B4LLS

Overview

This post serves as an update to my coverage in November.

It is still my firm belief that Samsara (NYSE:IOT) is facilitating digital transformation across a wide range of sectors that contribute significantly to the US economy. In my opinion, Samsara can expand its market share in both existing and emerging replacement markets by attracting and serving new customers. Samsara currently focuses on fleets, having only recently begun efforts to expand into the equipment and site sectors. Samsara is set up for long-term growth, in my opinion, because the company’s strategy is to target a large, under-penetrated TAM with a cutting-edge platform that serves both replacement markets and net new markets.

Performance review

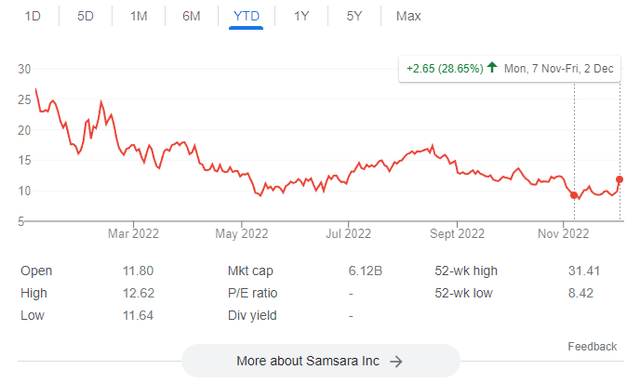

Since my initial post, the share price of IOT has increased by 28.65%. The share price appreciation is nice to see, but I believe there are still further upsides from here.

Thoughts on 3Q23 earnings

Despite the fact that it serves lower-margin end markets and has a higher working capital intensity than other software companies, I believe investors were encouraged by the company’s revenue growth and profitability, particularly FCF, as evidenced by the stock’s 20% post-earnings surge. The company’s $170 million in revenue was 9 percent higher than expected, thanks in large part to sustained growth among enterprises (those with $100,000 or more in annual recurring revenue).

As more customers become aware of the substantial savings provided by IoT products, I anticipate a continued shift in the mix in favor of this current cohort that IOT is addressing. Furthermore, I see a 29 percentage point increase in Adj. FCF as a result of moderate supply chain conditions, which may help accelerate the process of reaching positive FCF. Furthermore, if macroeconomic pressures persist, I believe IOT will be in a good position to grow within its current customer base. More specifically, while the vast majority of large and core customers have adopted at least two products, the vast majority of customers have not deployed IOT products, implying that there is still plenty of room for additional adoption.

In addition, IOT continues to screen well in the world of software, in terms of addressing an existing pain point. Most data in industries with lots of physical assets is still collected manually and kept in separate silos. This is because these sectors are still in the early stages of technology adoption. Samsara’s Connected Cloud Platform facilitates the gathering, linking, and extraction of useful data and insights across a company’s physical operations, thereby boosting operational efficacy. I think the company has a good chance of succeeding in the huge, under-penetrated TAM because of the wide gap between it and the competition. Samsara’s cloud-native platform provides a consolidated view of all physical assets (fleet, equipment, and sites), plus powerful third-party integrations and analytics, which together boost operational effectiveness.

Earnings review

The company’s revenue and profit for the third quarter of FY23 were both upbeat. Sales reached $170 million, which is 9% more than was predicted. The 10% improvement in non-GAAP operating margins from the -20% predicted by the market was also driven by the strong performance of the top line. Additionally, both FCF and Non-GAAP EPS results exceeded expectations.

Results were driven mainly by:

- Total ARR is $724 million, up 47% year on year, while Enterprise ARR is $340 million, up 57% year on year.

- Growth in the number of customers spending over $100,000 in ARR to 1,113 demonstrates progress in upmarket and up-sell efforts.

- Net Retention Rates, which remained higher than the company’s goals of 115% and 125% for its core and enterprise businesses.

Guidance

The company’s guidance for full-year FY23 revenue growth was raised by management from 42% to 43% to 48% to 49%, and operating margin was expected to improve from -18% to -14%. To me, the guidance for FY23 shows that the company will keep up its strong top-line growth momentum thanks to enterprise traction, customer acquisitions, and the increasing adoption of multi-products by customers.

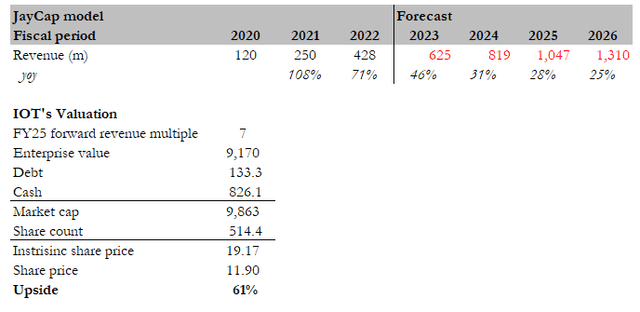

Model update

My model has been updated to more accurately represent revenue for FY22 in light of the new guidance and the impact on future revenue figures. My belief remains that IOT is competing in a very underpenetrated industry, which will allow it to grow for many years. I continue to believe that IOT is undervalued, and I believe that investors can profit from this mispricing.

In light of my new assumptions, I believe that the IOT upside remains appealing, with a potential upside of 60% from the current share price over the next few years.

Conclusion

I continue to believe that IOT is currently undervalued and that patient investors could profit from purchasing the stock in the long run. I am encouraged by IOT improved guidance, which shows growth momentum and better-than-expected profitability.

Be the first to comment