André Muller/iStock Editorial via Getty Images

Introduction

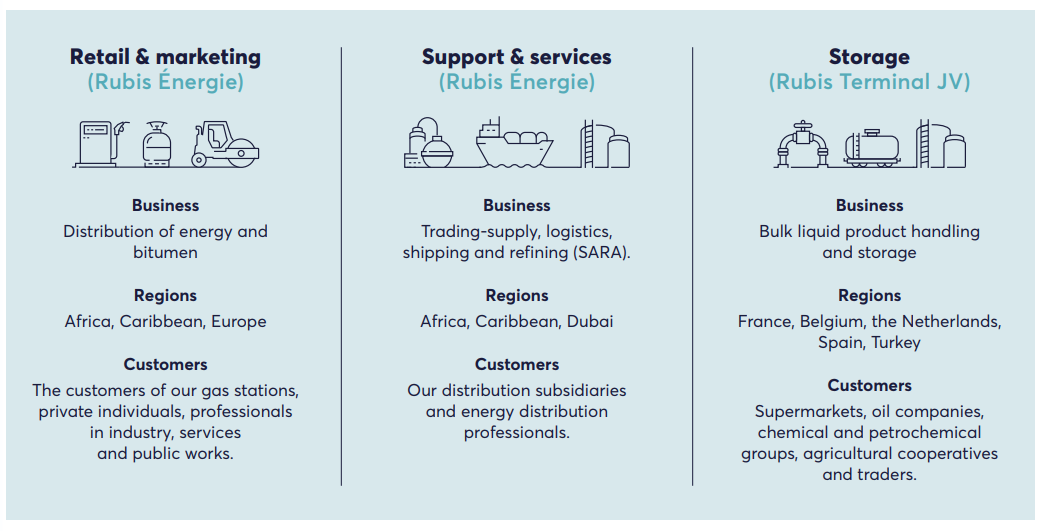

As it has been years since I last had a look at Rubis (OTCPK:RBSFY), I think it’s time to have another good look at this company as its share price has continued to slide now trading about 40% lower than when my previous article was published. As Rubis still is a part of the Nest Egg Portfolio (you can read the most recent issue here), I need to keep tabs on this Paris-listed distributor of energy. Although this is a French company, it generated just 17% of its revenue in Europe in 2020, so it should be seen as a vehicle to gain exposure to the Caribbean and African market.

Rubis Investor Relations

Rubis has its main listing on Euronext Paris where it’s trading with RUI as ticker symbol. The average daily volume in Paris is just over 250,000 shares for a monetary value of approximately 8M EUR per day. That clearly makes the Paris listing the most liquid listing to trade in the company’s shares.

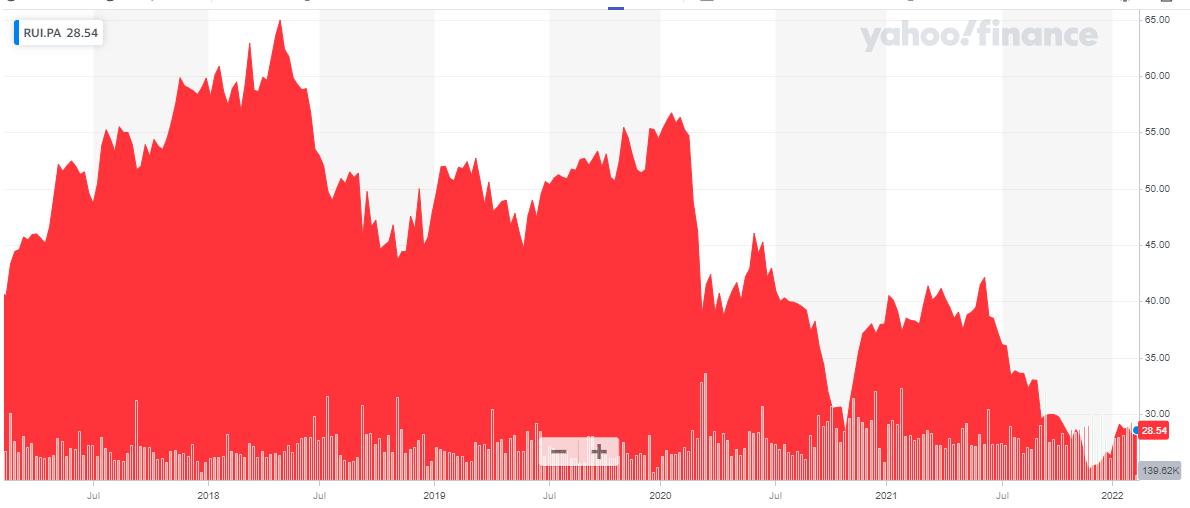

Yahoo Finance

The petroleum business is not dying

As you can see in the chart above, Rubis has been a disappointment for pretty much every investor in the past five years. After the initial drop related to the COVID pandemic at the end of Q1 2020, Rubis saw its share price drop below 30 EUR before regaining some of the lost ground. Unfortunately the bounce back to 40 EUR/share was short lived and here we are again, at a share price below 30 EUR.

The market seems to think the petroleum sector is a dying breed. While it’s easy to understand new sources of energy are up-and-coming, keep in mind Rubis is operating in developing regions and that means ICE engines will likely remain very important. Additionally, the bitumen business could also be seen as a call option on developing nations as more and more African dirt roads will get a nice layer of asphalt. So I would like to argue Rubis has a lot of potential. Not only because the stock is now trading at a low valuation but also because Rubis is using its free cash flow result to expand into other sectors.

The company will only report its financial results in March so I’ll have to rely on the detailed financial statements from H1 2021, in combination with the most recent trading update issued by Rubis after the end of Q3.

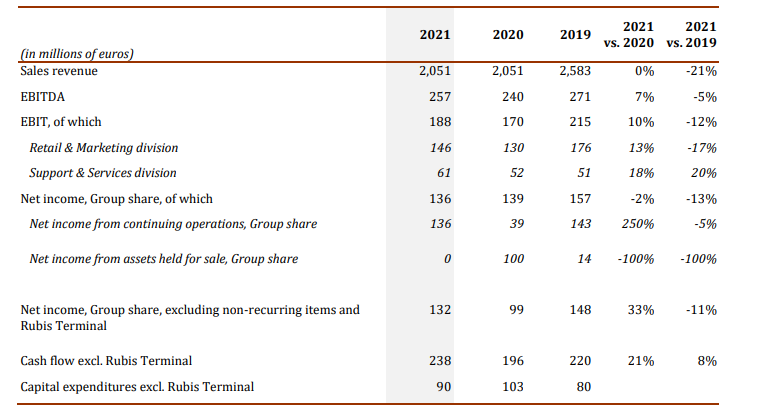

The most important takeaway in the first half of 2021 is that although the revenue remained stable compared to H1 2020, we did see a considerable margin improvement as the EBITDA increased by 7% compared to flat revenue. That’s also encouraging from a 2019 perspective. Although the reported revenue decreased by 21%, the EBITDA decreased by just 12% as the margins improved.

Rubis Investor Relations

Looking at the H1 2021 results we indeed see how the EBITDA increase results in a nice improvement of both the EBIT as well as the net income as Rubis reported a net income of 136.2M EUR which represents an EPS of 1.33 EUR per share. That’s important as this includes just 1.25M EUR in contributions from the Rubis Terminal Joint Venture (which used to be fully owned). On a like for like basis, and excluding the non-recurring elements, the net income increased by approximately 33% in the first half of the year.

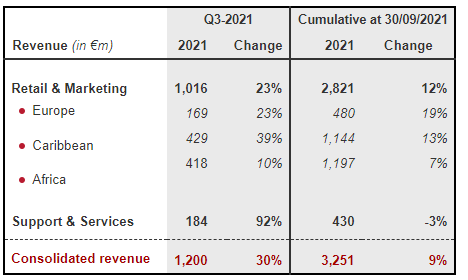

Of course that was just the first half of 2021. Rubis has also provided an interim update after the end of Q3 and there we see the total revenue has picked up by about 30% in the third quarter. That’s obviously also due to the higher prices for oil and petroleum products so the revenue growth by itself may not be meaningful and unfortunately the company has not provided an update on its Q3 EBITDA and EBIT margins.

Rubis Investor Relations

So while the revenue is trending in the right direction, the jury is still out on the margins and I think that’s one of the main reasons why the share price is still trading below 30 EUR/share.

The sustaining free cash flow remains very strong

As Rubis is a services provider with a rather large exposure to infrastructure (terminalling, a refinery, …), it’s also important to look at the cash flows. And more specifically, the sustaining free cash flow.

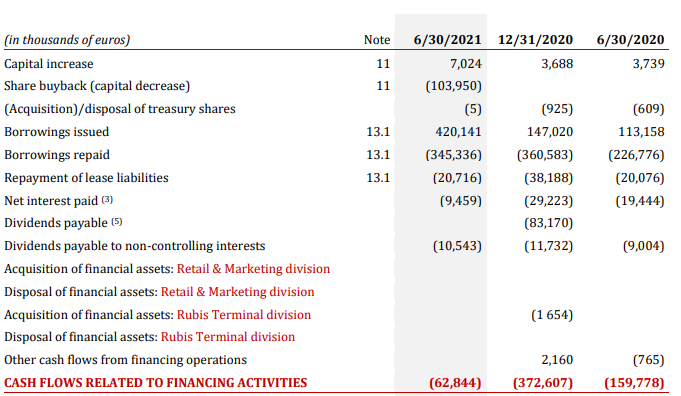

I’m going back to the company’s detailed financial results for the first half of the year. As you can see below, Rubis generated 280M EUR in operating cash flow but we still need to deduct the taxes due (32M EUR) and the lease payments (21M EUR) and the interest payments (9.5M EUR). And to be complete, I’m also deducting the 10.5M EUR payments to non-controlling interests. The cash flow table below only shows the financing cash flow to explain where the lease and interest payments were sourced from.

Rubis Investor Relations

So after deducting these elements from the 280M EUR as shown below, the adjusted operating cash flow was approximately 207M EUR.

Rubis Investor Relations

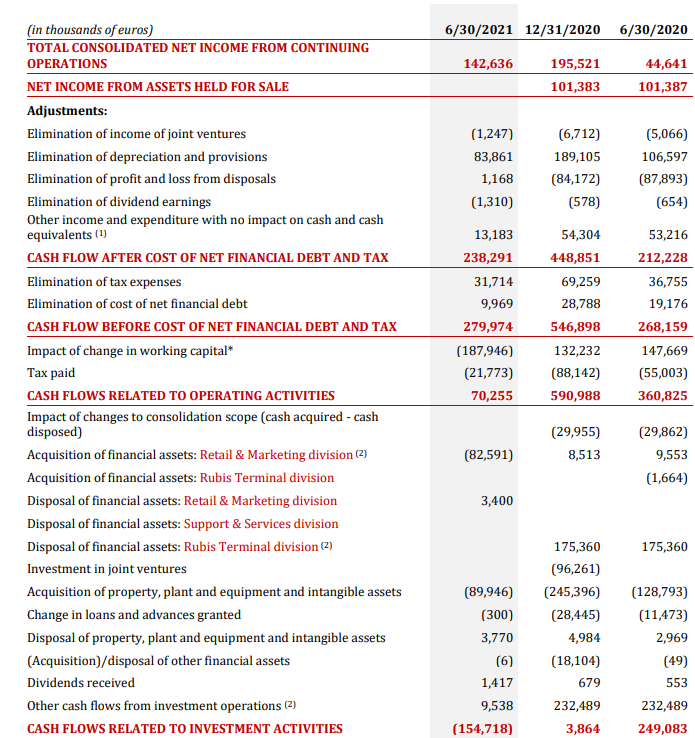

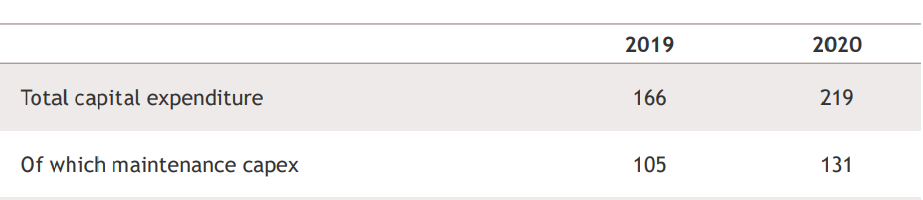

We see the total capex was approximately 90M EUR, resulting in a free cash flow result of 117M EUR. That’s about 15% below the reported net income but this actually provides an excellent example of why it’s important to separate growth capex from maintenance capex. The past few years, only about 60% of the full-year capex was actually sustaining capex.

Rubis Investor Relations

That actually means the sustaining free cash flow will likely be pretty close to or even exceed the reported EPS of 1.33 EUR per share, and the lower reported free cash flow could be explained by the growth capex.

Also keep in mind Rubis reported a dividend income of just over 1M EUR from the joint venture which has a book value of in excess of 300M EUR. That’s just a symbolic dividend as the JV generated 127M EUR in EBITDA and is generating plenty of free cash flow. So once the Joint Venture will start to stream up a larger portion of its free cash flow we will see a direct impact on the free cash flow bottom line of Rubis.

Rubis has been using its strong cash flows for a share repurchase program, but it has also created a new division: Rubis Renewables. As mentioned before, Rubis is putting its euros generated in the petroleum-related divisions to work in different sectors to diversify away from being a pure oil-related player.

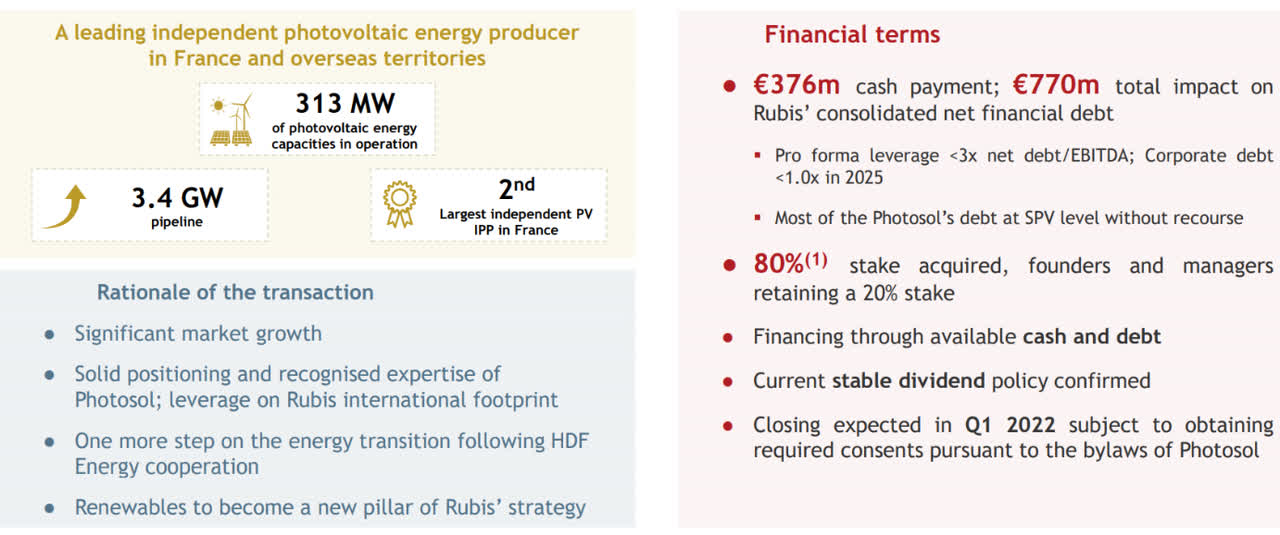

Rubis has purchased an 80% stake in Photosol France, a large independent renewable Independent Power Producer owning 313MW of operating capacity with an additional 101MW under construction.

Rubis Investor Relations

This is for sure not a cheap deal as Rubis is paying 376M EUR in cash and is valuing the enterprise value of the company at 770M EUR. That’s quite rich considering the expected EBITDA contribution is just 35M EUR but Photosol is also one of the strongest growers as the EBITDA is expected to increase at a 40% CAGR in the next four years which means Rubis’ attributable EBITDA could actually reach 100M EUR in 2026. And using that growth rate, the acquisition consideration is reasonable – but everything depends on the solid execution of this new division within Rubis. Additionally, Rubis could deploy Photosol’s know how in its core regions in Africa and the Caribbean, so there are some synergy benefits whereby Photosol could expand into other regions, using Rubis’ existing network.

Investment thesis

The Photosol acquisition could be a game changes for Rubis although the company will have to show this deal can live up to the expectations. Rubis currently has a market capitalization of just under 3B EUR and including the Photosol deal, I expect the company’s net debt to increase to approximately 1.15B EUR. With an EBITDA of 240M EUR (excluding lease depreciation) in H1 2021 and a full-year EBITDA expectation (my expectation) of in excess of 500M EUR for this year, the balance sheet can easily handle the acquisition.

I think the EPS will increase to around 2.80-3.00 EUR per share this year and as Rubis is guiding for a 60% payout ratio, the dividend will likely continue to come in around 1.75-1.80 EUR per share for a dividend yield of approximately 6% based on the current share price. The dividend tax in France for foreigners can be reduced to 12.8% by proving you are a not a French resident.

I currently don’t have a position in Rubis but I like the switch from “old energy sources” to renewable energy as the company is looking to increase the current capacity of its renewable division by a factor of 8 by 2030.

Be the first to comment