Olivier Le Moal/iStock via Getty Images

Strategy And Investment Thesis

Early on in my investing journey, I identified AbbVie (NYSE:ABBV) as a perfect long-term hold for my retirement account. The stock is a dividend growth beast, and over the years there have been many buying opportunities on dips associated with concerns over earnings, the patent expiration of Humira, valuation, and more. While I still love the company and hold a large percent of my Roth IRA in the stock, I have decided to trim my holdings and reposition the capital into another one of my long-term holds, Otis Worldwide (NYSE:OTIS).

I wrote a Seeking Alpha article about Otis a few months ago, when the stock started to drop on concerns over economic activity in China and the Evergrande situation. In this previous article, I gave several price predictions of where the stock could end up in the short-term, and put a fair value of around $75 per share on it. Recently, on market volatility, the stock tested the $70 level, which satisfied my expectations and prompted me to begin adding more shares to my long position.

Otis’s stock could drop more from here, and I would be more than okay with that. As a long-term investor and not a short-term speculator, my strategy is to accumulate more and more shares for cheaper prices as time goes on. This will lower my cost basis and increase my long-term returns. The idea of selling some ABBV shares here to reposition into OTIS makes sense for many reasons.

AbbVie’s Wild Outperformance

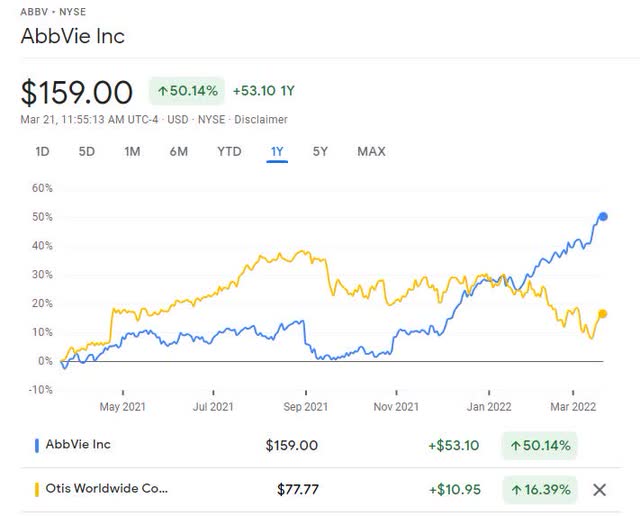

Looking at a comparison of ABBV and OTIS over the last year, it is clear there has been a divergence between the two stocks.

Comparison of ABBV and OTIS (Google)

AbbVie has just had a major long-term breakout above the previous high set in early 2018 of $123.21. Technically speaking, the chart is extended to the upside, with a yearly return of 50%. The entire big pharma sector is having a euphoric rally, with stocks like Eli Lilly (LLY), which I also own in a different account, also setting new all-time highs. This is an amazing performance, and I will continue to hold the majority of my position, as I believe AbbVie is stronger than ever as a long-term hold. However, taking profits at these levels is also not a bad idea, as a reversion to the mean is definitely expected.

Because my retirement account is a Roth IRA, I do not create any tax implications by selling some shares here at this price. The capital I can then use to redistribute to OTIS, which is lagging currently and being unfairly punished by the market due to exposure to China.

Otis Worldwide Will Make A Comeback

When looking at great businesses to invest in for the long-term, one must consider many factors. Otis stock is not cheap, per say, but it is in an oligopolistic market with few sound players, and it is the dominant company in terms of market position. Otis is positioned for strong earnings growth over the long term, despite short-term negativity surrounding China and an economic slowdown.

Recently, the company maintained full-year organic sales guidance, showing that China is not causing as many problems as the market previously thought. Now that the market is starting to recover from a correction, Otis is in buy territory, and taking the proceeds from my AbbVie sells to buy Otis seems like the opportune thing to do.

AbbVie may keep going higher and higher, due to a plethora of positive news surrounding the company which I will not go into at present, but may follow up on in another article. Otis has been beat down hard in comparison, and I am betting on a reversion to the mean for both stocks. I do believe that Otis will once again return to all-time highs on continued outperformance, and also because of the recent $300-500M stock buyback plan announced by the management.

Strategy Can Be Applied To Other Stocks

If you do not own either of these stocks but would like to examine your Roth IRA or other retirement accounts for example of this, the strategy could be utilized for literally any company. If one of your holdings has outperformed by a great deal over the last year, and another has suffered, it might be wise to compare the holdings and see if a reposition makes sense.

Every portfolio is different, and while I am taking a more concentrated portfolio strategy for retirement, others may not have as big concentrations. ABBV and OTIS together make up nearly 75% of my portfolio at this time of writing, and I hold very little cash in the account. For this reason, I have to periodically take profits in stocks that have outperformed and reposition the capital.

Having a Roth IRA is a blessing because of the tax advantages, and I strongly encourage anyone who does not have one to do some research and open an account. I would love to see in the comments section if others are doing the same strategy as I am, or if one holds ABBV as a majority of a retirement portfolio because of the dividends and growth.

Conclusion

This simple strategy of selling an outperformer to reposition into a stock that has corrected is a prudent investing maneuver. For my own personal retirement portfolio, this happens to be ABBV and OTIS. While I still hold a majority of my ABBV position, I have been trimming recently and repositioning into OTIS in an attempt to increase my long-term returns and bet on a reversion to the mean. I would fully expect both stocks to correct in opposite directions from here but continue on a long-term bullish trend. OTIS has been beaten down recently and is in buy range with a fair value of $75, so I will continue to add around this price.

Be the first to comment