Robert vt Hoenderdaal/iStock Editorial via Getty Images

Investment thesis

Shell’s (NYSE:SHEL) stock is riding high this year, on the back of a commodities bull market that shows no signs of relenting. Higher oil, gas & LNG prices are helping Shell’s financial results, giving the markets reason to evaluate the company to higher and higher levels. Its current P/E ratio, which is less than 6, currently suggests that it is still a cheap stock. These are all backward-looking, or at best short-term forward-looking considerations. Looking forward, further into the future, Shell’s fast-declining upstream production volumes, in large part due to fast-dwindling oil & gas reserves, suggest that Shell will benefit from the higher oil & gas prices less and less going forward.

By the end of the decade, its upstream sector will play a minor role in its overall business. Even its LNG business could see some contraction, as natural gas available for export around the world may see some decline. Shell’s gradually emerging green business profile makes it hard to argue that it can transform into a company that still merits a market cap at least as high as it is right now. Green energy is unlikely to replace the lost revenues and profits that the upstream oil & gas sector provides.

Stellar current financial results and more of the same is expected for the next few quarters, even as oil & gas production is declining at an accelerating rate, along with reserves

Shell’s Q1 results contributed a great deal to the bullish case for its stock price. Revenues and profits are both strong, on the back of the commodities price boom. Shell’s Q1 2022 income came in at $7.1 billion, which is down 38% compared with Q4 2021 results, but it is up by 25% compared with the same quarter in 2021. This surge in profits occurred despite a significant decline in oil & gas production. In Q1 2021, Shell produced almost 3.5 mb/d of oil equivalent. In the latest quarter, production stood at just under 3 mb/d. That is a very significant upstream production decline of 14%.

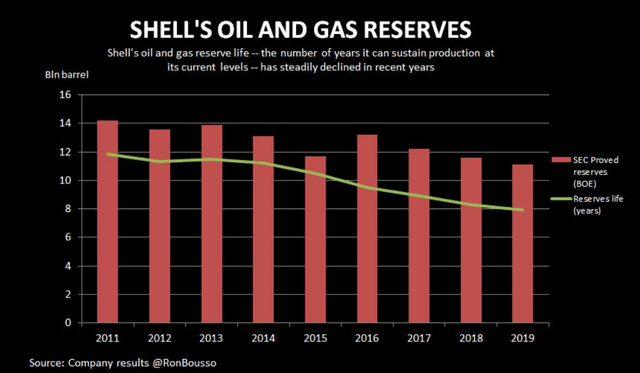

In 2019, Shell had upstream oil & gas reserves of 11.1 billion barrels. By the end of 2021, its reserves declined to 9.4 billion barrels. I chose these two years for comparison because the average price of oil & gas tended to be very similar in both years. It represents a decline in reserves of 15% over the two-year period. It is not a new trend by any means. Shell has been unable to preserve its reserves life ratio as well as its absolute volumes for many years now.

Shell reserves volume & reserve life (Reuters)

As a consequence of the steadily dwindling reserves, we are now seeing the beginning of a significant shrinkage in its upstream production. The green agenda strategy is a very convenient way to explain it while trying to downplay the negative effects of the company’s steady loss of viable reserves, which arguably started at the beginning of the current century, or perhaps even slightly before that. Some readers might remember the first major reserves issue that Shell came up against almost 20 years ago.

What we can conclude from the results is that while the massive spike in oil, gas & LNG prices is providing a massive boost to its current financial results, the very products that it currently produces, which are seeing a massive increase in price, are declining in production volume, mostly driven by an acute shortage of upstream reserves. That shortage is getting much worse. The much higher market price for oil & gas should help Shell to upgrade some of its resources in place to proven reserves status. That will hardly be a real boost to its production capacity. Higher oil & gas prices should allow for more investment in enhanced recovery projects, but it will not be enough to stem the production decline.

LNG will continue to provide Shell with steady revenues & profits, while the viability of the growing green energy sector will depend to a large degree on subsidies

There is very little doubt at this point about Shell’s upstream sector being on its way to insignificance, as soon as the end of this decade. The reserves to keep it going are simply not there. Because Shell’s LNG sector does not depend on its own upstream production, it can continue to thrive for as long as there are buyers, as well as sellers of natural gas willing to sell to LNG producers. For the first quarter of the year, Shell’s earnings from integrated gas, which is mostly LNG came in at $3.1 billion, which is almost half of all earnings for the quarter.

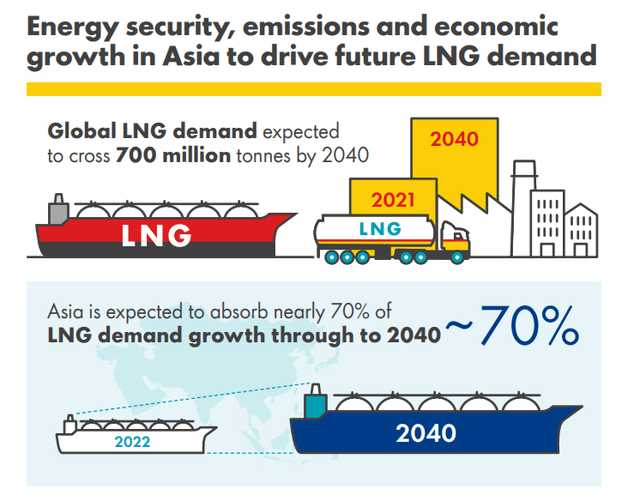

Based on Shell’s own global LNG market forecasts, LNG demand is set to continue growing at a robust pace.

Global LNG demand forecast 2040 (Shell)

In 2021 global LNG demand reached 380 million tonnes, so demand is forecast to almost double by 2040. Personally, I think LNG demand forecasts, such as this one are actually somewhat conservative. I don’t believe that LNG producers and transporters will have much of a problem finding markets for whatever LNG supplies they will be able to deliver. Finding natural gas to liquefy and export as LNG may become a much greater challenge. US exports may be hit by politics, with some grumblings emerging already, as growing LNG exports are causing the US natural gas spot price to converge with the much higher prices that customers pay in Europe. I believe this issue will become more prominent this coming winter, as many US households will be faced with those winter gas heating bills. The new government in Australia is also looking at the matter of natural gas export volumes, as it was just recently revealed.

Iran & Russia may see an increase in LNG exports in the coming years, but it is unlikely that Shell will ever play much if any role in either of those export markets. Shell just pulled out of Russia, and I doubt that there is much of a path back for any of the Western oil & gas majors. Iran seems to be well on its way to becoming a China protege, meaning that it will dominate every aspect of Iran’s future energy policies. If there will be growing natural gas shipments from Iran, they are likely to head East, mostly via pipeline. Any LNG shipments from Iran will most likely involve China’s CNPC (PTR) or some other Chinese, Russian or Asian companies. Given the long history of Western sanctions against the country, I doubt that there will be much of a chance for Western oil majors to gain a foothold in Iran’s energy sector, regardless of the outcome of any future rapprochement outcomes.

Shell may see some opportunities in Canada, South America, parts of Africa, and the Middle East to expand its LNG activities, but certainly, there are also major potential LNG growth countries where it will be shut out, while some of its current activities may see some curtailment in the longer term. Shell’s LNG future is therefore by no means a sure thing. There are significant challenges, with also some potential opportunities, which will interplay, with a somewhat still uncertain long-term outcome.

The green energy gamble is a huge one and it is the factor that puts into question the future ability of Shell to grow into its current market cap, even as its upstream sector is shrinking at a very fast pace. There are some straightforward plans in place, such as adding EV charging outlets at its current gas stations. Other plans, such as its efforts to create green hydrogen from wind power currently make absolutely no sense from an economic perspective. Such projects will need deep government incentives to take off and produce operating profits. As I recently pointed out in an article, if one wants to make a bet on a hydrogen future in Europe, then perhaps a startup like Fusion Fuel (HTOO) might make far more sense than betting that Shell will replace its dwindling upstream profits with new and growing profits from its green initiatives. The current upstream sector that Shell relies on seems like a very big legacy shoe to grow into, never mind surpassing it on the back of green projects.

Investment implications

I kept the other important segment from which Shell currently draws its stellar financial results out of the conversation because there is simply too much uncertainty surrounding the outlook for refining and petrochemicals this decade. On one hand, demand for refined products and petrochemical products of all sorts will continue to remain strong worldwide. On the other hand, there are rising costs associated with environmental effects, mitigation costs, as well as higher input costs, as oil & gas prices are set to remain high on average this decade. It is simply too much of an unknown factor for us to draw any relevant conclusions as investors.

We do know that Shell’s upstream sector is set to shrink dramatically. We can also assume that the LNG sector is far from being secure, given the geological and geopolitical factors that I already touched on, but odds are still very high that LNG will play a largely positive role in Shell’s financial results for many years to come, with some potential for growth in volumes and profits to be expected.

There is much that can go wrong with Shell’s green pivot. The biggest threat in my view is that it will lose the financial backing that governments, especially in the EU are providing to emerging industries such as green hydrogen. The way I see it, the EU economy is more fragile than many might realize, thus continued lavish spending on supporting these industries may not have the lasting power we currently assume to see in place for the foreseeable future. There is also always the chance that growing economic hardships will eventually erode the political will to maintain the current course of a complete green transformation of the economy. With the prospects of such a turn, Shell could easily be caught out on a path towards its green transformation, with a lot of capital investments, which could then suddenly lose the expected support.

On the other hand, it is getting to be extremely difficult to see a way out of the current global energy scarcity predicament, without green energy playing a growing role in the overall energy mix, so perhaps Shell is not on an entirely hopeless path. One thing that is certain is that it really had no choice but to embrace the green transformation, given that it failed to maintain its upstream reserve volumes in the past few decades. It cannot remain a major oil & gas producer without viable reserves to produce. This may have been Shell’s best choice within the context of a difficult situation. As things stand right now, the situation remains difficult. Shell’s success this decade will be measured in terms of whether it can fill the revenues and profits void left by its shrinking upstream sector, with mostly green projects.

Its stock may continue to have some significant upside in the short term, as oil & gas prices continue to rise. In the longer term, it may become a potential buying opportunity during periods of oil & gas price crashes, which will drag Shell’s stock price down. Long-term fundamentals however do not look positive for this company. Odds are that this company will shrink in terms of revenues, profits, and market cap, and it is set to all but cease being an oil & gas major by the end of the decade.

Be the first to comment