Guido Mieth/DigitalVision via Getty Images

Introduction

The talking heads tell me that we have an energy crisis which is driving inflation. There isn’t an energy crisis, it is a crisis of political ineptitude, as it is the lack of vision and failure to strive for energy independence that’s driving energy costs higher. When energy costs more, these costs are passed on and materialize, with the customer paying more for that product or service. There is also the money-spewing printing press that has been on steroids for a long time inflating the money supply to record levels. This issue appears to have been overlooked by many commentators.

Although it has to be noted that Mining Operations are particularly sensitive to energy costs, as they often account for 25% or more of the total operational budget. In order to minimize some of our exposure to the myriad of risks that come with investing directly in a gold mining company, we have chosen to utilize the Royalty/Streaming company business model for this purpose. Royalty companies are not immune to risk altogether, and their stock price can and will fluctuate wildly on a frequent basis. However, it does allow us to vary the mix of our portfolio in the precious metals market

We have invested in a number of these companies over the years, one of which is Sandstorm Gold Ltd. (NYSE:NYSE:SAND), which we will take a quick look at today.

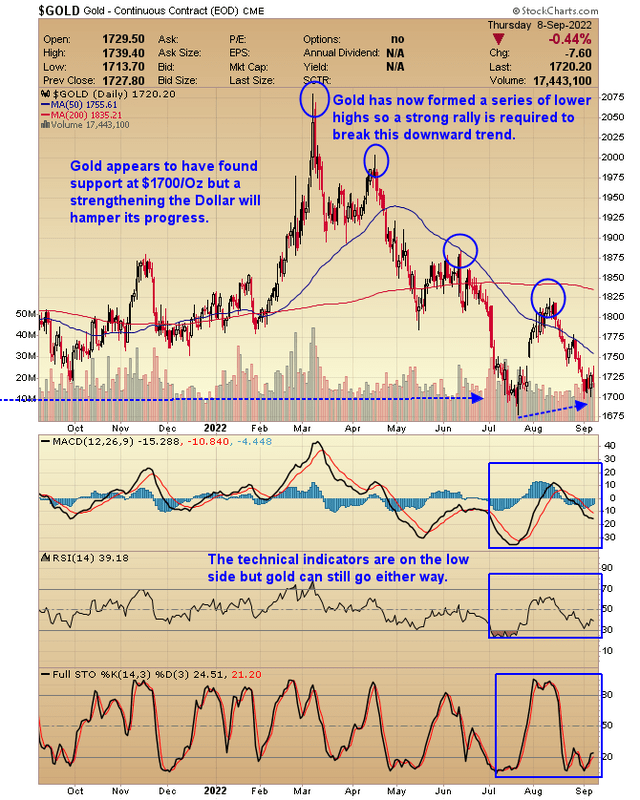

We will start with a chart of the underlying commodity: gold.

The 12 Month Gold Chart

12 Month Gold Chart (Stockcharts)

Gold appears to have found support at $1700/Oz, but a strengthening of the dollar will hamper its progress. Gold has now formed a series of lower highs, so a strong rally is required to break this downward trend.

Sandstorm Gold Ltd: brief description

Sandstorm has managed to acquire 250 royalties since 2008 from a cold start when they had no royalties. The speed of their deal making progress is something to be admired, and I believe positions them well for future growth and profits.

At the moment, they have 39 assets in production with more in the pipeline which bodes well for future growth.

Financials

Sandstorm Gold Ltd has a market capitalization of $1.71Bln, a 52-week trading range of $5.31 – $9.18 which reflects the volatile nature of this sector, a P/E ratio of 19.09, with an EPS standing at 0.32. The average volume 1,528,050 shares traded provides adequate liquidity for those traders wishing to move in and out of this stock quickly.

It should also be noted that despite the volatility in this sector of the market, the share price for SAND is little changed. It started the year at around $6.00 and is currently trading at roughly the same price today as the chart below indicates.

Sandstorm Gold Chart (Stock Charts)

By comparison, the Gold Bugs Index (HUI) started the year at 255 and has fallen to 193, registering a loss of around 24%.

As for the future, the Company is forecasting attributable gold equivalent production to be 155,000 ounces in 2025. In the short-term, attributable gold equivalent ounces by year end is estimated to be between 80,000 and 85,000 ounces.

The news flow is good, as there is rarely a long period of time without an announcement regarding new acquisitions etc.

The chart above shows the stock peaking at around $9 in April 2022, so it has been beaten down since then. If this trend continues or not remains to be seen. An awful lot depends on the price of gold, monetary policy, and future transactions on the acquisitions trail. I am long on this stock and I will continue to hold it and I have no intention of selling it. Being a little bit contrarian, I’m happier buying stocks that have been beaten down and have the potential to boom dramatically once the environment for the precious metals sector becomes more positive

Sandstorm is quoted on both the NYSE under the ticker symbol of SAND and on the Toronto Stock Exchange the symbol is SSL.

Conclusion

Sandstorm has been beaten down and is unloved and unwanted, so the current stock price may well be very close to the bottom for this company

Their aggressive approach to deal making ensures that the company is growing quickly. How beneficial these deals are will not really be known for some time, so care needs to be taken if you intend to make a purchase

The price of gold is holding up well and given the present inflationary scenario, and I think it could go a lot higher from here, which will be a benefit to the whole sector, mining companies and royalty companies alike.

There are a number of royalty companies now operating in this space, so it is worth spending some time looking at what the other companies have to offer before deciding which companies meet with your particular objectives.

I am of the opinion that this stock will perform well compared to its peers. Therefore, I will continue to hold onto it

Got a comment? Then, please fire it in whether you agree with us or not, and I will do my best to address each and every one of them. The more diverse comments we get, the more balance we will have in this debate and hopefully, our trading decisions will be better informed and more profitable.

Be the first to comment