Solskin/DigitalVision via Getty Images

Investment Thesis

Sensus Healthcare, Inc. (NASDAQ:SRTS) provides the non-invasive and affordable treatment. The company is recovering from the impact of the covid-19, and I think it might continue this growth trend with the sale of TransDermal Infusion Systems, and industrial growth can fuel the long-term growth. I will explain the Q2 FY2022 results and full-year outlook in this report.

Company Overview

SRTS is a medical device firm that provides non-invasive and affordable treatment of keloids, melanoma, and non-melanoma skin malignancies. Over more than ten years, deep research and development have produced the patented superficial radiation treatment (SRT) low-energy x-ray radiation technology SRTS utilizes. With the SRT-100TM and SRT-100 VisionTM, SRTS has successfully included SRT therapy in its line of therapeutic equipment. With the SRT technology, the company provides successful and secure treatment for oncological and non-oncological skin problems. The business thinks its SRT solutions give dermatologists a competitive edge by enabling them to cure non-melanoma skin cancer patients themselves rather than needing to recommend them to other specialists. The business has received FDA authorization to treat keloid scars and skin cancers other than non-melanoma.

Additionally, the organization has expanded its SRT operations in China. SRT frees up more expensive radiation equipment, including linear accelerators, for certified radiation oncologists in the USA. The company has a growth opportunity in the plastic surgery and laser aesthetics market in the coming years. SRTS also has plans to provide an effective solution for a benign tumor which can open a new market opportunity. The company reports its revenue in two segments: Product Segment and Service Segment. The company earns 82.2% of its revenue from the product segment, and the service segment generates 17.8% of the total sales. SRTS generates 95% of the revenue from US customers, and one customer from the USA accounted for 57% of the sales. The company’s dependency on one customer is a big negative. The company has recently shown dramatic growth in the last quarter. I believe this strong growth will continue in the upcoming fiscal years.

Potential Industrial Growth

The company is experiencing industrial tailwinds as skin cancer patients are continuously increasing globally. The expected number of patients worldwide is 150,000 adults, which shows that the skin cancer market is growing, and it can expand the targeted audience for the company’s medical devices. The global dermatology devices market is expected to clock $79.68 billion by 2030. I think increased skin problems could drive this growth due to the increased exposure to UV radiation. I believe the company can be a key beneficiary of this growth.

Order for 10 TransDermal Infusion Systems

The company has recently announced the sale of ten Transdermal Infusion Systems to Texas-based Hair Enhancement Centers. The devices will be utilized to distribute the non-invasive hair-health serum Skin Savers Hair from U.SK Under Skin. SRTS is planning to supply two devices in the current quarter and complete the remaining transaction in the next quarter. The benefits of this transaction will be visible in the results of both quarters as the company will recognize the revenue in results after delivering the systems. I believe this deal can grow the financials significantly in the coming quarters and strengthen the company’s position in the hair-health market.

Strong Q2 2022 Results

Recently, SRTS announced strong Q2 FY2022 results. The company has reported revenue of $12.1 million, a growth of 124% compared to $5.4 million in the previous year’s same quarter. The primary driver of revenue growth is high demand and the adverse effect of the covid-19 on Q2 2021 results. The company’s cost of goods sold last quarter was $3.8 million, which is 80% higher than Q2 FY2022. The company has reported a gross profit margin of 68.6%, an expansion of 750 basis points. This expansion was derived from the negative effect of covid-19 on last year’s same quarter. The reported EBITDA for Q2 2022 was $4.7 million compared to $(0.1) million for the second quarter of 2021. The company has reported a net income of $3.5 million, or $0.21 per diluted share, compared to the net loss of $(0.3) million, or $(0.02) diluted per share of the same period of last year. The company has ended the quarter with cash and cash equivalent of $33.7 million, which is more than double as compared to the $14.5 million of December 31, 2021. For a total of $1 million, the firm bought back 126,523 shares of stock during the second quarter of 2022 at values in the range of $7.46 to $8.36. I believe the Q2 FY2022 was strong, which is a sign that the company is recovering from the impact of the covid-19 and may continue the strong growth in the coming years. The company has not given any full-year outlook, but after analyzing the sale of TransDermal Infusion Systems, I believe the company might continue this growth spree in the remaining two quarters as the delivery will be completed in the fourth quarter. I estimate the full-year EPS to be in the range of $1.40 to $1.65.

Key Risk Factor

Single supplier for major components: SRTS has a single preferred supplier of X-ray tubes and other major components. This exposes the company to the risk of supply deficit in case of suppliers’ inefficiency in delivering products or due to global supply chain disruption like the one we are witnessing now due to Covid-19 and Russia-Ukraine war. Also, the company can be affected by indiscriminate price rise by the supplier, which could negatively impact the company’s profit margins.

Quant Ratings and Valuation

Seeking Alpha

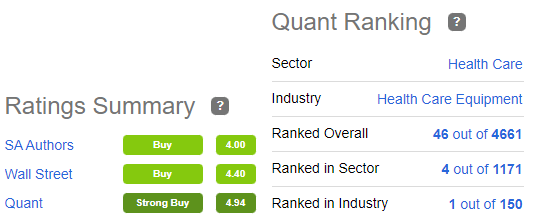

SRTS has a Quant rating of strong buy by Seeking Alpha. This aligns with my recommendation of a buy for SRTS. Wall Street also has a buy rating for the company, which further strengthens my thesis. I want to highlight the Quant ranking of the company. It is ranked 1 out of 150 companies in the industry and 4 out of 1171 companies in the health care sector. This reflects the potential that the company has and its outperformance against its peers in the market.

SRTS has a market cap of $185 million and is currently trading at a share price of $14.55, a YTD increase of 101%. SRTS has seen a significant increase in the share price given its improved performance in the quarterly results. It is trading at a PE multiple of 11.54x with an FY22 EPS estimate of $1.26. SRTS is trading at a relatively cheaper valuation, even with a significant jump in the share price. SRTS is trading at a forward PE of 11.54x as against the sectoral median of 20.40x. I believe the company will trade at a higher PE multiple of 15x in the future. This gives us a target price of $19, a 30% upside from current price levels. I believe SRTS is a great growth company and an attractive investment opportunity.

Conclusion

The sale of SRTS ten Transdermal Infusion is expected to improve the company’s position in the hair-health market. Systems posted strong Q2 2022 results with improved margins and significant revenue growth. The company is trading at a cheap valuation in terms of PE multiple, and we can witness a significant upside from the current price level. The company faces the risk of a single supplier for major components, but there has been no significant impact of this risk on the company’s performance so far. After considering all the risk and growth factors, I assign a buy rating for SRTS.

Be the first to comment