Dr_Microbe

Platform-agnostic gene therapy pioneer Rocket Pharmaceuticals (NASDAQ:RCKT) gave us a 200% to 316% gain in ROTY’s model portfolio the first time we owned this name, cutting it loose when the share price spiked after initial data for the Danon disease program in late 2020 to early 2021.

From the peak above $60, shares have lost over two-thirds of their value as the company certainly took a hit along with the rest of the biotech sector during the recent downturn. Pessimism took a hold here in part due to safety concerns, both for the overall gene therapy space (patient deaths including for Novartis’ Zolgensma and Astellas’ AT132 for XLMTM (liver failure, sepsis & GI bleeding) as well as for the Danon program at the higher (discontinued) dose.

As data across all four clinical programs continues to read positive and pipeline momentum accelerates, I wish to revisit this one for readers to determine upside prospects for the years ahead.

Chart

FinViz

Figure 1: RCKT weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares trend upward in 2020 as Rocket reported positive data sets across multiple gene therapy programs (albeit with smaller market potential). From there, in December there was a parabolic spike in share price after promising initial data was presented for the first-in-class Danon disease program (blockbuster potential indication). As the euphoria dissipated, share price steadily declined due to wider concerns surrounding viability for gene therapy companies as well as specific toxicity issues for high dose of Danon program. They bottomed at the $10 level and since have rebounded to the high teens. My initial take is that long term investors who are willing to hold patiently will do well to accumulate dips to the $15 level (20-day moving average).

Overview

In my prior writeup, I touched on the following keys to a bullish thesis:

- Management appeared quite optimistic on the firm’s prospects, talking up their first-mover advantage and pursuit of a variety of best-in-class indications.

Corporate Slides

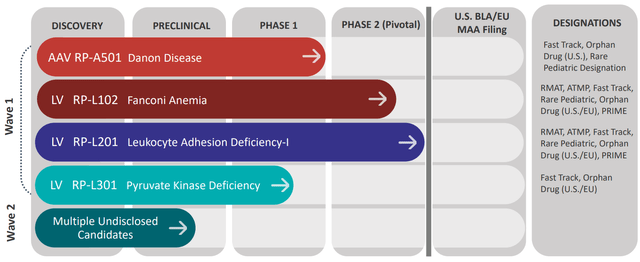

Figure 2: Pipeline (Source: corporate presentation)

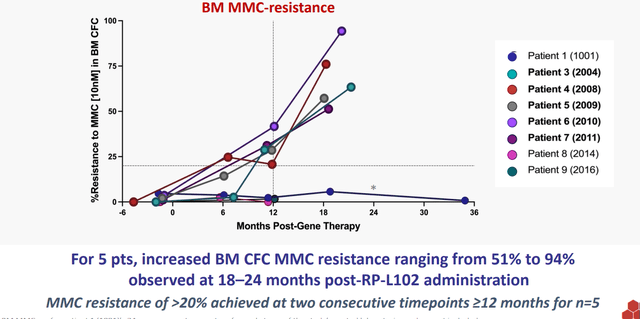

- The first opportunity started with Fanconi Anemia. RP-L102 is a lentiviral vector-based gene therapy candidate and I pointed out that there’s no cure for this disease, which is caused by FANC gene mutations impairing DNA repair function. This in turn leads to bone marrow failure and later on down the road cancer. Presently patients are treated with HSCT (hematopoietic stem cell transplantation), which unfortunately comes with the risk of graft-versus-host disease. Prevalence was noted to be around 2,000 patients in the United States and Europe (currently 30% to 40% of these patients receive a transplant), of which 250 per year could be treated by RP-L102. Lastly, I noted that via pivotal studies the company would shoot for accelerated approval on the basis of prevention of bone marrow failure. So far, safety looked highly favorable positioning RP-L102 as a first-line treatment option (no signs of dysplasia). Additionally, efficacy was quite good including 6 of 9 patients showing preliminary signs of engraftment and 5 of 9 showed increasing evidence of engraftment with BM MMC resistance ranging from 51%-94% and ≥20% at two consecutive timepoints.

Corporate Slides

Figure 3: Increasing phenotypic correction over 1 to 2 years after treatment with RP-L102 (Source: corporate presentation)

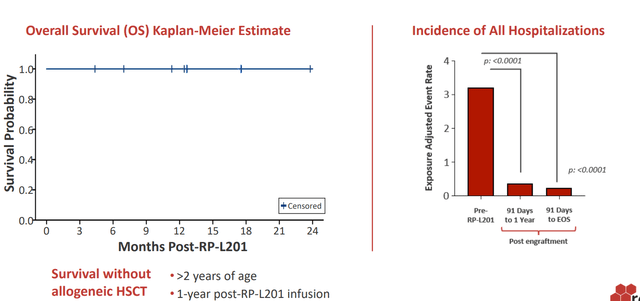

- As for other assets of interest, I touched on their LAD-I (Leukocyte Adhesion Deficiency-I) and PKD (Pyruvate Kinase Deficiency) programs. The asset for IMO (Infantile Malignant Osteopetrosis) drug candidate was discontinued, unfortunately. LAD-I market opportunity was quite small (perhaps $25M to $50M), but it’s hard to understate patient impact for this monogenic immunodeficiency as over 50% of patient shave the severe phenotype (60% to 75% mortality by age 2). As with Fanconi, the currently available treatment is allogeneic hematopoietic stem cell transplant which is associated with significant graft failure and acute GvHD. Estimated market is just 25 to 50 patients with potential for up to 100 in expansion to the moderate LAD-I population. Data was a homerun, with 100% engraftment and CD18 constitution across all patients (CD18+ PMN expression ranging from ~19.6% to ~87.4%, keeping in mind that levels over 10% are associated with survival for decades). There was evidence of spontaneous resolution of disease-related rash, restoration of wound repair capabilities, 100% overall survival one year post-treatment and significant reduction in disease-related hospitalizations and severe infections in all 9 of 9 patients.

Corporate Slides

Figure 4: LAD-I data was a homerun as reflected in improvement in clinical outcomes (Source: corporate presentation)

- As for RP-L301 in Pyruvate Kinase Deficiency (PKD), I noted that this was the largest of the lentiviral indications with ~250-500 patients/year for transfusion-dependent post-splenectomy patients and 3,000 to 8,000 total patients in the US, Europe and rest of world combined. Data here was only in a couple patients, but they were able to show marked hemoglobin improvement from low single digit levels to 13.0-14.8 g/dL and no transfusions required following engraftment. Importantly, there were no IP-related serious adverse events and they have commercial grade product along with centralized testing available for all patients.

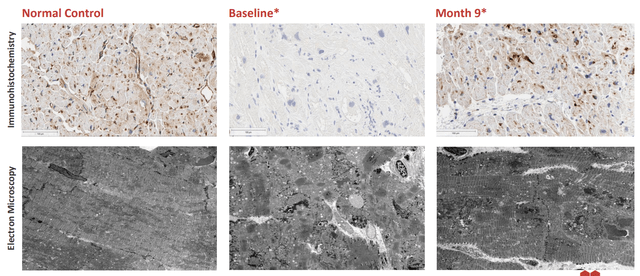

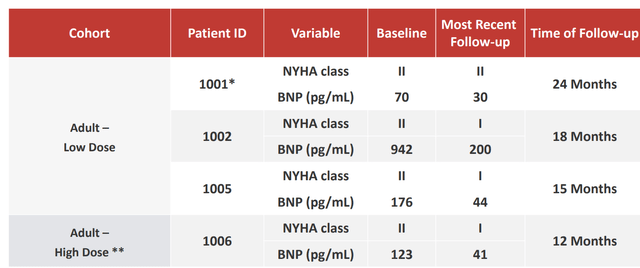

- As for my favorite opportunity in Danon disease (the crown jewel of the pipeline), this is a monogenic heart failure syndrome that affects multiple systems of the body and is caused by X-linked dominant LAMP2 mutations. Progressive cardiomyopathy is the main cause of early death in these young male patients where median overall survival is just 19 years. For females, prognosis is better as presentation is generally delayed due to possession of an additional X chromosome. One would simply think heart transplant is the logical solution, but unfortunately these are associated with substantial morbidity and mortality (10 year overall survival of just 50%). Also, only 20% of these patients are able to get them. Market opportunity is outsized here at estimated US + EU prevalence of 15,000 to 30,000 patients. If I use very conservative numbers (5,000 patients and $500,000 price tag), that still equates to a $2.5 billion market opportunity. I noted that initial data was a landmark moment as they were able to achieve greater than 50% of normal LAMP2B in two patients and also showed reduction of myocardial cell disarray and accumulation of autophagic vacuoles, a hallmark of Danon Disease. This in turn translated into early stabilization and suggests a trend toward improvement in functional measures. Importantly, safety profile looked manageable with elevation in transaminases observed in all three low-dose patients and returned to baseline within the first one to two months post-treatment. These elevations were largely responsive to corticosteroids and other immunosuppressive therapies. Unfortunately, one of the two high dose patients experienced reversible thrombocytopenia and acute kidney injury (returned to baseline in three weeks and regained normal kidney function). I can understand why management decided to try a higher dose (see how high they could push efficacy including extending benefit to all organs), but I am glad they discontinued it. CEO Shah stated that the slide on vacuoles stopped him in his tracks¨, showing the change from extensive vacuoles and no muscle architecture to fewer vacuoles and relevation of intact, restored muscle architecture (¨the vacuum cleaner is working¨). Significant improvements in cardiac output were observed consistent with BNP decreases and high levels of protein expression. Again, I liked seeing improvement across multiple endpoints (more convincing).

Corporate Slides

Figure 5: Changes in LAMP2 cardiac protein expression is quite striking to my eyes (Source: corporate presentation)

Corporate Slides

Figure 6: Improvement in functional clinical status of adult cohorts (Source: corporate presentation)

- Lastly, I cited a key green flag with noteworthy institutional investors (RTW Investments had almost 15 million shares) and stacked management team (hailing from the likes of Novartis, Bristol-Myers Squibb, Biogen, Eli Lilly, AstraZeneca and more).

Select Recent Developments

In January, management started the year in their typical manner by transparently sharing projected clinical milestones. Of note, pediatric data for Danon was expected in Q3 and initiation of pivotal phase 2 study activities was guided for Q4. For Q2, they set out the goal of achieving in-house AAV GMP (Good Manufacturing Practice) manufacturing, which I consider vital for value creation in cell therapy and gene therapy companies. For the PKD program, I was surprised that with so few patients’ worth of data, they plan to initiate a pivotal phase 2 study in Q4.

On May 16th, the company reported updated data across three programs (Danon, Fanconi, PKD). Starting with Danon as it is the focus of my investment thesis for this company, pediatric data with April 30th cutoff showed the low dose of RP-A501 was well tolerated in both patients (normal-range platelets, diminished complement activation and no complement-related adverse events). Importantly, all adverse events in pediatric and adult cohorts were reversible with no lasting renal, hepatic, or other sequelae. As for signs of activity, patients demonstrated evidence of cardiac LAMP2B expression versus normal control, echocardiograms showed decreased cardiac wall thickness with improved or stabilized ejection fraction and perhaps most impressively patients demonstrated sustained improvement or stabilization in BNP and NHYA (New York Heart Association) class, 6-minute walk and most importantly increases in physical activity.

As for the Fanconi Anemia study, 5 of 9 evaluable patients had increased resistance to MMC in bone marrow-derived colony forming cells (21% to 42% at 18 months, compared to 51%-94% at 18 to 21 months). This is important, keeping in mind that the primary endpoint of the study has thus been achieved as it required minimum five patients to attain increased MMC resistance at least 10% above baseline at two or more timepoints. As for the PKD program, as noted prior both patients at 18 months post-infusion experienced sustained transgene expression, normalized hemoglobin, improved hemolysis, no red blood cell transfusion requirements post-engraftment and improved quality of life both reported anecdotally and as documented via formal quality of life assessments. Pediatric cohort is enrolling, and importantly safety profile appeared favorable with only transient transaminase elevation observed in both patients post-therapy/conditioning (no clinical stigmata of liver injury).

A few days later, astoundingly positive LAD-I data update was shared and it surprised me the stock responded so well considering this program presents a tiny market opportunity. At 3 to 24 months post RP-L201 infusion, all nine patients sustained stable CD18 expression (median: 56%) with no therapy-related serious adverse events. The plan here is to initiate discussions with regulatory authorities and complete filings in the first half of 2023.

Finally, on July 27th the company disclosed an important new hire in the form of Mayo Pujols as Chief Technical Officer (served prior as Head of Global Cell and Gene Technical Development and Manufacturing for Novartis Pharmaceuticals). This experience is highly relevant for the person who will lead the technical operations function and chemistry, manufacturing and controls (CMC) for all lentiviral programs as well as AAV manufacturing facility for a planned phase 2 pivotal study in Danon Disease.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $321M as compared to elevated net loss of $54M. Research and development expenses rose to $41M, while G&A costs came in at nearly $13M.

It would seem management is aware of the impending cash crunch, as in June the company sold 1.3M shares via at the market facility and received $17.3M in proceeds. They are guiding for current resources to provide them operational runway to 1H 2024 (includes buildout and initiation of AAV cGMP manufacturing capabilities and facility as well as “future pipeline programs”).

Gene therapy is certainly an expensive area of biotech to operate, and so far the company has an accumulated deficit of $491M as per the 10-K filing.

Moving on to management’s presentation at UBS Global Healthcare conference, here were a few nuggets that stood out to me:

- Shah describes Rocket as multi-platform and platform agnostic. They have two platforms, one being an in-vivo AAV platform applied to cardiology disease and ex-vivo lenti programs applied to three bone marrow-derived diseases. Fanconi anemia and LAD-I programs are nearing the end of their phase 2 pivotal studies. Danon disease and PKD will enter phase 2 by the end of the year or into 2023. Both platforms had further validation with promising data sets presented in May.

- “When gene therapy works, it really works” and LAD-I data is used as an example. These children otherwise pass away in early single digit years and restored CD18 function allows them to live normal, happy lives (normal lifespan).

- Fanconi Anemia hit the primary endpoint ahead of planned schedule, regulatory filings expected for FA and LAD-I in 2023.

- For Danon disease, it was a big deal that they presented favorable safety data in pediatric patients. They were able to translate safety in the mid e13 range, both patients had minimal complement activation and no clinical AEs.

- The total Danon natural history study will be up to 200 patients, not all will be followed for every single time point they are interested in for phase 2. They are finding a good number of them are followed for lab markers, for echo (wall thickness, EF, etc) and some are followed for NYHA class & 6-minute walk test. So far, they have been able to identify a couple markers that trend very differently from patients in their study (BNP and posterior wall thickness). Based on the delta they see (differences), they think they can design a well-powered, modest study potentially as single arm design. Danon patients’ ejection fraction is usually preserved until late in the disease, the last one or two years. Most of Rockets’ patients have 50% or 60% EF and there is not much to measure as an outcome (did improve overall). Other parameters such as wall thickness are grossly deranged and much easier to follow (mechanistic rationale for posterior wall thinning). Greater magnitude of benefit is observed here letting them design a smaller pivotal study. As for protein expression as a possible endpoint, Shah states a little protein in each cell goes a long way. “You need to turn on the vacuum cleaner just a little bit and give it enough time to clean up the cell”. If they turn it on too much, they could theoretically damage the cell. The right goldilocks zone has a little protein and a lot of cells, so IHC is the better measure (want broad expression and takes 9 to 12 months to see true clinical effect in these patients).

- Shah states that there is a lot of interest from female Danon patients and they do get sick. They tend to live to a longer age but still have cardiomyopathy and pass away in their 40s. This study could start sometime in 2023, but the first goal is to get pivotal male study up and running.

- As for overall opportunity in Danon, Shah states it will be all comers males and females (at least 8 years old, potentially earlier). Males should be everybody except males who have pre-existing AAV immunity or patients too far gone in fibrosis. With females, Danon disease manifests differently so they might wait until there are more symptoms before treating.

- As for Fanconi Anemia market opportunity, Shah states that prevalence is 4,000 EU+ US.

- As for cash burn and runway, they are guiding for runway to 1H 24. As they start thinking about launches for LAD and Fanconi, at some point those could result in Priority Review Vouchers to generate internal revenue.

- Moving onto IP position, most of the IP around lenti programs is expired. For AAV in Danon, they have a license from REGENXBIO for the AAV capsid and beyond that they own everything.

- Shah confirms that big pharma is more interested in derisked companies with programs in late stage or ready for launch.

As for prior financing, aside from the recent use of ATM facility, upsize secondary offering in December took place at $56/share (~3x upside from current levels).

As for institutional investors of note, Perceptive Advisors sold nearly half of its take and owns 3% of the company. RTW Investments continues to incrementally add to its position and owns a whopping 25% stake.

As for insiders, Chief Medical Officer Jonathan Schwartz owns over 80,000 shares and has been continually selling down his stake from over 200,000 originally. CEO Guarav Shah owns over 500,000 shares.

Moving on to the management team, CEO Guarav Shah served prior as Global Program Head in the Cell & Gene Therapies Unit at Novartis, where he had strategic oversight of 12 functions and helped spearhead pivotal trials with CART-19 for patients with leukemia and lymphoma. I touched on two new key hires above and their relevant technical expertise as well. Chief Commercial Officer Carlos Martin served prior as U.S. Commercial Head of Advanced Accelerator Applications (AAA), a Novartis Oncology Company. Uniquely of interest, Chief Development Officer Gayatri Rao served prior as Director of the Office of Orphan Products Development (OOPD) within the FDA.

On the board of directors, unsurprisingly we find Rod Wong (Managing Partner at RTW Investments). Elisabeth Bjork is SVP Head of Late-stage Development, Cardiovascular, Renal and Metabolism R&D at AstraZeneca. Naveen Yalamanchi, another partner & portfolio manager at RTW Investments is also on the board.

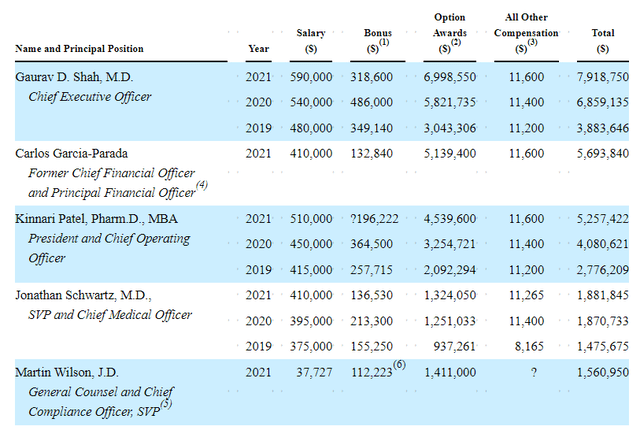

As for executive compensation, cash salary is in the normal range for a company this size as are bonuses and option wards. Perhaps in the interest of conserving cash I wish the bonuses were paid out in options instead of a decent cash component as they are currently.

Proxy Filing

Figure 7: Executive Compensation Table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, DSJ.2018 shared a case study that I found very helpful which involved a boy with Danon disease who prior to therapy could barely walk up a flight of stairs without stopping to catch his breath. The boy stayed in his room to play video games all day, used a motorized scooter to get around and often complained of fast heart rate and chest pain. Four months after therapy he stopped using his motorized scooter all together, is able to work 4 to 6 hours a day standing, driving and sitting. Overall, he is able to do more of the things that normal kids can do.

As for IP, the company has two in-licensed families for Fanconi Anemia and pending applications that if granted could expire in 2037. Likewise, pending PKD patent portfolio would expire in 2037 and LAD-I is set to expire in 2039. As for largest indication of Danon disease, they have an in-licensed portfolio from University of California and pending patents would expire between 2037 and 2041.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), keep in mind for Danon disease the company remains on the hook for high single digit to low teen royalties paid to partner REGENXBIO from whom they licensed the vectors. They also would need to pay REGENXBIO 20% of proceeds of payment fees received for Priority Review Voucher.

Final Thoughts

To conclude, I appreciate the intentionality and execution of Rocket’s management as they steadily progress the pipeline forward across all fronts while exclusively focusing on first and only-in-class opportunities. They have not limited themselves to a particular approach or technology platform, and current enterprise value of $900M seems discounted compared to market potential for lead programs (especially Danon and PKD). A great deal of derisking has taken place so far, with Fanconi and LAD-I assets on track for regulatory submission of pivotal data and possibly Priority Review Vouchers which would help fund the pipeline.

On the con side, the company has already disclosed data across all four programs in May, so I think any updates that come later this year or the first half of 2023 will be at best incremental in nature. I look forward to the unveiling of their next wave of gene therapy programs, which are likely to sport blockbuster potential similar to the Danon disease program. However, it will take several years before such assets generate significant phase 1 data sets in the clinic.

For readers who are interested in the story and have done their due diligence, RCKT is a Buy and I suggest accumulating dips to the mid-teens level (between 50 and 20-day moving averages on the weekly chart).

Again, I wish to caution readers that an investment here is only appropriate for long term investors with time horizon of at least 3 to 5 years, in my opinion. This would provide a sufficient timeframe for Fanconi and LAD-I to get on the market and generate sales, for Danon and PKD to produce pivotal data sets and for Wave 2 programs to move forward in early-stage studies.

From an ROTY perspective (focus on next 12 months), while I am very much a fan of this company and its highly capable management, I see no rush to purchase given lack of near-term needle-moving catalyst. I could see myself revisiting around the end of this year or potentially scooping up shares 1H 23 if the story has progressed sufficiently and valuation remains appealing.

As for risks, given current cash burn and state of the balance sheet I would expect another financing (dilution) by the end of this year or 1H 23 at the latest. Regulatory setbacks including delays for filings of Fanconi and LAD-I programs would weigh on shares, as would setbacks or delays for Danon and PKD moving into pivotal studies. Additional serious adverse events, if they occur, would very much weigh on share price as it’s the principal reason that gene therapy companies are remain in the doghouse. Market opportunities for lead assets including LAD-I are very small and thus might not meaningfully contribute to reducing cash burn (or never produce return on investment). Success of the Danon program, especially in an accelerated timeframe, depends in part of the FDA’s willingness to accept biomarker or other surrogate endpoints that have yet to prove their utility conclusively.

While as an investor I leave price targets to the analysts, I do look at a blend of technicals, enterprise value, upcoming catalysts and future prospects to provide a realistic guess of potential upside in the medium term. By the end of next year, I could see share price returning to the $30 level representing 60% upside from current levels and a market capitalization of $2.2 billion (factoring in $200M of dilution via secondary offering). That would still be on the discounted side considering sum of market opportunities of four current clinical-stage programs (conservatively) exceeds $2 billion.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below.

Be the first to comment