CloudVisual/iStock via Getty Images

Note:

I have previously covered Seanergy Maritime Holdings (NASDAQ:SHIP), so investors should view this as an update to my earlier articles on the company.

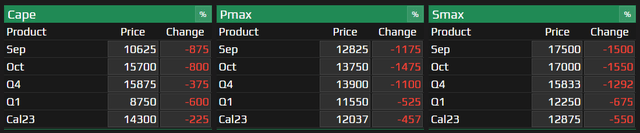

For some time now, I have been bullish on dry bulk shipping stocks but since my last update on Greece-based Capesize pure play Seanergy Maritime Holdings or “Seanergy” in June, the Baltic Capesize Index (“BCI”) has decreased another 75% to new 2-year lows and forward freight agreement (“FFA”) rates look just plain ugly:

Braemar Atlantic Securities

Given this issue, it is hardly a surprise that Seanergy’s common shares have experienced some major selling pressure in recent weeks and currently change hands near 52-week lows as investors are rightfully concerned about the company’s ability to keep the quarterly dividend at current levels and potential requirement to conduct a reverse stock early next year.

Dividend

The company initiated a quarterly cash dividend of $0.025 per common share in March. At current share prices, annual dividend yield calculates to approximately 15.5%.

At this level, Seanergy will have to generate approximately $17.5 million in cash on an annualized basis to cover its payout.

Assuming no fixed-price charters at higher rates and using the current FFA rates for 2023, I would estimate the company to generate approximately $20 million in Adjusted EBITDA next year which already includes a premium for Seanergy’s ten scrubber-fitted vessels.

Under this hypothetical scenario, I would expect the company to reduce or even cancel the dividend going into 2023 but keep in mind that Seanergy’s fleet is mostly operating on index-linked time charters which causes some seasonality in the company’s results.

That said, I would expect Seanergy to keep the dividend unchanged for at least the remainder of the year basically regardless of short-term charter rate movements based on the company’s first half results and preliminary Q3 time charter equivalent (“TCE”) rate guidance.

At the end of Q2, Seanergy had cash and cash equivalents of $41.4 million which I would expect to decrease to approximately $35.0 million by the end of this quarter, mostly due to the company’s recent $10 million investment in spin-off United Maritime (USEA).

On the Q2 conference call, management remained optimistic on the company’s prospects going forward:

There are various negative events on a global scale, such as the ongoing conflict in Ukraine, the fears about inflation and the ensuing risk of recession as well as the COVID-19 related lockdowns in China.

However, our view is that the robust fundamentals of the Capesize sector will provide for solid market conditions despite these uncertainties.

Reverse Stock Split

The Nasdaq recently granted Seanergy a 180-day grace period until January 30, 2023 to regain compliance with its $1 minimum bid price requirement.

Under certain circumstances, the company would be eligible for a second 180-day grace period but without a very meaningful recovery in Capesize charter rates, investors will likely have to prepare for a reverse stock split early next year.

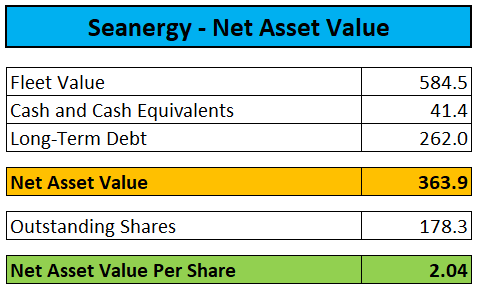

In a perfect shareholder value world, management would consider taking advantage of decade-high second hand vessel prices and sell some Capesize carriers to repurchase a large number of common shares at a fraction of the current net asset value (“NAV”) of above $2 per share:

Company Presentation, Compass Maritime

Keep in mind that the NAV calculation above does not include the company’s $10 million convertible preferred shareholdings in recent spin-off United Maritime, which provides Seanergy the opportunity to grab back up to 29.9% of the company on the cheap next year.

Unfortunately, I do not remember a single case of a Greek shipping company having sold vessels to aggressively buy back shares in recent years and I do not expect Seanergy Maritime to go down this avenue either.

Bottom Line:

Speculative investors with some faith in management’s expectations for Capesize charter rates to recover sooner rather than later should consider building a position in Seanergy Maritime’s shares at the current 70% discount to net asset value.

That said, the beaten-down share price reflects the much weaker-than-expected charter rate environment and associated risks of a dividend cut and potential reverse stock split early next year.

After reducing my holdings in the shares to almost zero following the United Maritime spin-off last month, I increased my position in Seanergy back up on Monday mostly based on the massive discount to asset value which is by far the largest among dividend-paying dry bulk shippers.

Based on the increased risks to the investment thesis, I am downgrading the shares from “strong buy” to “buy“.

Be the first to comment