piranka

Investment Thesis

Sabre Corporation (NASDAQ:SABR) is a software and technology company that provides its services, particularly to the global travel industry. Recently, the company signed a multi-year distribution agreement with Avianca. I think this agreement and scalable capacity of the airline retailing technology could be a primary growth factor for the company. I assign a buy rating for this growth investment opportunity.

Company Overview

Sabre Holdings Corporation, a Texas-based company, offers global software and technology services for the travel industry through its subsidiary Sabre Holdings Corporation. The company provides its services through two segments: Travel Solutions and Hospitality Solutions. The company earns 91% of its revenue from Travel Solutions, and Hospitality Solution contributes 9% of the total net sales. SABR’s business was severely affected by the covid-19 outbreak as all governments ceased domestic and international traveling during the pandemic to stop the spread of the virus. The reduced revenue adversely affected the company’s liquidity, forcing management to suspend the dividend payment and share repurchases.

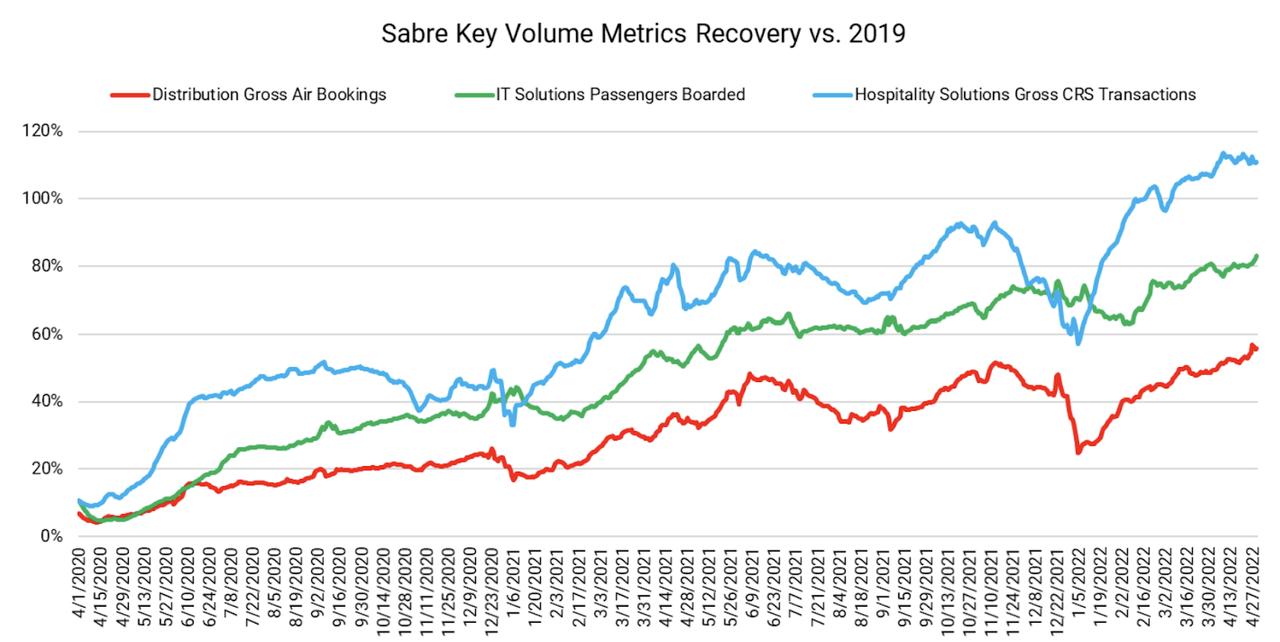

In FY2022, SABR is experiencing the highest recovery level in volume compared to the 2019 fall due to the covid-19. Hospitality solutions gross CRS transactions have surpassed 2019 and grown by 112%. IT solutions passengers have recovered 82%, and distribution gross air bookings have recovered 58%. With the accelerated recovery, I believe the company might start capital distributions to its investor soon.

Investor Presentation

The company is currently focusing on expanding its business with agreements with the airline and other traveling-related companies. It has announced a multi-year distribution agreement with Avianca, which can help it grow its agency sales.

Distribution Agreement with Avianca

Recently, Avianca has chosen Sabre’s global distribution system (GDS) to distribute flights & related services. Avianca is also planning to distribute its New Distribution Capability (NDC) content from the Sabre marketplace. A business focus for Sabre is moving beyond NDC to achieve its goal of becoming the leading global travel technology platform. Today, more than 3,000 agencies use the Sabre marketplace to browse, reserve, and service NDC content. More than 25 airlines have agreements with Sabre to use its GDS to distribute their NDC content. Avianca wants to implement NDC to deliver better content and solutions to travelers, and it believes that SABR will provide robust and scalable solutions that optimize the company’s global distribution strategy. I believe this multi-year deal might be a stable income source for the SABR in the coming period as it is a multi-year deal. I think airline retail technology development is scalable and could be the biggest growth factor for the company because all the airline companies might prefer SABR as its distributing partner as the company provides efficient strategies to expand the revenue and margins of the airline.

Key Risk Factor

High Debt: SABR has a huge long term debt liability that could negatively affect the company’s performance in the coming years. As of March 31, 2022, the company had long term debt of $4.7 billion. High debt obligation results in increased interest payment burden. With the recent rate hikes, the interest payment burden has increased resulting in decreased profit margins. Going ahead I believe company will have to address this issue to ensure smooth functioning and increased profit margins.

Valuation

SABR has a market cap of $2 billion and is currently trading at a share price of $6.26, a YTD decline of 31%. The share price has taken into account the negative factors and I believe we can witness a significant upside from current price levels. I believe the company on track to beat the market estimates for Q2 2022. The company is trading at a price/sales ratio of 1.04x compared to the sector median of 3.06x. It also has an A- grade for price/sales ratio and the leading price/sales ratio is expected to be 0.79x. I am estimating an 85% revenue and volume recovery as compared to the FY19 revenue numbers. That’s the reason I believe the company will trade at a higher price/sales multiple of 1.35x as revenue and volume have shown a remarkable recovery at the start of FY22, giving us a target price of $8.2, a 30% upside from the current price levels. The company is a good investment opportunity before the quarterly results at current price levels.

Conclusion

The multi-year deal with Avianca to provide GDS services is expected to drive significant growth for the company in the long term. The company faces the risk of high debt burden but the current valuation provides the company a favorable risk-reward profile. The share price has accounted for the negative factors and we can witness a significant upside from current price levels. The company is experiencing the highest recovery volumes since the Covid-19 pandemic. I believe the company will perform exceedingly well in the coming quarters. I assign a buy rating after taking into consideration all these factors.

Be the first to comment