Luis Alvarez/DigitalVision via Getty Images

I had nearly given Osmotica (NASDAQ:RVLP), since renamed as discussed below, up for dead. The following comment to my latest previous Osmotica article spurred me to reconsider:

@Out of Ignorance , thank you for your article on $OSMT. Any changes to your thesis after yesterday’s update, please ? If one goes by the projections they made, this one seems to be close to a Price/Sales of 1.

This little penny stock has some real potential as I discuss below.

Osmotica Pharmaceuticals recently changed its name to RVL Pharmaceuticals.

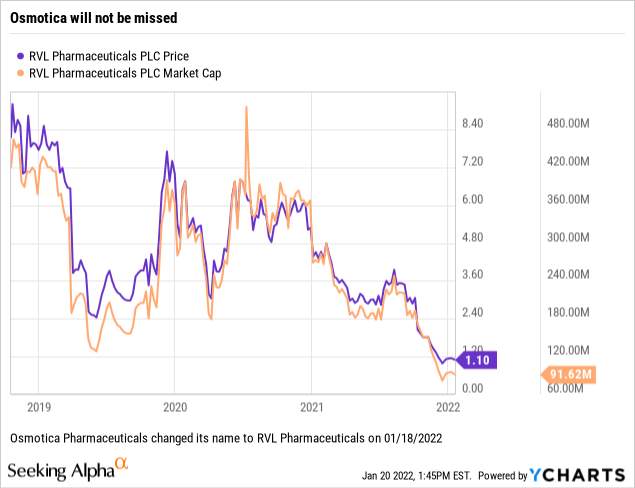

Since its 10/2018 IPO, Osmotica Pharmaceuticals has been a snake destroying shareholder value as shown by the chart below; whoosh ~$.5 billion gone in little more than three years:

In 01/2022, the snake, as all snakes must slithered out of its discredited Osmotica skin and rechristened itself RVL Pharmaceuticals. Sorry about mixing the metaphor, but in “Osmotica: A Different Breed Of Cat”, I was despondent on its prospects in trying to run the show with UPNEEQ (oxymetazoline hydrochloride ophthalmic solution) as its sole product.

Recent developments have moved me off the dime from a bearish “neutral” rating to a more optimistic take.

I will explain.

RVL Pharmaceuticals has a novel business model which vastly simplifies its business.

As I write on 03/29/2022, RVL Pharmaceuticals is getting ready to release its Q4, 2022 earnings tomorrow afternoon. However, they already pretty much spilled the beans on Q4, 2021 with their 01/19/2022 guidance press release (the “Release“). Their business is small enough and simple enough that they likely had a true complete picture on revenues on 01/19.

The business is small having a single product UPNEEQ. It is simple because it sells UPNEEQ on a direct sales basis through its own in-house pharmacy. It describes its pharmacy operations in its Q3, 2021 10-Q, p. 28. These consist of direct sales through its pharmacy subsidiary and licensing revenue from:

…commercial partners that … purchase … UPNEEQ from us … for the purpose of sub-distribution. Licensing revenue is recognized when the performance obligation identified in the arrangement is completed. …

Its initial sales have focused on an optometry-62%/ophthalmology-38% eye care customer. The Release guides for Q4 2021 net eye care sales for UPNEEQ to grow by ~41% to $3.1M compared to Q3 2021. This is nice growth but from such a small base it is not terribly impactful.

Without some dramatic alternative to enhance revenue production, RVL Pharmaceuticals would be of little interest. As it turns out it has two developing avenues which could provide the revenue lift it so sorely needs:

- An 02/2022 launch into medical aesthetics as discussed below, and

- expansion outside the US as initially anticipated with its 07/2020 Santen licensing deal.

The expansion into aesthetics should have immediate impact as discussed below; any impact from the foreign license will be a longer-term impact.

RVL Pharmaceuticals has high expectations for heady UPNEEQ growth as 2022 unfolds.

The Release confirms RVL Pharmaceuticals’ imminent intent to enter a new channel of medical aesthetics, pegged to take place in 02/2022. It also announces high expectations for business to be generated during 2022 from its combined channels as follows, stating that it:

…expects net sales for Q4 2022 to be between $20M and $25M combined between eyecare and medical aesthetics.

As I write on 03/29/2022, RVL Pharmaceuticals has a share price of $1.75 and a modest market cap of $154 million. Should it hit its Q4/2022 guided revenues one can see that it might be headed for explosive growth. There are few guideposts by which to judge where its peak sales might settle.

Management is optimistic about UPNEEQ’s market potential as recounted in RVL Pharmaceuticals’ 01/2022 Investor Day Video; however anecdotal reports are unreliable markers.

The first real data will have to await RVL Pharmaceuticals’ Q1, 2022 earnings call. This has not been scheduled, however, if we can go by Q1, 2021’s release date we should think of mid-May 2022 as a target for Q1, 2022’s earnings release.

Conclusion

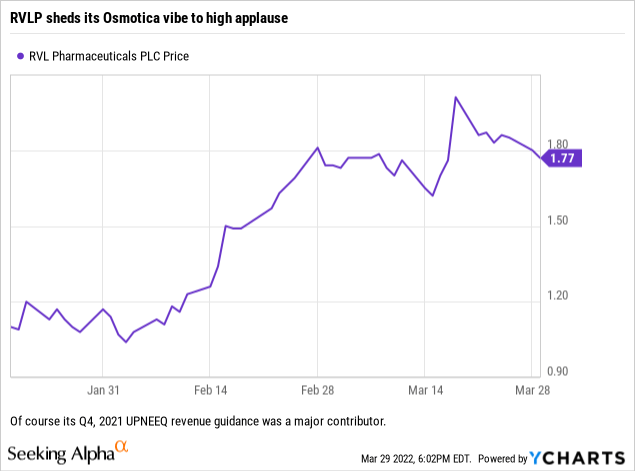

Under its discarded Osmotica moniker, RVL Pharmaceuticals was a wrecking ball for investors’ capital. Its performance since its 01/19/2021 guidance and name change announcement has been considerably better as shown below:

The question for current investors has to be can the run continue? By my estimate, it clearly can. In order to maintain its new upward trend, it will need to convince investors that it is on target with its 2022 guidance. It will also need to show that it is not overspending to do so.

This will be a story that will unfold in four chapters over the next year (likely 05/2022, 08/2022, 11/2022, and 03/2022) as RVL Pharmaceuticals reports its 2022 earnings. It is an interesting story. With its modest market cap and its 01/2022 guidance in hand, it is well worth a go for investors looking to deploy high-risk capital.

Be the first to comment