MarsBars

Contrarian investing may not be a popular strategy, but it’s one that which can lead to market-beating returns, especially if you pick quality companies trading at below average valuations. With so many stocks being on sale, it can be hard to pick the right one, and size your positions appropriately, given that they all trade at different price points.

That’s why it’s sometimes easier to just go with an ETF that does all of the allocation work for you. It’s also a good strategy for those who don’t want to commit too much capital all at once, since you can get broad diversification for under $100 with an ETF.

This brings me to the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), which is now again back close to its 52-week low. This article highlights why SCHD is a great buy at present for strong and growing income, so let’s get started.

Why SCHD?

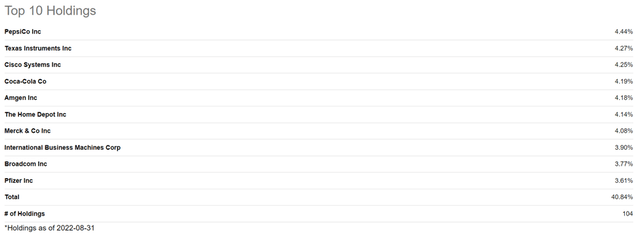

SCHD is an index ETF that tracks the performance of U.S. large-cap value stocks. It has a broader scope than the S&P 500 (SPY), as it covers the gamut of the Russel 1,000. The lower valuations of the stocks in this ETF equate to higher dividend yield. This is not to say, however, that SCHD doesn’t have high dividend growers in its portfolio. As shown below, SCHD hails Texas Instruments (TXN), Amgen (AMGN), Broadcom (AVGO), all of which have 5-year dividend CAGRs in the double digits.

SCHD Top 10 Holdings (Seeking Alpha)

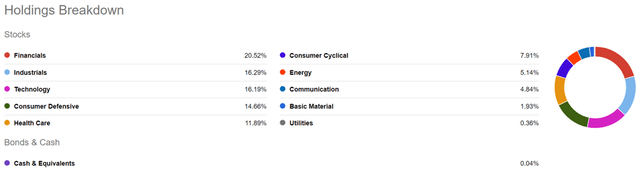

I also like the fact that SCHD is fairly well balanced, with no outsized exposure to any one sector. Its top sector is financials, representing a 20.5% weighting on the portfolio, followed by industrials, technology, consumer staples, and healthcare, which range from 12% to 16% weightings on this ETF.

SCHD Sector Mix (Seeking Alpha)

Dividends don’t lie, and are great for compounded returns. This is reflected by the fact that SCHD’s 3.4% dividend yield is more than double the 1.6% yield of the S&P 500 at present. Moreover, SCHD has seen a much faster 5-year dividend growth rate of 13.3%, sitting well above the 5.3% 5-year CAGR of the S&P 500. This has resulted in market-beating returns over the S&P 500 over the past 5 and 10 years. As shown below, SCHD has given its investors a 77% total return over the past 5 years, surpassing the 69% return of the S&P 500.

SCHD 5-year Total Return (Seeking Alpha)

Risks to SCHD include the potential for a recession, which may impact financial stocks harder than other sectors of the economy. Given the fact that financials represent SCHD’s biggest sector, a hit to this segment may result in slower dividend growth and even share price decline.

However, as famed investor Peter Lynch once said: “More money has been lost preparing for recessions than during recessions themselves.” As shown below, SCHD has seen peaks and valleys over the past year, and it’s once again trading at its valley on market concerns that rising rates could force the economy into a recession.

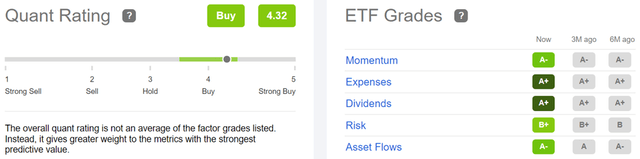

Meanwhile, I find SCHD to be rather investor friendly, as it sports an A+ grade for expenses, with just a 0.06% expense ratio, sitting well below the 0.44% median across all ETFs. Notably, Morningstar ranks SCHD’s risk profile as being below average combined with high returns, giving it an overall 5-star rating. As shown below, SCHD also scores a Buy rating from the Quant system, with A and B grades for momentum, expenses, dividends, risk, and asset flows.

SCHD Quant Rating (Seeking Alpha)

Investor Takeaway

SCHD is a great ETF for those who want to buy quality U.S. large-cap stocks at a discount. Moreover, SCHD sports a strong dividend yield and has strong dividend growth potential going forward, given its high 5-year dividend CAGR. With the market again selling off on concerns of a recession and SCHD’s low price, I believe that this ETF is a great buy for long-term income and total return potential.

Be the first to comment