Sean Gallup

Thesis

Shopify (NYSE:SHOP) stock is down some (almost) unbelievable 85% from all-time highs that were made only 10 months ago, in November 2021. Accordingly, many investors might be keen to research the business in order to explore if SHOP stock is now a buy.

Although I like SHOP’s current valuation, I am concerned about the company’s profitability. And honestly speaking, I am not sure if Shopify deserves the label of a growth company going forward, as the year over year business expansion has slowed to a rate similar to the FAANGs.

My target price for SHOP is $25.02/share. Accordingly, I believe the company is valued fairly. Hold.

About Shopify

Shopify Inc. is a technology company based in Canada that provides cloud-based e-commerce technology for businesses worldwide. The company’s platform is designed to offer merchants an opportunity to easily manage, display and market products through the e-commerce sales channel, by providing customers

… the all-in-one commerce platform to start, run, and grow a business.

Moreover, according to the Shopify’s SEC F1 filing, the business pitches the following value proposition (emphasis added):

Our platform provides merchants with an intuitive user experience that requires no up-front training to implement and use, enabling merchants to set up their shops in less than 15 minutes.

In connection with the offering of an e-commerce outlet, Shopify also supports businesses in their management of client relationships, product inventory, payment and order processing, as well as e-commerce data analytics.

Shopify is mainly addressed to and used by small and medium-sized businesses.

A Growth Company?

On the back-drop of rapid e-commerce expansion, which has been accelerated by the covid-19 pandemic, Shopify has experienced rapid growth.

From 2018 to 2022 (TTM reference), Shopify has managed to grow revenues from $1.07 billion to $5 billion, which is a CAGR of about 50%. Over the same period, gross profit increased by $596 to $2.59 billion.

But investors should consider that e-commerce penetration — at least in the US, Europe, and developed Asia — has now reached a level that does not support rapid expansion anymore. And accordingly, Shopify’s topline growth has slowed down significantly, to only 16% year over year growth as of Q2 2022.

Management has highlighted, that (emphasis added):

We have grown our adjusted operating income over the past five years through 2021. We now expect 2022 will end up being different, more of a transition year, in which ecommerce has largely reset to the pre-COVID trend line and is now pressured by persistent high inflation.

Challenging Profitability

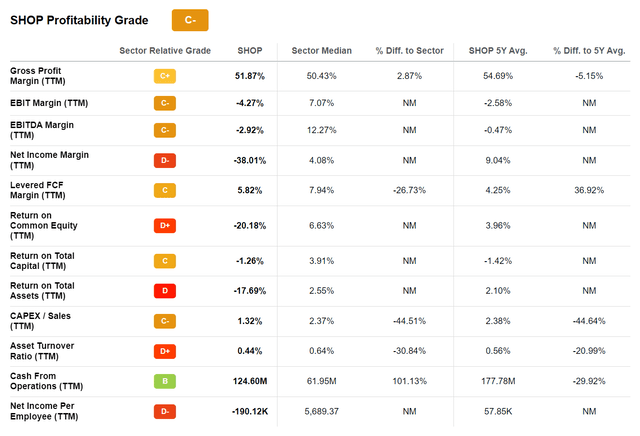

Notably, Shopify’s growth has now slowed down to a rate that is achieved also by the leading tech companies such as Google (GOOG), Amazon (AMZN) and Microsoft (MSFT). But Shopify’s valuation multiple is much higher, despite materially lower profitability.

Investors should consider that Shopify, although trading at a $35 billion market capitalization, must yet deliver positive operating profitability. The company’s TTM EBIT margin is negative 4.3% versus positive 7.1% for the sector median. respectively, net income margin is negative 38% for Shopify versus positive 4.1% for the sector.

For the near-term future, profitability is likely to remain pressured. Talking about the FY 2022 outlook, management said that

gross profit dollar growth will trail revenue growth

and further added that (emphasis mine)

we expect to generate an adjusted operating loss for the second half of 2022, with our third-quarter adjusted operating loss, excluding severance costs, expected to materially increase over the second quarter …

Finally with regards to profitability, investors should also note that Shopify is giving lots of stock based compensation — estimated to be $750 million dollars in FY 2022, which is more than 30% of the business’ 2021 gross profit.

To be fair, Shopify’s lack of profitability should not be to concerning for the moment, given that the business has a very strong balance sheet that could potentially absorb multiple years of loss-making. As of June 2022, the company recorded $7 billion of cash and short-term investments versus total debt of only $1.2 billion.

Valuation

To estimate a stock’s fair implied share price, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

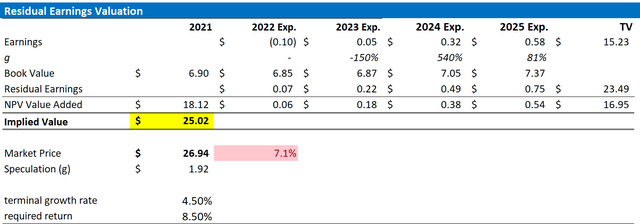

With regard to my SHOP stock valuation, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. I have decided to base my analysis on analyst consensus EPS, because I believe that it is the most precise way to estimate a company’s future financial performance, taking out any subjective bias that I might have. Investors should also consider that generally speaking for 2-3 years projections the analyst consensus is usually quite precise. If an investor would like to infuse personal assumptions, I argue this is best achieved through the variation of the terminal growth rate and cost of equity. (See sensitivity table enclosed).

- To estimate the capital charge, I anchor on SHOP’s cost of equity at 8.5%, which is in line with the industry average for technology stocks.

- For the terminal growth rate after 2025, I apply 4.5%, which is about one and a half percentage points higher than estimated nominal global GDP growth.

- I estimate that Shopify’s net-cash position will earn an after-tax income of 3.5%.

Given these assumptions, I calculate a base-case target price for SHOP stock of $25.02/share. And accordingly, I argue that Shopify is currently valued quite fairly.

Analyst Consensus EPS; Author’s Calculation

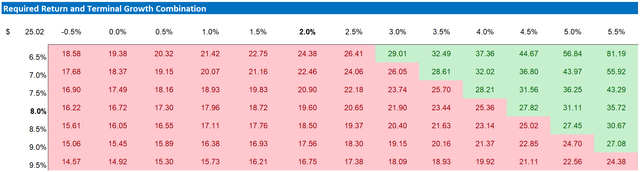

Here is a sensitivity analysis that calculates SHOP’s share price based on different assumptions of both cost of capital and terminal growth rate.

Analyst Consensus EPS; Author’s Calculation

Conclusion

I agree with management commentary that 2022 is going to be a transition year for Shopify. After multiple years of high growth and no profitability, the company must now switch to an environment of low growth and (hopefully) high profitability. If you think Shopify can deliver on this transition, then the company might be worth a bet.

But personally, I am not sure how long the transition will take and how successful the transition will be. Accordingly, I advise remain on the sidelines. I believe the current valuation for Shopify is fair, and relatively closely matches my personal target price of about $25.02/share.

Be the first to comment