Jian Fan/iStock via Getty Images

Rocket Companies (NYSE:RKT) is expected to deliver its third quarter financial results on Nov. 3, with a revenue target of $1.08 billion being set by analysts. In addition, the street believes Rocket could deliver a normalized earnings per share number of -$0.03, which is the exact figure it achieved in its second quarter.

We’ve taken it upon ourselves to do an earnings preview by means of quantitative analysis. We didn’t forecast any figures, as general earnings forecasts are offered to our service members. However, we identified meaningful relationships among key variables, which we’re excited to share with readers.

Here are a few factors to note about Rocket Companies leading up to its third-quarter earnings report.

Critical Drivers Behind Rocket Companies

Today’s analysis is mainly quantitative; however, let’s examine a few qualitative variables first.

Rocket Companies operates an integrated business model. The company’s core activities relate to cyclical loan origination, such as mortgages and automotive loads. Furthermore, the company provides ancillary services like marketing, title insurance, valuations, and more.

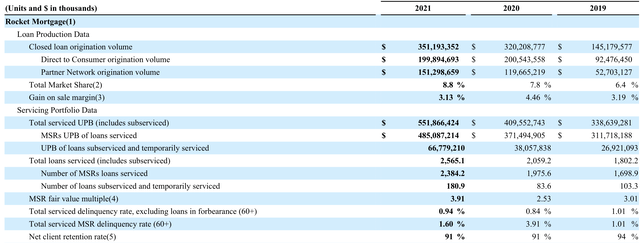

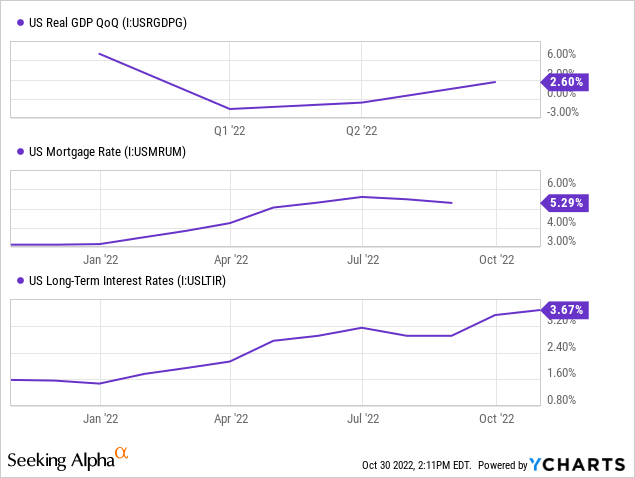

The numbers below communicate sound growth as the firm has grown its mortgage market share to 8.8% from a mere 6.4% in 2019. Moreover, the company’s mortgage business presents respectably low delinquency rates. Furthermore, Rocket Companies’ “other companies” segment has grown staggeringly in the past few years all enterprises’ revenue surging since 2019 apart from “Rocket Loans,” which has experienced an approximate 4.14x year-over-year drawdown (as of Q-2).

Rocket Companies 10-K

Rocket Companies 10-K

This might be a bit off the topic of assessing Thursday’s earnings report, but it’s critical for investors to know. I want to point out a business activity with extreme long-term potential. Rocket Companies has delved into the renewable energy space with solar financing offerings. The company holds a presence in 42 metros and plans to leverage this business unit in the coming years. Only 3.2% of American homes are solar powered. However, with the government pushing toward a net zero emissions environment, most households will likely one day be solar powered. Yet, many likely can’t afford to convert to solar on a cash basis, and financing options might be a lucrative business.

Key Metrics

Even though Rocket Companies possesses a range of business activities, its offerings are essentially intertwined and can be parsimoniously explained by a few leading indicators.

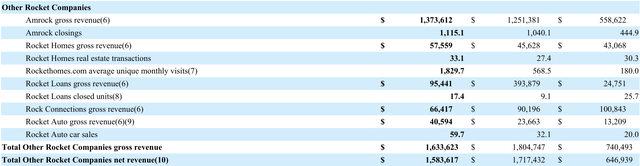

Based on recent data, mortgage originations have capitulated this year. It may be due to cyclicality and rising inflation. Mortgage applications usually taper whenever interest rates rise due to fewer people financing or re-financing their acquisitions. However, despite rising interest rates, automotive loans are seemingly still on the rise, indicating that it’s not all doom and gloom for loan originators.

Furthermore, household obligations have stacked up in the past year. This could decrease broad-based demand for Rocket Companies’ products as inflation and weaker household balance sheets could prevent most consumers from taking on additional debt.

Despite the various demand-related headwinds, Rocket Companies could benefit from wider spreads on new loans and variable-interest loans. Higher rates are usually associated with exacerbated credit risk, thus, loan originators often charge larger spreads when benchmark rates increase.

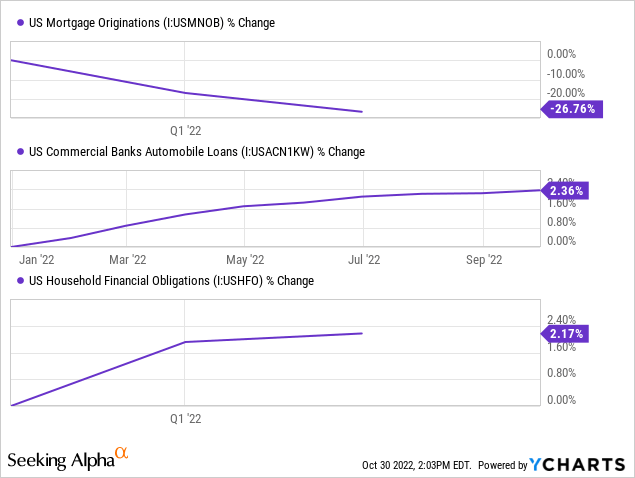

Moreover, the U.S. GDP has reignited since Rocket Companies last reported earnings, reverting to a 2.6% growth rate. GDP rates and load demand are often intertwined, meaning Rocket Companies could’ve benefited from recent economic growth.

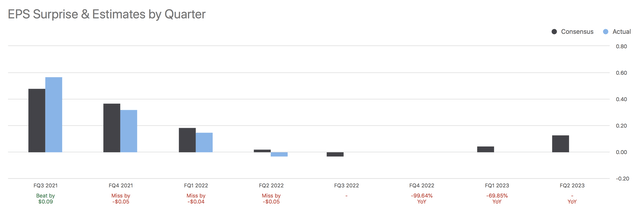

Forecasting a company’s earnings can be as simple as observing the earnings momentum anomaly. The theory says that companies who beat earnings regularly will likely beat future earnings estimates more so than missing them.

Rocket Companies has missed numerous of its recent earnings targets, which doesn’t instill much confidence leading up to Thursday.

Seeking Alpha

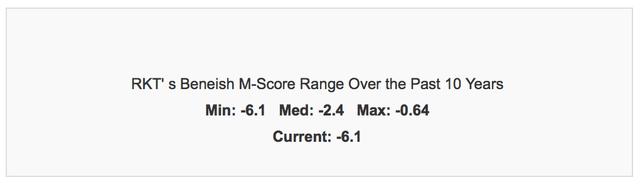

On the flip side, Rocket Companies has one of the best Beneish M-Scores I’ve seen in a long time. The Beneish M-Score analyses the likelihood of earnings manipulation with a score below -1.78, meaning a company is in the safe zone. Therefore, Rocket Companies’ M-Score of -6.1 suggests that the company has recorded its income statement conservatively in its previous financial quarter, providing it with the potential for leveling its earnings recognition in its third-quarter report.

Gurufocus

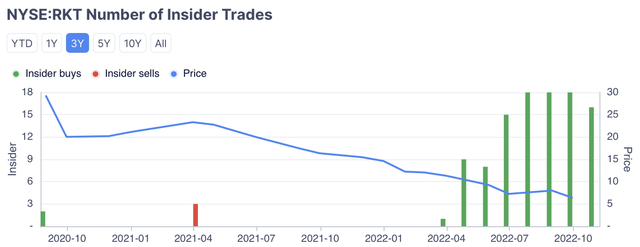

The final variable I looked at is the company’s insider trading. Insider trading (not to be confused with trading on material non-public information) refers to the stock positions held by a company’s own management team. Insider trades usually unveil management’s confidence in the company’s future financial prospects, and based on Rocket Companies’ recent insider activity; its C-Suite is very bullish on the firm’s prospects.

Gurufocus

Potential Price Action In RKT Stock

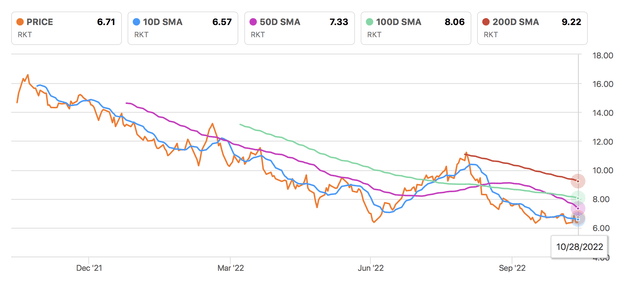

In isolation, Rocket Companies’ stock could be set for upside as it’s trading below its 50-, 100-, and 200-day moving averages. In addition, the stock’s recently exited oversold territory with the trajectory of its RSI (Relative Strength Index), indicating that an early-stage momentum pattern has formed.

Nevertheless, as we’re all probably aware, much depends on the company’s earnings report, and the technical features of the stock will probably only coalesce with tangible price action if Rocket Companies beats earnings.

Seeking Alpha

Seeking Alpha

Furthermore, Rocket Companies’ stock shows signs of deep value, with most of its relative valuation metrics trading at promising levels. The market’s very value-orientated at the moment; therefore, it wouldn’t surprise me if investors latch onto this undervalued stock.

| Price-to-Cash Flow | 0.07x |

| Price-to-Book | 1.46x |

| Price-to-Earnings | 4.75x |

Source: Seeking Alpha

Concluding Thoughts

Key indicators suggest that Rocket Companies faces a risk of demand destruction with rising mortgage and interest rates leading to a calm U.S. loan demand. However, a few positives exist, such as resilient automotive loan demand and Rocket Companies’ accelerating market share. Moreover, it’s possible that investors could delve into Rocket Companies’ relative value as the stock’s price multiples are well aligned.

All matters considered, we’re neutral on Rocket Companies and expect a mixed bag when it releases its third quarter earnings report on Nov. 3.

Be the first to comment