mcech

When we last wrote about Sabra Health Care REIT, Inc. (NASDAQ:SBRA), we did not have high hopes for strong returns from this REIT. While the yield was high, we were concerned about the tenant issues that constantly required write-offs and asset sales. Specifically, we said,

So far doubling down on more projects has only helped revenues, without improving or even stabilizing FFO per share. The REIT has a large amount of managed properties where it will be feeling the full brunt of low occupancies. For 2022, Sabra will have to contend with another fresh round of labor pressures and likely a few more rent cuts.

Source: FFO Likely To Drop 10% In 2022

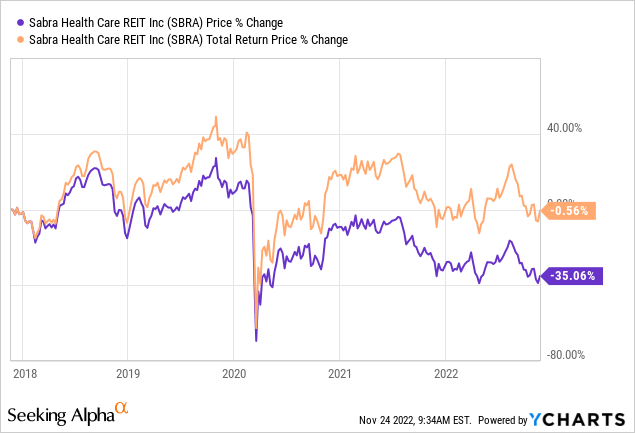

The stock has not given a real edge to bulls or bears, and the double digit drop stock price has been partially offset by the large dividend.

Seeking Alpha

While the bears may have been kept at bay, the recently announced Q3-2022 results actually bore out a lot of our earlier warnings. Let’s have a look.

Q3-2022

SBRA took a decent sized GAAP loss in the quarter. As is usually the case, investors ignore the GAAP numbers for REITs. While that logic is sound in general, there are a few GAAP numbers that investors should pay attention to and this is one of them. In this case we are referring to the $60.8 million of impairment charges in the quarter. In the case of real estate under US GAAP, properties are marked on books at far below fair value thanks to depreciation. When a REIT takes an impairment charge on depreciated property, it usually signals a very a big drop relative to where investors would have valued that property. That impairment was coupled with yet another portfolio repositioning.

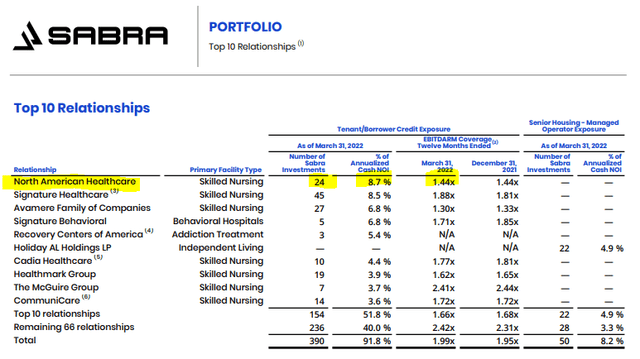

As detailed in a separate press release, Sabra announced that it will transition the 24-property portfolio previously leased to North American to two of Sabra’s existing tenants, Ensign and Avamere, for a combined initial annual rent of $34.5 million. As a result, Ensign will become one of Sabra’s largest relationships, representing approximately 8% of Annualized Cash NOI, while Avamere will remain one of Sabra’s largest relationships, also accounting for roughly 8% of Annualized Cash NOI. Sabra believes this transaction represents a unique opportunity to improve the long-term value of this high-quality real estate portfolio, noting the enhanced credit profile that supports its rental income, highlighted by Ensign’s corporate guaranty and $5 billion of equity market capitalization.

Source: SBRA Q3-2022 Press Release

In yet another example of how completely useless EBITDARM (Earnings before interest, taxes, depreciation, amortization & management fees) metric is, the tenant was at a “comfortable” 1.44X two quarters back. It was also SBRA’s largest tenant.

SBRA Q1-2022 Supplemental

This transition was done due to an apparent management change at North America. Nonetheless, there was yet another hit to the SBRA cash flow. This was raised during the conference call.

Juan Sanabria

Rick, hoping, you could talk a little bit more about the transition and why the need to reduce the rent if the coverage on the assets that was in place was seemingly pretty healthy from the outside looking and maybe the T3 coverage was a lot worse than that necessitated a rent — a lower rent for the new operators. So just hoping you could talk through why there’s some dilution coming in with the transition.

Rick Matros

Well, it’s just really a function of negotiation, I think, from — the cash flow stream was pretty steady. Every once in a while you can transition a portfolio and get an increase in rent. And we’ve done that with smaller portfolios, historically. But most cases, people know that you have to transition. And so, it just becomes a part of the negotiation. And in this case, we didn’t see the 12% reduction as being significant enough to offset the positive aspects of moving to Ensign.

Source: SBRA Q3-2022 Transcript

Alongside these, there are an additional 17 assets that might take up to two more years to stabilize.

Austin Wurschmidt

I appreciate it. Sorry about that. And then separately, I was worried you could provide an update on the 17 in process transitions that you announced last quarter. And if there’s been any change in cash rent contribution versus what those were contributing in 2Q. And when do you expect the $10 million plus of cash NOI on those 17 assets to sort of commence overtime?

Michael Costa

Yes. So I think the quick answer is there’s no changes to what we put into our investor presentation, last quarter, those transitions are still in process. And the timing is unchanged. We expect those to stabilize between now and the end of ’24.

Source: SBRA Q3-2022 Transcript

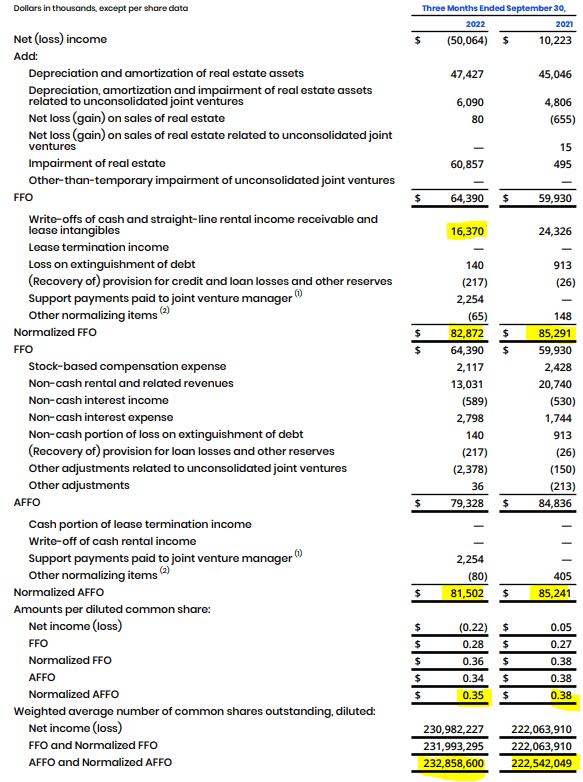

Anyone following this saga should note that this has occurred so frequently that we have lost track of the write-offs and losses. The game remains the same, though the actors change. In the latest case, $16.37 million was written off from tenant receivables.

Funds From Operations (FFO) & Adjusted FFO (AFFO)

The walk through from net income to FFO and AFFO is pretty instructive. We have the $16.37 million add back, which are tenant receivables being written off. Interestingly enough, we saw a similar write-off in Q3-2021 as well ($24.33 million). Normalized AFFO which is where you get after you remove the impact of everything bad, was $81.5 million, about $3.7 million lower than last year.

SBRA Q3-2022 Supplemental

Thanks to about 10 million more shares outstanding, AFFO per share dropped by about 10%. The exact percentage drop will depend upon whether you run AFFO or normalized AFFO, but the point is the same. We continue to see an ice cube melt in progress.

Outlook & Verdict

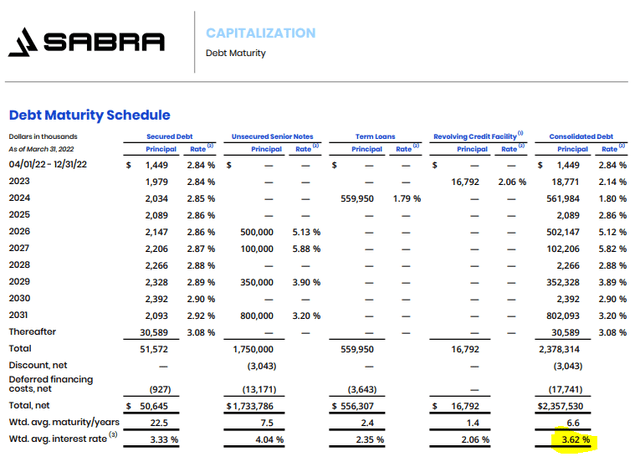

You already saw FFO drop below the dividend amount of 30 cents, but normalized AFFO has held over that mark. With the 12% in rent reductions on those 24 properties, we expect to see more pain on this front. The biggest positive for SBRA on the other hand is the relatively long-term fixed rate nature of their debt. They are paying just 3.6% on their overall liabilities and the weighted maturity of 6.6 is very helpful.

SBRA Q3-2022 Supplemental

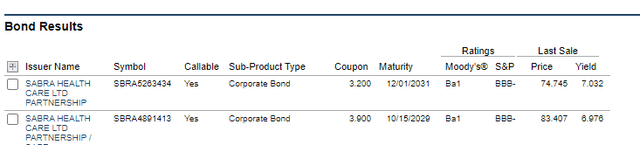

As a comparison, their 2029 unsecured bonds are actually yielding about 7%.

FINRA

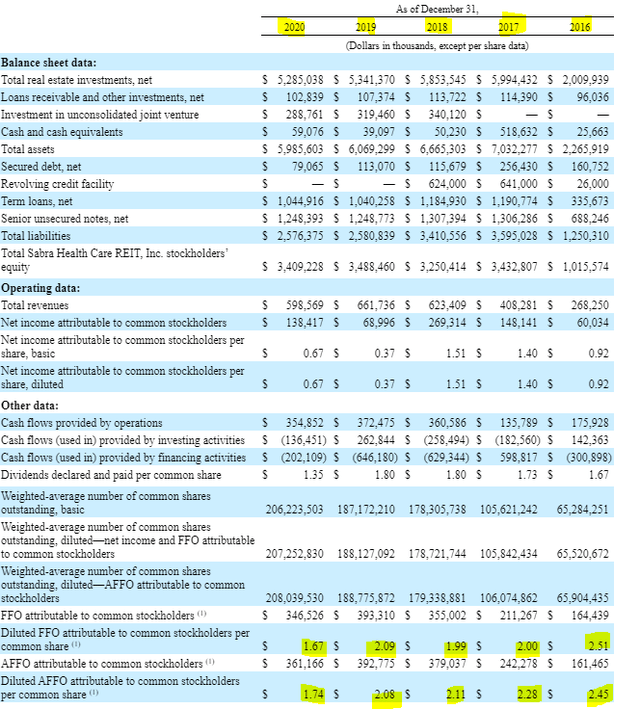

In all honesty, we would not finance this company at even 10% for 8-9 years out as there is a constant deterioration in the earning power (10-K link for pic below).

SBRA 2020 10-K

For 2023, we are likely to come in under $1.40 in FFO, and that is assuming everything goes right. The dividend is likely safe for the next 12 months but we would not get too comfortable beyond that.

The rating agencies have not raised an alarm bell as SBRA’s stock issuance has continues briskly and has offset any pressures from tenant troubles. Of course, that window may not always be open and hence our reluctance to even buy the bonds. The common stock remains high risk and there is a reason total returns have been so poor despite the hefty dividend.

We would avoid both stock and the bonds as there are far safer ways to make 7-9% in today’s market.

Be the first to comment