JHVEPhoto

Thesis

Shopify Inc.’s (NYSE:SHOP) Q2 release hasn’t sent it crashing back to its June lows, despite guiding for worsening macro headwinds exacerbated by the ongoing consumer spending slowdown. Coupled with Shopify’s significant e-commerce growth normalization, the market seems content to look past its current challenges to what lies ahead.

We are also confident that SHOP has likely staged its long-term bottom in June. Therefore, we are ready to reconsider our previous Hold position as we assess the forward opportunities for Shopify moving ahead, as it laps highly challenging 2021 comps.

Management is certainly not alone in its incorrect judgment of an enduring e-commerce pull-forward, clouded by the pandemic-driven tailwinds. Therefore, we aren’t going to be unduly harsh on Shopify. The company remains a share gainer in the broader e-commerce market and retains its competitive edge for independent DTC merchants, even as Amazon (AMZN) edges closer with its logistical capabilities on Buy with Prime.

Therefore, we revise our rating on SHOP from Hold to Speculative Buy, with a medium-term price target (PT) of $60 (an implied upside of 52%).

Don’t Be Fixated With Shopify’s FY22 Troubles

We have highlighted Shopify’s challenges in past articles about maintaining its growth premium as the company continues to invest in taking share. While its Deliverr acquisition is expected to lift its ability to fulfill its 2-Day delivery target better, it’s also margins-dilutive. Therefore, the market was justifiably concerned with the impact on Shopify’s valuations, given the impact on its profitability profile. Jeffries also highlighted the risks in a recent note:

While the outlook held some positive nuggets, the quarterly results point to an e-commerce environment that continues to deteriorate [year-to-date]. Ultimately, we see the balancing act of growth investments & efficiency targets as posing new execution risks. – Seeking Alpha

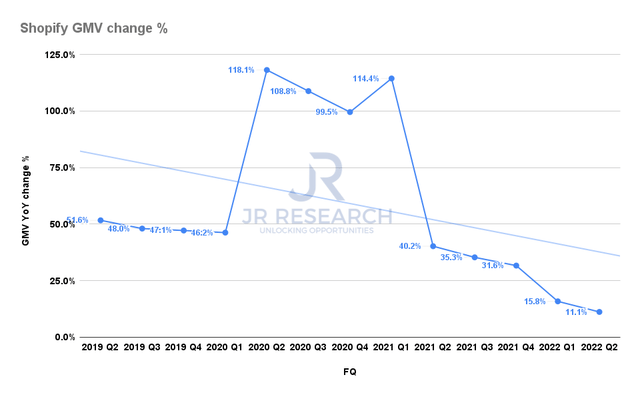

Shopify GMV change % (Company filings)

But, management also highlighted that Deliverr is accretive to revenue growth. Note that Shopify’s revenue growth has also been moderating markedly since its highs in 2021, in line with its GMV trend, as seen above.

Furthermore, its GMV has been growing well below trend over the past few quarters, as Shopify faced significant e-commerce headwinds. However, we believe that the market has already accounted for these near-term challenges, as Shopify’s growth normalization could be bottoming out in FY22.

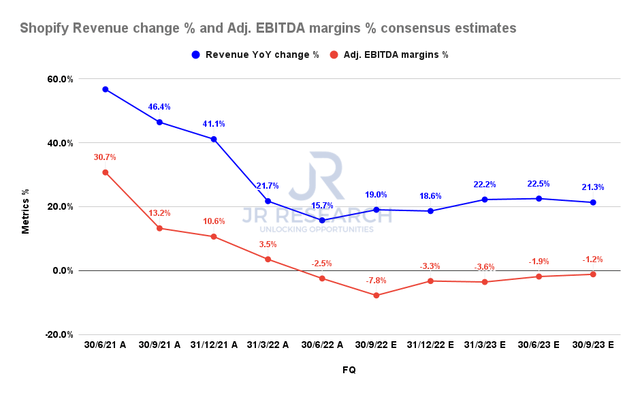

Shopify revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that Shopify’s revenue growth has reached a nadir in the recent FQ2. Moreover, its adjusted EBITDA margins are projected to bottom out by FQ3 before recovering through FY23. Therefore, we are confident that the bottoming process seen in SHOP’s price action reflects such optimism.

SHOP Has Already Formed Its Long-Term Bottom

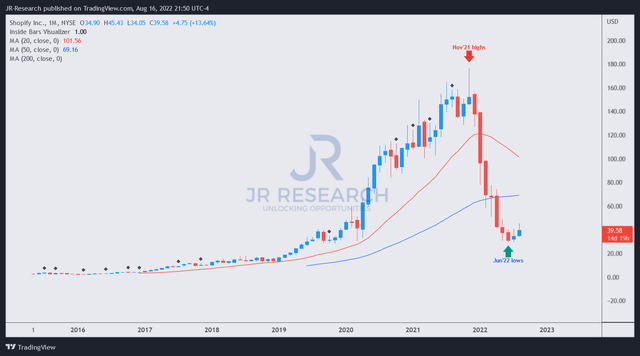

SHOP price chart (monthly) (TradingView)

Even though we had previously telegraphed getting in lower than $20 as an attractive entry level, the market seems to disagree with us. And as price-action practitioners, we are flexible enough to leverage the changes in price action dynamics to adjust our parameters and reassess our decision.

As seen above, we are confident that SHOP has formed its long-term bottom in June, which also corresponds with our assessment of the market’s bottom. Therefore, we are increasingly optimistic that risk-on behavior has reappeared in earnest, lifting buying sentiments in SHOP and other high-growth plays.

Is SHOP Stock A Buy, Sell, Or Hold?

While SHOP’s growth profile has undoubtedly changed over the past year, we are confident in its rebuilding process. Coupled with its long-term bottom, we believe the risk/reward is now tilted toward the upside.

Therefore, we revise our rating on SHOP from Hold to Speculative Buy, with a medium-term price target of $60.

Be the first to comment