Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) significantly harmed its own investment case last week when it offered a bleak prognosis for the third fiscal quarter due to a slowdown in ad sales.

Roku is feeling the pinch as growth in the digital advertising sector slows.

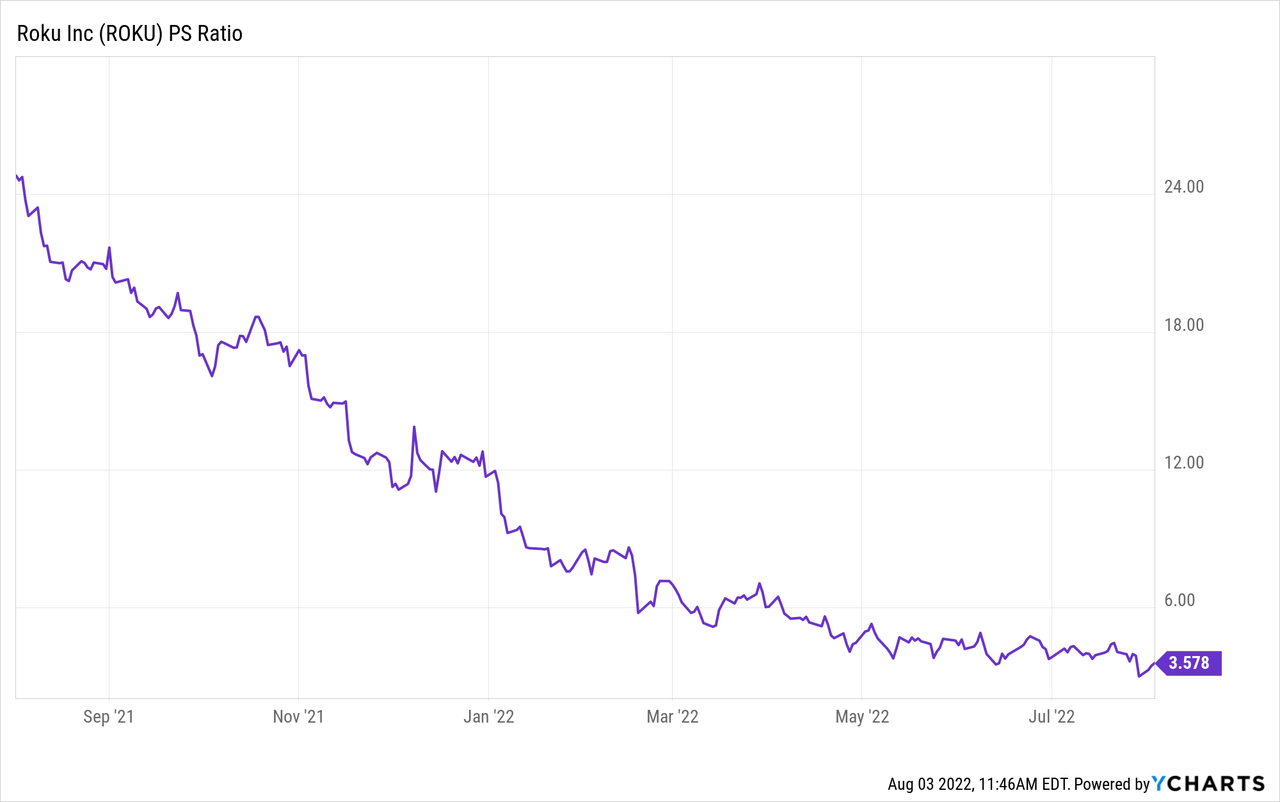

Weaker-than-expected sales growth and expanding platform losses are significant headwinds for Roku’s shares, given how highly the market values the streaming-TV platform.

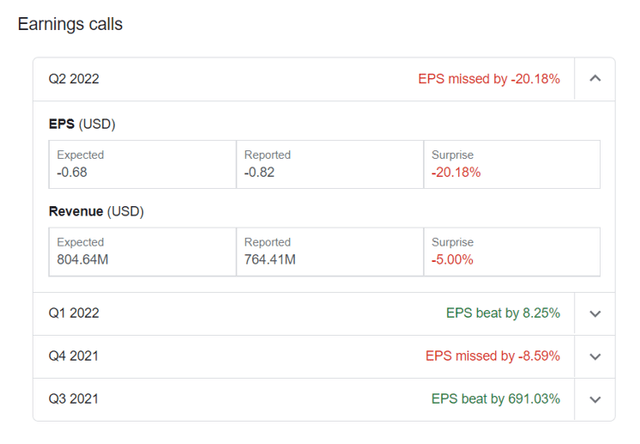

A Double-Miss Followed By A Downbeat Guidance

Roku’s second-quarter double-miss wasn’t even the worst aspect of the company’s earnings report last Thursday. Having said that, the double-miss did not inspire trust in the streaming-TV platform. Roku reported profits per share of -$0.82, missing average analyst projections by 20%, and revenues of $764.41 million, missing by 5%.

Roku’s shares fell 23% after earnings, owing mostly to the company’s deeply troubling sales outlook for 3Q-22. Roku has not traded at $65 since April 2019, implying that the stock is now at its lowest level in three years.

ROKU Share Price (Yahoo Finance)

What’s To Blame For Roku’s Soft Performance?

Slowing ad sales on the Roku platform are to blame, as also a broader worsening of the macroeconomic situation. Roku monetizes its platform through ad placements, which marketers can easily disable.

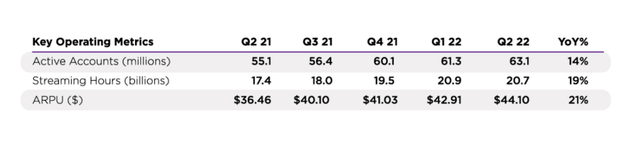

With advertisers cutting back on ad spending, every important statistic of Roku’s streaming-TV platform slowed. Roku’s active accounts, streaming hours, and ARPU, a crucial monetization metric, all grew by double digits YoY, but the fundamentals are obviously worsening, notably Roku’s ARPU.

Roku’s ARPU increased 34% YoY in 1Q-22, however growth slowed dramatically to 21% in 2Q-22. There is a significant slowdown in Roku’s business, which indicates difficulty for the streaming-TV platform, especially since the platform is not profitable at the moment and still has extremely high valuation multiples based on sales.

The slowing of Roku’s ARPU growth is attributable to slower ad revenues in a market that is growing less appealing to advertisers. Consumer spending is being weighed down by inflation, and advertisers are responding by reducing their digital advertising initiatives.

Most ad-focused internet businesses, including Meta Platforms Inc. (META), Snap Inc. (SNAP), and Alphabet (GOOGL, GOOG), reported significant headwinds in the digital-advertising market in 2Q-22. Some companies drastically cut their outlook in expectation of a more difficult ad-sales market.

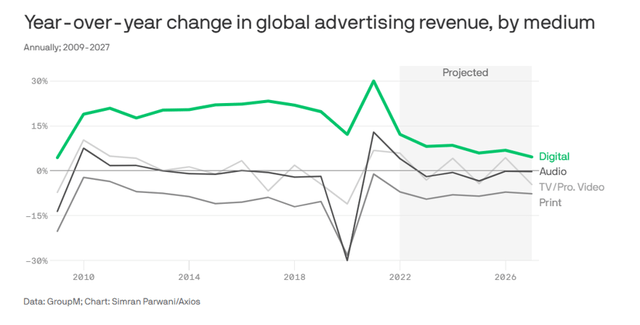

Ad sales increased significantly during the pandemic, but GroupM, a renowned media investment firm, predicts that the global advertising business will experience a multi-year decline in ad expenditure beyond 2022.

YoY Change In Global Ad Revenue (GroupM)

This indicates that Roku’s monetization and sales growth will likely be lower than planned in the future. In fact, it already is.

Gloomy Outlook, Surging Platform Losses

Roku anticipated $805 million in net sales for 2Q-22, which it failed to meet. The company’s net sales in 2Q-22 were 764 million, falling 5% short of Roku’s own expectation due to a downturn in consumer discretionary spending.

Furthermore, the projection for 3Q-22 is just $700 million in net sales, meaning another 8% QoQ loss on top of the 5% drop in net sales in 2Q-22. Roku forecasts only a 3% increase in net revenue over the same period last year.

The reality that macroeconomic headwinds are undermining Roku’s earned status as a profitable video streaming pioneer dragged on Roku’s stock on Friday, in addition to the bleak prediction for 3Q-22. Roku has been able to generate positive quarterly operating profits in every quarter of 2021, despite revenue and ARPU growth spiking throughout the epidemic.

However, in 2022, things began to change as advertisers drew back and growth slowed, resulting in two consecutive quarters of operating losses. Roku’s operating losses in 2Q-22 were $111 million, roughly five times the company’s loss in 1Q-22 ($24 million).

Roku Is Still Quite Expensive Considering The Deceleration Of Sales Growth

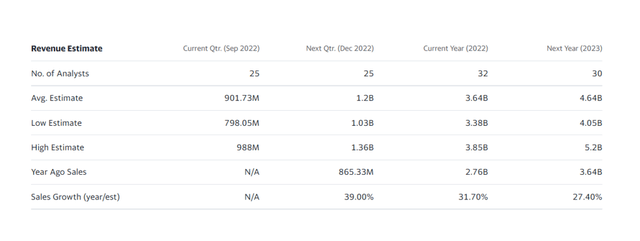

The market anticipates 31.7% sales growth for Roku this year, followed by another 27.4% gain in sales next year. Analysts predict Roku to increase its sales by $1.0 billion in 2023, but after Thursday’s dismal results presentation, these figures were likely rendered impossible last week.

Revenue Estimate (Yahoo Finance)

Roku is still given a generous sales multiple of 3.5x based on projected sales for the following year. This price multiple is now much more difficult to justify, especially if the market lowers its expectations for Roku’s sales growth in the coming year.

Why Roku Could See A Higher Valuation, Or A Much Higher Valuation

Roku’s fundamentals would most likely improve if TV and ad sales recovered. Having said that, the fundamentals now indicate a financial weakening of Roku’s platform, with everything from revenue, operating income, accounts, and ARPU being negatively impacted. The avoidance of a recession could significantly alter Roku’s financial tendencies.

My Conclusion

Despite Roku’s issues, which include dropping ARPU indicators, poorer sales growth, a bleak outlook, and rising operational losses, the company is still trading at an extremely high, and ultimately unsustainable, sales multiple.

Roku is a value trap that should be avoided, as industry trends and declining key metrics are expected to result in larger losses for Roku in the near term.

Consensus sales forecasts are likewise unduly optimistic, with growth predicted to decline to just 3% in the coming quarter. Avoid.

Be the first to comment