Sundry Photography

I think we could be seeing one of the best buying opportunities for software companies in this current weakness in the stock market. My strategy would be to invest in the software companies of tomorrow, investing when sentiment is low and riding the strong industry tailwinds when business conditions get better. As such, I think that ServiceNow (NYSE:NOW) is a great candidate that fits into such a profile.

Investment thesis

I think that ServiceNow is one of the companies that are key to helping companies with their digital transformation journey. With its leadership position in its core market, the company has significant room to cross-sell its other products and services to its very large installed base. Furthermore, ServiceNow looks to be rather resilient in uncertain times as its renewal rates continue to be best-in-class and it continues to be hiring key talent needed for growth when competitors are seeing renewal rates fall and slowing hiring in the near term. As the guidance for the second half of the year has been largely de-risked and rather conservative, along with continued confidence in achieving their ambitious 2024 and 2026 subscription revenue goals, I think that ServiceNow is in a position where the risk/reward perspective skews positive and thus, presents an excellent opportunity for investors.

Overview

ServiceNow aims to use its Now platform to make workflows more efficient through the use of technology and digitalization. The Now platform helps to break the silos between different systems to enable cross system collaborations in an organization. The company has 4 main categories to tackle different aspects of the business.

The largest segment of ServiceNow is its IT workflow segment that makes up 60% of its business. The IT workflow includes a variety of products and services to IT departments across the entire IT lifecycle. This segment is where ServiceNow’s success came from as it is the market leader in the Information Technology Service Management (“ITSM”) segment. ServiceNow’s ITSM offering automates IT services and has capabilities like machine learning, predictive intelligence, which are offered to customers. The next largest workflow makes up almost 30% of its business includes its employee workflow and customer workflow. The employee workflow aims to help improve productivity and improve employees’ experience, automating many typical human resources processes. The customer workflow, on the other hand, helps to improve customer loyalty through better and digital customer experiences. These will include automation of customer service requests and cases. Lastly, the creator workflow makes up 14% of ServiceNow’s revenues. The creator workflow allows its customers to develop their own digital workflow applications through a low-code platform. It includes an app engine, which helps customers develop low-code applications quickly and at scale.

Deep competitive moat in core ITSM product

Every successful company needs to achieve mastery and success in a particular product. Just as Apple (AAPL) has the iPhone, ServiceNow has its ITSM product offering. It is worth noting that ServiceNow occupies an enviable market position of more than 50% market share in the ITSM space and has won the status of market leader in the ITSM segment 7 times in a row according to Gartner Magic Quadrant. The key advantage of the ServiceNow product, in my view, is the benefits it brings to help improve IT productivity using machine learning tools and virtual agents. With the deep expertise in its core ITSM product, next comes ServiceNow’s ability to cross-sell to other products. I think that this cross-sell ability hinges on the core ITSM product because the pre-requisite for customers to be convinced to buy other products and services of ServiceNow will come from a loyal installed base with a positive and good customer experience. Another implicit advantage is that ServiceNow has a large installed base from the core ITSM product.

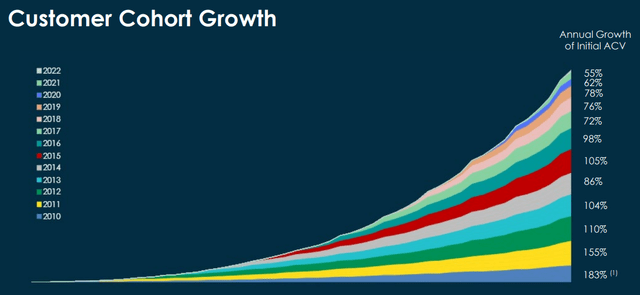

Customer Cohort Growth (ServiceNow Investor Presentation)

As can be seen by data disclosed by ServiceNow, its 2010 cohort’s annual contract value has an annual growth rate of 176%, which showcases the huge opportunity for ServiceNow in relation to more recent customer cohorts.

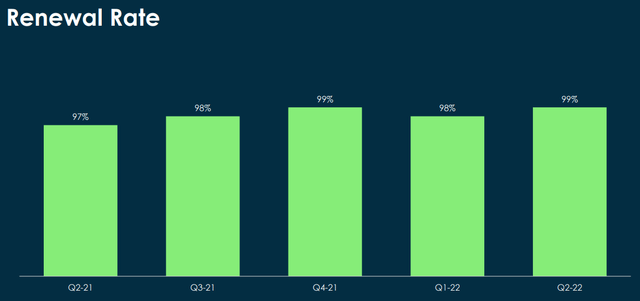

Best-in-class renewal rates

I think that although this has been highlighted many times before, it is important to continue to give credit where credit is due. The best-in-class renewal rates we see from ServiceNow do give investors some assurance in terms of the resilience in demand for ServiceNow’s offerings amongst existing customers. Although new customer growth and expansion may slow, with this higher renewal rate than that of most of its peers, these higher renewal rates signal to investors the healthy demand and the recurring nature of ServiceNow’s products and services.

Renewal rates (ServiceNow Investor Presentation)

Another point to note is that ServiceNow continues to see more large customers as its customers paying at least $1 million in ACV grew 22% year on year and its customers paying over $10 million in ACV grew by 50% year on year. As a result, in the current quarter, we saw the continued increase in wallet share of its customers as customers continue to increase spend with ServiceNow and on the Now platform even as the global macroeconomic situation remains uncertain.

Solid 2Q22 with rock-solid confidence for longer-term targets

ServiceNow managed to beat the high-end expectations for subscription revenue growth and operating margin guidance despite CEO McDermott’s cautious tone on CNBC 2 weeks before the results. In addition, ServiceNow managed to maintain its best-in-class renewal rate of 99% across all regions and segments. Subscription revenues were up 30% year on year. Operating margin was 23%, one percentage point above guidance due to operating efficiencies while partially offset by FX headwinds.

While listening in to the second quarter earnings call, I was encouraged to find that the management was rather positive in their tone for ServiceNow’s recently set financial targets. ServiceNow CEO continued to have “rock solid” confidence in the company’s 2024 subscription revenue target of $11 billion-plus and 2026 subscription revenue target of $16 billion-plus. This implies 83% growth from 2021 to 2024 and 167% growth from 2021 to 2026, if achieved.

Furthermore, the management of ServiceNow continues to see strong demand for automation and digital transformation, and they expect to continue to see the deal sizes get bigger as customers use more of its products. In fact, I think that it was encouraging to see that all of these businesses are doing very well, with at least 10 of the top 20 deals in each of its segments done by ServiceNow, and with its Creator Workflow seeing 20 out of 20 largest deals in the market in 2Q22 actually came from ServiceNow.

While the management continued to emphasize that business continued to be resilient for ServiceNow, the main issues ServiceNow is seeing are deal delays. While management may categorize them as deal delays now, I think that these may potentially become deal slippages if the delays continue to be prolonged and business conditions weaken.

The reason for the deal’s delay, ServiceNow claims, is that customers now need to elevate larger spend decisions to the C-suite. However, the message that management is trying to bring across is to assure investors that while these deals may be delayed and take a longer time to materialize, they are still being closed and most delays that have been delayed earlier in the year have already been closed.

Increasing hiring when others are slowing hiring

I think that ServiceNow is emphasizing the need to increase hiring now when other technology companies are slowing hiring. Based on headcount data reported in 2Q22, the headcount continued to grow at 27% year on year in the current quarter.

At the same time, the astute investor would note that the company still managed to improve on operating margins through improving operating efficiency. This would imply, in my view, that management is being mindful in which areas they are investing in and hiring, while at the same time controlling expenses which they view as not critical or necessary for growth. As such, the hiring has been on the critical areas of research and development, and in their go-to-market staff while management has been careful to control spend on support type staff. As such, I think that the disciplined approach taken by management is commendable and with the global uncertainty, when ServiceNow is hiring, it will be positioned for growth when this period of uncertainty ends.

Concerns about deal slippage

While I think that the management has communicated rather clearly that they do not expect huge deal slippages, especially for renewals, and that they have expressed a rather positive tone during the recent quarter results, there is always a risk that the slippage in deals come due to external factors not in the control of management.

More importantly, the growth targets set by management for its 2024 and 2026 subscription revenues may seem ambitious if the whole industry does slow down and the first signs of a slowdown could be in ServiceNow’s expansions and new businesses.

In my view, the risk of this happening in the second half of 2022 is low due to the fact that I think the second half guidance has already been de-risked. This is to say that the guidance takes into account further deal delays in the event of weakness in contract renewals.

Valuation

As explained earlier, I think that the estimates given in management’s guidance numbers have been de-risked, barring any negative external events. As such, based on a forward EV/FCF multiple of 35x, my 1-year target price for ServiceNow is $585, representing 42% upside from current levels. I think that ServiceNow’s higher multiples are warranted as it does have a higher growth profile with higher renewal rates than the average peer.

Risks

Macroeconomic risks

Given that ServiceNow operates in the global environment, a slowdown in the global economy and negative sentiment may cause a slowdown in growth for software players like ServiceNow. In particular, there may be higher risks of lower renewal rates and lower growth as a result of a weakening economy.

Execution risk

While I am of the opinion that ServiceNow has a great management team with the competency in execution of its strategy, the execution risk that I am referring to here deals more with the fact that investors are pricing in a premium valuation for ServiceNow, and if management were to slip in terms of execution, this premium may no longer be warranted if investors view that ServiceNow’s higher growth positioning or its highly recurring revenue positioning may be challenged. As such, there is the risk that the high expectations set by the market may not be met by management should challenges start to mount for the company.

Competitive pressures

While ServiceNow may be dominant in the core ITSM product, there are many other players that may develop products to compete against its core offering that may increase competitive pressures for the company. Furthermore, there are many deep-pocketed companies like Atlassian (TEAM) and Microsoft (MSFT) operating within the ITSM market that might cause increased competitive pressures if they were to pursue a more aggressive growth strategy. In addition, as ServiceNow ventures into new markets beyond its more dominant, core ITSM market, there are specialist rivals in each market that may compete with it and make operating conditions more challenging for a new entrant like ServiceNow.

Conclusion

ServiceNow is well positioned for the future digital transformation. As the current quarter demonstrated, the company continues to have best-in-class renewal rates when the industry and external environment seems to be softening. While there are large deals that have been delayed, the management has shown the ability to close these deals subsequently, making it more a matter of when these deals close rather than whether they will close. As it leverages on its expertise and leadership position in its core ITSM market, the company has significant room to cross-sell to its existing installed base. As management has demonstrated high confidence in meeting the ambitious 2024 and 2026 targets, they have shown that ServiceNow continues to grow by focusing on investing in people and hiring more people needed for growth. As ServiceNow looks to be in a de-risked position for the second half of 2022 with conservative guidance, my 1-year target price for ServiceNow is $585, representing 42% upside from current levels.

Be the first to comment