Introduction

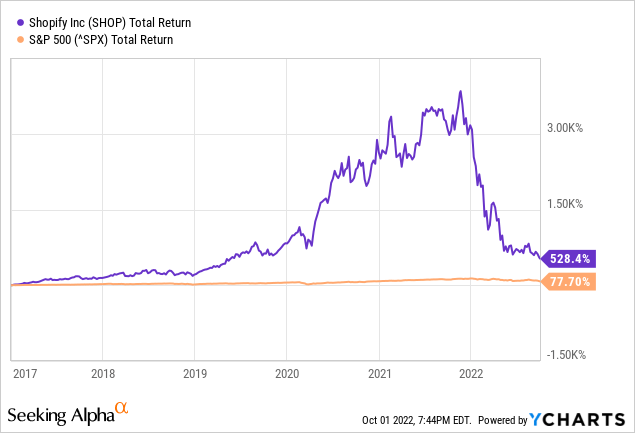

Shopify’s (NYSE:SHOP) total return as of 2017 is astounding. Even after the decline, the stock has risen an average of 44% per year, compared to an average of 12% per year for the S&P 500. This is a strong achievement. Due to the corona measures, physical stores had to close, and many retailers innovated by further expanding in e-commerce. This has paid off for Shopify, one of the best-known e-commerce platforms available.

The corona crisis has done Shopify well, revenue in 2020 increased by no less than 86% compared to 2019. Now that physical stores are open again, Shopify’s popularity has disappeared, but it remains a strong player in the e-commerce market. The investor euphoria continued to sparkle through early 2022, after which Shopify entered a bear market like other growth stocks.

From the beginning of 2022, inflation is measured high, and the Fed intervenes by raising interest rates. This is detrimental to stock prices, and (expensive) growth stocks such as Shopify were strongly corrected.

Despite the strong correction, I don’t see the Fed pursuing a dovish policy, their current policy will affect consumer spending and Shopify will experience temporary headwinds as a result.

I’d love to see this fast-growing company in my portfolio, but not during the Fed’s aggressive policies.

Growth Is Stagnating

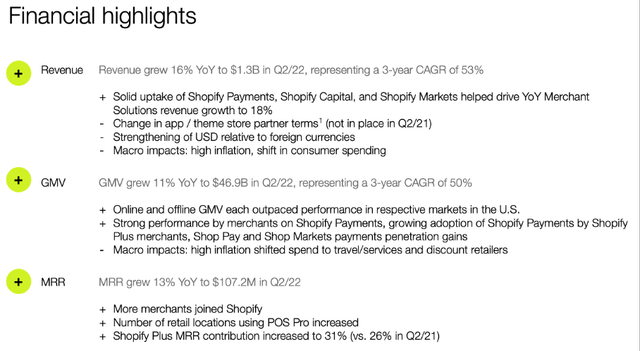

Recent quarterly results show revenue growth of 16% year-over-year and gross trading volume (GMV) grew by 11% year-over-year. The presentation slides showed that macro effects such as high inflation and shifts in consumer spending negatively impacted Shopify’s results. I think inflation will remain high in the coming years, which could continue to reduce consumer spending and affect their financial results for years to come.

Financial Highlights (SHOP 2Q22 Investor Presentation)

Shopify continues to be a strong player in e-commerce and is a well-known brand in this industry. Monthly recurring revenue (MRR) grew 13% year over year and more merchants joined Shopify.

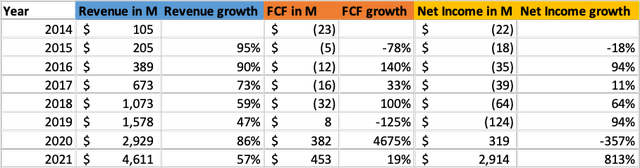

Shopify has grown a lot in recent years. From 2015 to 2021, sales grew by an average of 64% per year. As of 2019, Shopify makes positive free cash flows, and as of 2020, its net income is positive.

Shopify’s financial results over the past years (SEC and Author’s Own Calculations)

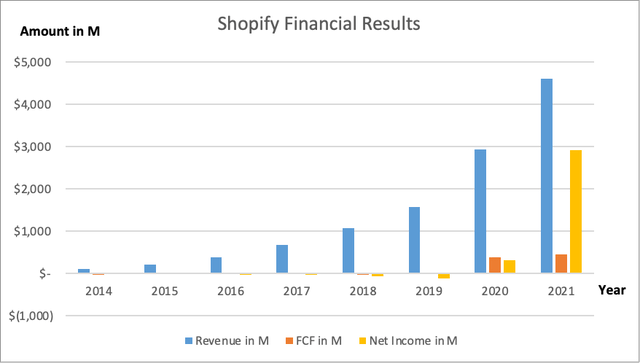

Revenue, free cash flow, and net income are shown in the chart below. The share price has fallen sharply this year, as revenue growth for 2022 is expected to be much lower than expected. From the SA SHOP ticker page, 41 analysts expect revenue of $5.49 billion and non-GAAP EPS of -$0.10, representing revenue growth of just 19%. A pittance compared to the growth of previous years.

Shopify’s Financial Results (SEC and Author’s Own Graphical Representation)

The 2023 revenue forecast looks brighter, with 42 analysts forecasting revenue of $6.83 billion. This is partly because the revenue from the recent acquisition of Deliverr has been included from 2H22 onwards. If the revenue is indeed $5.49 billion in 2022, that equates to a growth of 24%. Strong and improved growth, but still below the 64% average revenue growth over 5 years.

Valuation Looks Favorable

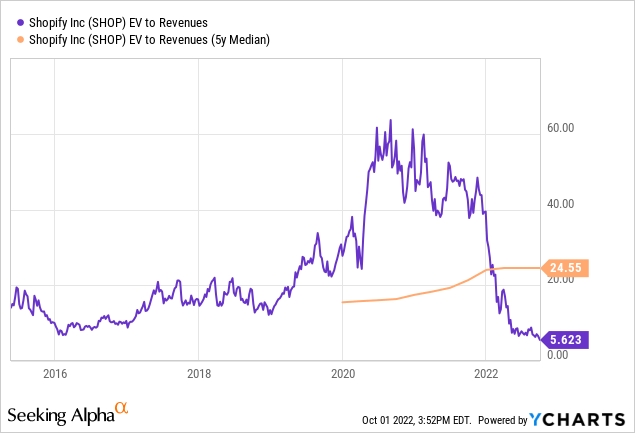

Shopify is a growing company investing its profits into further growth. For a growing company like Shopify, I think the cash and debt should also be taken into account to map the valuation. That is why I opt for the EV to Revenue ratio. Shopify went public in 2015, so limited data is available for comparison.

The EV-to-income ratio is historically low since Shopify’s IPO. In 2016, the ratio was also low, slightly higher than 6, but sales growth in that period was significantly higher than it is now. Sales grew by 59% in 2018, while sales will grow by 19% in 2022.

Shopify investors were excited in 2020, when physical stores closed due to government measures to contain the spread of corona. The stock rose sharply, and the EV-to-income ratio was at its peak at 60.

At first glance, Shopify seems to compare well with Amazon (AMZN), they are both active in the e-commerce business. However, Amazon is an online store while Shopify offers the service. This is a big difference because Shopify’s gross margin is a strong 50%, while Amazon’s gross margin is just 13%. The valuation ratios are therefore not comparable.

Alphabet’s (GOOG)(GOOGL) gross margin is 57% and is close to Shopify’s gross margin. Alphabet trades at an EV to Revenue of 5.2 and is expected to see revenue growth of 13% in 2022. Shopify is trading at an EV to Revenue ratio of 5.6 and revenue growth in 2022 is expected to be 19%. The valuation of both shares is therefore almost equal. I like to see both stocks in my portfolio, but because Alphabet is already very profitable, Alphabet’s downside risk is lower than Shopify’s.

The historically low ratio makes it interesting to buy Shopify stock, but due to the aggressive policy of the Fed and the downward revisions, I don’t see the stock rising any time soon. I would like to see this strong and well-known growth company in my portfolio, but I am waiting for upward revisions and for the Fed’s dovish policy before making my initial investment.

Key Takeaway

Shopify is a well-known company doing business in e-commerce platform and services. The company has grown strongly due to the measures of the corona crisis but is struggling due to lower consumer spending. From my article, I took the following pros and cons:

Pros:

- Shopify is one of the best-known and easy-to-use e-commerce platforms on the market.

- Shopify is a growth stock, and revenue grew an average of 64% per year over the past 5 years.

- For 2023, revenue growth of 24% is expected, an increase compared to the revenue growth of 2022.

- The stock valuation looks very rosy at this price level.

Cons:

- The Fed’s aggressive policy has negatively impacted consumer spending and hurt Shopify.

- Recent quarterly results have been mediocre, with revenue growth of only 16% year-over-year, while Shopify’s 5-year average growth was 64%.

- Analysts expect FY22 revenue growth of 19%, which is below Shopify’s 5-year average revenue growth of 64%. But at the current stock valuation, the share price is justified.

Overall, I think the stock was justifiably penalized for its slow growth figures this year. The recent acquisition of Deliverr will further boost revenue growth in the coming years. For 2023, revenue growth of 24% is expected, this is an improvement from 2022 revenue growth. I believe the stock is on hold until the Fed announces a dovish policy.

Sean Gallup

Be the first to comment