PaulMcKinnon/iStock Editorial via Getty Images

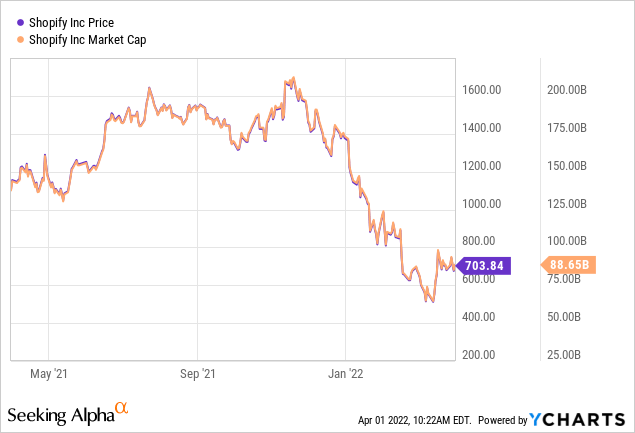

When we last covered Shopify (NYSE:SHOP) we rated this as a rare “Strong Sell” within our coverage. While we were certain of the longer-term outlook, we were a little circumspect about the shorter-term movements. Specifically, we said:

But just like AMZN in 2000, the valuation is what’s critical for an investment to pan out. SHOP’s valuations, even after this drop, are so horrifying that we think that a positive return is unlikely over the next 10 years. We still rate this a sell, although a bounce would not surprise us in the least.

SHOP did move lower and then had a rip-roaring rally, including a last minute $100 move that confounded even the bulls. With that bounce out of the way and the stock no longer oversold, we go over why we think the next 40%-50% move is likely to be down.

Revenue Estimates Falling As Expected

One of the key legs of our bearish call was that the analyst community was far removed from reality on revenues and that this will require multiple downgrades. Stocks tend to struggle when revenues are consistently downgraded, and we think SHOP will be no different. This has not exactly played out as expected, but that is a good thing in our opinion. Consensus revenue estimates have fallen, but they are nowhere near where we expect things to come in.

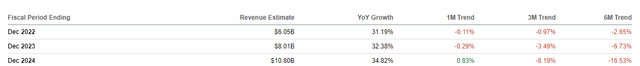

SHOP Revenue Trends (Seeking Alpha)

The mean estimate is still at $6.05 billion and looking for 31% growth over 2021.

SHOP Mean Revenue Estimate (Seeking Alpha)

We think the low end is more likely ($5.7 billion) to be achieved and that comes from our verdict on the economy and saturation of online merchant growth. It also comes from our thought that the pandemic pulled forward demand on multiple levels and normalization will be painful. This should lead to more downgrades after the next report, pressuring the stock.

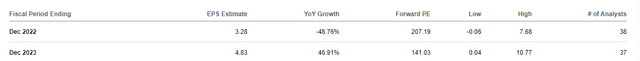

Earnings Estimates Get Full Dose Of Reality

Unlike the revenue estimates, Wall Street and Bay Street have been quick to realize that their earnings estimates were just plain bonkers.

SHOP Earnings Estimates (Seeking Alpha)

Here the low estimates are actually for a loss and that is where we stand.

SHOP Earnings Estimates (Seeking Alpha)

Keep in mind that SHOP had already experienced EBIT margin pressures in Q4-2021 and inflation was still ramping up substantially. If a loss is projected for SHOP, bulls are likely to throw in the towel on the growth story. Looking beyond those numbers that we see above, investors who have not been brainwashed by the 2020 and 2021 hype, will remember that those are not real earnings. They are fluffed up bunnies that hide the actual GAAP earnings. In 2021, stock based compensation was $3.18 of earnings. That works out to over $400 million that investors tend to ignore when computing the value of the company. Since we expect even non-GAAP to be a loss in 2022, this does not really matter for now. But it does matter from a longer term perspective, and we think adjusted for this, even 2023 will be unprofitable.

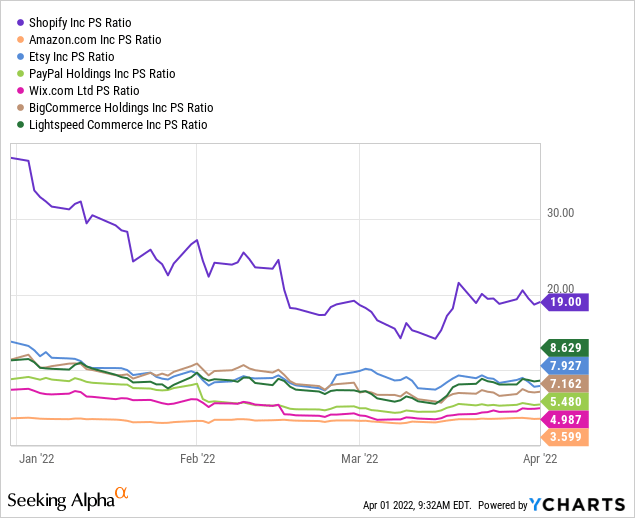

Comparatives & Valuation

With interest rates rising sharply we expect SHOP and all growth stocks to return to more reasonable levels of multiples in 2022 with final troughs in 2023. What is a more reasonable level for SHOP? Exact comparatives are hard as SHOP does a few different things but Wix.com (WIX), BigCommerce Holdings Inc. (BIGC) and Lightspeed Commerce Inc. (LSPD) are perhaps the most similar. Amazon Inc. (AMZN) and Etsy Inc. (ETSY) while perhaps not exactly comparable, are competing for the same growth in e-commerce and are shown as well. Finally we threw in PayPal (PYPL) which is a good comparative for the payment processing segment. SHOP makes a lot of dough from payment processing. While all of them are at expensive valuations in their own right, none of them are remotely as expensive as SHOP.

We would look for an 8X revenue multiple by end of 2022 and a $46 billion market capitalization in the same time frame.

That works out to about 45% lower from here. We remain bearish and think all surprises will come on the negative side. As investments that looked for 2020-2021 growth to repeat start competing with SHOP, margin pressure will accelerate and that has potential to hasten the move to normalized sales multiples.

Be the first to comment