Nearmap/DigitalVision via Getty Images

With an impressive YTD return of around 260%, Scorpio Tankers (NYSE:STNG) is arguably one of the best performing stocks in 2022. The Monaco based company is involved in the seaborne transportation of refined petroleum products and has achieved record quarterly earnings in the first nine months of the year thanks to the surge in product tanker rates during this period.

The cost of moving refined petroleum products over sea has been on an uptrend for most of 2022, benefiting STNG which has a fleet of 124 tankers operating in shipping markets worldwide.

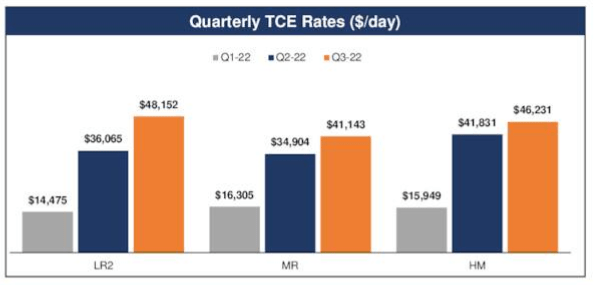

Freight rates as measured in time charter equivalent (TCE) have increased substantially for all vessel types, including the Long Range (LR), Medium Range (MR) and Handymax (HM) vessels that STNG operates. Oil tankers are categorized by size based on their dead weight ton capacity. This brief but comprehensive overview by McKinsey is useful for a general understanding of how oil tankers are categorized by size; if you’re interested in a deep dive and some history of how tankers have evolved through the years, you can check out this detailed article on Seaman Memories.

The chart below, sourced from STNG’s latest earnings call presentation, shows how the company’s TCE rates have increased sharply between Q1 and Q3 2022 for all the three categories of vessels it operates. On average, TCE rates have increased between 200 to 300% over this period.

Scorpio Tankers

STNG’s management is confident that its customers will keep paying these high rates in Q4, with the CEO Emanuele Lauro noting on the Nov 1st earnings call that the company had already booked a TCE of $45,500 per day for 52% of the available days in the quarter.

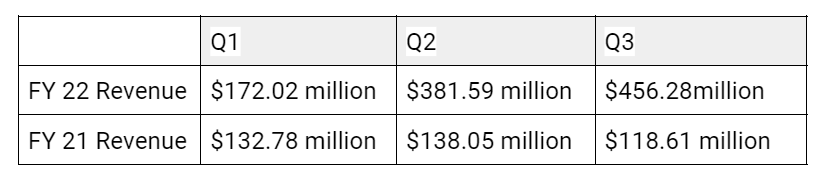

Thanks to these high rates, STNG has had a record year in terms of financial performance. Its revenues are the highest they have been on record and the company has capitalized on this to clean up the balance sheet, a move we believe has helped accelerate the bullish run in its stock.

Revenues have increased substantially vs 2021 (Seeking Alpha)

Understanding the bull case

While the obvious catalyst for STNG’s bullish run has been the surge in product tanker rates through the year, I believe investors have been more impressed by its capital allocation strategy.

The company has capitalized on the record cash generation to aggressively cut back on debt and is on track to reduce its obligations to creditors by as much as $1 billion in 2022. “In the first nine months of the year, we’ve repaid $685 million in debt. In the fourth quarter, we expect to pay $296.3 million in debt,” said James Doyle, Head of Corporate Development and Investor Relations, on the Q3 earnings call.

STNG had a stretched balance sheet at the end of 2021 with $3.1 billion in total debt and $2.8 billion in net debt. In contrast, its last reported net debt stood at $1.97 billion, bringing its debt levels to a range last seen in 2016.

Debt reduction in a high interest rate environment is something that investors typically reward with higher bids, provided the money to pay creditors is not coming from dilutive financing or divestments of strategic assets.

With leverage coming down, STNG is in a strong position to build healthy levels of free cash flows. The company further benefits from the fact that it has one of the youngest fleets in the industry with an average age of 6.2 years. This translates to lower maintenance costs. The company also doesn’t have any significant capex coming up.

Do not get greedy

The price target for STNG has seen seven upward revisions by several analysts since September, with the latest revision being an increase from $60 PT to a street-high PT of $65 by Jefferies. This implies an upside of around 30% from current levels.

Investors who are still bullish on STNG assume that the current high product tanker rates will remain for the foreseeable future. There are several reasons to hold this view. The first is that demand for refined petroleum products is increasing faster than supply amid declining inventories and a decline in refinery capacity globally. The second is the sanctions against Russian oil, which has disrupted global shipping routes and led to longer distances for shipping oil (hence higher rates). The third is the fact that the supply of product tankers is constrained. The product tanker fleet is estimated to grow by 1.6% in 2022 and by 1.0% in 2023, according to BIMCO.

However, I believe the risk of a recession and the ongoing interest rate hikes will lead to a decline in TCE rates. The sharp decline of crude oil prices in recent weeks is an indication of what could follow for the prices of other services, including shipping.

It’s not prudent to underestimate the lengths to which central banks will go to declare ‘victory’ over inflation – because the opposite will look like a policy failure, which is something they want to avoid.

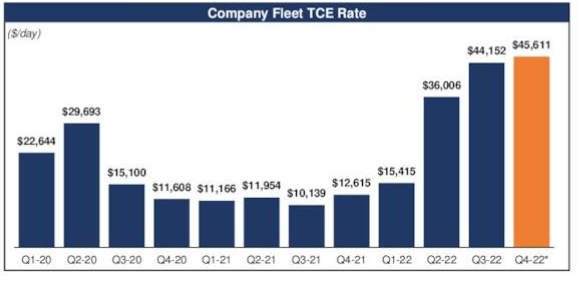

The high TCE rates that have propelled STNG to its present level are disconnected from historical trends as the chart below shows. The odds are higher that they will crash in a scenario where a global recession leads to declining demand for refined products or interest rate hikes lead to a slowdown inflation and a decline or stagnation in prices, including the price to ship oil.

STNG’s historical TCE rates (Scorpio Tankers)

Now is not the time to get greedy. The upside opportunity is not compelling enough given the risk of rates declining and STNG’s sensitivity to rates. STNG also has a history of losses and, despite cleaning up its balance sheet, has its own thorny performance issues that would dissuade investors from taking a long position now. Its last reported retained earnings was a deficit of $166 million and it has in the 19 quarters since Q1 FY 2018 reported a positive EPS figure only six times.

Conclusion

STNG has had a good run in 2022 but is not a good investment now. It was a good investment earlier in the year when I covered it and warned about some of the downside risks and an even better investment in 2021 when I covered it and called out the low valuation.

However, it is now trading at a high valuation of 1.27x book value vs a 5 year average of 0.59x and faces an uncertain future earnings outlook given rates are unlikely to increase in the face of a recession and interest rate hikes. The short interest of around 10% is telling. Bulls who hold on to their stock in the hope that there’s still upside left could suffer the sting of regret. Stocks that are sensitive to cyclical trends like STNG are just as good at giving profits as they are at taking them back.

Be the first to comment