FrankvandenBergh

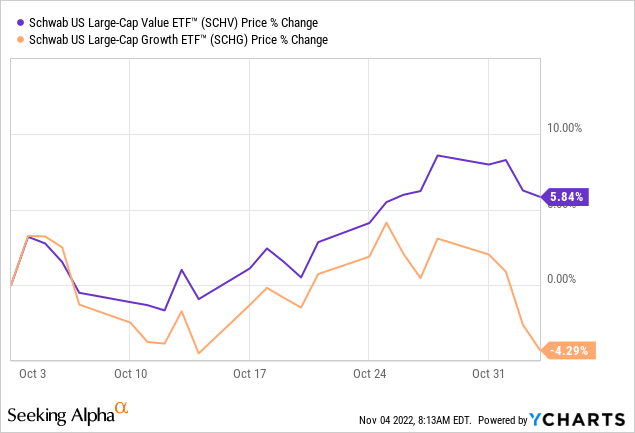

In the current highly volatile market conditions where equities and bonds all seem to be going down at the same time with no place to hide, it becomes important to differentiate what is working from what is not. For this purpose, the performance differential between the Schwab U.S. Large-Cap Value ETF (NYSEARCA:SCHV) and the Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG) provides a hint of what is happening in the market as shown in the chart below.

The growth ETF is down by more than 4.29% compared to the relatively 5.84% upbeat performance for its value peer, which signifies that the relatively inexpensive larger-cap stocks pulled off an unprecedented month of outperformance, but more is needed in order to make a bullish bet on SCHV.

For this purpose, the objective of this thesis is to show that the rotation from growth to value is indeed happening, and to substantiate it, I use a divergence chart. At the same time, I explain the underlying reasons in the context of the changes which are going on in monetary conditions.

The Divergence Chart Skewed Towards Value

First, for those who are looking forward to that elusive bottom in order to make their bets, they may be wrong as there is an underlying rotation from growth to value. In this respect, some will remember that there was a lot of talk about this growth-to-value pivot at the beginning of this year, but subsequently, some of the Nasdaq’s bear market rallies cast doubts about its sustainability. But this is now clearly the case as, in addition to showing the one-month performance, the above price action also shows that the divergence between SCHV and SCHG has been accelerating, from about 2% on October 10 to more than 9% on November 3.

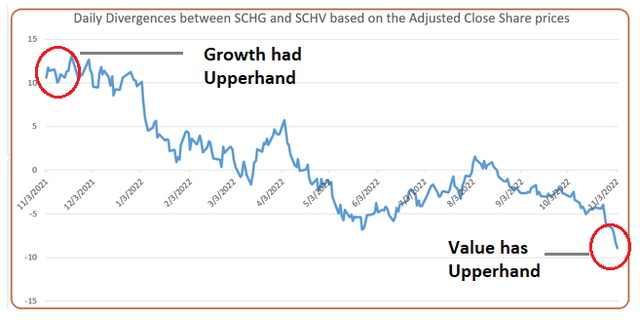

Now, extending this time frame to one year and plotting the daily divergences between the share prices of SCHG and SCHV (or SCHG minus SCHV as extracted from Finance Yahoo), I obtain the chart below. Its merit compared to the classical price performance chart is that it clearly shows how the differential which was in favor of the growth stocks in November 2021 has now resolutely pivoted in favor of value. Going into details, from about $10 at the left of the chart or last year, the difference is now heading to $-10, implying that the value ETF has made up for most of its lost ground against its growth peer.

Trend Chart Built Using Data from Yahoo Finance (finance.yahoo.com)

Additionally, the fluctuating path shows that it has not been a straightforward rotation, but one where growth has tried to resist, as evidenced by the March 2022 comeback where after going to sub-zero, the divergence sprang back to $5. Also, the mid-June slump of tech-heavy Nasdaq which also includes a lot of growth names marked a low in the difference, at $-5. After some further resistance, SCHV’s outperformance of SCHG appears to be gaining steam as seen by the chart’s steep downtrend.

Now, this increased divergence in favor of value can be interpreted as a capitulation of growth stocks, but these can still offer some resistance on basis of speculation that the Fed may pause its pace of interest rate hikes or even pivot to a more dovish instance. However, given Chairman’s Powell hawkish tone on Thursday, the only economic event which may change his mind is a recession. Well, this is also a worst-case scenario that can occur given the rapid pace at which monetary policy is being tightened, but this is a slowdown being engineered by the U.S. Central bank itself.

In the meantime, the divergence is clearly in favor of value, and let me dig into some of the reasons for the demise of growth stocks.

SCHG’s Woes

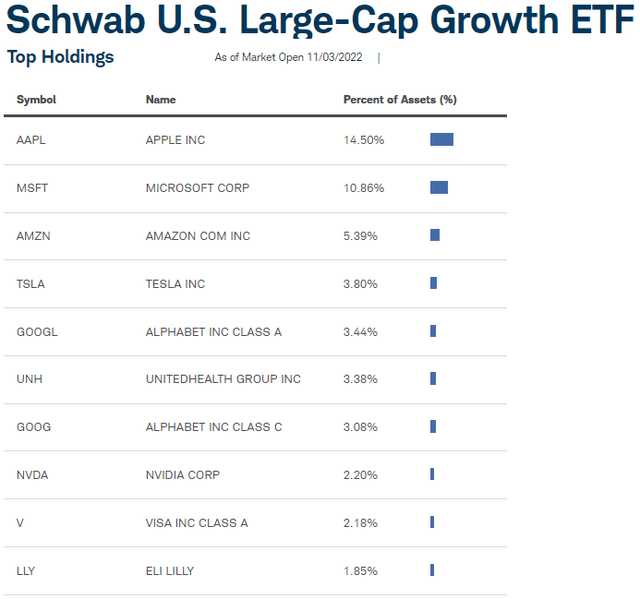

When you go deeper into SCHG’s holdings, you find Big Tech names like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL). These are some of the stocks which exhibit the stock market’s highest capitalization and have global footprints.

SCHG Holdings (www.schwabassetmanagement.com)

As a result, most are all suffering from a strong dollar which makes their products dearer than local competitors in different countries where they operate, with Alphabet not being immune to the cyclicality of the economy and reduction in corporate advertising budgets. Moreover, as multinationals, they are also suffering from supply chain problems mostly resulting from China’s highly restrictive Covid-Zero policy. Now, there was some enthusiasm in Hong Kong’s stock market, mostly due to hopes that China is relaxing lockdown measures, and this could favorably impact the Nasdaq where some Chinese tech is listed.

However, bear in mind that there are deep divergences between the U.S. and China, namely when considering Taiwan. Also, seeing China as a competitor for global dominance in artificial intelligence, the U.S regularly imposes export restrictions for items like semiconductors. Furthermore, America’s policy of onshoring supply chains for key electronics is not aligned with China’s endeavor to have a more sophisticated industrial base.

Hence, in light of the above, tech companies as well as other growth names are likely to continue losing ground, especially in the short-to-medium term, and this explains my bearish position on SCHG.

SCHV Being Rewarded

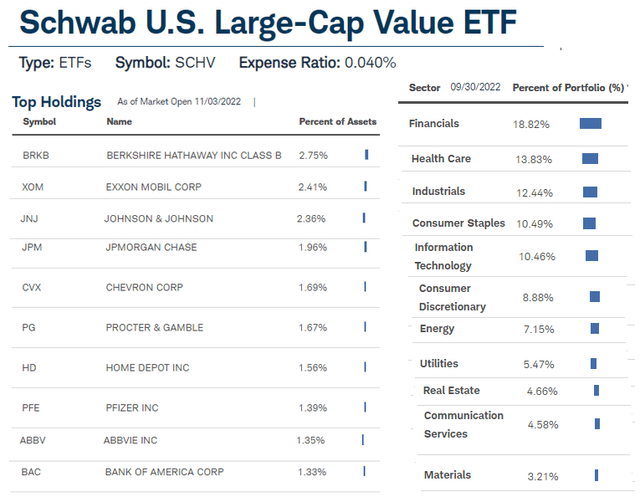

On the other hand, with its plethora of value stocks which form part of the more traditional sectors of the economy like financial, health, and energy as pictured below, SCHV has less exposure to the rest of the world where dollar-led inflation is causing widespread economic disarray.

SCHV Holdings (www.schwabassetmanagement.com)

As listed below, apart from Exxon Mobil (XOM), Chevron (CVX) which came into the limelight for their ability to rapidly stem up production of energy or Pfizer (PFE) which was able to ramp up vaccine availability in order to make possible the reopening of the economy last year, other names have largely been ignored by the market, all at the expense of tech. In this respect, as recently detailed, some are no longer growing earnings at the same pace as in the previous 3-5 years and therefore do not deserve their higher valuations.

This explains why investors are coming back with a vengeance into lower valued stocks, and as per the divergence chart above, this looks likely to continue, but do expect a lot of fluctuations as is normally the case when a new market regime sets in. This is the reason why momentum factors, namely the simple moving averages while being bullish, do not show a smooth uptrend for SCHV. Still, the ETF scores a “B” for asset flows, while it is a “C+” for SCHG, implying that more money is pouring into value and thus SCHV could climb back to its August high of $68.5. The ETF pays a 2.6% trailing dividend yield too.

Conclusion

This thesis has made the case for the rotation from growth to value to have reached a critical point and appears to be gaining further momentum. This justifies a bullish case for SCHV and a bearish one for its growth peer, but it is important to be aware that a recession will most likely impact all stocks across the board.

Along the same lines, SCHG’s holdings are some of the most innovative companies in the world and they should be on your watchlist for the longer term. Another observation is that the rotation does not seem to be impacting lower-cap stocks for the time being. Consequently, it is better to be selective and invest in moderation.

Finally, this thesis also provides an opportunity to bring some clarification as to the price action of the broader market with respect to growth stocks, which includes a lot of the tech names, as I recently elaborated upon in my thesis entitled “Bullish On UPRO And QID Based On S&P 500 Vs. Nasdaq Divergence”. In this case, with about 26% of the S&P 500 index composed of IT stocks, it has also been impacted by the Nasdaq’s woes, but this should not be interpreted as the broader market going down and that nothing is working as I mentioned at the very start. This is where an analysis of divergence makes things clearer.

Be the first to comment