SHansche/iStock via Getty Images

Zim Integrated Shipping Services Ltd (NYSE:ZIM) stock is undervalued. Its price increased by 110% in the last 12 months. The stock’s price reached from $29 on 20 April 2021 to $90 in March and then retreated to below $60. Is the stock a Buy, a Sell, or a Hold? I expect charter rates and freight rates to stay high in 2022. Even with a decrease in freight rates, the average freight rates in 2022 will still be higher than in 2021.

2021 financial results

In its fourth-quarter and full-year 2021 financial results, ZIM reported a 2021 net income of $4.65 billion, or $39.02 per diluted share, compared with a 2020 net income of $524 million, or $4.96 per diluted share. The company’s operating income for 2021 increased by 706% to $5.82 billion. ZIM reported a 2021 revenue of $10.73 billion for the full year 2021, up 169% YoY. ZIM’s carried volume increased by 23% from 2841000 TEUs in 2020 to 3481000 TEUs in 2021. The average freight rate per TEU jumped from $1229 in 2020 to $2786 in 2021, up 127%. ZIM declared a $17 per share dividend, representing 50% of its 2021 net income. The company entered into multiple charter agreements for 36 new-build vessels (to be delivered by 2023 and 2024), including 28 LNG dual-fuel container vessels. Also, the company extended its cooperation with the 2M alliance partners.

Eli Glickman, the CEO, said that since the company’s IPO on NYSE, ZIM achieved extraordinary results, generating the highest ever full year of revenues, adjusted EBITDA, net profit, and operating cash flows. Thus, ZIM invested in equipment to facilitate the movement of cargoes and expanded its new lines. “We launched 17 new lines since June 2020, resulting in ZIM’s year-over-year carried volume tripling the global volume growth rate,” the CEO commented. The company has paid $2.6 billion or $21.50 per share since its IPO, which is about 30% of its market cap at the end of 2021. “We are seizing the opportunity to be at the forefront of carbon intensity reduction among global liners,” the CEO continued. Glickman believes that ZIM’s strategy to predominantly charter in vessels provides the company a unique advantage, as ZIM can easily change its operating strategy without a legacy fleet to replace.

New vessels, new agreements

The company expects to report the full year 2022 adjusted EBITDA of between $7.1 billion to $7.5 billion, and adjusted EBIT of between $5.6 billion to $6 billion. Is the market condition in favor of ZIM’s expectation? In 2021, the company entered into multiple charter agreements for 36 new-build vessels (to be delivered by 2023 and 2024), including 28 LNG dual-fuel container vessels.

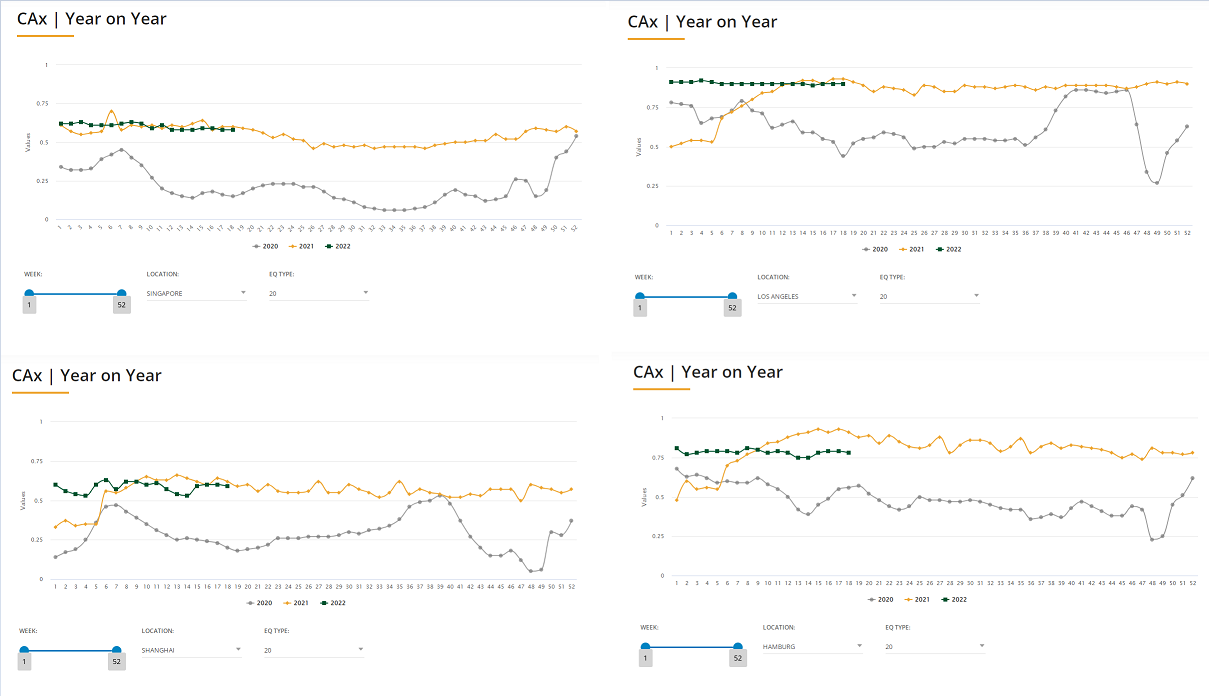

According to Figure 1, 39% of ZIM’s operations happen in the Asia-America West Coast route. Also, 27% of its operations is on the Intra-Asia route. Thus, the freight rates and container supply and demand in these two routes have the highest effect on ZIM’s financial results. Figure 2 shows the Container Availability Index (CAx), which allows interested parties to monitor the import and export of containers around major ports. According to the CAx website explanation, a CAx value of > 0.5 means more containers enter, and vice versa.

I choose 4 locations: Singapore, Shanghai, Los Angeles, and Hamburg. For example, Figure 2 shows that import to Los Angeles in the first 11 weeks of the year 2022 was higher than the first eleven weeks of the year 2021. We can see that since the end of 2021, container imports to Singapore, Shanghai, and Los Angeles have not changed significantly. However, container imports to Hamburg have decreased since the end of 2021. I think that at least, in the first 18 weeks of the year 2022, ZIM’s operations in most of its routes have been in the same line as the last nine months of 2021. Thus, I expect the company’s 1Q 2022 financial result to be strong.

Figure 1 – ZIM’s trade routes

ZIM’s 2021 presentation

Figure 2 – Container Availability Index

www.container-xchange.com

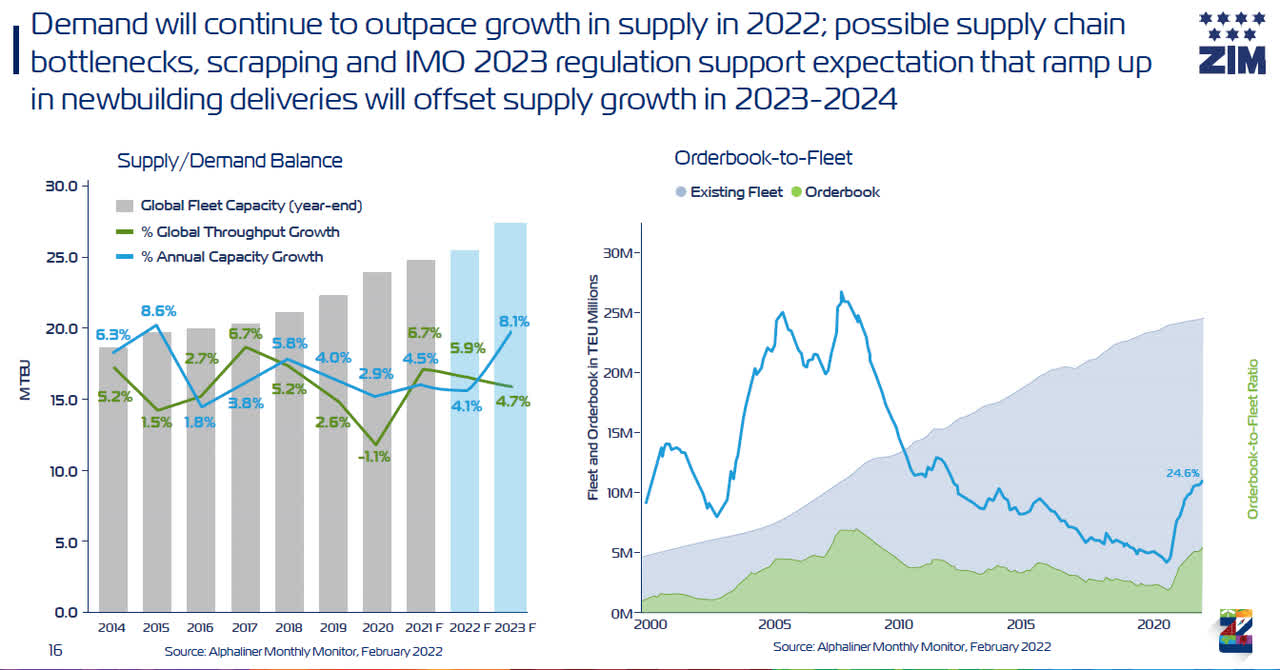

ZIM expects average freight rates in 2022 to be higher than in 2021; However, expects gradual freight rates decline in spot rates in the second half of 2022. On the other hand, ZIM expects charter rates remain stable in 2022. The company expects an excess demand for container vessels due to possible supply chain bottlenecks, scrapping, and IMO 2023 regulations (see Figure 3).

Figure 3 – Container vessels supply and demand

ZIM’s 2021 presentation

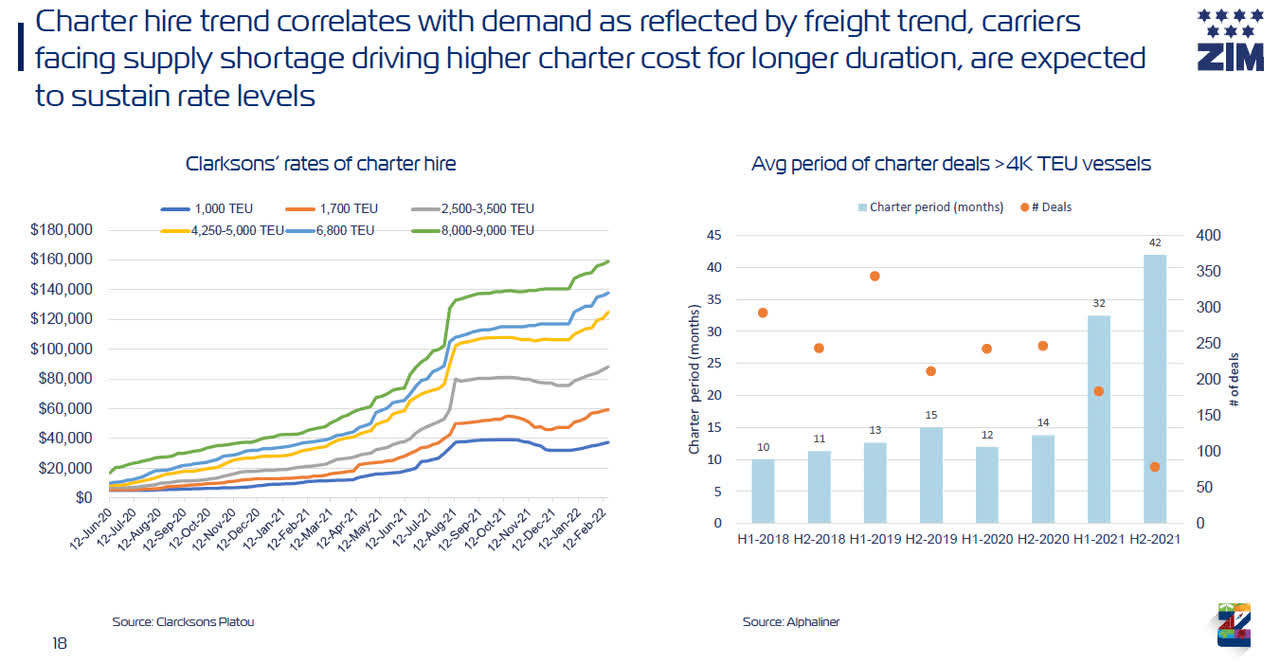

Figure 4 shows that due to supply shortages, charter rates of TEU container vessels have surged since 2020. As a result, the average period of charter deals has increased from 10 months in 1H 2018, to 42 months in 2H 2021. However, the number of deals has dropped. Thus, those who wanted to hire vessels with current charter rates entered into long period agreements. On the other hand, those who expect charter rates to decrease postponed entering into charter agreements. ZIM is in the first group. I have two scenarios in mind:

1- Charter rates and freight rates decrease.

2- Charter rates stay high, and freight rates remain high or increase.

I see the second scenario happening. But why?

Figure 4 – TEU container vessel charter rates, charter period, and number of deals

ZIM’s 2021 presentation

See the big picture

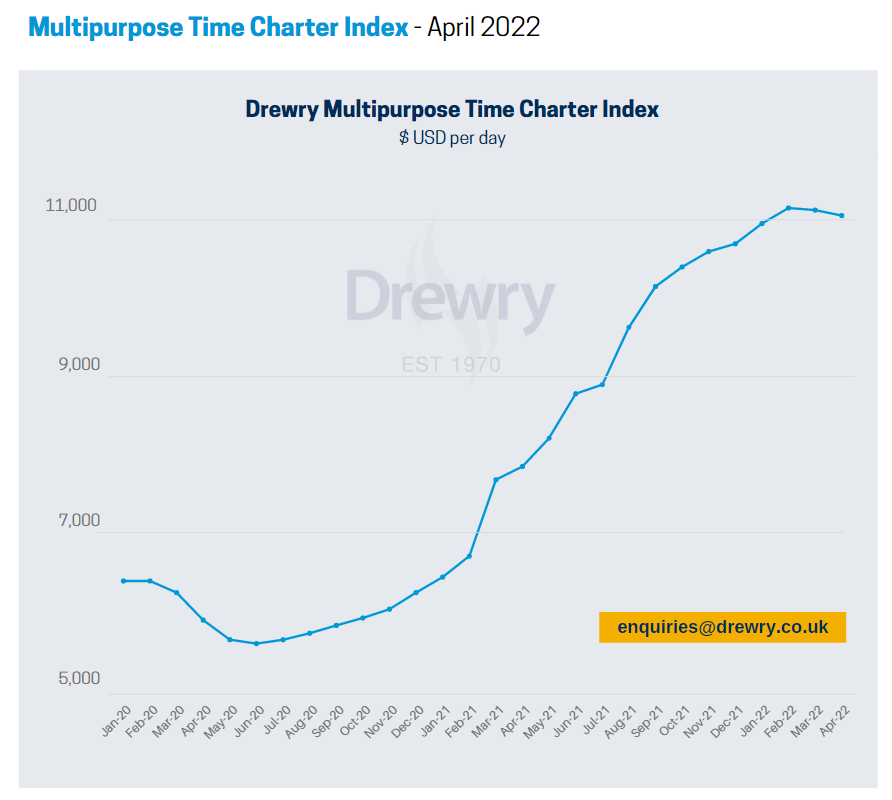

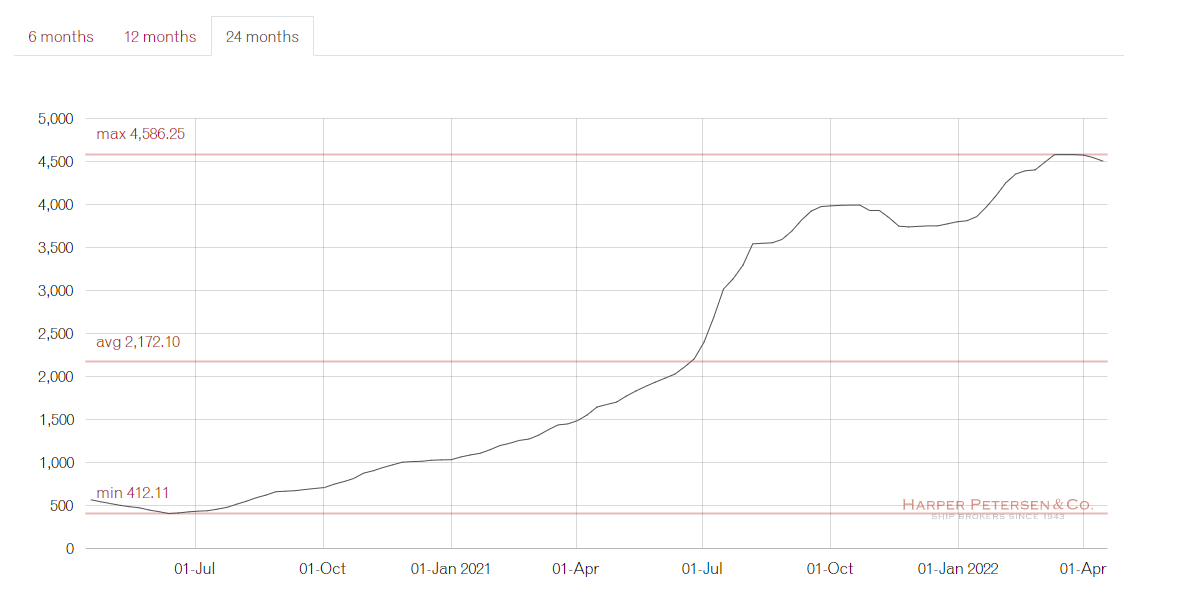

For full-year 2022, I expect more revenues and earnings for ZIM, compared with the full year 2021. According to the Drewry Multipurpose Time Charter Index, rising commodity prices have faltered the recent rise of charter rates. Grounded on growing oil prices and increasing uncertainty (due to the Russia-Ukraine war), Drewry sees little chance for charter rates to increase; however, says nothing about a drop in the rates. Moreover, the Harper Petersen Charter Rates Index, which reflects the worldwide price development on the charter market for container ships, shows that charter rates stopped climbing in the last recent weeks (see Figure 6).

Figure 5 – Drewry Multipurpose Time Charter Index

www.drewry.co.uk

Figure 6 – Harper Petersen Charter Rates Index

www.harperpetersen.com

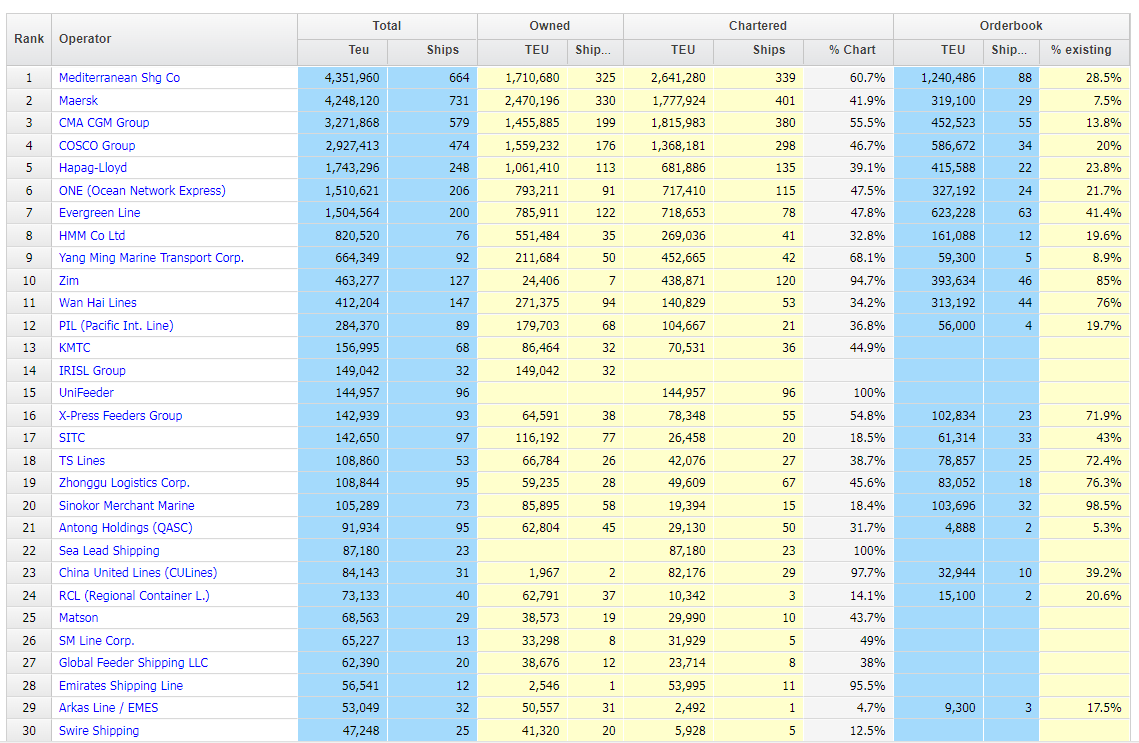

According to Alphaliner, with 127 vessels and a capacity of 463277 TEUs, ZIM ranks 10th among container shippers. ZIM has chartered 94.7% of its vessels, significantly higher than other companies (see Figure 7). ZIM charters vessels for long periods. This strategy brings stability to the company.

Figure 7 – Biggest container shippers in the world

alphaliner.axsmarine.com

What about the freight rates? According to Drewry, spot freight rates for eight major routes surged in the last 12 months. However, recently, freight rates experienced a decrease (see Figure 8). Furthermore, according to the Global Container Freight Rate Index, freight rates didn’t change significantly compared to 31 December 2021. The small picture is that freight rates are retreating from their top. However, the big picture is that freight rates in 2022 are higher than in the first nine months of 2021. To conclude, I expect strong 1Q and full-year 2022 financial results for ZIM.

Figure 8 – Spot freight rates

www.drewry.co.uk

Figure 9 – Global Container Freight Rate Index

fbx.freightos.com

Performance

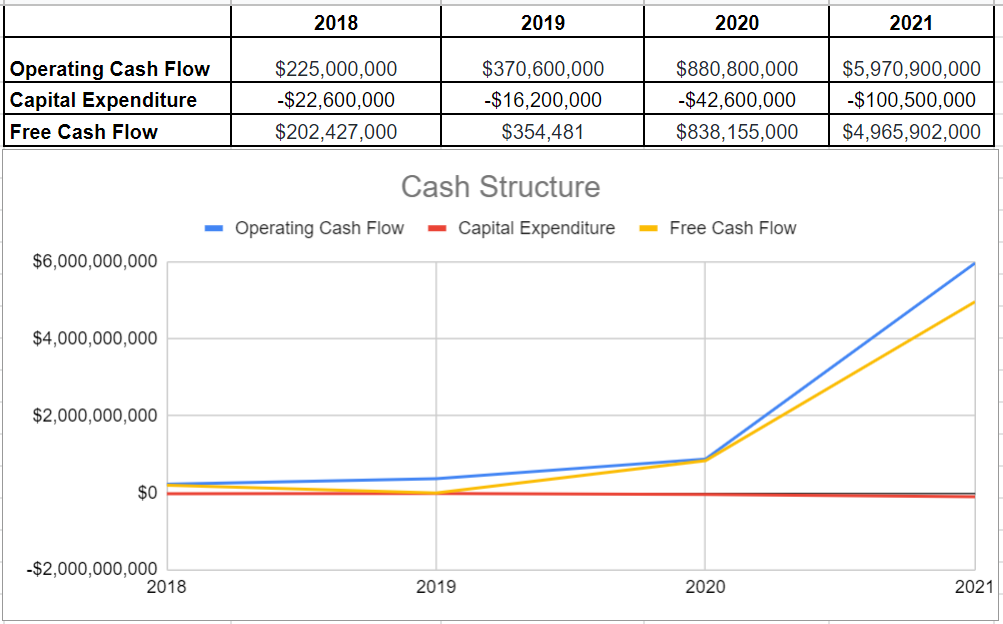

Analyzing the company’s operating conditions shows that ZIM’s operating cash flow surged from $880.8 million at the end of 2020 to $5.97 billion in 2021. Also, the company’s capital expenditure saw an increase from $42.6 million in 2020 to $100.5 million in 2021. When all was said and done, the company’s free cash flow ultimately sat at $4.965 billion at the end of 2021, which is far higher than its level of $838.2 million at the end of 2020. Thus, ZIM’s cash structure provides scope for higher distributions and dividend payments (see Figure 10).

Figure 10 – ZIM’s cash structure

Author

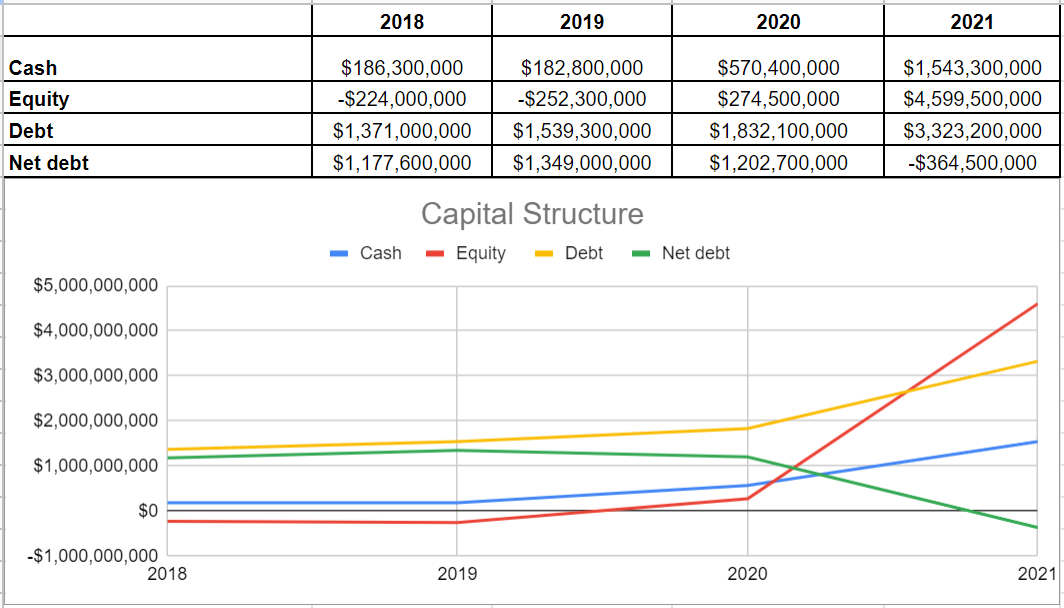

The company’s capital structure shows that ZIM’s net debt declined severely. Also, The company’s equity level surged amazingly to $4.599 billion compared with its previous level of $274.5 million in 2020. ZIM’s cash generation grew by over 170% to $1.54 billion at the end of 2021. Meanwhile, the company’s debt sat at $3.32 billion, which is above its previous level of $1.83 billion at the end of 2020. It is well beneath ZIM’s equity level and thus leads to better leverage conditions (see Figure 11).

Figure 11 – ZIM capital structure

Author

Valuation

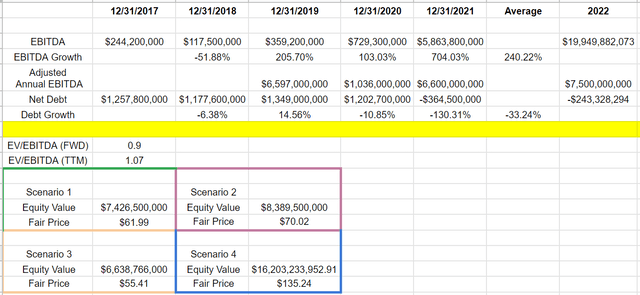

To estimate ZIM’s fair value, I investigated its EBITDA growth during the last five years. The company’s EBITDA grew impressively in recent years. Meanwhile, its net debt declined by over 33% in the previous five years. In the past year, the company’s EV/EBITDA ratio has fallen from 16.89x to 1.07x, and its forward EV/EBITDA is estimated to be 0.9x. ZIM’s adjusted EBITDA is announced to be $7.1b-$7.5b in 2022. Based on the company’s adjusted EBITDA, there are different scenarios for ZIM stock price (see Table 1).

Table 1 – ZIM stock valuation

Scenario 1: based on the 2021 adjusted annual EBITDA of $6.6 billion and the company’s net debt, I evaluated that ZIM’s price is around $62 per share, which is in line with the company’s market price.

Scenario 2: based on ZIM’s 2022 guidance, the company announced its adjusted EBITDA to be $7.1 billion to $7.5 billion in 2022. Thus, its price would have upside potential to reach around $70 per share.

Scenario 3: based on the company’s last report of net debt and EBITDA amounts and its EV/EBITDA (TTM), the stock’s fair value would be $55.

Scenario 4: if ZIM’s forward EV/EBITDA reach 0.8x, and its EBITDA and net debt grow by their average 5-year growth rate, the company’s fair value will be $135 per share.

In a nutshell, I investigate that the second scenario is the most probable one based on ZIM’s financial guidance. Thus, the stock has about 16% upside potential to reach $70.

Summary

ZIM stock is worth more than its current prices. I expect the company to report strong 1Q and full-year financial results. In analyzing ZIM, the small picture is that freight rates are retreating from their top. However, the big picture is that, on average, freight rates in the full year 2022 will be higher than in the full year 2021. Freight rates in 1Q 2022 are much higher than in 1Q 2021, 2Q 2021, and 3Q 2021. In a word, I am bullish on ZIM stock.

Be the first to comment