smshoot/iStock via Getty Images

Introduction

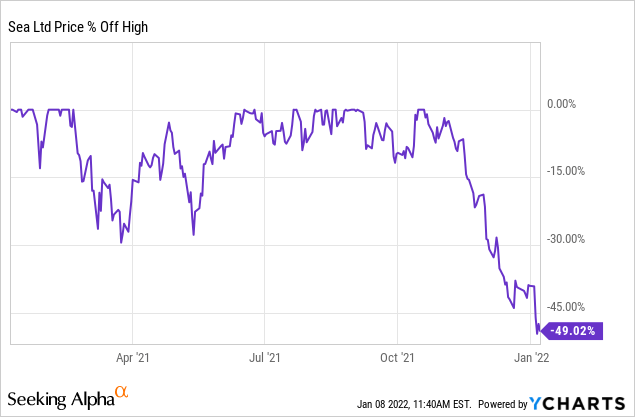

It seems like the stock price butchering for high-growth stocks continues in 2022 so far and, whereas Sea (NYSE:SE) was immune for quite a while, over the last few weeks that has changed too. The stock now trades down 49% from its high that was only chalked in October 2021.

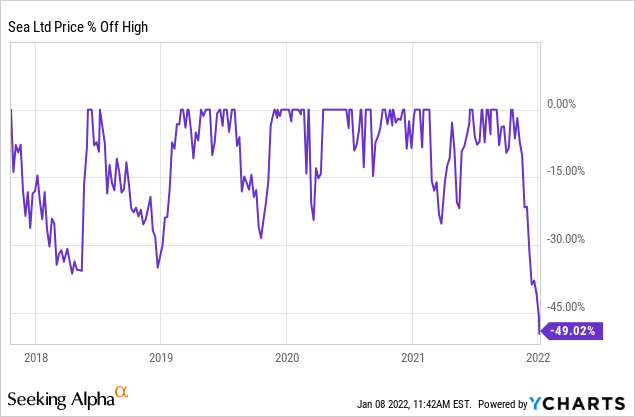

Just to give you some context on how brutal this sell-off is, it’s the first time since Sea became a public company in 2017 that the stock is down so much:

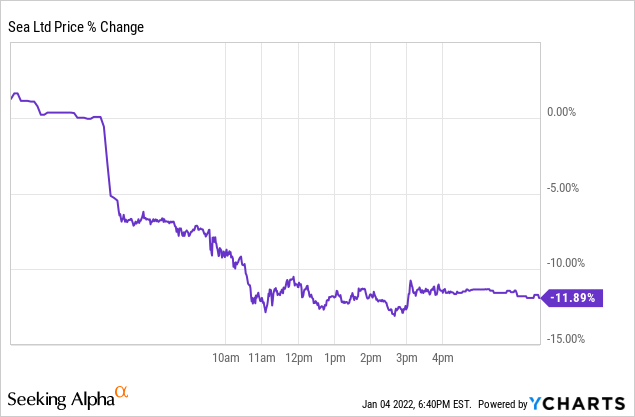

Of course, this has to do with the sell-off of a lot of high-growth stocks, but on Tuesday, Sea was down a lot more because of news about one of its investors, Tencent.

What happened?

Tencent (OTCPK:TCEHY) announced on Tuesday that it will sell a portion of its stake in Sea Limited. That was not really surprising after Sea had already disclosed on Monday that Tencent would convert all of its Class B shares to Class A shares. That means that the company could sell these shares.

Like many tech companies, Sea has a dual-class structure. Each Class B share gives rights for 3 votes… up to now (more about that later).

Tencent was a very early investor in Sea. It invested in 2010 when Sea was still only Garena. Tencent and Sea’s founder and CEO Forrest Li had an agreement (or proxy) that stipulated that Forrest Li had the voting power for all of the Tencent shares. Together with his own Class B shares, this made that Forrest Li had more than 50% of the voting power in Sea.

Now, with all of the Class B shares of Tencent converted to Class A shares (which only have 1 vote) and Tencent selling a portion of its shares, Forrest Li would not have absolute control anymore in votes. That’s why Sea proposes to change the voting power of the Class B shares (of which Forrest Li is now the only holder) to 15 votes instead of 3. That is something that has to be voted on at the Annual General Meeting, which will be held on February 14th.

Tencent will sell 2.6% of the company, which will bring down its stake in Sea from 21.3% to 18.7% and the Chinese tech giant says that it will keep ‘the substantial majority of its equity stake’ for the long term:

Tencent intends to retain the substantial majority of its equity stake in Sea for the long term and will continue its existing business relationships with the company.

(Source)

In the six months following the sale of the shares, there will be a lock-up period in which Tencent cannot sell any shares of Sea. But because of the conversion of Class B to Class A shares, Tencent’s voting power drops below 10%.

Why does Tencent sell?

Recently, Tencent announced the distribution of more than $16B in shares of JD.com (NASDAQ:JD) among its shareholders and now it sells for more than $3B in Sea shares, more than 14 million shares between $208 and $212. Why?

To understand that, you have to know what’s going on in China. You may have heard that the Chinese government is making it hard for big tech in China: Alibaba (NYSE:BABA), Tencent, JD, etc.) One of the reproaches that the CCP (Chinese Communist Party) throws at these very successful and big companies is that they don’t distribute their wealth enough. That’s why they are pushed to pay gigantic sums for “charities”. Alibaba already pledged $15.5B, Tencent itself $7.7B in April 2020.

These are actually thinly veiled donations to not be outlawed by the CCP. That’s why Tencent writes about the sale of the Sea shares:

The divestment provides Tencent with resources to fund other investments and social initiatives

It’s not that Tencent doesn’t have money enough to pay for the forced charity projects, but it probably wants a bit of a war chest for whatever else there might be coming its way. At the same time, distributing JD shares and giving up much of the voting power (in a more clear way than the proxy) also is a way of giving into the Chinese government, which keeps hammering on the nail of antitrust.

What does this mean for Sea?

When something happens, news outlets always stress the negative because they know that attracts worried readers. So, of course, immediately, a link was made with Tencent and Sea’s contract about the gaming distribution of Tencent games in Southeast Asia. In November 2018, Sea’s Garena obtained the first right to publish all Tencent games in Indonesia, Taiwan, Thailand, the Philippines, Malaysia and Singapore, which is important, as Tencent is the biggest gaming company in the world. This contract still runs until 2023 but several commentators tried to justify the big price drop by referring to this higher risk.

I’m sorry, but 2.6% less with 18.7% ownership of the company remaining, that doesn’t change the relationship between Sea and Tencent substantially. Yes, they give up the B Shares with triple voting rights, but the voting rights were given to Forrest Li anyway.

For Sea, this might be good. Now that Tencent has less than 10% of the voting power, this is an argument less for Indian sellers that say that Shopee/Sea is owned by ‘the Chinese’ and should be banned, just like Tencent’s games in the country. Although Forrest Li was born in China, he is a citizen of Singapore. With Tencent now not having that much voting power anymore, the argument becomes even weaker than it already was. Shopee only recently entered India and local trade unions were not happy about that, as the company is known for selling cheap and asking no commissions initially.

Sea will also give Forrest Li a majority voting power again, as shared above. I’m definitely OK with that. He has had that privilege de facto since the start of the company up to today, so why wouldn’t it be good, all of a sudden? The only difference was that Tencent gave him their voting power. Making this clearer looks like de-risking to me.

What will I do now?

With the Tencent stock price sale pegged in the range of $208-$212, it’s normal that Sea would fall to this range. But since then, the stock price kept diving and even broke the $200 line.

What I will do is simple: I will just continue to add to my Sea position. Nothing of this news shows any weakness in the business or a changed picture, no matter what you might hear out there.

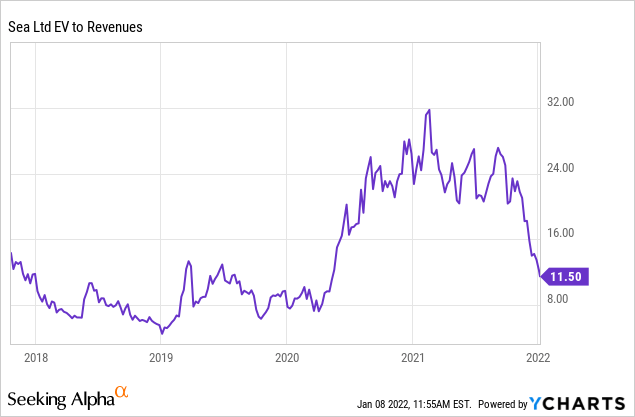

If you look at the long-term valuation on an enterprise value to revenue ratio, you see that Sea has basically come down to pre-pandemic levels already.

With the Q4 earnings around the corner, this will decrease further (as this is not a forward-looking chart).

The company has a stable cash cow in Garena, its gaming division, which funds the expansion of Shopee, Sea’s e-commerce business. Shopee has been launched outside of Sea’s core market of Southeast Asia: Brazil, Mexico, Argentina, Chili, France, Spain, Poland, India and I may be missing some. On top of that, the company recently raised $6B through a stock offering and convertible notes. The stock was sold for $318 per share. The stock price now is $187, 41% lower. Well-timed.

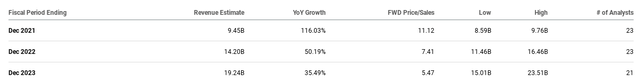

If you look at the revenue estimates, you see that the company is set to continue its growth, albeit, of course, at a slower rate.

(From Seeking Alpha Premium)

In a few markets (Thailand, Malaysia) Shopee is already profitable, as profitability comes with scale. It also has a lot of levers to pull left. Advertising, for example, is only starting out. This is very high-margin revenue. At this moment, it’s just 0.5% of GMV (gross merchandise volume, the total dollar amount that an e-commerce site sells). Amazon (NASDAQ:AMZN), which is of course much more mature, has 3.5% on a GMV of $390B. With an expected $50B in GMV for 2021, Shopee, which was only started in 2015, shows how incredibly fast Sea can scale its businesses.

And advertising is just one of the many possibilities. Shopee Food (think of Uber Eats) has been rolled out in a few countries already, the company has a VC fund of $1B, SeaMoney, its fintech, is growing like gangbusters and so on. To me, Sea has a huge potential for long-term investors. With Potential Multibaggers, I try to look for companies that can go up 10 times or more over the next 10 years. I think Sea still has that potential. I know that would make it a $1T company, but I think it will get there.

Conclusion

Stock price drops don’t feel great, but retrospectively, they often looked like great opportunities to scale in or to add. Don’t let the fear that is spread now take your eyes off of the long-term goal.

In the meantime, keep growing!

Be the first to comment