JHVEPhoto

Investment Thesis: Lower churn rates and rebounding earnings could mean a rebound in upside for Rogers Communications.

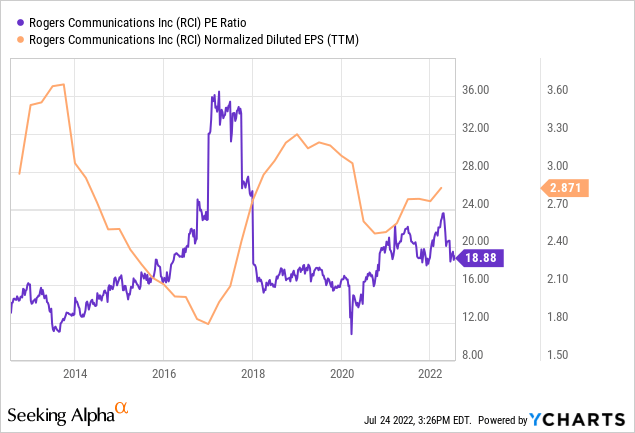

In a previous article, I made the argument that Rogers Communications Inc. (NYSE:RCI) has seen a significant rebound in wireless growth – that the company could see some downside going forward as a result of the stock potentially trading at a premium based on its P/E ratio.

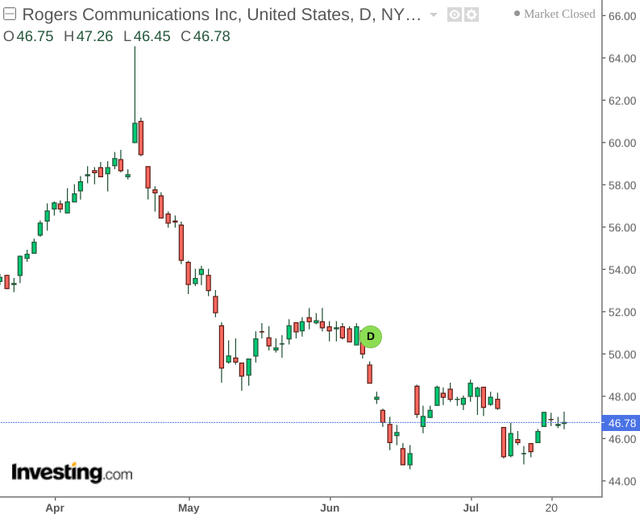

Since April, we have seen the stock decline by over 20%:

With that being said, the purpose of this article is to make the argument that the decline in Rogers Communications may be overdone – and resilient performance by the company could result in a significant rebound in upside from here.

Performance

When looking at the company’s P/E ratio, we can see that while the ratio may still be higher than levels seen in 2020 – the stock is still trading near levels seen between 2018 and 2020, while earnings have been seeing a rebound in spite of the decline during COVID:

investing.com

One of the most important metrics for a telecommunications company is churn – i.e., the rate at which customers cease usage of services with a provider. A higher churn rate is concerning – as this would indicate that the company is losing customers which will affect its ability to raise revenue in the long-term.

For the purposes of this article, I decided to examine churn rates of postpaid mobile phone subscribers for Rogers Communications, as this has accounted for the majority of wireless subscriber revenues. For context, postpaid mobile phone subscribers accounted for over 8.9 million subscribers in Q1 2022, as compared to 1.15 million prepaid mobile phone subscribers in the same period.

In order to determine whether postpaid churn rates have been improving (i.e., decreasing) over time – I decided to average quarterly postpaid churn figures for Rogers Communications from 2019 to the present. The postpaid churn figures for competitor Bell (BCE) were also averaged as a comparison point. Note that the churn figure for 2022 only includes the first quarter of data given availability.

The original quarterly figures and calculations using SQL can be found here.

Rogers Communications: Postpaid Churn Rates

| Year | Postpaid churn (%) |

| 2019 | 1.11 |

| 2020 | 1.00 |

| 2021 | 0.95 |

| 2022 | 0.71 |

Source: Churn rates calculated by author using SQL.

Bell Canada: Postpaid Churn Rates

| Year | Postpaid churn (%) |

| 2019 | 1.13 |

| 2020 | 0.99 |

| 2021 | 0.93 |

| 2022 | 0.79 |

Source: Churn rates calculated by author using SQL.

From the above, we can see that postpaid churn rates have been slightly lower for Rogers Communications than that of Bell. However, we can see that average yearly churn rates have been decreasing across both companies.

In this regard, the fact that inflationary pressures do not appear to have been leading to a higher degree of churn (to date) has been encouraging, and should this trend continue – then this would be a positive indication that Rogers Communications can continue to bolster its revenue and subscriber base in spite of macroeconomic pressures.

Looking Forward

Going forward, I take the view that Rogers Communications is in a good position to see a rebound in longer-term upside, even if we do see some short-term pressure on price as a result of macroeconomic headwinds.

With that being said, the company could still face some challenges ahead.

Particularly, while Rogers Communications had previously agreed to sell Shaw’s (SJR) Freedom Mobile to Quebecor (OTCPK:QBCRF) in order to alleviate concerns over anti-competitiveness across the wireless business – the company has yet to reach a resolution with Canada’s antitrust authority regarding the takeover.

However, the Wireless segment does not stand to be particularly impacted if the takeover goes ahead – given that the company would be taking over Shaw’s cable and home internet division while Quebecor would buy some of Shaw’s wireless business.

Moreover, with a broad network outage earlier this month across Rogers’ nationwide network – the company might meet further scrutiny from regulators as to whether the Shaw takeover remains in the public interest – particularly as this outage is reportedly the second major outage for two years.

Additionally, while we have seen churn rates decreasing – potential for further disruptions might see churn rates increase once again – as affected customers seek alternative providers.

Conclusion

To conclude, the fact that Rogers Communications has seen a decline in churn rates has been quite encouraging, and the company seems to be trading at more reasonable value from a P/E standpoint.

While the company faces some regulatory headwinds with respect to the Shaw takeover, I take the view that the Wireless business will continue to perform strongly. In this regard, I take a long-term bullish view on Rogers Communications.

Be the first to comment