coffeekai/iStock via Getty Images

Investment Thesis

Shopify Inc’s (NYSE:SHOP) shares went on a sharp decline in November 2021, when many high-growth tech stocks were punished post-COVID-19 pandemic. The event is not unique to the company, given that many others, such as Wix.com Ltd. (WIX), Block (SQ), and PayPal Holdings, Inc. (PYPL), also rose and fell in the past two years. However, we believe the sell-off was overdone, given how SHOP has proven itself to be highly invaluable and adaptable in the past two years. In contrast to WIX, SHOP has also been reporting net income profitability along with its massive revenue growth.

Nonetheless, the sell-off has also created an attractive entry point for tech investors, who are looking for undervalued stocks with excellent growth moving forward. We will discuss further.

SHOP Is Focusing On Long-Term Growth Post Pandemic Boom

SHOP’s Global Expansion

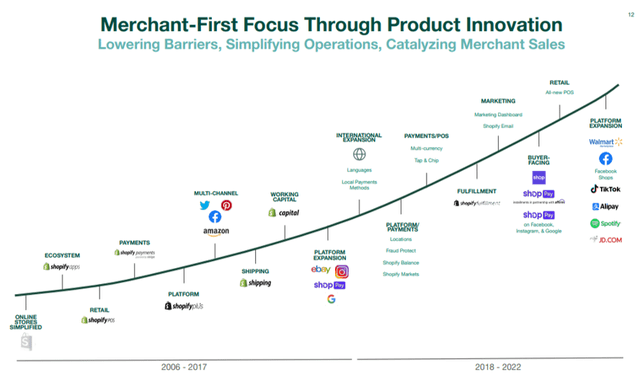

Shopify

On 18 January 2022, SHOP announced its partnership with JD.com (JD), making it easier for its merchants to sell their products cross-border to Chinese consumers. The deal will allow SHOP’s merchants to reach China’s 1.4 billion population via JD’s 550 million active customers. SHOP’s merchants will be able to start selling within three weeks rather than the conventional twelve months with the new sales channel, through:

- Expedited merchants’ onboarding.

- End-to-end fulfillment from JD’s US-based warehouses to China.

- Smart price conversion to local currencies.

- Intelligent translation of product names and descriptions.

Given that China accounts for 50.8% of retail e-commerce sales in 2021 at $2.49T, the significance of the partnership is monumental to SHOP. In addition, the Chinese e-commerce market is expected to exceed $3.6T by 2025, accounting for 48.6% of the global sales at $7.4T at that time. As a result, we expect the groundbreaking partnership to more than offset SHOP’s deceleration in future revenue growth post-pandemic.

However, cross-border selling is not new, given that Amazon (AMZN) has long penetrated the China market since 2004, when the company acquired Joyo.com. Furthermore, Walmart entered China in 1996. Nonetheless, since SHOP had successfully forged a partnership with TikTok Shopping in 2021, we expect its growth in the Chinese market to accelerate, assuming a similar agreement for its Chinese equivalent, DouYin. In 2021, TikTok boasted over 1B of users globally, with DouYin accounting for 639.4M users in China.

In addition to these strategic partnerships, SHOP is looking to aggressively improve its monetization strategies in 2022, through:

- Connecting merchants with consumers for improved shopping experiences.

- Helping merchants reach and thrive in local and global markets.

- Developing scalable tools and ecosystem to support merchants of all sizes.

- Accelerating fulfillment by consolidating its in-house operating networks and its in-house warehousing management while improving cost efficiencies in the long run.

Considering SHOP is also investing in new consumer-facing apps, we may see the company consolidate even more market share and grow its Gross Merchandise Volume (GMV) moving forward.

The Pandemic Propelled SHOP To Global Success

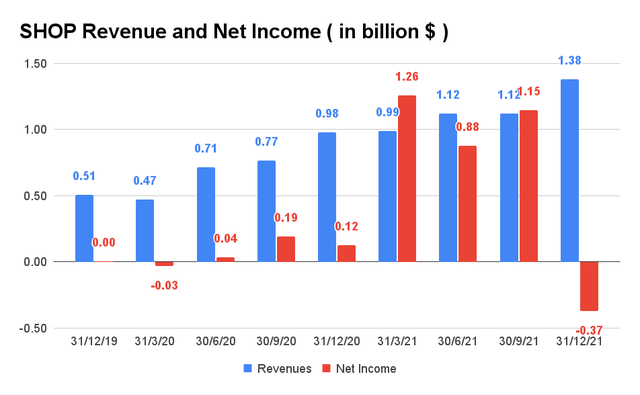

SHOP Revenue and Net Income

S&P Capital IQ

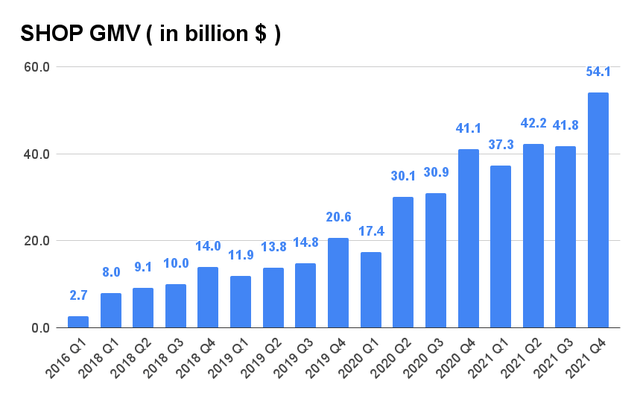

Pre-pandemic, SHOP grew its revenue at an impressive CAGR of 59.48% from FY2016 to FY2019. During the COVID-19 pandemic, the company further grew in strength while recording YoY growth in revenue at 85.6% in FY2020 and 57.4% in FY2021. As a result, it led the company to finally report net income profitability of $319.51M in FY2020 and $2.91B in FY2021. In addition, SHOP also grew its Gross Merchandise Volume (GMV) by double in FY2020 and 46.7% in FY2021.

SHOP GMV

S&P Capital IQ

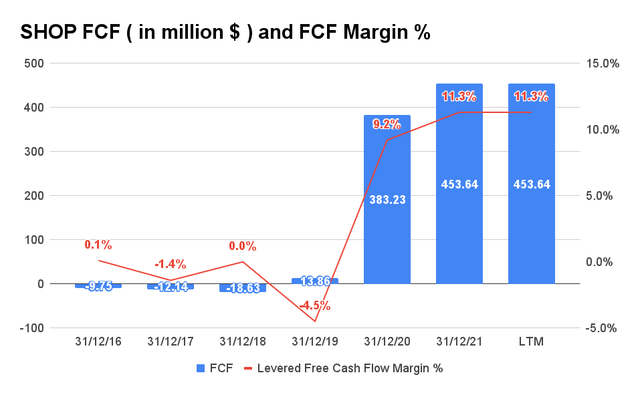

SHOP FCF and FCF Margin

S&P Capital IQ

SHOP also finally reported positive Free Cash Flow (FCF) and growing FCF margins in the last two years, with FCF of $453.64 in FY2021 and an FCF margin of 11.3%. However, given the aggressive proposed reinvestment into its business in FY2022, we expect SHOP to report lower net income and Free Cash Flow for the year, due to additional:

- capital expenditures of $200M.

- stock-based compensation expenses and related payroll taxes of $800M.

- amortization of acquired intangibles of $28M.

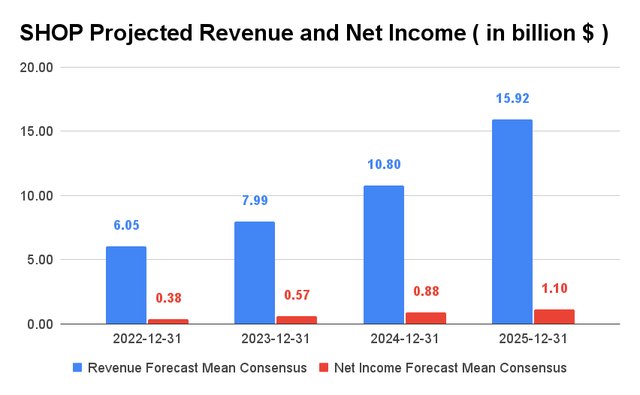

SHOP Projected Revenue and Net Income

S&P Capital IQ

Nonetheless, SHOP is still expected to report excellent revenue growth at a CAGR of 36.32% over the next four years. In FY2022, consensus estimates that the company will report revenues of $6.05B and net income of $0.38B, representing YoY growth of 31.2% and 30.5%, respectively. Despite SHOP’s deceleration in future revenue growth, we simply view it as a normalization of the pull forward growth experienced during the pandemic in the past two years. As a result, investors who have yet to buy into the pandemic highs, should definitely take a closer look at SHOP’s excellent execution and robust business model.

Why The Untimely Stock Split Though?

On 11 April 2022, SHOP announced its plans for a 10-for-1 stock split of its Class A and B shares to make its “share ownership more accessible to all investors.” Since the stock is trading at $617.38 per share that day, the company’s stock split does not seem logical to us. It would have made sense for SHOP to announce the stock split in October or November 2021, before the stock began its downwards decline to pre-pandemic levels. At that time, the stock was trading at sky-high levels of over $1.5K per share, which had probably been unsustainable in the long term.

Conventionally, stock splits occur to high growth tech companies with elevated valuations and stock prices, such as those recently announced by Tesla (TSLA) on 28 March 2022 at $1.07K, Amazon on 10 March 2022 at $2.93K, or Alphabet (GOOG) on 3 February 2022 at $2.96K. It made sense for these companies to split their stocks then, given that retail investors made up a good 11% of the stock market trading in 2021. Since 2016, the percentage of retail investors in the stock market has increased by 300 points from a median of 8%, largely due to the COVID-19 pandemic. In addition, these stocks have generally rallied post stock split announcement, proving that their investors are convinced of its high growth story.

Regardless, what we find interesting in SHOP’s announcement is that the company also proposed an update to its voting structure. The company will convert Director John Phllips’ shares from Class B to Class A, thereby increasing the total voting power held by Class A shareholders from 49% to 59%. Given the change, SHOP also seeks to protect its CEO, Tobias Lutke, by increasing his voting power to 40%, through the combination of newly issued “founder share” and his family and affiliates’ existing Class B shares.

Due to the ‘impeccable’ timing of the announcement, we believe the issuance of the founder’s share is the main reason for the stock split, rather than the supposed affordability of SHOP’s stock. Many brokerage accounts already allow fractional trading, so stock splits do not actually benefit retail investors. In addition, since SHOP’s stock is already down 65%, there is no reason to believe that its valuations will rally just like those of TSLA or AMZN post-split announcement. In contrast, SHOP’s stock only popped 1.5% on 11 April, before continuing its downwards decline.

Given the recent weakness in SHOP’s performance, shares and valuations, it is imperative that the Canadian company bolster its CEO’s position through the ‘founder shares.’ Media and telecommunication companies in Canada have long used dual-class share structures for generations to maintain management and voting control. The practice is also similar to Meta’s (FB) current course, where its CEO, Mark Zuckerberg, owned 58% of the company’s voting shares as of October 2021. Alphabet deployed a similar strategy, where its co-founders Larry Page and Sergey Brin also owned 51.5% of the company’s voting rights as of September 2021. These strategic moves allowed the management, i.e., the founder, to make long-term executive decisions that may have seemingly negative short-term impacts on its shareholders. It also ensures that the founders could never be outvoted and fired at will. Zuckerberg had said:

You don’t have to worry about losing your job over a couple of bad quarters or controversial short-term decisions, and that makes it easier to make the decisions you think are correct. (Fortune)

Nonetheless, given that SHOP’s new issuance of founder shares came with a sunset clause, investors need not worry about the “intergenerational transfer of voting power.” However, we must highlight that the future conversion of Class B to Class A shares may potentially dilute existing shareholders and further transfer voting powers, when Tobias Lutke ceases to be SHOP’s CEO, similar to the currently proposed conversion for Director John Phillips.

So, Is SHOP Stock A Buy, Sell, or Hold?

SHOP is currently trading at an EV/NTM Revenue of 11.52x, lower than its 3Y mean of 29.49x and pre-pandemic levels of 13.61x. The company is also trading at $604.78 as of 13 April 2022, down 65% from its 52 weeks highs of $1762.92, and is almost at its pre-pandemic levels in February 2020. As a result, SHOP currently looks very attractive, given its reasonable entry point, proven business model, stellar engagement, and aggressive investments in its future monetization capabilities.

However, barring a rally from any future earth-shattering events similar to the COVID-19 pandemic, we do not expect SHOP’s valuations to skyrocket again. Instead, SHOP is more likely to grow steadily in the long run, similar to Amazon and Oracle Corporation (ORCL).

Therefore, we rate SHOP stock as a Buy only for long-term investors.

Be the first to comment