Justin Sullivan

Investment Thesis

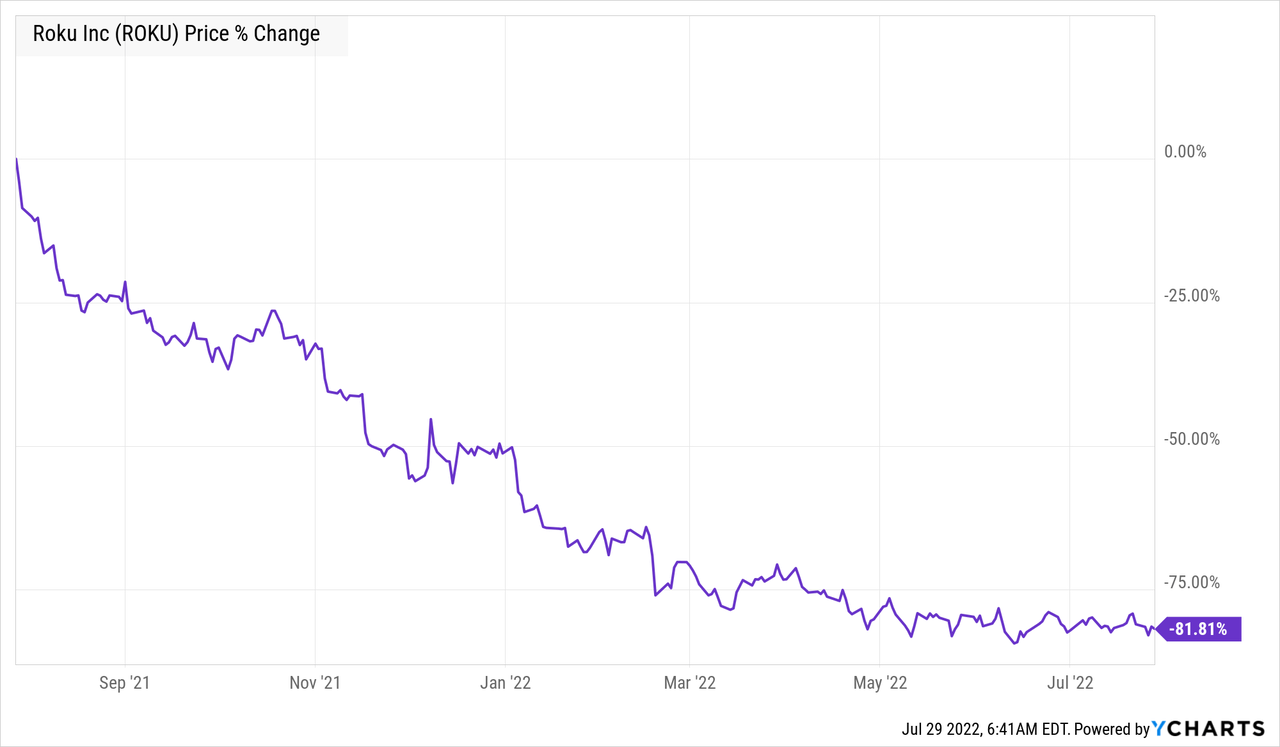

The transition from linear TV to streaming has been well under way for years, and it will continue to be a secular tailwind throughout the next decade. Despite Roku (NASDAQ:ROKU) being one of the driving forces behind this change, shares have plummeted over the past 12 months – and, following its Q2 results, shares of Roku are in their latest freefall.

Roku itself the leading TV streaming platform in the United States, Mexico, and Canada (by hours streamed) and has been driving a shift from linear TV to streaming over the past decade. Roku’s core offering is its Roku platform, a connected TV operating system that can be accessed either by purchasing a plug-in Roku stick (transforming a linear TV to a connected TV) or a connected TV that has Roku’s platform as the backbone of its CTV offering. Manufacturers such as Philips, TCL, Hisense, and Hitachi offer TVs with Roku’s operating system integrated, giving Roku access to millions of households across the globe.

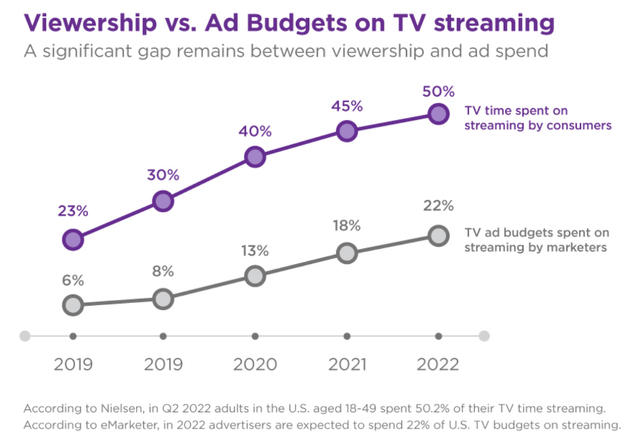

The biggest revenue driver for Roku is digital advertising, and these are gained through its OneView advertising platform that brands use to advertise on the Roku platform. Advertising through connected TV gives brands the ability to target companies with much more precision, and this is core to the thesis for investing in Roku. Roku can place these ads, for example, on The Roku Channel, which is the largest free ad-supported linear streaming (or FAST) channel in America.

My personal investing thesis for Roku is the following: being a leader in the space, Roku has access to millions of eyeballs thanks to its reach in connected TV. This gives it the ability to benefit from advertising revenues through FAST channels, through banner adverts, as well as the ability to benefit from revenue share agreements with content streaming services. As more consumers switch to connected TVs, and advertising dollars make their way across from linear TV, Roku should continue to be a big beneficiary of this secular trend.

With shares down ~25% as I write this, I have to ask myself whether or not this thesis is busted? Let’s take a look at Roku’s results & find out.

Earnings Overview

Quick warning… this does not paint a pretty picture for Roku shareholders such as myself.

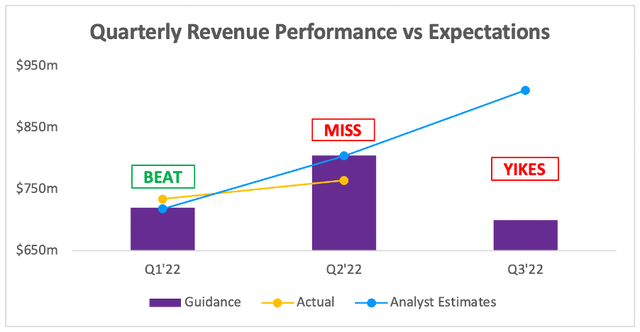

Let’s take a start with the revenue figures. Management guided for revenue of ~$805m, and analysts also expected a very similar figure of ~$804m, so the actual revenue figure of $764.4m is one of the reasons that shares have taken a whack. This represented 18% YoY growth, but it gets worse.

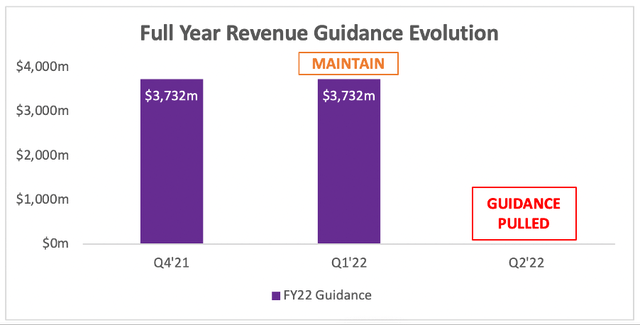

I think the most damage was done to shares courtesy of Roku’s guidance. Bear in mind that the company had previously guided to 35% YoY growth for FY22, so it’s fair for analysts to be expecting Q3’22 revenues to be ~$911m. Well, both analysts and shareholders were stunned by the Q3’22 guidance of $700m, representing a woeful 3% YoY increase.

Perhaps unsurprisingly, management pulled back on its FY22 guidance – in fact, it pulled the guidance altogether.

Perhaps the most worrying aspect of this is the fact that guidance was maintained for FY22 when Roku released its Q1 results at the end of April – 4 months into the year. Is this representative of a macroeconomic environment that is rapidly deteriorating, or is this a sign that management failed to appropriately manage shareholder’s expectations? Whatever way you look at it, these financial results were horrific.

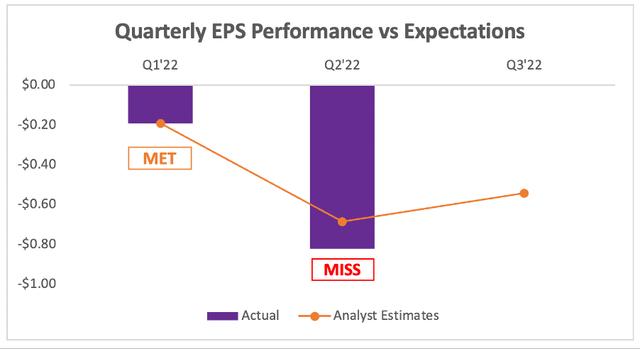

Roku also missed analyst estimates in terms of EPS. Whilst I don’t pay too much attention to this, since Roku doesn’t provide EPS guidance & it is not yet aiming for EPS maximisation, a miss on EPS can highlight margin issues. Management guided to breakeven Adjusted EBITDA in Q2’22, which came in at -$12.1m, so… breakeven-ish?

The biggest pain point here is certainly the sharp revenue slowdown & dramatically lower guidance, so let’s dig a bit deeper into what’s caused this plunge.

A Severe Revenue Slowdown

Firstly, it’s worth noting the differences between Roku’s two revenue streams. Platform revenue actually grew 26% YoY, whereas the Player revenue fell by 19% YoY – this is good news in one sense, as the Platform side of Roku’s business is most attractive to me, yet a fall in sales of its hardware could result in lower customer acquisition.

Starting with Platform revenue; a large portion of this comes from advertising, and with recession fears on the horizon, ad budgets are often the first casualty. This was highlighted in Roku’s Q2’22 Shareholder Letter:

In Q2, Platform revenue increased 26% year over year to $673 million. This growth was lower than expected as many marketers abruptly curtailed or paused advertising spend in the ad scatter market during the latter half of Q2. According to a survey by Advertiser Perceptions, 47% of advertisers in the U.S. say they made in-quarter pauses on ad spending on TV streaming, 44% on digital video, and 42% on legacy pay TV. We believe this pullback mirrors the start of the pandemic in 2020, when marketers prepared for macro uncertainties by quickly reducing ad spend across all platforms.

It’s quite staggering to think that 46% of advertisers in the US made in-quarter pauses on ad spending for TV streaming, and I think this shows the single biggest reason for Roku’s dramatic slowdown. This company is so reliant on advertising, and it has very few alternative sources of revenue when advertising spend is dramatically cut.

Moving onto Player revenue; this may only make up ~12% of Q2’22 total revenue, but it is important for Roku to keep selling the hardware in order to increase the number of active accounts. This is continuing to be a macroeconomic story, as inflation and fears of a recession have weighed on consumer discretionary spend, which has put sales of Roku TV and player unit sets under pressure.

It’s worth highlighting that Roku is keeping the price of its hardware low, since the real money maker is the Platform revenue. As such, Q2 Player revenue was down by 19% whereas the unit sales were ‘only’ down by 16%. According to CFO Steven Louden on the earnings call:

Roku player unit sales remained above pre-COVID levels in the US and the average selling price decreased 5% year over year. We have continued to insulate consumers from our cost increases in our player business based on our growing ARPU, which enables us to prioritize account acquisition.

A Few Bright Spots

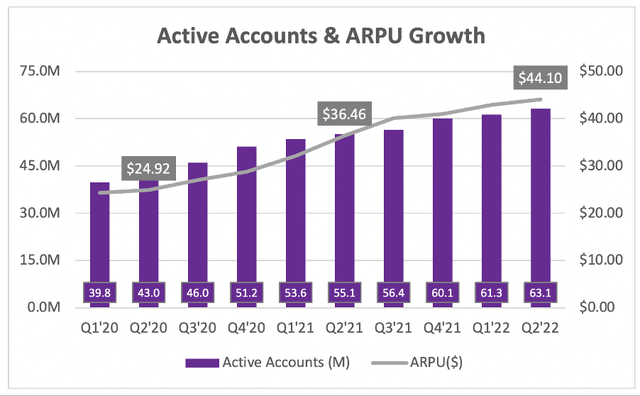

There’s a lot of negativity in the revenue results, and with good reason – I think Roku shares deserve the trouncing that they are getting today. But I do see some positives in this report, starting with the continued growth in active accounts and average revenue per user. Despite the macroeconomic difficulties in the quarter, Roku still managed to add an additional 1.8 million accounts & continued to grow the amount of revenue it makes from each individual user, despite the hit to advertising.

It is worth highlighting that the ARPU figure is calculated over the trailing 12-months, so there may well be a lag to the impact of a revenue slowdown.

Another bright spot was the level of commitments that Roku managed to sign, despite a difficult macroeconomic environment. As per the shareholder letter:

Despite a challenging ad environment, we closed Upfront deals for the 2022-2023 TV season with all seven major agency holding companies and surpassed a milestone of $1 billion in total commitments. We continue to take ad dollar share away from traditional TV. Our negotiations with brand advertisers occurred at the same time as the broadcast networks, signaling a strategic shift to TV streaming, and 25% of all advertisers who committed to Roku during the Upfronts were new commitments (did not participate last year).

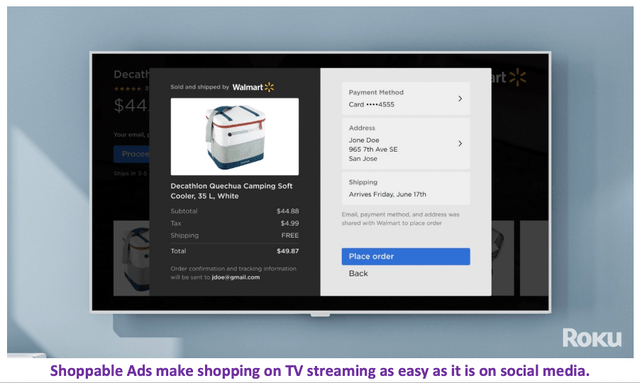

Roku also continues to roll out new products to its platform, such as Shoppable Ads that I highlighted in my previous article, which aims to make shopping on TV as easy as it is on social media. These Shoppable Ads are integrated with Roku Pay (another potentially substantial revenue source), and orders can be placed in a couple of clicks.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Roku is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

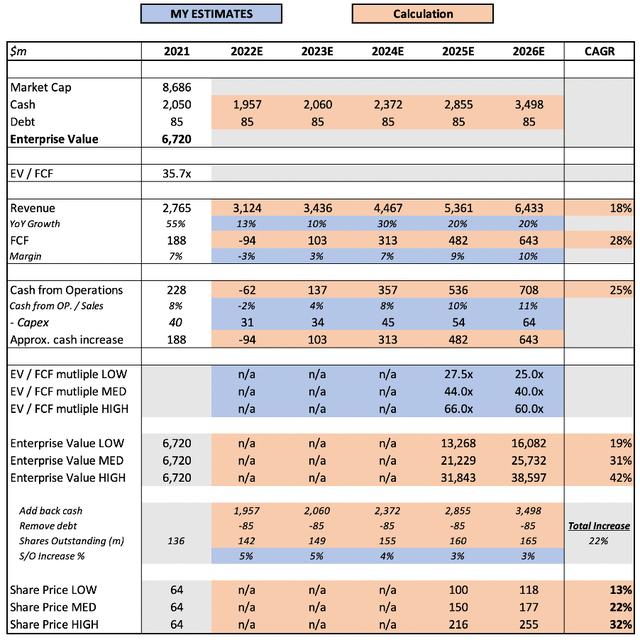

Details of all assumptions in my model can be found in my previous article; I will just call out the core changes made below, other than updates to the enterprise value, with market capitalisation based on Roku shares opening ~25% lower on Friday 29th July:

- Revenue Growth: previously assumed 32.5% YoY growth for FY22 based on management’s 35% guidance – well, that’s out the window. H1 growth was ~23%, Q3 growth is forecasted to be ~3%. If I assume H2 growth of 3% YoY and average that out, my revised FY22 growth rate is now 13%. I have also assumed lower growth rolling forward into FY23, with a recovery starting in FY24.

- Free Cash Flow Margins: substantially decreased for FY22, as H1 has resulted in substantial negative free cash flow, and management have not given any indication that these margins will improve throughout the year. I have also assumed a slower improvement over time in FCF margins, as the impact of the macroeconomic environment continues to hurt Roku.

Put all that together, and I can still see Roku shares achieving a 22% CAGR through to 2026 in my mid-range scenario.

Investment Thesis: On Track, With Warning Signs

My main thesis for Roku revolves around its ability to create a huge ecosystem of connected TVs, with its platform becoming the standard for this new era of streaming & digital advertising. The company is continuing to win advertising share and grow advertising accounts, as it benefits from this secular tailwind. I personally don’t see anything that breaks my investment thesis; it would appear that there is a slowdown in advertising spend due to macroeconomic concerns, yet Roku is still in a financially solid position with ~$2 billion in net cash, so it can ride out any difficult times such as this.

It also continues to expand internationally, which is exciting and equally important to the thesis. CEO Wood highlighted the following on the earnings call:

International is going well for us, just as a reminder obviously streaming is a large global opportunity, over a billion broadband TV hustles around the world. They’re all going to switch the streaming. Roku is the number one streaming platform in the United States, but also in Canada and Mexico. We’re growing fast in Brazil and Latin America generally doing well starting to make good progress in the UK. And we just recently launched in Germany.

So, we are focused on global expansion. I am happy with the results there. We’re going well generally. We do — our business model is to focus first on scale, and then second on monetization, most international companies, we haven’t started monetization yet, so that, it is something that will come in the future primarily focus on scale, at least for now on international.

There are concerns, however, primarily surrounding the abrupt nature of this advertising market slowdown & management’s inability to even semi-accurately forecast the impact. If this is a one off, I won’t complain, but it’s certainly enough to make me more cautious. Roku’s reliance on ad spend is clearly a risk & can lead to more volatile results, and I’m sure the upcoming quarters will be difficult for the company and shareholders.

Bottom Line

My investment thesis for Roku remains intact, but it is clear that both the economy and Roku itself are heading into a difficult period. I still believe in the potential of Roku, but there is substantial short-to-medium-term risk associated with this company – as such, I will be weighting it appropriately in my portfolio.

Given all this, I am lowering my rating from a ‘Strong Buy’ to a ‘Buy’. I think Roku looks very attractive at current prices for the substantial opportunity ahead, but investors should be prepared for a difficult 12 months.

Be the first to comment