SIphotography/iStock via Getty Images

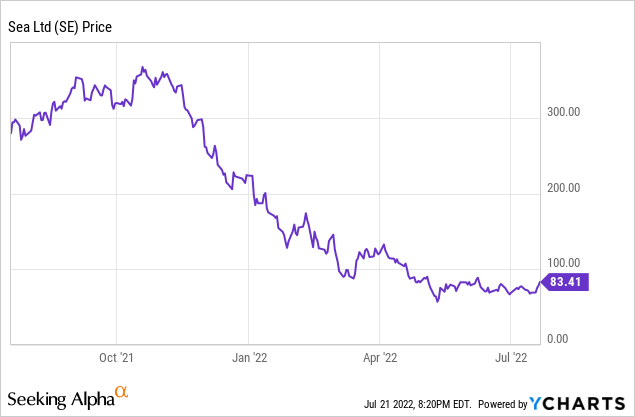

Sea Limited (NYSE:SE) has seen its stock be pushed down over 60% so far this year as investors quickly rotated out of risky assets. Driven by higher interest rates and fears around a possible recession, among other factors, the market has not been kind to fast-growth companies that currently fail to show profitability metrics.

While I do believe there remains a lot of optimism around the company’s long-term outlook, investors should be a little cautious heading into the Q2 earnings report next month.

Just last quarter, management called out a slowdown in its user engagement within the Digital Entertainment segment as well as challenging E-Commerce segment revenue comparisons.

Higher interest rates seen around the world combined with fears around a potential recession may cause consumers to shift the spending habits to be more conservative, thus potentially placing more pressure on spending trends.

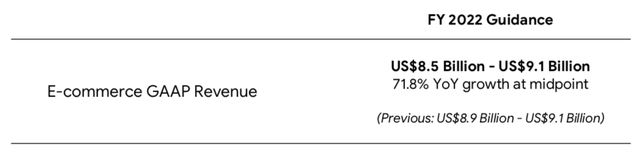

In addition, in Q1 the company lowered their guidance for E-Commerce revenue, calling out a challenging macro environment in Asia-Pacific. Since the company reported earnings, not a lot has changed in the macro environment that would make investors more positive into the quarter.

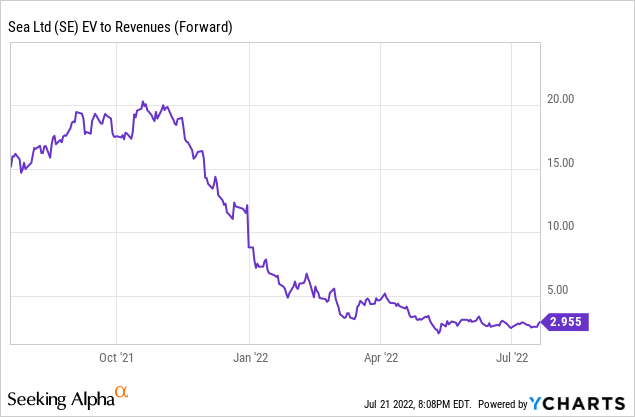

Plus, valuation still remains somewhat expensive at over 3x 2022 revenue and over 2x 2023 revenue. Compared to other software companies, valuation is not expensive. However, Sea Limited’s revenue streams are not as recurring as software revenue and the company continues to hemorrhage money each quarter.

For now, I believe investors should use more caution heading into Q2 earnings, though I continue to believe the long-term outlook for the company remains positive once we move past the current challenging economic conditions.

Brief Financial Review

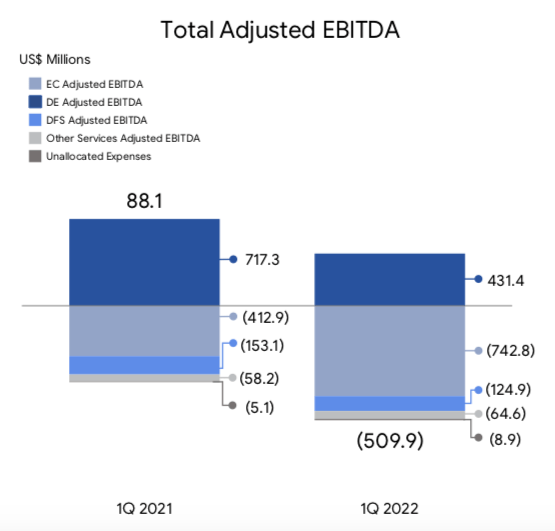

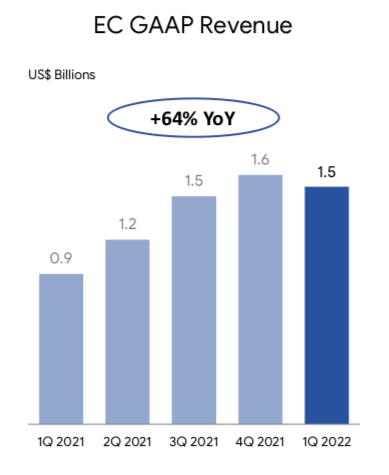

Back in mid-May, the company reported revenue growth of 64% yoy to $2.9 billion, which beat consensus estimates by $40 million. Though there still remains a lot of runway left in profitability, gross margins improved to 40.4% (from 36.6% in the year-ago period) and adjusted EBITDA loss was $510 million, though beat expectations for a near $600 million loss.

Sea Limited

Cautious Into Upcoming Earnings

With the company reporting earrings next month, I believe investors should remain cautious heading into the print. With the company already having acknowledging a slowdown in user engagement and E-Commerce segment revenue trends facing difficult comparisons, the company may start to report more normalized growth trends, which could disappoint

During Q1, Digital Entertainment segment revenue grew 45% yoy, management acknowledged a slowdown in user engagement as quarterly active users declined 5% yoy and quarterly paying were declined 23% yoy.

While Garena experienced headwinds in its growth post-COVID, we saw some preliminary positive effects from our efforts to improve user engagement in Free Fire. In particular, the monthly user trends for Free Fire began to show some early signs of stabilizing toward the end of the first quarter. While this is encouraging, the longer-term impact of reopening around Free Fire remains to be seen and we will continue to focus on user engagement and user base stabilization.

User engagement trends can move around quarter to quarter, though with the company already acknowledging a potential, there appears to be some underlying risk that user engagement remains weak.

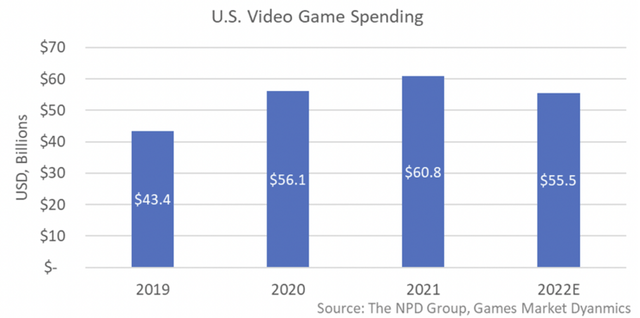

And while this is not a perfect correlation, The NPD Group is projecting video game spending to decline 9% yoy during 2022. Yes, this chart only analyzes the US video game market, though global video game trends tend to move in similar patterns, thus potential weakness in the US may be seen elsewhere in the world.

Some of the drivers of the decline include the return of experiential spending, higher prices in everyday spending categories such as food and fuel, the uncertain supply of video game console hardware and certain accessories such as gamepads, and a lighter release slate of games, among others.

The surge in video game players and engagement the market experienced during 2020 and 2021 has leveled off, and we are now seeing more entertainment opportunities emerge that compete for consumer attention and, of course, dollars.

In hardware, the video game console market has yet to reflect normalized demand given ongoing supply constraints, particularly on new generation systems such as the PlayStation 5 and the Xbox Series X. This is not likely to change throughout 2022 and will lead to continued uncertainty for the market.

Higher inflation has been an issue throughout the world and with the cost of everyday items going up, consumers may be spending less time and money on their mobile/video games.

On top of the potential slowdown in the Digital Entertainment segment, E-Commerce segment is starting to face more difficult comparisons, thus we could see a slowdown in growth.

Sea Limited

The chart above does a good job depicting the significant sequential growth patterns seen in the E-Commerce segment, and the yoy trends clearly benefited from the pandemic with consumers shifting their spend to online channels.

Back in Q1-2021, E-Commerce segment revenue growth was 250% yoy, Q2-2021 was 161% yoy, Q3-2021 was 134% yoy, Q4-2021 was 89% yoy, and this past quarter was 64% yoy. These trends show that the comparison from the year ago period is still very challenging.

On top of that, consumers are faced with high inflationary pressures across most retail categories. Combined with the fears of a potential recession, consumers may start to pull back on their discretionary spending patterns, thus further putting downward pressure on the E-Commerce growth rate.

After reporting Q1, the company also downward revised their E-Commerce revenue expectations, now expecting revenue of $8.5-9.1 billion, down from the prior guidance of $8.9-9.1 billion. While the top-end of the guidance range was reiterated, the wider and lower range takes into account the uncertainties around the global macro-environment, specifically around the Asia-Pacific region.

Since the company reported earnings in mid-May, the macro-environment has certainly not improved, with interest rates continuing to rise, inflation reaching record levels around the world, and the Asia-Pacific region remained constrained by COVID-restrictions.

Given all of these moving parts, it would not be shocking to see the company lower their E-Commerce segment revenue guidance again, which I believe would push the stock even lower and cause negative sentiment to persist.

Valuation

With the stock remaining down over 60% so far this year, the stock has actually been up almost 5% since the company reported Q1 earnings. I believe part of this positive performance was related to the company posting better profitability than expected and some optimism around recovery.

However, I believe there remains a lot of negative macro impacts that can cause the stock to be weak. If they were to miss E-Commerce revenue expectations or make additional commentary around user engagement slowing down, investors may be quick to sell the news.

The stock has a current market cap of ~$46.7 billion and net cash of ~$8.5 billion, resulting in an enterprise value of ~$38.2 billion.

However, I believe there continues to be downside risk to consensus estimates given the ongoing macro challenges around the world. Factors such as high inflation, difficult E-Commerce comparisons, potential slowdown in video game engagement/spending, and fears around a recession may cause many companies to lower expectations heading into the second half of the year.

For comparison, if 2022 revenue ends up closer to $12.5 billion, this would imply a 2022 revenue multiple of over 3x. And if growth further decelerates in 2023 and we end up with $16 billion of revenue, then valuation is still over 2x 2023 revenue.

Yes, this is not an overly expensive multiple to pay, but investors must balance the risk/reward of investing in a fast-growth company that is facing growth deceleration on top of ongoing adjusted EBITDA losses.

While I am a long-term bull in the company, I do believe we could see some volatility in upcoming months given the difficult macro environment we are currently living in. Caution into the Q2 earnings report is warranted, and if the company is able to execute well, then long-term shareholders will surely be rewarded.

Be the first to comment