kmatija

I first wrote about Schwazze (OTCQX:SHWZ) in April 2022 in an article titled Schwazze: The Best Cannabis Company You Never Heard Of. Despite that effort, and another in May titled Schwazze: Unexpected Opportunity for Astute Cannabis Investors, Schwazze remains relatively unknown. Their market cap is only $61 million and the daily volume is about 40,000 shares. The opportunity is still there and the company continues to execute a strategy that is decidedly different and may indeed show that they are one of the better opportunities in today’s cannabis universe. In this article we will discuss how the Schwazze strategy is different, look at the recent Q2 2022 earnings report to see how they are doing, and make recommendations for investors.

Company website

How is Schwazze Different?

As a corporate entity Schwazze has a relatively long history for the cannabis industry. They were incorporated in 2014 and went public in 2016 as Medicine Man Technologies (NOTE: Medicine Man will continue to be the legal name but the company has done a corporate rebrand as Schwazze.). The business was consulting, support and retail in Colorado. In 2020 Dye Capital arrived and began applying capital and operational expertise, transforming the company from $10.6 million in revenue in 2019 to a current annual run rate of $175 million.

Justin Dye, Schwazze CEO and Chairman of Dye Capital, looked at the nascent cannabis industry and saw a unique opportunity. Prior to 2020 Colorado law did not allow non-Colorado entities to participate in cannabis businesses, and the industry was ripe for the application of new capital and expertise. His plan was to bring those things to a fragmented industry and reap the benefits of consolidation. Schwazze would also be able to maximize the performance of businesses in a state where individual company results varied considerably. Dye is eminently qualified to make this strategy work. Among other successes, he led the effort to remake and rebuild Albertsons, the national grocery chain. He turned a company that had become moribund, underperforming and unfocused into a dynamic enterprise that had a very successful IPO in 2020. He returned the company to profitability and raised sales from $10 billion to $60 billion.

Acquisitions are key to Dye’s strategy. The aim is to buy businesses that have promising products or other attributes and realize their potential through superior management. At the same time, by consolidating small companies the overall business will benefit from the not insignificant advantages of scale. It’s a time tested strategy for success, and Schwazze is well equipped to make it work.

In addition to Colorado, Schwazze operates in New Mexico where adult use was legalized in April. They are not opposed to expanding to other states but are not actively pursuing it. If they do, it will be in one that maintains the benefits of a regional footprint.

Schwazze Second Quarter 2022 performance

A summary of the latest five quarters is in the table below. All numbers in $ millions except EPS and gross margin.

| Schwazze | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Revenue | 30.7 | 31.8 | 26.5 | 31.7 | 44.2 |

| Gross profit | 14.9 | 15.1 | 12.1 | 10.9 | 25.2 |

| Gr. prof. Margin | 48.5% | 47.5% | 45.6% | 34.4% | 57.0% |

| Net income | 4.4 | 1 | 12.8 | -26.8 | 33.8 |

| EPS | .10 | .02 | .12 | -.61 | .65 |

| EBITDA | 7.5 | 6.8 | 4.4 | -2.2 | 12 |

| Op. Cash flow | -0.03 | 3.4 | 52.5 | 5.8 | -13.8 |

On the plus side, there was a healthy increase in revenue, mostly due to acquisitions and new adult use in New Mexico. They also showed positive net income, higher EBITDA, gross profit and gross margin. The usefulness of net income and EPS is limited. They are distorted by the revaluation of the derivative liability related to investor notes in the amount of $29 million in Q2, $13.4 million in Q1, and smaller amounts in other quarters. Cash flow, gross margin, and revenue are better measures for evaluation.

Other metrics changed in a negative direction. Cash flow turned negative, although Dye expects positive cash flow for the year. In Colorado two year comparative store sales were up 22.7%, but one year comps were down -8.1%. In New Mexico two year comps were up 37.3% but one year comps were down -1.9%. Comp numbers are helpful, but it’s too soon to use them to evaluate the company. Two years ago the business was just starting to ramp up and last year comps were affected by COVID.

These results are similar to the Q2 reports of other cannabis companies, particularly the higher revenue, lower cash flow, and reduced projections for the year. Everyone is being affected by weak industry conditions like weak wholesale prices, cost inflation, consumer weakness, supply chain constraints, and more.

Schwazze is taking the latest industry weakness in stride, as are other cannabis companies. Similar to other companies, Schwazze will be dialing back capex for the rest of the year, focusing on projects with the earliest and highest potential return on capital. As with other companies, revenue guidance has been reduced, from a run rate of $220-260 million to $175-200 million. Still, the conference call had repeated references to “continuing to execute the plan,” recognizing that changing and challenging conditions are part of the normal course of business.

No new debt or equity is needed to continue the 2022 acquisition strategy. As Dye said in the conference call,

Our current criteria for potential acquisitions includes revenue growth or growth potential that exceeds the applicable state’s averages EBITDA profitability with synergy opportunities, attractive acquisition prices that are accretive to our shareholders, provides high-quality branded products and attractive retail locations.

Schwazze currently owns 23 of the 600 adult use dispensaries in Colorado, so there’s plenty of runway.

Schwazze share price and recommendations

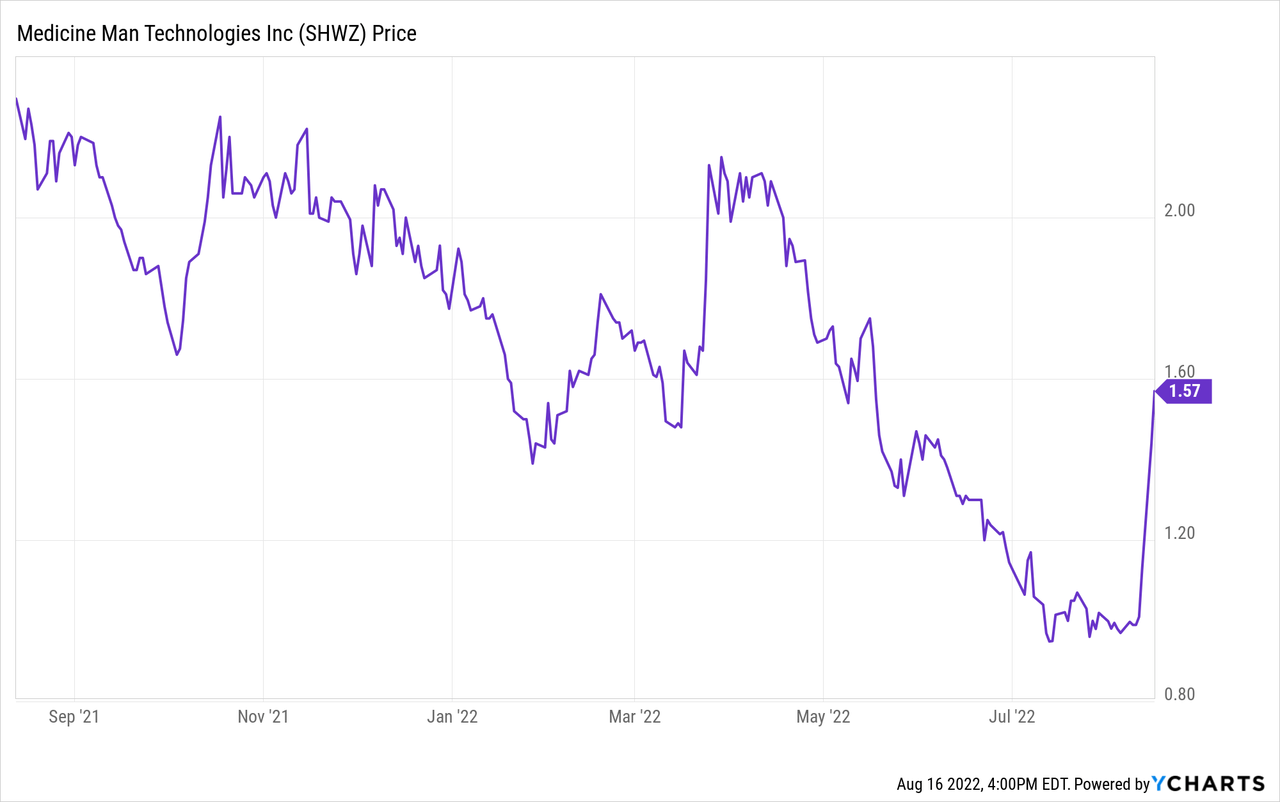

Schwazze stock declined from around $2 to $1 over the past 12 months, roughly in line with the industry. In the three days since the earnings report the price is up 61% to $1.61, on four times the normal volume. It is up 17% since my last report in May.

Dye’s strategy is one that has proven successful many times and in many places. Acquire good businesses that are accretive, and focus on synergies, operational excellence and brand development. Setting aside the present industry conditions there is evidence that this strategy is succeeding. Revenue, EBITDA, and gross margin are up sequentially and YOY. Schwazze outpaced the industry in Colorado by 11% this quarter and six quarters in a row.

There are risks for an investment in Schwazze, as for any emerging growth company. If their performance is below expectations because of inadequate execution of their operational or acquisition strategy, or because of persistent general industry conditions, then the stock will suffer. Although they have skilled management, the viability of their strategy in this specific market is yet to be determined. In addition, they have a large amount of high interest debt, up to rates of 13%, that will have to be refinanced in 2-3 years. Inability to refinance on favorable terms will hurt the company. On the other hand, favorable refinancing will strengthen the company.

Building a successful company with an incremental strategy like this takes time. If Schwazze continues to execute as they have been, the share price will eventually reflect it. On this basis I give Schwazze a BUY recommendation, but only for a risk tolerant investor. It’s difficult to predict a price target, but in 2019 a large number of warrants were issued with an exercise price of $3.50.

An additional factor for consideration is that the Schwazze endgame is most likely acquisition by another company. Dye Capital is in the business of growing companies to sell at a gain, just as Justin Dye did with Albertsons. This is an incentive to work on a higher share price that many other cannabis companies don’t have to the same degree.

Summing up

Schwazze provides an opportunity to invest in cannabis that differs from other companies in a number of ways. It is concentrated on a small number of states rather than spread around the country. It is focused on acquiring and maximizing performance of existing companies rather than creating a business from scratch. It’s leader has a background in applying this strategy successfully on a large scale. It has an (unspoken) goal of building a company for eventual sale at a profit, rather than being in cannabis forever.

This unusual combination of attributes may be attractive to investors who want to “cover more bases” in a new industry where the paths to success have yet to be determined. Schwazze’s strategy is sound and time tested, but the key is how well they can execute. The key is superior management, which I believe they possess. Although the strategy will take years to come to fruition, there is evidence in the latest quarterly report that they have what it takes. Considering the risks in a venture like this, it is only appropriate for risk tolerant, patient individuals. These investors may wish to start a partial position here and add funds in future quarters, and years, as the company progresses.

Be the first to comment