magicmine

Investment Summary

Following its latest set of numbers I’ve reiterated the hold rating on SeaSpine Holdings Corporation (NASDAQ:SPNE) and note that little has changed in the investment debate. In the previous analysis I conducted on the company (see: here) I noted there were several downside risks that were yet to be fully realized at the company level. Most notably, the lack of profitability coupled with consistent free cash flow (“FCF”) burn were the most unattractive features at the time, seeing as we’re looking to capture profitable, quality names in medtech this year.

From the previous analysis, before the Q2 FY22 earnings, the following points were noted:

- Operating leverage had averaged down to -1.4x in the past 2 years.

- SPNE’s harvested zero return from its invested capital and has realized a series of losses on investment instead.

- Investors had realized a cumulative $21.80 loss in FCF/share from Q3 F19-Q1 FY22.

- Multiple downside targets were in place with respect to price distribution and valuations.

From the most recent set of numbers, not much has changed to this outlook. With this in mind, I continue to rate SPNE a hold with a $4.58 valuation.

SPNE Q2 earnings again soft

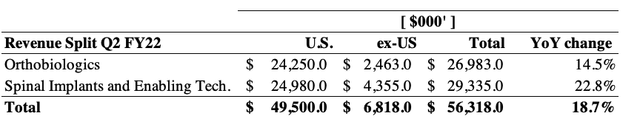

The company came in with another set of mixed numbers, with upsides versus consensus at the top-line only. Revenue of $56.3 million (“mm”) was up c.18.5% YoY and pulled down to a gross profit of $37.9mm, up 24% YoY as well. Segmentally, growth was strong as well, with a 22.8% YoY expansion in the spinal implants and enabling business.

Exhibit 1. Revenue distribution evenly split between both segments.

- Top-line growth continues to impress with double-digit gains in turnover with each segment

- It’s the inability to bring this growth to the bottom-line and FCF that are mitigating factors in the investment debate

Data: Adapted from SPNE Q2 FY2210-Q

However, it also printed an operating loss of $14.53mm, behind the loss of $11.1mm the year prior and brought this down to a net loss of $13.9mm of loss per share of $0.38.

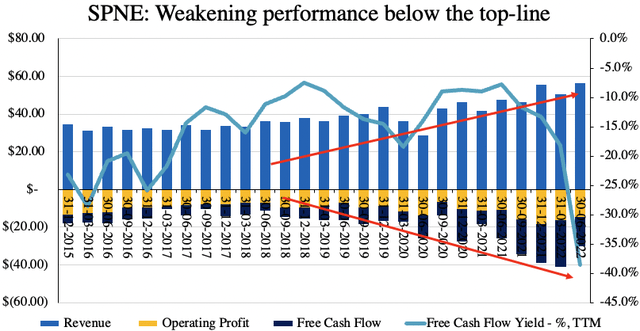

As seen in Exhibit 2, the spread in performance from top-bottom line growth continues to widen for SPNE on a sequential basis. Whilst revenue continues to tick up since listing in 2015, bottom-line fundamentals haven’t enjoyed the same upswing. The gap in operating and FCF losses is now near its widest on TTM figures, whereas the realized FCF yield has tumbled to its lowest mark on record.

These are unattractive features in the current investment landscape, much less so when looking ahead. Ideally, I’d be looking for SPNE to narrow this gap in operating performance seen below, versus trends widening. This is particularly important as the cost of capital rises and abundant liquidity dries up. Should the company need to raise additional cash from the ongoing operating losses, it would have to head to the high-yield debt capital markets, or raise additional dilutive equity, itself commanding a premium at present.

Exhibit 2. Operating performance continues to widen from top-bottom line on a sequential basis

- The ‘gap’ isn’t narrowing, and this is a risk in the forward-looking economic landscape

- Realized FCF yield is a concern when benchmarked to corporate value and is unsupportive of a bullish view.

- This is whilst SPNE’s market cap drops to its lowest marks since listing.

Note: All figures in $mm or [%]. Free cash flow calculated as [NOPAT – investments]. FCF yield calculated as a function of enterprise value on a TTM basis. (Data: HB Insights, SPNE SEC Filings)

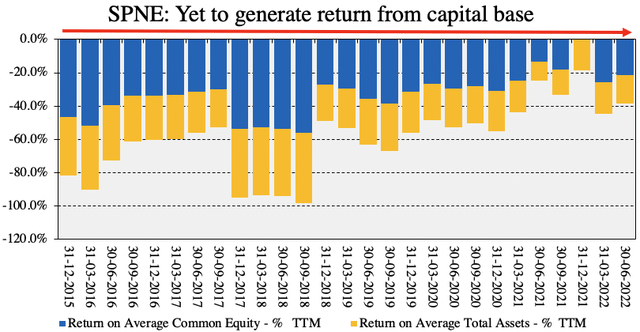

Furthermore, as seen in Exhibit 3, SPNE has yet to generate a return from its ongoing investments or current capital base. This places a huge dent in the upside case for SPNE as we are looking to position against long-term cash compounders that feed large amounts of cash below the bottom line. SPNE misses the mark substantially here. Normally, a declining or negative FCF and FCF yield is preferable if there’s adequate return on capital that beats the WACC hurdle, and capital is readily available. At SPNE’s WACC of 13% it doesn’t beat the hurdle here, and there’s a lack of tangible value in free cash flow to mitigate this.

Exhibit 3. Return on capital continues to print negative and therefore doesn’t compensate for the FCF burn.

- This places a large downside tilt to the risk/reward calculus.

- Without the profitability to overcome the WACC hurdle and the lack of cash earnings, this remains a key risk as well.

Note: All figures calculated using GAAP earnings with no reconciliations. (Data: HB Insights, SPNE SEC Filings)

Valuation and conclusion

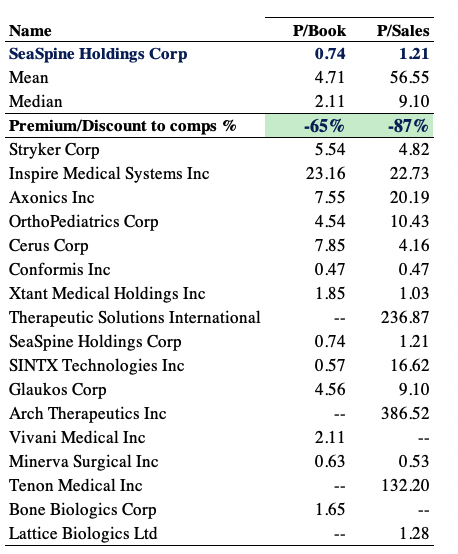

Shares are trading at a discount to the peers in the GICS industry across multiples used in this analysis. Trading at ~0.75x book value and 1.2x sales represents relative value at respective discounts to peers. However, I’d argue this deep discount is warranted.

As I said in the last analysis: “But what are we valuing here? A 7.5% 5-year average sales growth? That doesn’t even constitute a growth play.”

Certainly, we’ve seen no change to multiples from the previous report and the stock itself hasn’t re-rated to the upside. Moreover, trading below its book value of equity doesn’t mean all that much without a positive return on equity to benchmark this against. Therefore, on the question on valuation, whilst shares are trading at a discount, this is justified in my estimation. In my previous report, I valued SPNE at $4.58 based on a blend of valuation inputs, and I’ve made no change to this value here today, given there’s no stimulus to do so.

Exhibit 4. Multiples and Comps

Data: HB Insights, Refinitiv Datastream

Net-net, there are too many headwinds at the cash flow and profitability level for my liking right now in SPNE. We are seeking to position against strong, predictable cash flows, and the company doesn’t meet this criteria just now. It’s been listed for 7 years and hasn’t demonstrated a reasonable path to get there in my estimation. Whilst shares are trading at a deep discount to peers this looks to be justified, but represent relative value on pure multiples nonetheless. It’s just if one is prepared to pay for a series of ongoing operating losses, further FCF burn guided by management, but without the return on capital to make this worthwhile. These points in mind, I reiterate SPNE is a hold with a $4.58 valuation.

Be the first to comment