13threephotography/iStock Editorial via Getty Images

My advice to investors amid this deep and stinging tech correction has been constant: don’t reduce your exposure to tech stocks, but rotate more into value-oriented names that have less to lose in a valuation crunch. To that end, I’ve touted SAP (SAP), the German software conglomerate, as a top play over the past year, thanks to its ability to combine a cloud growth story among a beefy earnings profile and justifiable valuation.

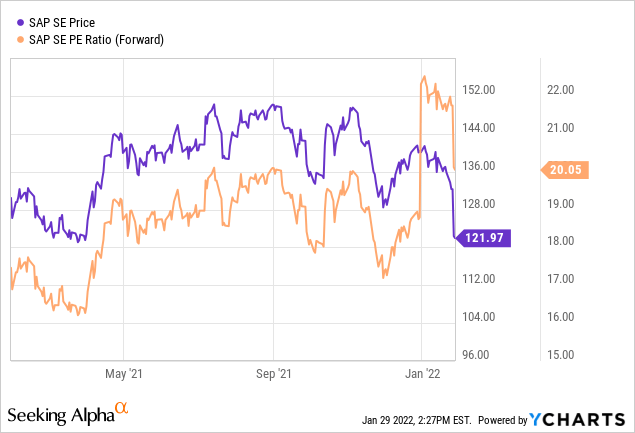

In the recent correction, many high-growth tech stocks have lost 35% or more of their value relative to peaks. SAP, meanwhile, has fallen only slightly shy of 20%, in recognition of the fact that this is an earnings-driven stock whose valuation isn’t just paper-based and arbitrary. In my view, after a recent strong Q4 earnings print, it’s a good time for investors to increase their exposure again to SAP.

SAP, in my view, boasts a number of key merits alongside the fact that it trades at a relatively reasonable (for tech) 20x forward P/E, as shown in the chart above.

As a reminder for investors who are newer to this name, here is a rundown of what I consider to be the key bullish drivers for SAP:

- Category leadership in many areas of enterprise software. Though the average consumer likely won’t interact with SAP, its dominance in enterprise software is unmistakable. It is the dominant player in ERP systems – which help companies manage their data and run their operations. Via a surprisingly sharp-eyed M&A strategy, SAP has also inherited other major category leaders, including Ariba, Concur, SuccessFactors, Qualtrics, and other notable brands. SAP, in fact, may have one of the most successful track records for M&A among enterprise software stocks, without any noticeable flame-outs and write-downs.

- Ambitious transition to the cloud. Part of the reason SAP’s near-term results look off is because of its shift toward cloud revenues. The company has heavily been pushing its customers away from license deals and into its SaaS products, which will stunt near-term revenue growth. Over the long term, however, cloud customers will deliver greater lifetime value. A similar shift was undertaken by other legacy software companies including Adobe (NASDAQ:ADBE), Autodesk (NASDAQ:ADSK), and Splunk (NASDAQ:SPLK) – each of which were rewarded handsomely for shifting into Wall Street’s favored business model.

- Very, very sticky product. SAP’s core ERP and database products lie at the root of a company’s operations, and once installed they’re very difficult to rip out. The combination of having a very sticky product plus a reliable stream of recurring cloud revenue (on a very high-margin revenue base) is a very powerful advantage to enjoy.

- Clear categories in which SAP has the potential to rebound post-pandemic. Overall growth right now is being held down by large SAP products such as Concur, which is impacted due to low business travel. The post-pandemic era will be a much kinder one for SAP, which has more direct exposure to pandemic impacts.

- Aggressive long-term targets. By 2025, SAP intends to triple its cloud business.

Let’s now dig into the last piece there in further detail.

The “Ambition 2025” Plan

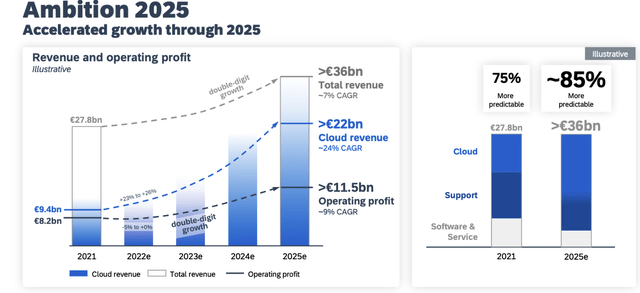

Alongside releasing its fourth-quarter results and initiating guidance for FY22, SAP also reiterated and laid out its aggressive long-term targets for 2025 again. The slides below capture the key milestones that SAP is aiming for:

SAP 2025 ambition growth targets SAP Q4 earnings deck

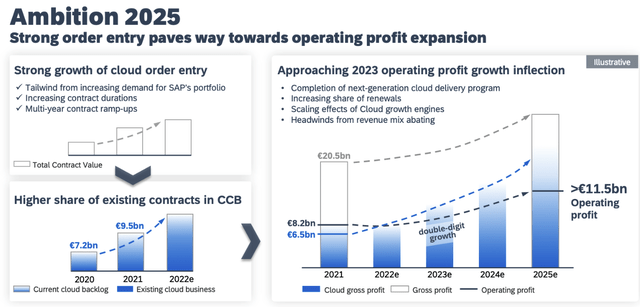

SAP 2025 ambition profit targets SAP Q4 earnings deck

The key lynchpin of SAP’s ambitions is to roughly triple its cloud business to €22 billion in revenue by 2025. In recent quarters, cloud growth has been trending to the mid-20s (and accelerated in Q4, which we’ll cover in the next section). SAP expects cloud revenue growth to continue accelerating through 2023, before potentially moderating to double-digit growth (likely teens) in 2023 and 2024. From a total revenue standpoint, SAP expects to be ~36% larger at a €36 billion annual revenue scale by 2025.

Of course, not all of this growth is purely organic. Part of it is going to come from acquisitions (SAP likes to acquire a lot of smaller bolt-on software products; its most recent acquisition is a financial software company called Taulia that helps with working capital management), and part of it is going to come as well from existing customers being nudged to shift to cloud deployment. Over time, though, we expect the widening breadth of SAP’s portfolio to drive incremental cross-sell. In addition, the higher revenue visibility and recurring nature of cloud subscriptions make SAP more steadily profitable. And to that regard, the company is also expecting to hit €11.5 billion in operating profit by 2025, roughly 40% more earnings power than it achieved in 2021.

Q4 download

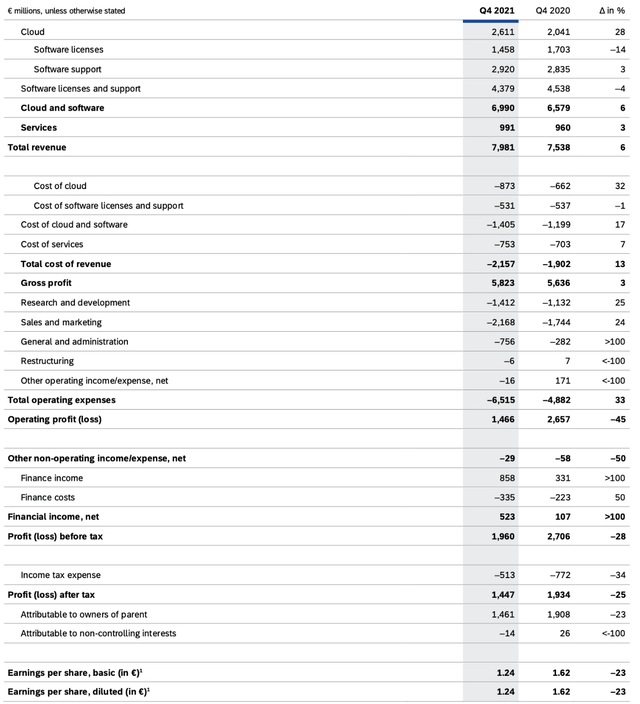

So far, we can only see SAP making measurable progress toward these heady goals. Q4 results came in strong – take a look at the earnings summary below:

SAP Q4 results SAP Q4 earnings deck

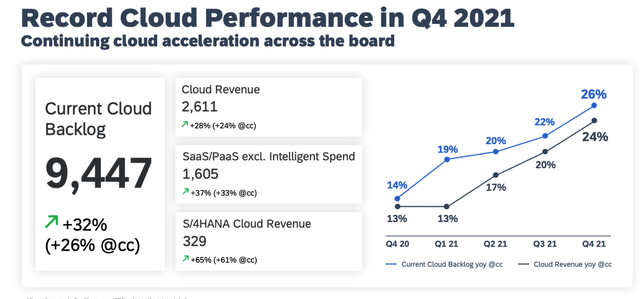

SAP’s revenue in the quarter grew 6% y/y on a total basis to €7.98 billion, accelerating slightly over Q3’s 5% y/y growth pace. Driving this top-line performance was continued acceleration in the cloud business. Cloud revenue grew 24% y/y on a constant-currency basis, accelerating for the fourth sequential quarter in a row and contributing to 33% of overall revenue (note that SAP’s “Ambition 2025” plan calls for cloud to rise to two-thirds of overall revenue). Meanwhile, cloud backlog also grew to €9.45 billion, growing 26% y/y on a constant currency basis and accelerating versus 22% y/y growth in Q1.

SAP cloud metrics SAP Q4 earnings deck

We can clearly see that more and more companies are choosing SAP to help them transform their business, build resilient supply chains and become sustainable enterprises as they move to the cloud. This is reflected in the strong adoption of RISE with SAP, in particular, by large companies across all geographies. We clearly exceeded our goal of at least 1,000 customers by the end of the year. But what is way more important in Q4, we saw the number of larger cloud transactions significantly increasing. Orders greater than €5 million contributed around 50% of our cloud order entry, up from just 31% last year. That was also driven by RISE with SAP. […]

Driven by the strength of our entire portfolio, our SaaS/PaaS cloud revenue outside intelligence spend surged to 33% growth in Q4. This is a rate hardly matched at that scale by any other cloud vendor. SaaS/PaaS intelligence spend cloud revenue also accelerated its growth to 12%. And within this business model, Concur returned to low double-digit growth. From a regional perspective, cloud performance was excellent throughout the year. We had a healthy balance and strong cloud momentum across all geographies accelerating during the year.”

Note as well that among many software companies that deploy an M&A growth strategy, SAP stands out as making especially effective acquisitions. Qualtrics, for example, saw 56% y/y growth in constant currency terms in the quarter, which is a faster pace of growth (at a larger scale) than when it was a standalone company. Concur, another SAP acquisition, also returned to “low double digit growth” after seeing its performance dampened by the coronavirus since the pandemic began and businesses ratcheted back travel and entertainment spending.

SAP’s pro forma operating margins contracted slightly by 50bps to 29.6%, driven by investments in R&D and a slight reduction in gross margins as the company invests for scale. Still, operating profits grew 1% y/y and came in ahead of the company’s internal guidance.

Pro forma EPS of €1.86 also grew 10% y/y, beat Wall Street’s expectations with ~11% upside.

Key takeaways

Among the large-cap, multi-product software giants, SAP stands out among my favorites due to the breadth of its portfolio, the tailwinds provided by its aggressive cloud shift, and its earnings profile. Especially in a correcting stock market, companies like SAP provide safe holds in the tech sector that also tout growth stories. Stay long here.

Be the first to comment