AndreyPopov

Diversified investing, something that the more conservative investor would likely advocate as a way to protect capital as it slowly grows, has been in the gutter. Never in my lifetime has the good ol’ stocks-and-bonds portfolio disappointed as much as it has so far in 2022, even after 18 months of less-than-impressive returns between late 2020 and 2021.

In the face of danger, it is human nature to act defensively. Since not much has been working well in the markets this year, being at least skeptical of multi-asset class diversification is understandable.

But I see the silver lining. In my view, this is one of the best opportunities in years to bet on risk assets; commit to the strategy for the long haul; and eventually, reap the benefits.

One way to do so, although certainly not the only one, is to own the RPAR Risk Parity ETF (NYSEARCA:NYSEARCA:RPAR). I have been bullish about this fund since a few months after its inception, but its performance has disappointed consistently since then.

A quick word on RPAR

I have written plenty about risk parity and RPAR on Seeking Alpha, and I invite the reader to check some of my older articles to dive deeper into the strategy. In a nutshell, RPAR is a 1.2-times leveraged, yet fairly minimalist fund that invests primarily in domestic and foreign stocks; nominal and inflation-adjusted government bonds; gold; and commodity producers.

The original idea of risk parity comes from my old employer, hedge fund Bridgewater Associates. The investment firm introduced its All-Weather family of portfolios in the 1990s with the idea of producing decent results in virtually any macroeconomic environment by risk-balancing a portfolio into as many asset classes as feasible.

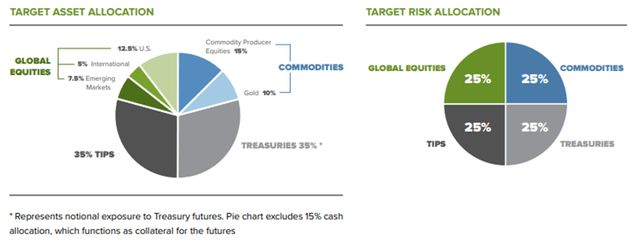

Below is RPAR’s current asset class and risk exposures:

Advanced Research Investment Solutions, LLC

A look at history

RPAR is not even three years old, but one can see that this has been one of the worst markets for the fund in decades. Using a combination of data from NYU Professor Damodaran, the US Energy Information Administration, and other sources, I created a simple, hypothetical multi-asset portfolio resembling RPAR. Then, I backtested its performance to 1970 — that is, an analysis of over 50 years of data through periods that include deep recessions and economic booms, record-high inflation, rising and falling interest rates, etc. The allocation is as follows:

- 58% government bonds (TIPS did not exist until a couple of decades ago, so I used only nominal treasuries for this exercise instead)

- 25% US stocks (old data on international stocks is sparse, so I simplified by using only the S&P 500)

- 8.5% gold

- 8.5% crude oil (used here as a proxy for commodities)

My backtest suggests that the RPAR lookalike portfolio described above is on track to having its worst year ever since 1970, assuming asset prices trade sideways from here through the end of 2022. One possible interpretation is that diversified investing is merely correcting from the “everything rally” period of 2020-2021, when heavy liquidity in the system helped to propel the value of risk assets across the board. However, the data does not support the thesis.

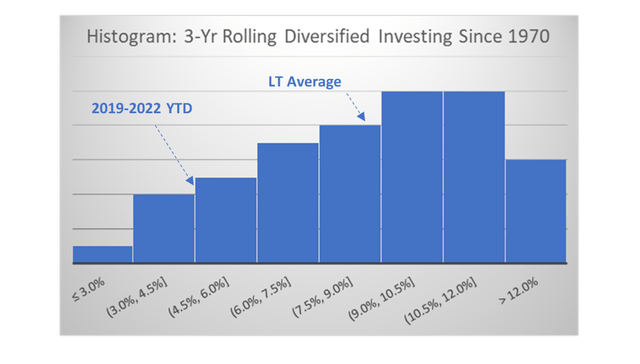

The histogram below shows that the current rolling three-year period has been terrible for multi-asset class portfolios — the sixth worst in five decades, to be more precise. Only in the early 2010s, driven by fear and skepticism over the economic recovery following the Great Recession of 2008 and the European crisis of 2011, and again for a brief moment in 1994, did diversified investing perform worse than it has in the past three years.

The implications are clear, in my view. Should the time-tested strategy of diversified investing continue to produce positive returns over the long haul, I believe it is a matter of time before a fund like RPAR returns to its previous peak levels (merely returning to the all-time high of November 2021 means upside potential of 31% for the ETF) and climb further from there. Therefore, now seems like a great time to buy the fear and patiently await what I believe will be decent returns a few years out.

How about the fundamentals?

Certainly, history does not always repeat itself, even if it may often rhyme. Only because multi-asset class investing has been in trouble in 2022 does not mean that the strategy will rebound and outperform in the next three, five, or ten years. There are good reasons why stocks around the globe, corporate and government bonds, gold, silver, cryptocurrency, and even many industrial commodities like iron ore have all been in negative territory so far this year, at the same time.

The markets have been dealt a cocktail of bearish news in 2022 that has led to uncertainty about the macroeconomic landscape: from record-high consumer prices to the prospect of rapidly rising interest rates (that not even the Federal Reserve has been able to anticipate with much precision) to geopolitical tensions in Europe, and lately, even growth deceleration and wavering consumer sentiment that has just reached an all-time low. While inflation, the bogeyman of 2022, has been showing very timid signs of moderating, it is anyone’s guess when we may reach economic stability once again.

As a long-term investor, however, I am not in a hurry. I believe that diversified investing is far from dead, even if it may seem so this year. While I do not have strong convictions about when things may turn around for a fund like RPAR, I am fairly confident that, looking back over the next decade, now will prove to be a good time to buy the fear.

Be the first to comment