M-Production

Roku (NASDAQ:ROKU) plunged after second quarter earnings due to gloomy guidance and has continued to fall since. This is a market that has decided to focus squarely on the near term profit outlook. It seems reasonable to expect the softness in the online advertising market to prove short-lived, but investors appear to have little patience for such thinking. The stock plunged 23% in a single day as growth investors all around threw in the towel in light of the steep growth slowdown. ROKU stock has become far too cheap for what arguably remains a dominant streaming platform.

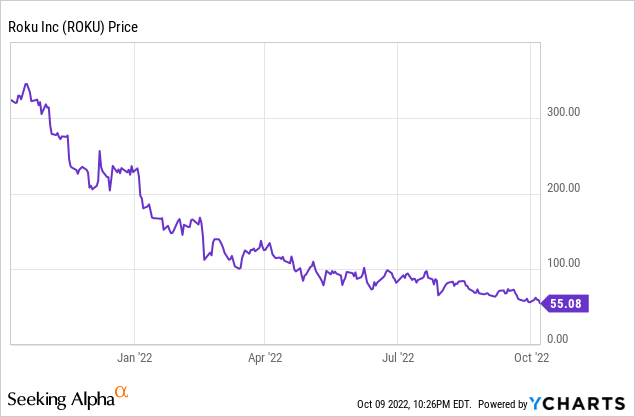

ROKU Stock Price

After peaking close to $480 per share in early 2021, the stock has since fallen around 89%.

I last covered the stock in January, where I rated the stock a buy on account of the solid cash flow generation and long term growth outlook. The stock has fallen another 70% since then, as valuations experienced a violent reset across the tech sector.

ROKU Stock Key Metrics

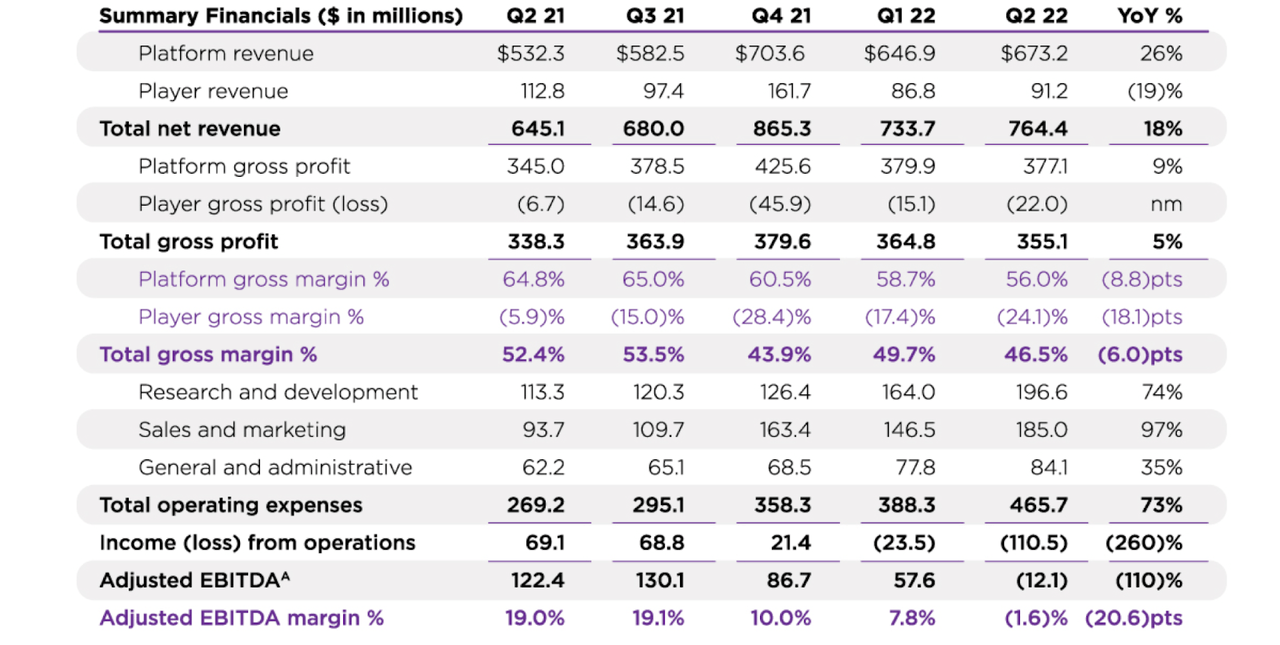

The latest quarter saw ROKU deliver 18% total net revenue growth, but platform revenue shined with 26% revenue growth. Due to promotional activity, player gross margins turned even more negative, leading overall gross profits to grow by only 5%. Throw in the company’s aggressive ramp-up in headcount and adjusted EBITDA declined from $122.4 million in the prior quarter to negative $12.1 million this quarter.

2022 Q2 Shareholder Letter

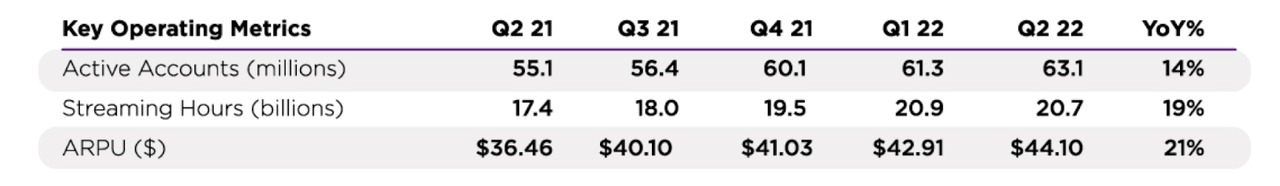

This market has punished companies for margin contraction with little consideration for long-term normalization. Even so, I expect that the shift from positive cash flows to negative cash flows took many investors by surprise. In spite of lapping tough comparables, ROKU continues to drive strong growth in both active accounts and streaming hours.

2022 Q2 Shareholder Letter

This past quarter actually was not so bad – one could excuse the lower margins as being near term in nature due to supply chain issues, and the increasing losses on player sales should lead to higher-margin platform sales. It was instead the outlook that spooked investors.

ROKU guided for $700 million in net revenue and $325 million in gross profit in the third quarter. Those reflect 2.9% revenue growth and 10.7% decline in gross profits. The adjusted EBITDA loss is expected to widen to $75 million.

ROKU ended the quarter with $2 billion of net cash, making up over 26% of the market cap. With such a strong balance sheet, I am not concerned about operating losses persisting for several quarters.

Is ROKU Stock A Buy, Sell, Or Hold?

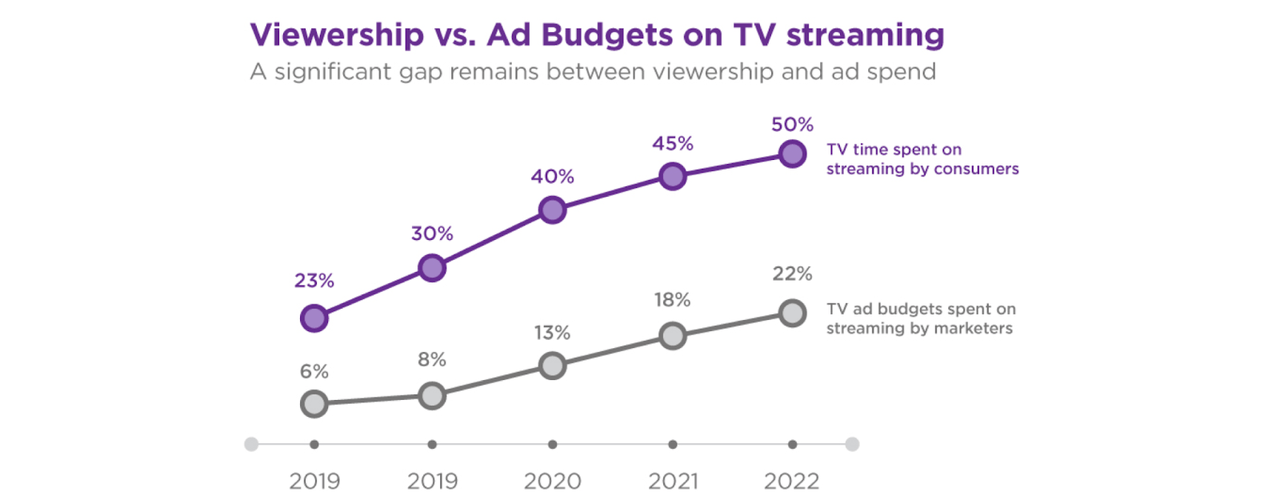

The fact that ROKU stock plunged over 20% even after already falling over 80% indicates the high degree of pessimism in the markets today. Investors seem to have forgotten the long term secular story for ROKU. The company remains a cross between the walled-gardens of Apple (AAPL) and streaming services like Netflix (NFLX). ROKU holds the top market share in the smart TV market, and it is hard to argue with the notion that the world is trending towards a smart TV world. Even as TV time spent on streaming steadily increased to 50% over the years, TV ad budgets spent on streaming still remains at only 22%.

2022 Q2 Shareholder Letter

ROKU expects the gap to eventually narrow as TV marketers focus their dollars on the higher ROI offered by streaming platforms.

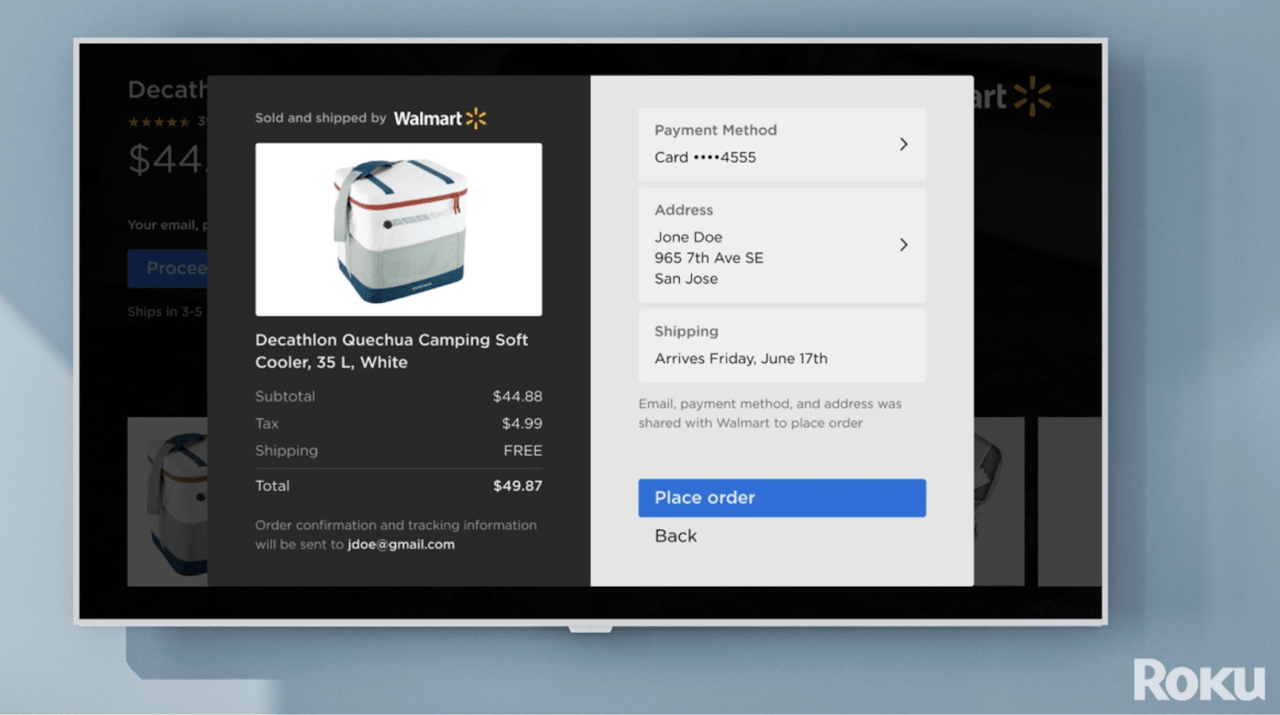

ROKU continues to aggressively innovate, including working on the ability to shop within the app.

2022 Q2 Shareholder Letter

While NFLX is experiencing pressures due to rising competition, the emergence of new streaming services can only benefit ROKU. ROKU is a play on the overall growth of smart TVs and video streaming – that is a secular growth story arguably as strong as e-commerce or credit cards. I can see ROKU returning to around 20% growth over the long term. The stock is currently trading at 5.4x trailing gross profits. Assuming that the company can earn 40% net margin based on gross profits over the long term and that the stock trades at a 1.5x price to earnings growth ratio (both assumptions appear conservative), the stock might trade at 12x gross profits. That suggests 122% potential upside from multiple expansion alone, which in conjunction with the long-term growth outlook should be more than enough for market-crushing returns. There are two key risks here. The first risk is if the softness in the online advertising market proves to be more than just a near term road bump, or if the market weakness persists for longer than expected. The second risk is if smart TV competitors are able to win market share away from ROKU. This appears to be the reason for ROKU’s significant investment in its Roku Originals lineup – it is still unclear if that will be enough to stave off competition. I have discussed my current market strategy for subscribers of Best of Breed Growth Stocks including my view that a diversified basket of beaten-down tech stocks can perform strongly from here. ROKU fits in nicely in such a basket on account of its secular growth story and beaten-down valuation. At current valuations, I am comfortable with my reasonable allocation in ROKU, as the market is not appreciating the strength of the balance sheet nor the long-term growth opportunity.

Be the first to comment