SrdjanPav/E+ via Getty Images

Rumble (NASDAQ:RUM) recently closed the SPAC deal with CF Acquisition Corp. VI to go public. The video-sharing platform has a lot of promise to open up the online video market, but the company still faces tons of growing pains. My investment thesis remains Bearish on the stock until after company publicly releases quarterly results and shareholders face the limited sales levels.

Q3’22 Results Approaches

Rumble plans to report Q3’22 results after the market close on November 14. Most investors were probably waiting on the company to release Q2’22 results.

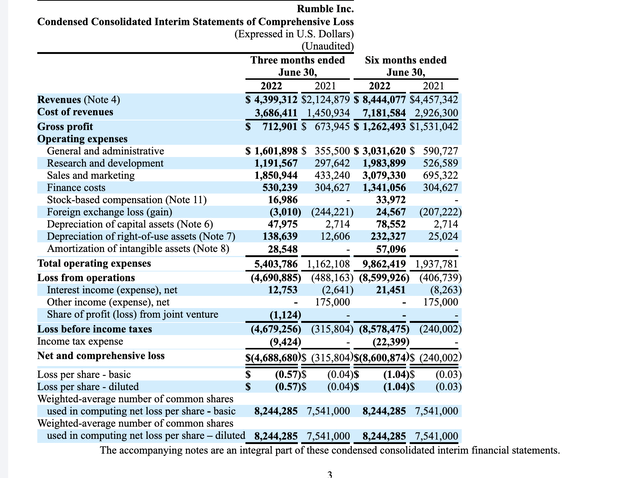

As part of a SEC filing in September, Rumble snuck in the Q2 results. The company reported June quarter revenues of just $4.4 million with a limited gross profit of $0.7 million.

Rumble only has quarterly operating expenses in the $5.0 million range, but the number did jump from only $3.5 million in the prior quarter. The company is accomplishing a lot without burning a ton of cash, though expenses grew far faster than revenues sequentially during Q2.

Investors were arguing whether the stock was worth billions, yet the company doesn’t even generate much of a gross profit and 1H revenues didn’t even top $10 million. The one analyst forecasting revenues estimates expects a bump to $6+ million in quarterly revenues for both Q3 and Q4. Rumble already reported a large jump in MAUs for August with a jump to monthly active users (MAUs) of 78 million.

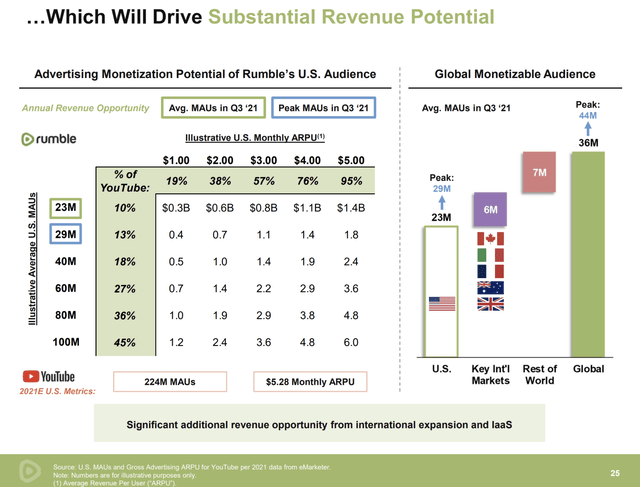

The company only makes a small amount of revenue on each user. In a simple example, Rumble would see revenues jump to $312 million based on just a minimal $1 ARPU each quarter. The big question is how long this takes to occur because most advertisers aren’t exactly looking for a new platform to utilize to reach consumers.

Rumble provided this handy table on the revenue potential. According to their data from YouTube, the video platform owned by Alphabet (GOOG, GOOGL), generates an impressive $5+ ARPU each month. Rumble would produce ~$400 million in quarterly revenues to match those metrics, though the usage level for each MAU is far higher on YouTube now. If Rumble ever matched the YouTube monetization level, annual revenues would reach nearly $5 billion.

Source: Rumble SPAC presentation

Stock Collapse

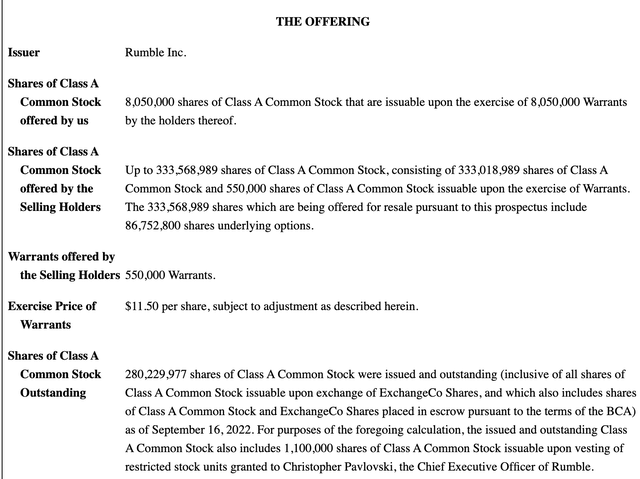

Rumble has already fallen below $8 due to investors waking up to the reality that the video-sharing platform hasn’t provided any detailed discussion on the financials. The company filed to register securities from the SPAC deal sending the stock down 10%.

The stock will now have 280 million diluted shares outstanding plus the warrants, and earn-out shares and a massive 87 million stock options. The fully diluted share count could end up higher based on warrants exercisable at $11.50 per share and earn-out shares not redeemable until at least $15.00.

Based on the share count of 280 million, Rumble has a market cap of $2.2 billion. The video-sharing platform has the ability to grow into this valuation with the 78 million MAUs only valued at just $30 each.

The question is whether investors can actually handle Rumble only generating $5 to $6 million in quarterly revenues. Since the SPAC deal announcement, the company has generally focused on the opportunity ahead with limited details on the current financials. Rumble never issued a press release or held an earnings call to cover the Q1 or Q2 results.

The company has a cash balance of $366 million providing the capital to further ramp up growth. Unfortunately, players like YouTube have access to a parent with over $100 billion in cash, so Rumble definitely isn’t playing on a level playing field.

Takeaway

The key investor takeaway is that the stock has further weakness ahead until the company can start generating some material revenues. Investors face a very bumpy road ahead because the business just isn’t ready for the public markets not very forgiving of growth companies building for the future.

Once the Q3 results are released and the stock falls further towards $5, Rumble will start grabbing more legitimate investment appeal.

Be the first to comment