alvarez/E+ via Getty Images

Industrial automation is becoming a very attractive fast growing industry, with a market that stood at $179.74 billion in 2020 and is expected to grow to $355.44 billion by 2028 while exhibiting a CAGR of 9.2% between 2021 and 2028. One of our favorite players in this industry is Rockwell Automation (NYSE:ROK), and we believe they will be able to profit from a significant portion of this growth.

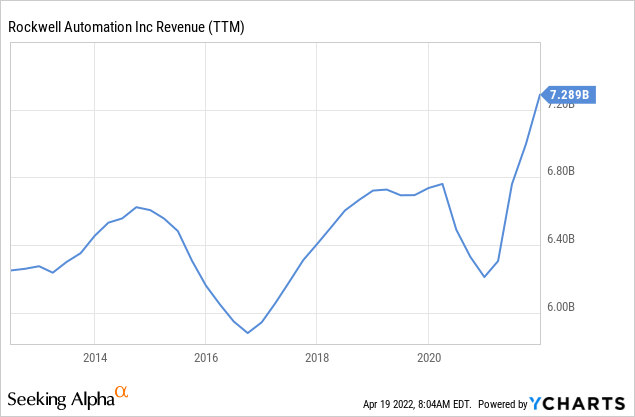

By looking at Rockwell’s revenue we see that it has indeed been growing at a very decent pace, and it has accelerated in the last year. We can also see that there is a growing trend and a cyclical trend; for example, revenue was deeply impacted during the COVID crisis. Nonetheless, the company is back to posting record revenue.

Competitive Moat

Rockwell Automation has a strong competitive moat for a couple of reasons. One is that it has high switching costs for customers because businesses become so reliant on its products, and they are so ingrained in the process that it becomes hard to change supplier. Companies whose customers have high switching costs can charge higher prices without the threat of losing business. The risk and downtime a company would incur from potentially disrupting its operations far outweigh any potential reduction in costs it might have from switching away from one provider to another.

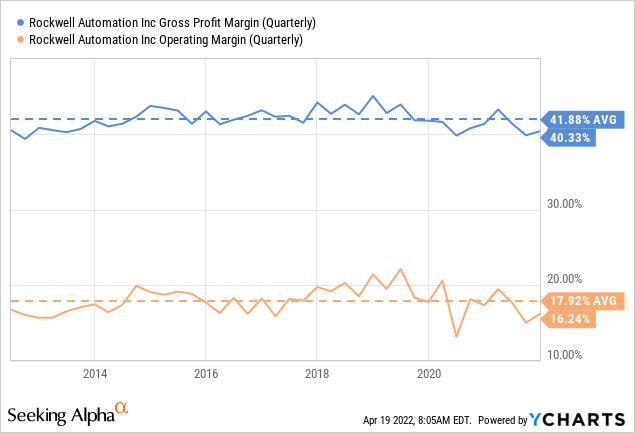

The second reason Rockwell has a strong competitive moat is that it has very valuable intellectual property, both in the form of patents and trade secrets, which protect the solutions it offers to customers. Together, these two moat sources give Rockwell an important business advantage that is reflected in above-average profit margins, and outstanding returns on equity (ROE) and invested capital (ROIC).

Financials

Rockwell’s pricing power can be seen in its high and stable gross profit margin and operating margin. These are considerably above average for industrial companies. For example, the electrical equipment industry has an average operating margin of 11.4% and in general the market has an average operating margin of 11.79%.

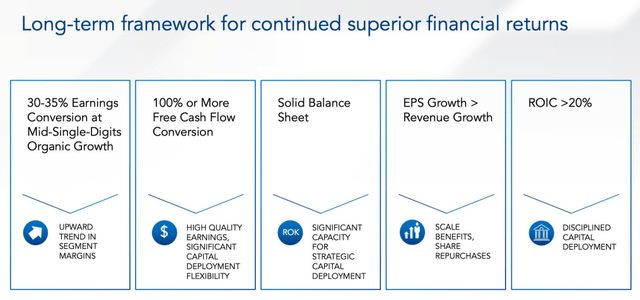

We can see that it is a superior company thanks to its quality earnings, where it is able to convert 100% or more of its earnings into free cash flow. Rockwell also boasts a very strong balance sheet with relatively little debt in relation to its equity, and it believes it can grow its earnings per share faster than revenue growth and have an ROIC above 20%.

Rockwell Investor Presentation

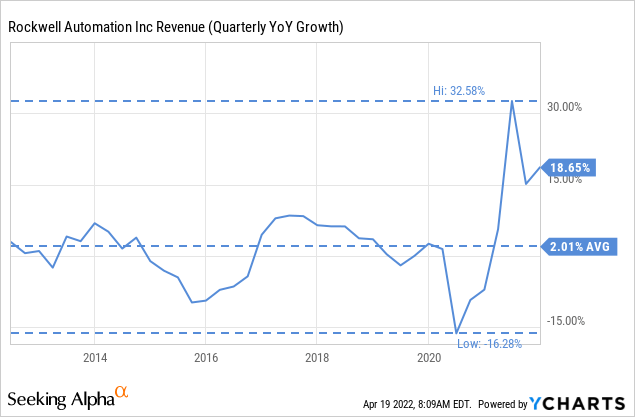

Looking at revenue growth, it seems that it has accelerated, although part of the increase in the growth rate is simply a recovery from the COVID crisis. It will be interesting to see how it behaves the next few quarters. During the last decade, revenue grew at an average of 2% a year. But given the acceleration in the industrial automation sector, we believe that it should grow much faster in the coming years.

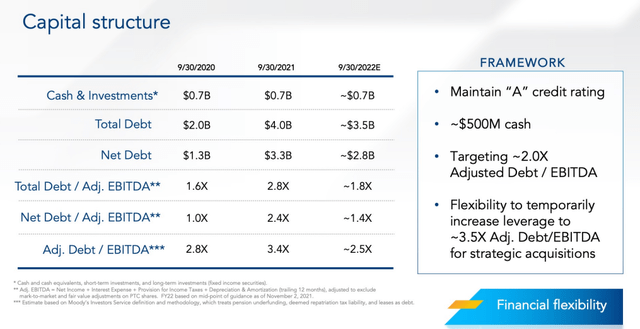

Capital Structure

Rockwell has a very solid balance sheet with ~$700 million in cash and investments, and an adjusted debt to EBITDA ratio of ~3.4x, which it is targeting to lower to ~2.0x. The company has an “A” credit rating, which gives it access to cheap financing in case it wants to proceed with strategic M&A.

Rockwell Investor Presentation

Valuation

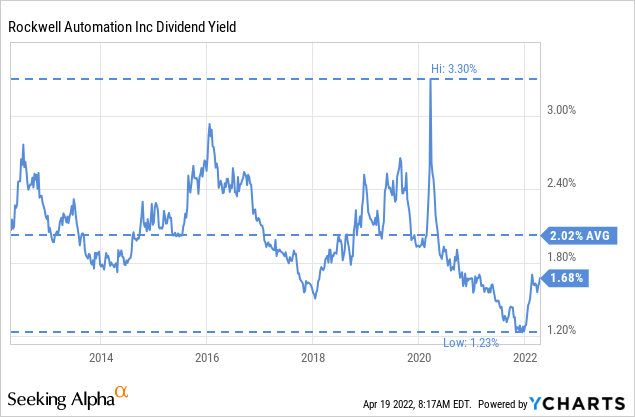

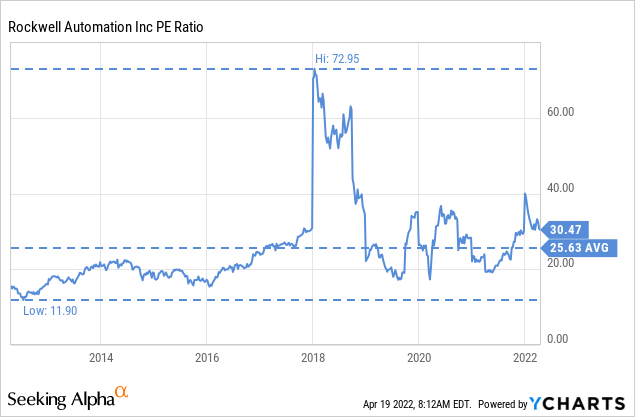

Unfortunately, shares are not exactly cheap, but quality companies rarely become really cheap. There are two indicators we like to use with a company like Rockwell, its dividend yield compared to its historical average, and its P/E ratio. Historically, Rockwell has paid around a 2% dividend yield, and it currently pays 1.68%. Shares had gotten too expensive, and were yielding only ~1.2%. Now that they are closer to the average dividend yield, we consider they are again in Buy territory.

The P/E ratio tells a similar story, after reaching almost 40x recently, it has come down and it is now closer to its historical average around 25x.

2022 Guidance

For 2022, Rockwell is guiding to a sales midpoint of ~$8.2 billion, with an organic growth range of 16-19% and inorganic growth adding ~2%. Adjusted EPS is guided at between $10.50 and $11.1, and free cash flow as a percentage of net income at ~90%.

Risks

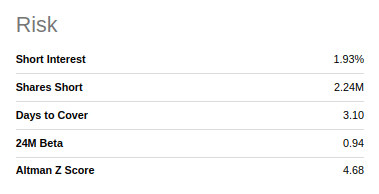

We do not consider Rockwell Automation a particularly risky company, even though it is quite cyclical and should probably be avoided just before a recession. The short interest in the shares is small at ~1.93%, and the company’s Altman Z-score is comfortably above 3, which means it has very little risk of bankruptcy.

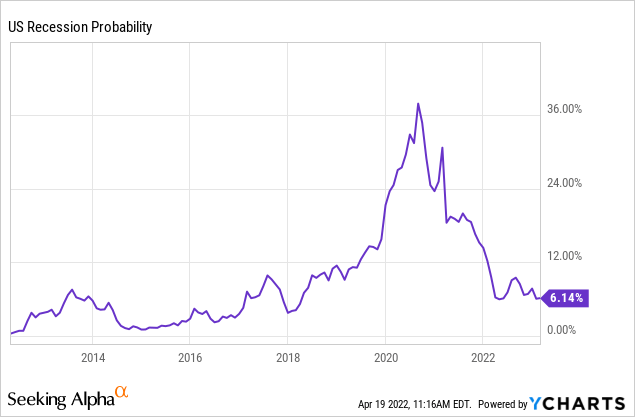

Seeking Alpha

In any case, we do not think that a recession is around the corner, the Estrella and Mishkin model puts the recession probability in the next two to six quarters at only 6.14%.

Conclusion

Rockwell Automation is a terrific company with a strong competitive moat that allows it to earn above average returns on investment and to produce high profit margins. It should also benefit from the acceleration in industrial automation investments, which are expected to grow at a ~9% CAGR. The company is not particularly cheap, but it is again in ‘Buy’ territory after having reached a very high valuation at the end of last year. Investors wanting a bigger margin of safety can wait for lower prices, but we think shares are starting to offer some value at these prices.

Be the first to comment