NNehring/iStock via Getty Images

The global commodity markets represent a significant opportunity for investors in the long haul. By their nature, commodities are always or almost always in high demand and the companies that can find a way to best serve this highly competitive and low margin space have the opportunity to create significant value for their investors. One business that operates as an integrated player that focuses on various commodities is Seaboard Corporation (NYSE:SEB). Despite some bottom line volatility largely associated with the COVID-19 pandemic, the overall picture for the company for both its top and bottom lines has generally been positive. Recent performance revealed by management shows that the company is doing quite well for itself at the moment. Due to this performance, shares of the firm do look fundamentally attractive. But even if we were to see fundamental performance pull back to what it did achieve one year earlier, shares might still make for a favorable risk to reward prospects.

Recent developments are mixed

Back in mid-January of this year, I wrote my first ever article on Seaboard Corporation. The company focuses largely on the production of hogs and pork processing in the US, as well as on trading and grain processing in Africa and South America, as well as on other activities like cargo shipping services in various markets, sugar, and alcohol production in Argentina, and electric power generation in the Dominican Republic, makes for an interesting prospect, to say the least. The diversity of the company both geographically and operationally makes it a good player for investors who don’t like to put all of their eggs in one basket.

In that aforementioned article on Seaboard Corporation, I acknowledged recent strong performance by management. Having said that, I also cited the mediocrity of the company’s bottom line results that came despite a continuing increase in revenue. This mediocrity is related not only to earnings but also to the cash flows as well. Even so, I felt that shares of the company were attractively priced to the point that the good more than outweighed the bad for investors. And, as a result, I, ultimately, rated the company a ‘buy’ prospect. Since then, shares of the company have generated nice returns for investors, with the return as of this writing amounting to 6.6%. This compares to the 4.7% decline experienced by the S&P 500 over the same window of time.

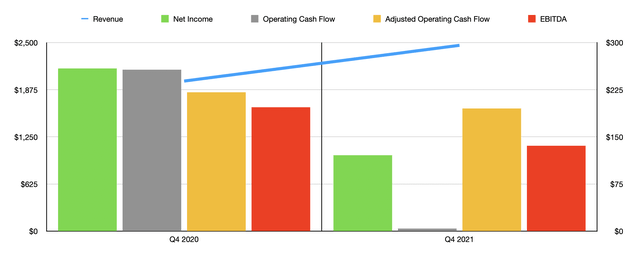

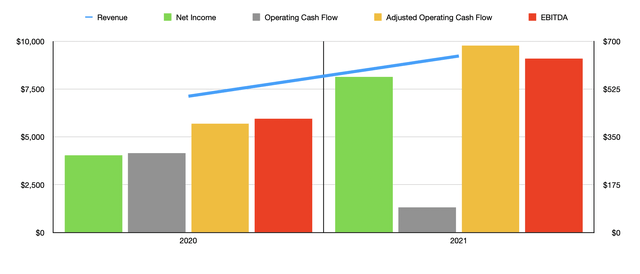

Given this disparity in returns, you might think that things are going really great for the business. In some ways, this is most certainly true. Consider, for instance, the company’s revenue. In the final quarter of its 2021 fiscal year, the only quarter for which data is currently available that was not available when I last wrote about the firm, the business generated sales of $2.46 billion. This translates to a 23.8% increase over the $1.99 billion the company generated one year earlier. This increase was not just a one-time thing. For the full 2021 fiscal year, the business reported revenue of $9.23 billion. That implied a year-over-year growth rate of 29.5% compared to the $7.13 billion reported for its 2020 fiscal year. Management attributed much of this growth to increases in commodity prices, as well as greater volumes of cargo sent through its Marine segment. For those familiar with the company, growth as a whole should not be surprising. That is because, from 2016 through 2020, sales rose each year, with an annualized growth rate during that window of 7.3% per annum.

Due to the higher prices, margins for the company generally improved for the 2021 fiscal year. However, the final quarter of the year proved to be a bit difficult. Net profits totaled just $121 million. That compares to the $259 million reported one year earlier. Even so, total net income for the company for the 2021 fiscal year was an impressive $570 million. That’s more than double the $283 million generated in 2020. There are, of course, other important profitability metrics to consider. For the full 2021 fiscal year, for instance, operating cash flow was just $92 million. That compares to the $291 million generated one year earlier. However, if we adjust for changes in working capital, then operating cash flow would have risen from $398 million to $684 million. Meanwhile, EBITDA for the business surged from $417 million to $636 million.

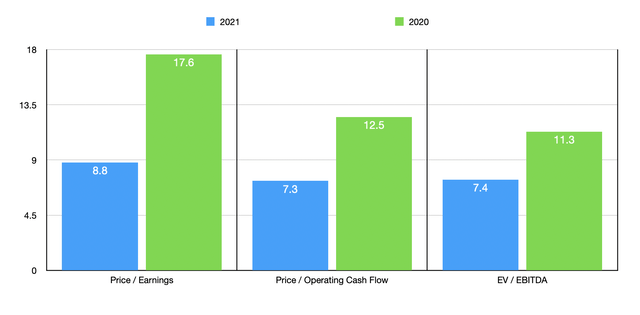

Taking this data, we can effectively value the company. Using its 2021 results, we find the business trading at a price to earnings multiple of 8.8. Even if financial performance were to revert back to what the company experienced in 2020, this multiple would come in at 17.6. That’s not exactly high, nor is it cheap. Rather, it probably indicates a fair value for the enterprise. Other metrics also look beneficial for shareholders. The price to adjusted operating cash flow multiple for the company was 7.3 in 2021. This is down from the 12.5 we saw in 2020. And the EV to EBITDA multiple for the company stood at 7.4. That stacks up against the 11.3 figure we get if we rely on 2020 figures.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.6 to a high of 127.3. Whether we use the 2020 results or the 2021 results, we find that only one of the five companies was cheaper than our prospect. Meanwhile, the price to operating cash flow multiple of these firms would be from 4.6 to 34.4. In this case, using both scenarios, two of the companies were cheaper than our prospect. And finally, I looked at the five companies through the lens of the EV to EBITDA multiple, ending up with a range of 3.5 to 28.4. In both cases, only one of the five firms was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Seaboard Corporation | 8.8 | 7.3 | 7.4 |

| The Simply Good Foods Company (SMPL) | 65.2 | 34.0 | 28.4 |

| Flowers Foods (FLO) | 27.7 | 16.4 | 14.4 |

| Post Holdings (POST) | 127.3 | 5.3 | 12.9 |

| Lancaster Colony (LANC) | 34.4 | 34.4 | 19.9 |

| Sanderson Farms (SAFM) | 6.6 | 4.6 | 3.5 |

Takeaway

All things considered, it looks to me as though Seaboard Corporation continues to expand its top line. Its bottom line results recently broke out of its historical range, which should be a positive if repeatable. Having said that, recent increase in prices for its products should not be counted on in the long haul. Eventually, the market should adjust. Even if this does come to pass and financial performance weakens back to what it was in 2020, I can’t see shares of the company being any worse off than fairly valued. Because of this, I would make the case that this is still a valid ‘buy’ prospect at this time.

Be the first to comment