Sundry Photography

Investment Thesis

ServiceNow (NYSE:NOW) is a platform-as-a-service business that helps global enterprises across all industries digitise their workflows, which refers to the individual tasks that need to be carried out in order to complete a certain job. Put simply, ServiceNow operates its core Now Platform that enterprises can use to help maximise worker productivity and efficiency, by ensuring that employees are making the most of the software tools available to them.

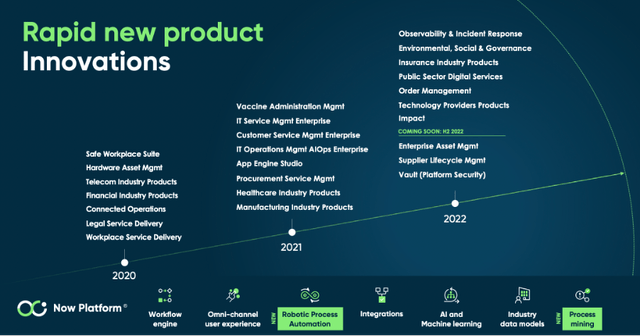

ServiceNow Q3’22 Investor Presentation

One of the most exciting aspects of ServiceNow as an investment is the company’s ability to roll out new products and services, whilst expanding into new areas of technology such as robotic process automation and process mining. They then have an existing base of customers to whom they can easily upsell – a solid land-and-expand strategy.

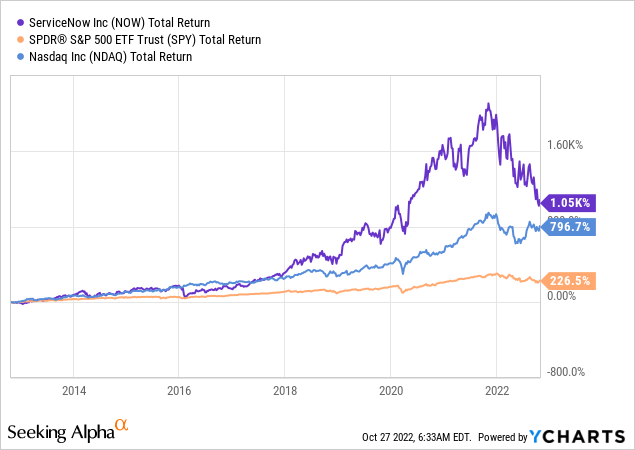

Combine this with renewal rates that are consistently above 98%, gross margins above 85%, and a positive net income, then it’s no surprise that this company has been a big winner for shareholders over the past decade.

Yet 2022 has been a difficult year for ServiceNow, since it’s not immune to the macroeconomic turmoil that’s been seen across all industries. The company has seen shares drop by more than 40% so far this year, and it has consistently reduced its full year revenue guidance.

The company just released its Q3 results, and investors will be hoping for some good news to stop the tumbling share price – so, did they get their wish? Let’s take a look.

ServiceNow Q3 Earnings Overview

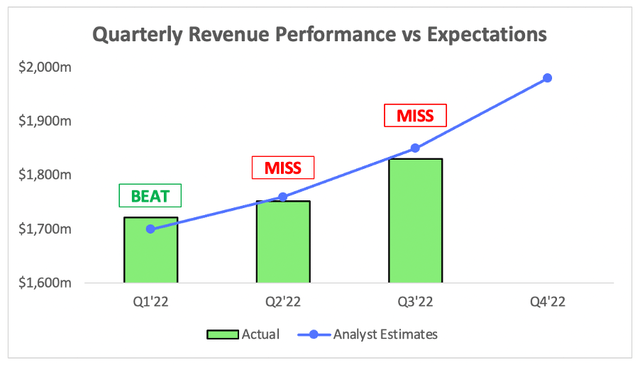

Starting from the top, ServiceNow saw its revenue grow by 22% to $1,831m, although this fell slightly short of analysts’ expectations of $1.85B.

In terms of outlook, ServiceNow gave fourth quarter guidance of $1,834-$1,839m for subscription revenue, which would represent 20-21% YoY growth. It’s worth highlighting that ServiceNow only gives guidance on subscription revenue, but there is also a small portion of overall revenue that falls into the ‘professional services and other revenues’ category.

The difficulty we have is that analysts’ expectations are based on the overall revenue, so one way we can compare guidance to expectations is by using growth rates. Analysts are expecting Q4 revenue of $1.98B, representing YoY growth of ~22.8%. Given that subscription revenue often exceeds the growth rate of the ‘professional services and other’ revenue, I would expect to see ServiceNow’s Q4 total revenue see YoY growth of 19-20% based on its guidance – meaning it is currently falling short of analysts’ expectations.

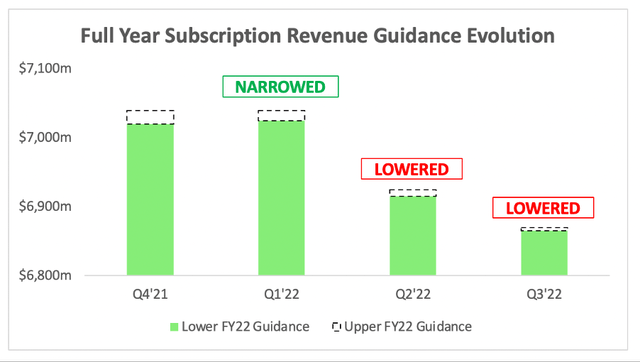

In fact, looking at the changes in ServiceNow’s full year guidance for subscription revenue, it’s clear to see what direction these revenue figures have been heading.

Management has lowered its full year revenue guidance for the second quarter in a row. It’s not a great signal to shareholders, but it is somewhat understandable, and we’ll get to the drivers of this later on.

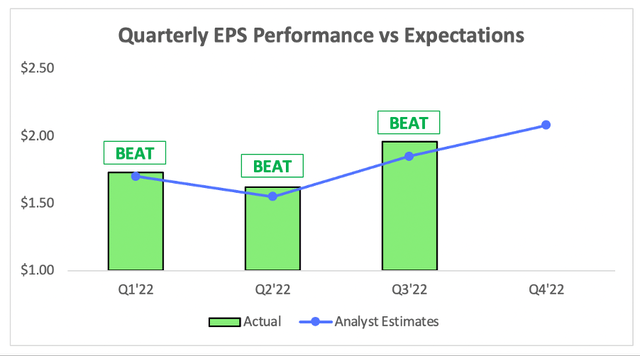

Moving onto the bottom line, and ServiceNow posted EPS of $1.96, which came in above analysts’ estimates of $1.85 for the third quarter in a row.

This is at least one positive sign; even though revenue growth is being hampered by difficult macroeconomic conditions, at least ServiceNow is still managing to deliver profitability that is ahead of expectations.

But what’s dragging this company down? Well, there’s one clear place to point the finger…

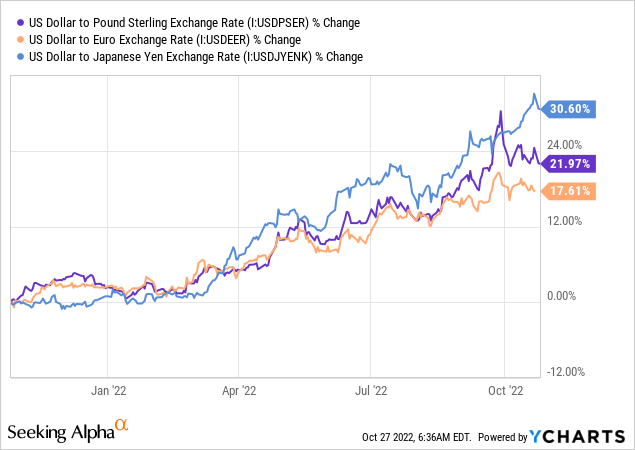

Currency Headwinds Are Plaguing ServiceNow

One recurring theme that has been seen across companies who report in US dollars is the currency headwinds they all face. Over the past 12 months, the strength of the dollar against most major currencies has resulted in weaker results from US businesses that operate globally – and given that revenues outside of North America account for over 35% of ServiceNow’s total revenue, this company is not immune.

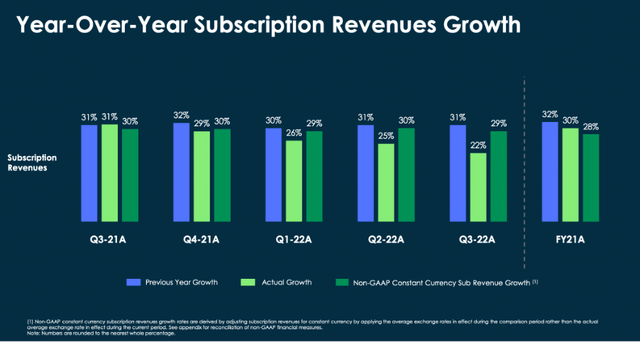

Management is incredibly keen to highlight the impact of this uncontrollable headwind, and frankly I don’t blame them. The below extract from ServiceNow’s Q3 investor presentation clearly demonstrates the impact that foreign exchange rates are having on YoY growth – the blue column represents last years’ growth, the light green column represents this years’ growth, and the dark green column represents this years’ growth on a constant currency basis (i.e., if the value of the US dollar had remained constant over the past 12 month).

ServiceNow Q3’22 Investor Presentation

The big takeaway is the fact that the blue and dark green columns are very similar, and on an FX-neutral basis, growth has only slightly eased up for ServiceNow – and I would expect growth to slow down anyway, since 2022 is a much more difficult macroeconomic environment than the boom we saw in 2020 and 2021.

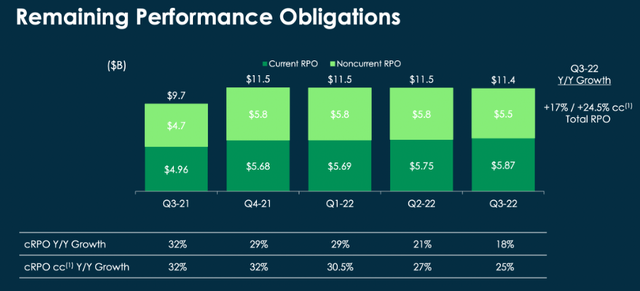

This currency headwind affects all areas of ServiceNow’s business, including RPO (remaining performance obligations). This is a key metric that helps investors to understand how much contracted revenue there is currently which has not yet been recognised, making it a key indicator for future revenue growth.

ServiceNow Q3’22 Investor Presentation

As we can see, the RPO growth has been slowing down over the past five quarters, and it only grew 18% YoY in Q3’22. But, once again, this was negatively impacted by the strong US dollar – and constant currency growth was 25%; still a substantial slowdown, but given the risk of a looming recession, it’s understandable to see businesses being more cautious about spending.

In truth, the underlying business of ServiceNow remains strong – currency headwinds and macroeconomic uncertainty are the biggest drivers of its weaker financial performance, but these should be temporary headwinds, perhaps providing a great buying opportunity to investors with a multi-year time horizon.

NOW Stock Valuation

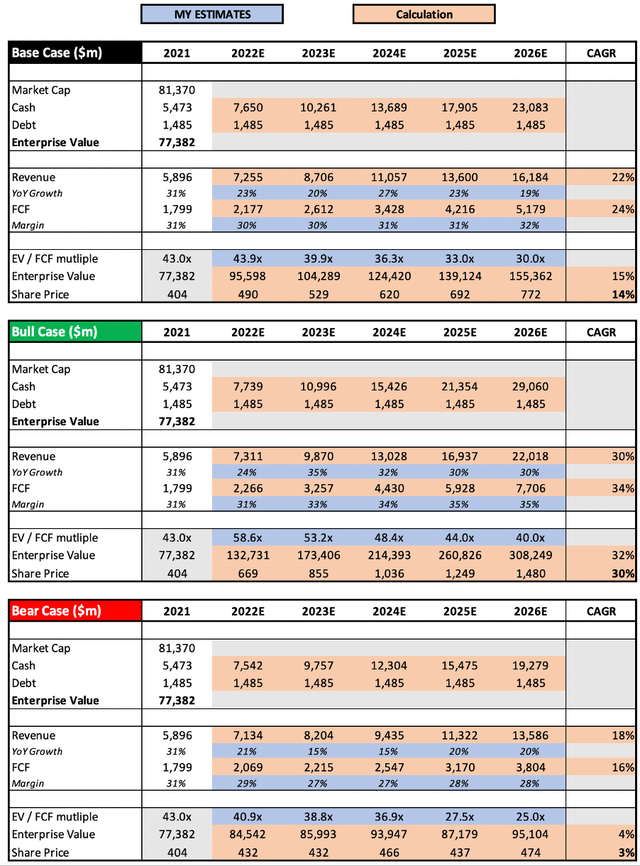

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether ServiceNow is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

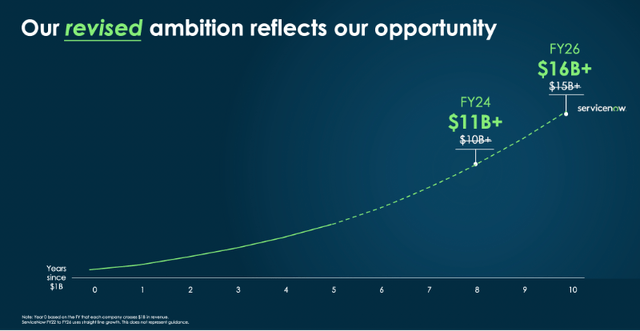

In my base case scenario, I have assumed that management’s recent long-term revenue guidance through to 2026 of at least $16B is achieved, and with that comes slight improvements on the already impressive free cash flow margins. I have also assumed that the shares outstanding over this period will increase by around 14% in total, since ServiceNow does like a bit of stock-based compensation.

My bull case scenario assumes that the slowdown in 2022 is short-lived, and that ServiceNow experiences a boost to its top line in 2023 as the economy sorts itself out. The company has consistently rolled out new products, and my bull case scenario assumes that these are used as growth levers to help the company achieve a revenue CAGR of 30% over the period. I’ve also assumed that with this additional revenue growth comes with additional scale and efficiency, with free cash flow margins hitting 35% by 2026.

My bear case scenario effectively assumes the complete opposite; that ServiceNow continues to be hit hard into 2023 due to the macroeconomic climate, and the business itself fails to recover back to its previously high growth rates.

Put all that together, and I can see ServiceNow shares achieving a CAGR through to 2026 of 3%, 14%, and 30% in my respective bear, base, and bull case scenarios.

Bottom Line

Looking at this quarter, it feels to me like ServiceNow is a high-quality business that is currently experiencing temporary, macro-induced headwinds. For investors with a short time horizon, this may make ServiceNow too risky, but I believe that the current share price may offer long-term investors a great opportunity to purchase shares in a brilliant business at a reasonable price.

Be the first to comment