toshimself/E+ via Getty Images

Nothing is certain except death and taxes. – Benjamin Franklin

Throughout the history of the world, humanity had to deal with death. It is a tough topic to address, but that makes it a lucrative business model. Service Corporation International (NYSE:SCI) is North America’s largest funeral home services company. Deathcare is a great business to be in because, generally, it’s something people aren’t cheap about. It’s the last will of a loved one and, on average, costs $5,900 (Slide 23). People often act emotionally.

The company outperformed SPY‘s total return of 55% over the last five years at 100%. Let’s look at the investment case for the company to find out if it could continue to outperform going forward.

I’ll mainly refer to Service Corporation International as SCI throughout the article.

Rolling up funeral homes

SCI is operating in the large and fragmented Deathcare industry. This $22 billion industry is split into two parts:

- 22,000 Funeral Homes generating a total of $17 billion annually

- 5,500 Cemeteries generating a total of $5 billion annually

The Deathcare industry is fragmented, a prerequisite for a roll-up strategy. Fragmented industries often include many small local businesses with just one or a few locations. Often these businesses aren’t very well run. A large corporation can purchase them and benefit from economies of scale and improving efficiencies by implementing best practices and consolidating G&A costs into the existing enterprise systems.

I am a big fan of companies rolling up fragmented markets and have covered a few of them previously on Seeking Alpha:

SCI has a 15-16% market share, with 80% being independent small businesses and just 5% other large roll-ups/consolidation businesses. This leaves ample opportunity for a well-funded corporation to gain market share. Out of the 22,000 funeral homes, SCI owns 1,471 and 488 of the 5,500 cemeteries. Cemeteries are especially interesting properties to own because they include a regulatory aspect (much like RCI’s clubs or Copart’s (CPRT) yards): You can’t just build new cemeteries; you need permits and approvals from the local municipalities.

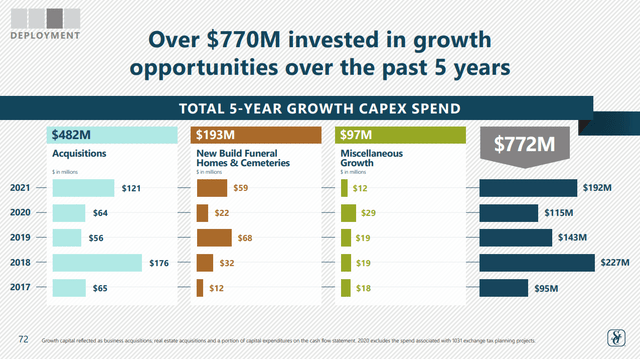

Over the last five years, the company invested over $770 million in growth opportunities, with the majority being acquisitions of new homes/cemeteries, followed by the development of new homes/cemeteries and lastly, some miscellaneous growth, like expansion and redesign of current business units. These can be high-return investments, but they are more scarcer. Acquisitions remain the focus of the capital deployment, with a target list of $0.8-1.0 billion in revenues. SCI expects low to mid-teens IRRs for both acquisitions and development.

SCI Capital deployment (SCI investor day)

Preneed to increase business predictability

A significant advantage the large players have over independent funeral homes/cemeteries is the ability to offer programs like Preneed: Customers can plan their funeral in advance, decide how they want the funeral to go, set budgets and set aside money for it. Preneed includes paying for the funeral in advance, in contrast to Preplanning. It’s a lucrative business for both SCI and the customer: SCI gets cash flow in advance and secures future business (they currently have a $4 billion Cemetery preneed backlog (Slide 29) and a $10 billion Funeral home preneed backlog (Slide 21)), while customers can plan forward and don’t fall into additional impulsive purchases if a funeral is planned in the grieving period. This adds tremendous predictability to the future revenues of SCI and gives them essentially a free loan in advance to reinvest into the business.

Covid pull forward and long term tailwinds

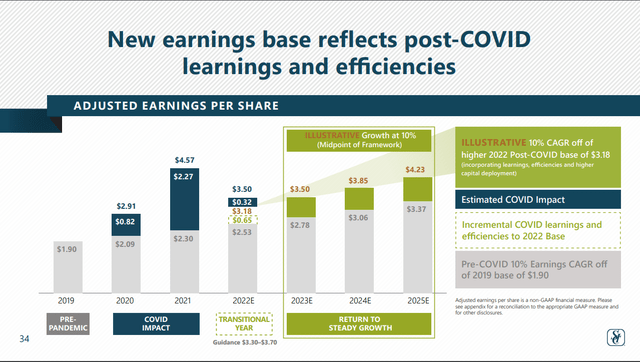

The Covid pandemic had a tremendous effect on SCI’s business. It drove efficiencies in the operations and especially in the company’s marketing efforts through increased investment in digital leads and enterprise software. Of course, it also had a direct effect on the business. So far, the US has had over 1.1 million deaths due to Covid and 48800 in Canada. The company estimated that 2021 EPS doubled due to the Covid impact. The company believes it learned valuable lessons during Covid and that growth will continue from a higher plateau after the Covid pull forward is over. At a midpoint of 10% EPS growth.

Covid pull forward EPS (SCI Investor day)

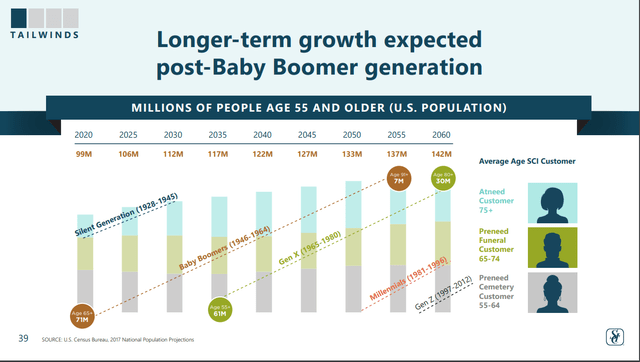

The covid pull forward of demand is just a temporary factor; what really matters are the long-term trends of the industry. Over the next four decades, The US Census Bureau expects US citizens aged 55 and older to grow by 43 million to 142 million.

An Aging population (SCI Investor Day)

Risks to consider

I do not see many serious risks for the operations of SCI. The company is the market leader in an industry that is very hard to disrupt and has a lot of real estate, acting as a moat. Here are a few risk factors to consider though:

- SCI has a lot of its operations focused in California, Texas and Florida, where natural disasters are more prevalent. This could disrupt operations and damage property.

- With a higher focus on digitalized marketing, the company also now runs a higher risk of becoming a target for data theft, which could impact its reputation.

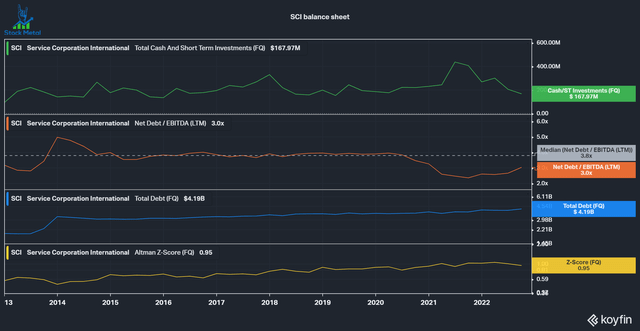

- The company’s balance sheet is too aggressive for me and is the main risk factor I see with SCI. The picture below shows that the company is heavily levered, with an average net debt/EBITDA of 3.8 times. I like companies with minimal debt, up to 2 times net debt/EBITDA. Although I do not think that SCI is at risk of bankruptcy (even though an Altman Z-Score of 0.95 would indicate such) due to its steady cash flows, it still makes me uneasy. The cash flows are more than enough to cover the interest payments ($154 million interest versus $467 million FCF in the last 12 months), but investors should not neglect these payments. Especially if we consider that SCI is a relatively capital-heavy business with $378 million in the last 12 months. If the business would come to a slowdown/decline, then SCI would have to either reduce investments, cut the dividend or take on more debt.

Valuation

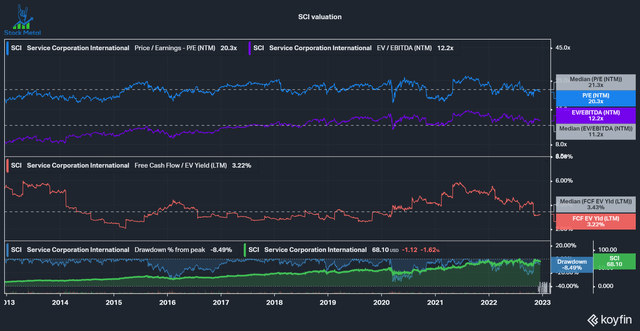

SCI currently is just 8% below its all-time high and trades around its ten-year average multiples. This is a reasonable price for a well-run business expected to grow earnings at 10%. The company is also very shareholder friendly; over the last ten years, SCI did:

- payout 28.7% of its FCF in dividends, equal to around 40% of the current market cap

- repurchase 59 million shares, reducing the share count by 28%

- reinvest $1.73 billion into cash acquisitions of new funeral homes and cemeteries

- reinvest $8.04 billion into capital expenditures.

SCI is on my watchlist

SCI is a high-quality business with high certainty and modest secular tailwinds. The company is well managed with small insider ownership (2.4%) and is shareholder-friendly. My main issue is the aforementioned leverage, which makes me uncomfortable for a business that requires considerable capital expenditures to uphold and grow its business. For that reason, I personally require a more considerable discount to consider adding SCI to my portfolio. I will still rate it a buy, though. If you don’t have a problem with leverage, this is a quality business trading at a fair price.

Be the first to comment