Tevarak/iStock via Getty Images

We all want to help the world become a better place, but in the business world, there is always a profit motive. As such I have learned to be extra skeptical of companies that try to present themselves as altruistic.

Remember how Robinhood (HOOD) was going to “democratize finance”? Or how Theranos was going to make healthcare cheaper and more accessible……

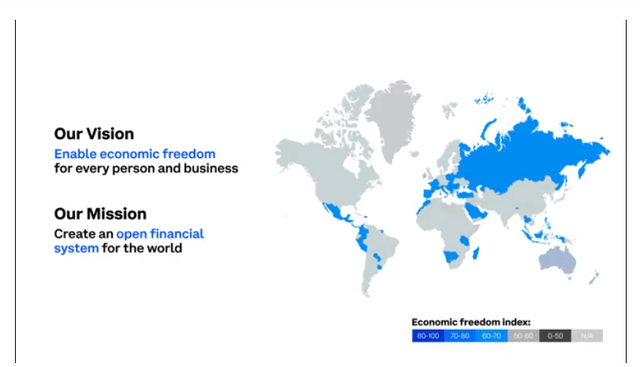

Well, now Coinbase (NASDAQ:COIN) is going to increase economic freedom in the world. It is the first line in their business description from the 10-K

“Our mission is to increase economic freedom in the world.”

In my experience, when a company tries to hide behind platitudes it might be wise for investors to run for the hills.

A proper business succinctly presents its profit engine to the investment public. It explains the strategic positioning that allows it to capture profits in exchange for providing some sort of good or service.

Businesses exist to turn a profit and if a business is operating in an ethical way it doesn’t need to hide that profit motive. As such, the presence of this extra layer of salesmanship is a yellow flag that causes me to immediately want to dig deeper and find out what is really going on.

Lessons of recent history

We now know that Theranos was largely fraudulent and that the amazing single droplet of blood diagnostic product they claimed to have didn’t really exist.

That said, such altruistic facades do not necessarily mean that the business isn’t profitable or that the product doesn’t work. It could instead mean that the company doesn’t really want the public to know how it makes its profits.

Robinhood’s “free” trading was really just commissions in the form of payment for order flow rather than direct commissions.

It was much easier to sell to new customers, however, if they are “democratizing finance” than if they came out and said that they were selling their customer’s trades to big institutions who could then get in front of Robinhood’s customers.

It was a fully legal business practice, but the optics around it were manipulated. Robinhood presented themselves as the populist helping the little guy benefit from Wall Street, but in reality, Robinhood was helping Wall Street firms like Citadel Securities profit off of the little guy’s trades in exchange for absolutely massive payment for order flow revenues.

As far as I know, all of this was properly disclosed, but it wasn’t until Interactive Brokers (IBKR) embarked on a massive advertising campaign to essentially out Robinhood that the general public became aware of how it worked.

Once the information became widespread, Robinhood’s customer acquisition pace was diminished and it became clear how overvalued the stock was resulting in a roughly 60% tumble from IPO pricing.

The reason I went into such detail about Robinhood in a Coinbase article is because the stories are remarkably similar.

- Both companies are custodians

- Both companies claim to be bringing economic success to the little guy

- Both companies profit by giving favorable treatment to institutions at the expense of retail investors

I will detail how COIN is overcharging retail investors, but first, we need some background information as to how it got to its current state of unmitigated success.

A perfect storm of tailwinds

Despite its blisteringly fast rise from a startup to a $40B market cap, Coinbase is not a bubble stock. In fact, it is trading at a reasonably cheap multiple as its earnings are remarkably high.

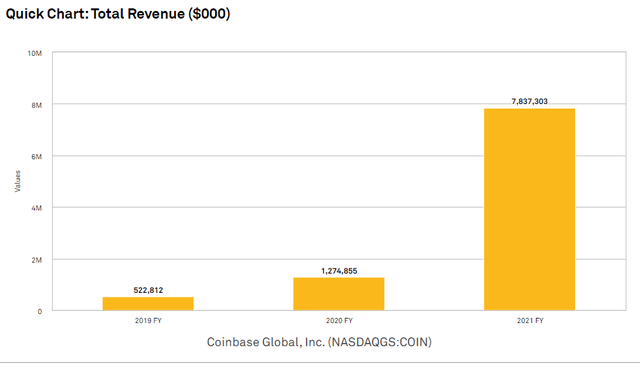

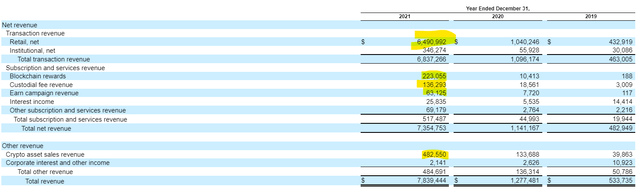

In just a few years’ time, it built to 2021 revenues of $7.87B.

These are high margin revenues and the company has already achieved sufficient scale that they overcome expenses with an impressive amount flowing through to the bottom line.

This is the venture capital dream – rapid achievement of a multi-billion dollar revenue stream and profitability.

So how did they manage to do it?

Well, crypto exploded from a state of non-existence to a multi-trillion dollar asset class. It works differently than other investments and most traditional custodians were not particularly well equipped to handle trading, derivatives, staking, and all the other microtransactions involved in crypto investment.

There was a void with massive demand and not enough accessibility.

Coinbase stepped in and filled this void, quickly becoming a dominant force in the transactional side of crypto. It became the first major custodian to be specifically specialized in crypto transactions, and in so doing, captured a substantial market share.

I am impressed with the speed at which they moved and the usability of their products. Coinbase strikes me as a well-run company and I think it is their strong operations that launched them to profitability in an era where other young companies were still chasing revenue growth at negative profitability.

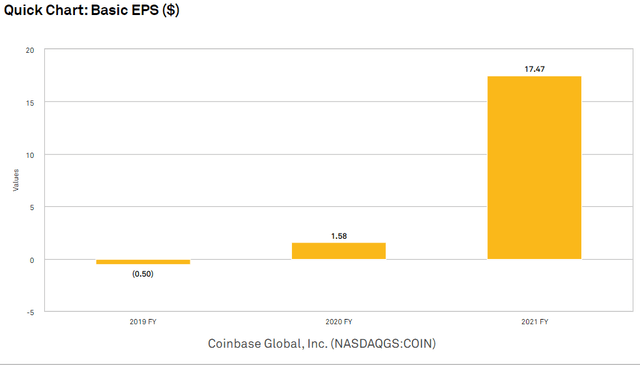

Given the historical growth rate, I can understand why COIN may appear like a good investment at its price of roughly 13X trailing earnings. There are things to really like about the company. However, I think 2021 was the peak year for earnings and that there is a substantial downside ahead.

Specifically, there are 3 sources of problems going forward:

- Robinhood style reputational damage

- Substantial declines in revenue per transaction and fee percentages

- Decline in crypto (already occurred and potential future)

Robinhood style reputational damage

At the start of this article, we discussed how Coinbase presents themselves as this big advocate for financial equality. Here is a snapshot from their intro video

In practice, however, just as Robinhood’s payment for order flow transfers wealth from Main Street to Wall Street, Coinbase is extracting extreme fees from retail customers while giving preferential treatment to institutional customers.

To be fair, it is common practice to give discounts to those who buy in bulk, but the discounts are usually rather small.

Interactive Brokers, for example, charges slightly lower commissions to customers with very high transaction volume. This amounts to maybe a few basis points of savings for institutions.

At Coinbase, the difference in what they charge institutions and retail investors is enormous. As per COIN’s CFO Alesia Haas in the business model presentation retail customers were charged on average 1.4% fees on crypto transactions while institutional customers paid under 10 basis points in 2020.

The retail investor has to pay more than 14 times as much in transaction fees. Not only is the difference shocking, but the absolute magnitude of fees is way too high.

With transaction fees of 1.4%, it makes trading crypto much lower expected return. If you trade frequently, it becomes almost impossible to turn a profit.

Coinbase justifies this rather extreme transaction fee with the following statement, also in the business model presentation:

“These fees reflect the additional value we provide to users such as integrated secure asset storage and fraud prevention”

I have worked with quite a few different custodians and these features were always provided to my account for free so I’m not sure they qualify as additional value.

The fees do not stop there. On the same business model presentation:

“Coinbase takes a fee on all staking rewards earned by our users”

For those unfamiliar, staking is essentially a way for someone to earn a yield on certain types of crypto assets. In exchange for holding them for a certain duration, the crypto owner gets a certain yield. It is analogous to dividends or interest payments on a stock or bond.

Taking a portion of these is the equivalent of pilfering a portion of one’s dividends. I can’t imagine any income investor staying at Schwab if they were to start taking a bite out of dividends.

All in, Coinbase is getting a massive stream of revenues and they come almost exclusively from the transaction and other fees to retail customers.

This is where I think there is potential for reputational damage and revenue erosion.

Nobody likes to get nickel and dimed and this is fertile ground for any other competing custodian to come in and point out all these egregious fees. As other custodians beef up their crypto capabilities you can bet they will be coming after Coinbase’s market share.

Just as Interactive Brokers successfully took down Robinhood, any of the major custodians can make an ad saying “Coinbase charges 1.4% transaction fees on crypto, come to our platform where we only charge 0.7%.”

Fees of this magnitude only worked because COIN was the only game in town. That is no longer the case. Many of the major custodians are now in on the crypto game and it will be a race to $0 trading just as happened to the whole industry on regular stock trading commissions.

If and when this happens, Coinbase’s revenues and margins would shrink dramatically. Their custodial assets and trading volume can support the $40 billion market capitalization when the fees are this high, but once they have to charge more normal fees it would require at least 10X the volume.

This brings us to the final factor that presents an existential threat to COIN.

The decline of crypto

In 2022, crypto prices have dropped significantly.

Historically, retail transaction volume in crypto for Coinbase has strongly correlated with crypto prices. As the prices drop, trading volume drops as well.

As such, COIN’s profitability is directly influenced by the level of hype for crypto assets. This presents an existential risk to COIN in a way that is simply not present at other custodians. Crypto’s status as an asset class is still unproven.

Since COIN is exclusive to crypto, this risk is unique to COIN. It is almost certain that the broader markets will still exist in 20 years so the other custodians will always have a market in which to facilitate transactions. It could, however, potentially be the case that in 20 years crypto just isn’t a thing anymore.

Overall, the bull thesis on COIN requires so many things to go right.

- Crypto must succeed as an asset class

- COIN must maintain or grow its oversized market share

- Transaction fees need to stay high

In contrast, the bear thesis on COIN only requires one of the above to fail.

Even if crypto proliferates and COIN maintains its market share despite ramping competition, the normalization of fees would be so devastating to margins that it would be hard to justify a $40 billion market cap.

Falling earnings

Even aside from the above structural challenges, the mere fall in crypto prices that has already happened in 2022 is clobbering earnings. Transaction volumes are down, crypto rewards revenues are becoming less rewarding and the crypto assets on COIN’s balance sheet are likely to have a nasty mark to market.

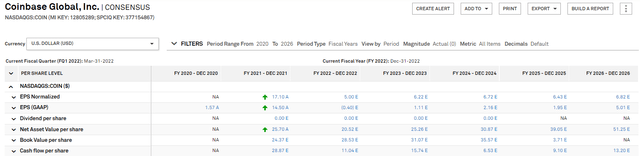

Consensus calls for earnings to fall from the 2021 peak of $14.50 GAAP to negative $0.40 in 2022.

Against 2021 peak earnings COIN appears to be trading at a decent valuation, but if you value it against any other year the multiple is extreme. Even if we are generous and use normalized earnings instead of GAAP the multiple is far too high.

Even the strongest brokerage houses don’t trade at multiples anywhere close to that of COIN.

- Coinbase 2022 multiple on Normalized EPS 36.6X

- Coinbase 2022 multiple on GAAP – (no multiple as negative)

- Coinbase 2023 multiple on GAAP – 164X

- Charles Schwab (SCHW)- 23.6X

- Interactive Brokers – 19.6X

- Morgan Stanley (MS) – 12.4X

Risks to shorting COIN stock

Although COIN’s early mover advantage is eroding in crypto, it has the potential to glean a fresh early mover advantage in Web 3.0 or Non-fungible tokens (NFTs). If these take off and COIN successfully monetizes its capabilities in the space it may be wise to close out a short position.

Despite being the subject of a highly publicized short by Jim Chanos, the short interest on COIN is relatively small at 4.15%. As a large-cap company with only moderate short interest, I don’t anticipate it incurring hard to borrow costs, but that of course can vary by custodian.

Shorting of course involves asymmetric risk to reward as the most one can gain is the stock dropping to $0, but in theory, the losses on a short position can be infinite. A more risk-averse investor may wish to short via options instead. This can be a viable way to do it, but it does come with the added difficulty of having to not just be right, but to be right within the timeframe of the option.

Wrapping it up

COIN’s meteoric rise came about in a period of time that was a perfect storm of tailwinds. There was extraordinary demand growth for crypto and a paucity of competition. This sort of environment cannot last forever. Even if crypto succeeds, competition will pour into the space and bring margins down to a normal economic level.

COIN has been very adept at profiting from the crypto craze, but it is not going to save the world from economic inequality. It is just a regular company trying to make a profit and forward profits do not justify a market capitalization anywhere near $40B.

Be the first to comment