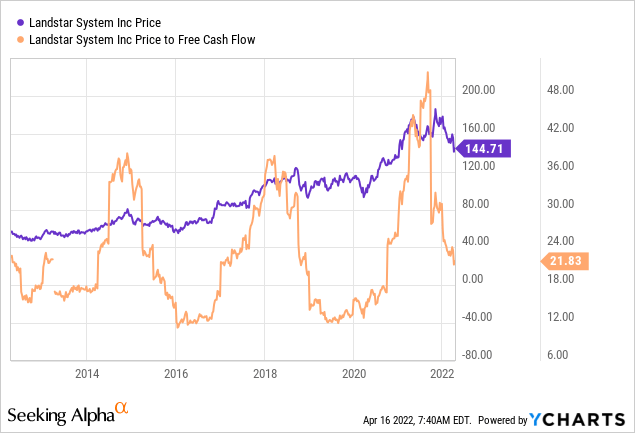

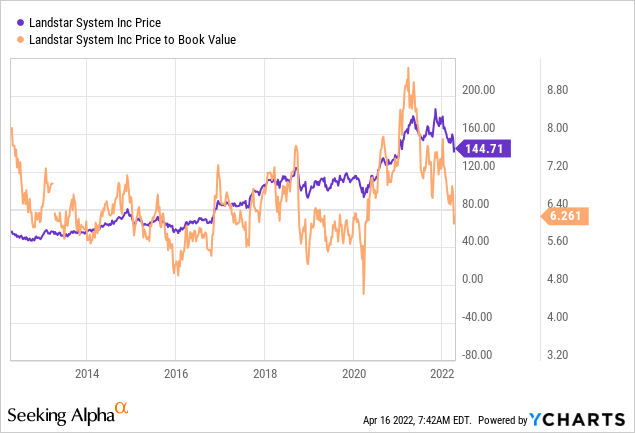

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. When I last looked at Landstar, I threw a hissy fit because the shares were trading at a price to free cash flow ratio of ~29 times, which was near the historical high for the equity. At a ratio of 6.94, the price to book was also rather high by historical standards. Currently, shares are much closer to reasonably priced on both a price to free cash flow and price to book basis in my view, per the following:

Source: YCharts

Source: YCharts

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Landstar at the moment suggests the market is assuming that this company will grow at about 4.8% over the long term. Although this is a much better assumption than the previous 5.5% growth rate, it is neither optimistic, nor pessimistic in my view. I’d suggest that the shares are currently neither cheap nor expensive. Given that I’m a coward, I’ll not buy at current prices, though the shares are getting quite a bit closer to a “buy” price for me.

Reviewing The Buyback

You may recall from the above that the company seems to have retired shares at a price of $89. I consider this to be a very good use of shareholder capital, because this is the equivalent of retiring shares at a price to free cash flow of ~13.4 times. That is very low by historical standards. In my view, if a retail investor bought at that valuation, they would be virtually guaranteed a great return on this stock. For that reason, I tip my hat to management for pulling off this buyback at this price.

Options Update

As I pointed out at the beginning of this article, the puts I wrote previously have just expired worthless, which was a positive outcome in my view. These returns, although small, were superior to the 9% loss that shareholders suffered from the time that I wrote these way back in September of 2021. This trade is yet another example of the risk reducing, yield enhancing potential of these instruments.

I like to try to repeat success when I can, and with that in mind, I’m comfortable selling some more put options on this stock. Now that we’re much closer to a price at which I’d be willing to buy, I’m comfortable initiating one of these trades that I so often characterise as “win-win.” if the options expire worthless, I obviously win because I collect premia. If the shares drop in price, I’ll be obliged to buy, but will do so at a price much lower than the current market price, which I consider to be a relative win.

I’d be happy to pay about 17 times free cash flow for this business, because that rate is relatively low for this business. That lines up with a price of ~$115, so I’m willing to sell puts with that strike price. At the moment, I like the October puts with a strike of $115. These are currently bid at $2.55, which I consider to be a reasonable level. If the shares remain above this price over the next six months, I’ll simply pocket this premium. If the shares fall in price, I’ll be obliged to buy at a net price of $112.45. Holding all else constant, this lines up with a dividend yield of ~.9%.

Welcome to the “risk” portion of the description of put options. If you read “win-win” and interpreted “risk free”, I’m sorry but I’m about to burst your bubble. After all, it’s all well and good for some stranger on the internet to characterize these things as “win-win” trades as I frequently do, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. This is why I didn’t write more puts on Landstar when I last reviewed the business. The shares were too expensive, and premia for reasonable strike prices was too thin for me. So, before considering this type of trade, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Landstar, and that spot prices revers and head higher from here, which drives shares jump to $180 over the next six months. The short put only offers you the option premium. The return from the short put may be lower risk, but it’s certainly limited, and that can be emotionally painful for many.

Secondly, I can say from many years of painful experience that it can be emotionally painful when the shares crash below your strike price. While these trades have worked out well in the medium to long terms, largely because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. So, I can make a reasonable argument that Landstar shares are a bargain at $115, but if they drop to $100 because of a market meltdown, for instance, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

I’ll conclude this rather long and tedious discussion of risks by looking again at the specifics of the trade I’m recommending. If shares of Landstar remain above $115 over the next six months, I’ll add the premium to other short puts I’ve written and move on. If the shares fall below $115, I’ll be obliged to buy, but will do so at a price that is very near the low end of the valuation range. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” It is strange to conclude a discussion of risk by describing, yet again, how these reduce risk. Such is the unpredictable world.

Conclusion

I think Landstar is a reasonable business, with a dividend that is very well covered in my view. The shares are much cheaper than when I last reviewed this name, but they’re not quite “there” yet. Rather than sit around and wait for a further price drop that may never come, I think investors would be wise to sell the puts described in this article. If the investor is exercised at $115, they’ll win over the long term. If the investor collects the premium only, they’ll win over the long term.

Be the first to comment